| From | Michigan Executive Office of the Governor <[email protected]> |

| Subject | Rolling Back the Retirement Tax |

| Date | January 19, 2024 5:24 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Governor Whitmer Header

Dear Friend,?

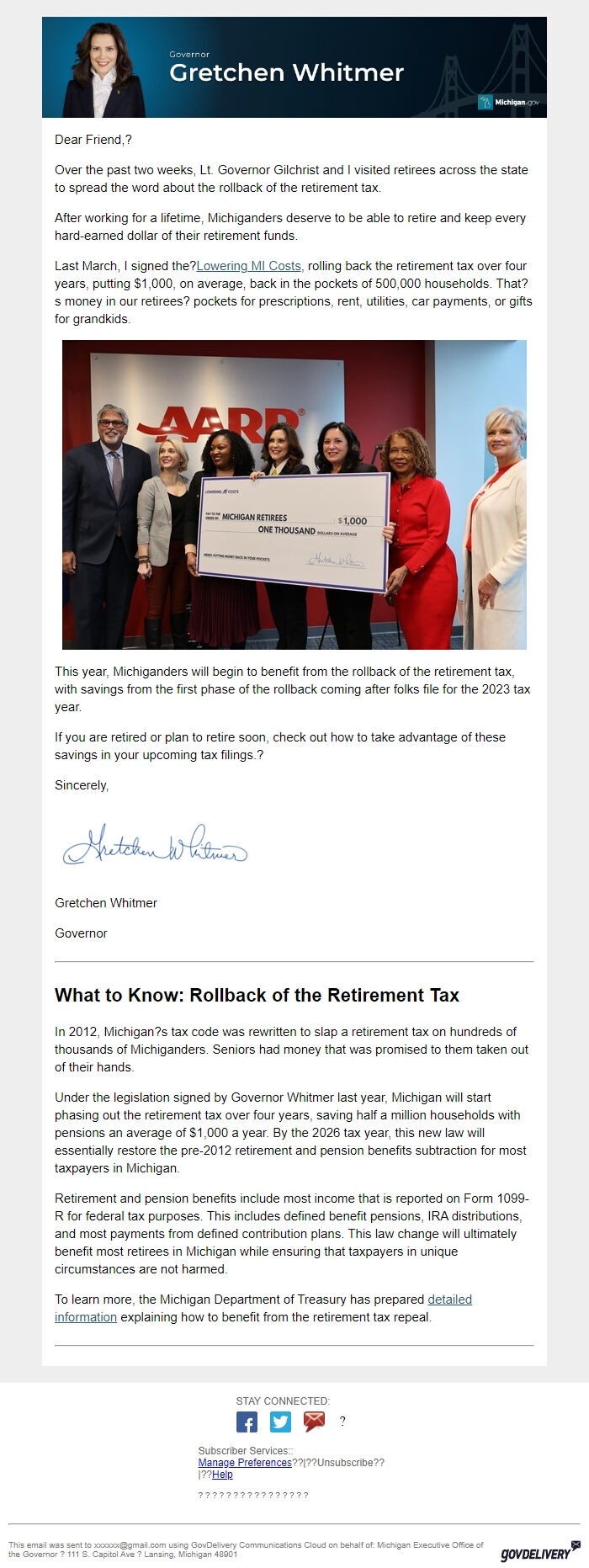

Over the past two weeks, Lt. Governor Gilchrist and I visited retirees across the state to spread the word about the rollback of the retirement tax.

After working for a lifetime, Michiganders deserve to be able to retire and keep every hard-earned dollar of their retirement funds.

Last March, I signed the?Lowering MI Costs [ [link removed] ], rolling back the retirement tax over four years, putting $1,000, on average, back in the pockets of 500,000 households. That?s money in our retirees? pockets for prescriptions, rent, utilities, car payments, or gifts for grandkids.

Retirement Tax

This year, Michiganders will begin to benefit from the rollback of the retirement tax, with savings from the first phase of the rollback coming after folks file for the 2023 tax year.

If you are retired or plan to retire soon, check out how to take advantage of these savings in your upcoming tax filings.?

Sincerely,

sig

Gretchen Whitmer

Governor

________________________________________________________________________

What to Know: Rollback of the Retirement Tax

In 2012, Michigan?s tax code was rewritten to slap a retirement tax on hundreds of thousands of Michiganders. Seniors had money that was promised to them taken out of their hands.

Under the legislation signed by Governor Whitmer last year, Michigan will start phasing out the retirement tax over four years, saving half a million households with pensions an average of $1,000 a year. By the 2026 tax year, this new law will essentially restore the pre-2012 retirement and pension benefits subtraction for most taxpayers in Michigan.

Retirement and pension benefits include most income that is reported on Form 1099-R for federal tax purposes. This includes defined benefit pensions, IRA distributions, and most payments from defined contribution plans. This law change will ultimately benefit most retirees in Michigan while ensuring that taxpayers in unique circumstances are not harmed.

To learn more, the Michigan Department of Treasury has prepared detailed information [ [link removed] ] explaining how to benefit from the retirement tax repeal.

________________________________________________________________________

STAY CONNECTED: Visit us on Facebook [ [link removed] ] Visit us on Twitter [ [link removed] ] [ [link removed] ]Sign up for email updates [ [link removed] ] [ [link removed] ] ?

Subscriber Services::

Manage Preferences [ [link removed] ]??|??Unsubscribe [ [link removed] ]??|??Help [ [link removed] ]

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ?

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Michigan Executive Office of the Governor ? 111 S. Capitol Ave ? Lansing, Michigan 48901 GovDelivery logo [ [link removed] ]

Dear Friend,?

Over the past two weeks, Lt. Governor Gilchrist and I visited retirees across the state to spread the word about the rollback of the retirement tax.

After working for a lifetime, Michiganders deserve to be able to retire and keep every hard-earned dollar of their retirement funds.

Last March, I signed the?Lowering MI Costs [ [link removed] ], rolling back the retirement tax over four years, putting $1,000, on average, back in the pockets of 500,000 households. That?s money in our retirees? pockets for prescriptions, rent, utilities, car payments, or gifts for grandkids.

Retirement Tax

This year, Michiganders will begin to benefit from the rollback of the retirement tax, with savings from the first phase of the rollback coming after folks file for the 2023 tax year.

If you are retired or plan to retire soon, check out how to take advantage of these savings in your upcoming tax filings.?

Sincerely,

sig

Gretchen Whitmer

Governor

________________________________________________________________________

What to Know: Rollback of the Retirement Tax

In 2012, Michigan?s tax code was rewritten to slap a retirement tax on hundreds of thousands of Michiganders. Seniors had money that was promised to them taken out of their hands.

Under the legislation signed by Governor Whitmer last year, Michigan will start phasing out the retirement tax over four years, saving half a million households with pensions an average of $1,000 a year. By the 2026 tax year, this new law will essentially restore the pre-2012 retirement and pension benefits subtraction for most taxpayers in Michigan.

Retirement and pension benefits include most income that is reported on Form 1099-R for federal tax purposes. This includes defined benefit pensions, IRA distributions, and most payments from defined contribution plans. This law change will ultimately benefit most retirees in Michigan while ensuring that taxpayers in unique circumstances are not harmed.

To learn more, the Michigan Department of Treasury has prepared detailed information [ [link removed] ] explaining how to benefit from the retirement tax repeal.

________________________________________________________________________

STAY CONNECTED: Visit us on Facebook [ [link removed] ] Visit us on Twitter [ [link removed] ] [ [link removed] ]Sign up for email updates [ [link removed] ] [ [link removed] ] ?

Subscriber Services::

Manage Preferences [ [link removed] ]??|??Unsubscribe [ [link removed] ]??|??Help [ [link removed] ]

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ?

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Michigan Executive Office of the Governor ? 111 S. Capitol Ave ? Lansing, Michigan 48901 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Office of the Governor of Michigan

- Political Party: n/a

- Country: United States

- State/Locality: MIchigan

- Office: n/a

-

Email Providers:

- govDelivery