| From | e-News for Small Business <[email protected]> |

| Subject | e-News for Small Business Issue 2024-01 |

| Date | January 17, 2024 9:55 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Clean energy; get ready to file; reporting to Treasury who owns or controls the company; disaster relief

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

e-News for Small Business January 17, 2024

Tax Resources for Small Business

Small Business Self-Employment Center [ [link removed] ]

Small Business Forms & Instructions [ [link removed] ]

Small Business Tax Workshops, Meetings and Seminars [ [link removed] ]

Webinars for Small Businesses [ [link removed] ]

E-file Employment Tax Forms [ [link removed] ]

Businesses with Employees [ [link removed] ]

Self-Employed Individuals Tax Center [ [link removed] ]

S Corporations [ [link removed] ]

________________________________________________________________________

Other Resources

IRS Home Page [ [link removed] ]

A-Z Index for Business [ [link removed] ]

Forms, Instructions & Publications [ [link removed] ]

Filing Your Taxes [ [link removed] ]

Pay Online [ [link removed] ]

Taxpayer Advocate Service [ [link removed] ]

Retirement Plans for Small Entities and Self-Employed [ [link removed] ]

Tax Information for Charities [ [link removed] ]

and Other Non-Profits [ [link removed] ]

State Government Websites [ [link removed] ]

SSA/RS Reporter [ [link removed] ]

IRS Social Media [ [link removed] ]

?

?

Issue Number: 2024-01

Inside This Issue

* Three-day extension to submit sales reports for dealers and sellers of clean vehicles [ #First ]

* IRS updates FAQs for the new, previously owned and qualified commercial clean vehicle credit [ #Second ]

* Treasury, IRS issue guidance on the tax credit for the production of clean hydrogen [ #Third ]

* IRS opens free IRA and CHIPS registration tool for organizations to register to monetize clean energy credits; pre-filing office hours [ #Fourth ]

* Get Ready with IRS filing resources for taxpayers [ #Fifth ]

* Certain entities must report beneficial ownership information to Treasury [ #Sixth ]

* Tennessee taxpayers impacted by storms and tornados qualify for tax relief ? deadlines postponed to June 17 [ #Seventh ]

* Other tax news [ #Eighth ] [ #Fourteenth ]

________________________________________________________________________

*1.??Three-day extension to submit sales reports for dealers and sellers of clean vehicles*

________________________________________________________________________

The IRS extended the due date to *Jan. 19, 2024*, for dealers and sellers of clean vehicles [ [link removed] ] to submit time-of-sale reports for vehicles sold Jan.1 through Jan. 16. The three-day grace period is provided in Revenue Procedure 2023-38.

The IRS recommends dealers and sellers to continue to submit time-of-sale reports through IRS Energy Credits Online (IRS ECO) [ [link removed] ].

Dealers and sellers can register for assistance at IRS office hours.?

Back to top [ #top ]

________________________________________________________________________

*2.??IRS updates FAQs for the new, previously owned and qualified commercial clean vehicle credit*

________________________________________________________________________

The IRS updated Fact Sheet 2023-29 [ [link removed] ] to provide guidance related to critical mineral and battery component requirements [ [link removed] ] for the new, previously owned and qualified commercial clean vehicle credits. Find more information about reliance [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*3.??Treasury, IRS issue guidance on the tax credit for the production of clean hydrogen*

________________________________________________________________________

The Treasury Department and IRS issued proposed regulations for the tax credit for the production of clean hydrogen [ [link removed] ].

The guidance also provides procedures to petition the IRS for provisional emissions rate, requirements for verifying the production and sale or use of hydrogen, and requirements for modifying an existing hydrogen production facility to obtain a new original placed in service date for purposes of the credit.

Back to top [ #top ]

________________________________________________________________________

*4.??IRS opens free IRA and CHIPS registration tool for organizations to register to monetize clean energy credits; pre-filing office hours*

________________________________________________________________________

The IRS announced qualifying businesses, tax exempt organizations or entities such as state, local and Indian Tribal governments can now register using the IRA/CHIPS Pre-filing Registration Tool, available free from the IRS to take advantage of the elective payment or transfer of credits [ [link removed] ].

*IRS offers office hours for help with the pre-filing registration process for elective payment and transfer of clean energy and CHIPS credits*

The IRS is excited to offer office hours (through Microsoft Teams) to help entities with the pre-filing registration process on the new IRA/CHIPS Pre-filing Registration Tool [ [link removed] ].

Pre-filing registration is a required step for applicable entities and eligible taxpayers to take advantage of elective payment or transfer of credits [ [link removed] ] available in the Inflation Reduction Act and CHIPS Act. Representatives from the IRS will be available to answer your pre-filing registration questions.

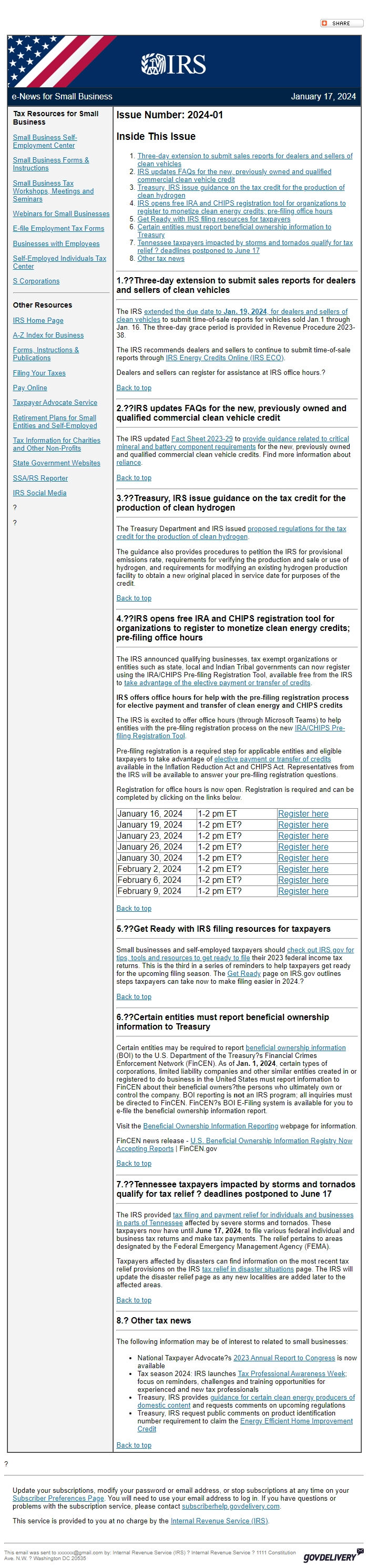

Registration for office hours is now open. Registration is required and can be completed by clicking on the links below.

January 16, 2024 1-2 pm ET Register here [ [link removed] ] January 19, 2024 1-2 pm ET? Register here [ [link removed] ] January 23, 2024 1-2 pm ET? Register here [ [link removed] ] January 26, 2024 1-2 pm ET? Register here [ [link removed] ] January 30, 2024 1-2 pm ET? Register here [ [link removed] ] February 2, 2024 1-2 pm ET? Register here [ [link removed] ] February 6, 2024 1-2 pm ET? Register here [ [link removed] ] February 9, 2024 1-2 pm ET? Register here [ [link removed] ]

Back to top [ #top ]

________________________________________________________________________

*5.??Get Ready with IRS filing resources for taxpayers*

________________________________________________________________________

Small businesses and self-employed taxpayers should check out IRS.gov for tips, tools and resources to get ready to file [ [link removed] ] their 2023 federal income tax returns. This is the third in a series of reminders to help taxpayers get ready for the upcoming filing season. The Get Ready [ [link removed] ] page on IRS.gov outlines steps taxpayers can take now to make filing easier in 2024.?

Back to top [ #top ]

________________________________________________________________________

*6.??Certain entities must report beneficial ownership information to Treasury*

________________________________________________________________________

Certain entities may be required to report beneficial ownership information [ [link removed] ] (BOI) to the U.S. Department of the Treasury?s Financial Crimes Enforcement Network (FinCEN). As of *Jan. 1, 2024*, certain types of corporations, limited liability companies and other similar entities created in or registered to do business in the United States must report information to FinCEN about their beneficial owners?the persons who ultimately own or control the company. BOI reporting is *not *an IRS program; all inquiries must be directed to FinCEN. FinCEN?s BOI E-Filing system is available for you to e-file the beneficial ownership information report.

Visit the Beneficial Ownership Information Reporting [ [link removed] ] webpage for information.

FinCEN news release - U.S. Beneficial Ownership Information Registry Now Accepting Reports [ [link removed] ] | FinCEN.gov

Back to top [ #top ]

________________________________________________________________________

*7.??Tennessee taxpayers impacted by storms and tornados qualify for tax relief ? deadlines postponed to June 17*

________________________________________________________________________

The IRS provided tax filing and payment relief for individuals and businesses in parts of Tennessee [ [link removed] ] affected by severe storms and tornados. These taxpayers now have until *June 17, 2024*, to file various federal individual and business tax returns and make tax payments. The relief pertains to areas designated by the Federal Emergency Management Agency (FEMA).

Taxpayers affected by disasters can find information on the most recent tax relief provisions on the IRS tax relief in disaster situations [ [link removed] ] page. The IRS will update the disaster relief page as any new localities are added later to the affected areas.

Back to top [ #top ]

________________________________________________________________________

*8.? Other tax news*

________________________________________________________________________

The following information may be of interest to related to small businesses:

* National Taxpayer Advocate?s 2023 Annual Report to Congress [ [link removed] ] is now available

* Tax season 2024: IRS launches Tax Professional Awareness Week [ [link removed] ]; focus on reminders, challenges and training opportunities for experienced and new tax professionals

* Treasury, IRS provides guidance for certain clean energy producers of domestic content [ [link removed] ] and requests comments on upcoming regulations

* Treasury, IRS request public comments on product identification number requirement to claim the Energy Efficient Home Improvement Credit [ [link removed] ]

Back to top [ #top ]

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

e-News for Small Business January 17, 2024

Tax Resources for Small Business

Small Business Self-Employment Center [ [link removed] ]

Small Business Forms & Instructions [ [link removed] ]

Small Business Tax Workshops, Meetings and Seminars [ [link removed] ]

Webinars for Small Businesses [ [link removed] ]

E-file Employment Tax Forms [ [link removed] ]

Businesses with Employees [ [link removed] ]

Self-Employed Individuals Tax Center [ [link removed] ]

S Corporations [ [link removed] ]

________________________________________________________________________

Other Resources

IRS Home Page [ [link removed] ]

A-Z Index for Business [ [link removed] ]

Forms, Instructions & Publications [ [link removed] ]

Filing Your Taxes [ [link removed] ]

Pay Online [ [link removed] ]

Taxpayer Advocate Service [ [link removed] ]

Retirement Plans for Small Entities and Self-Employed [ [link removed] ]

Tax Information for Charities [ [link removed] ]

and Other Non-Profits [ [link removed] ]

State Government Websites [ [link removed] ]

SSA/RS Reporter [ [link removed] ]

IRS Social Media [ [link removed] ]

?

?

Issue Number: 2024-01

Inside This Issue

* Three-day extension to submit sales reports for dealers and sellers of clean vehicles [ #First ]

* IRS updates FAQs for the new, previously owned and qualified commercial clean vehicle credit [ #Second ]

* Treasury, IRS issue guidance on the tax credit for the production of clean hydrogen [ #Third ]

* IRS opens free IRA and CHIPS registration tool for organizations to register to monetize clean energy credits; pre-filing office hours [ #Fourth ]

* Get Ready with IRS filing resources for taxpayers [ #Fifth ]

* Certain entities must report beneficial ownership information to Treasury [ #Sixth ]

* Tennessee taxpayers impacted by storms and tornados qualify for tax relief ? deadlines postponed to June 17 [ #Seventh ]

* Other tax news [ #Eighth ] [ #Fourteenth ]

________________________________________________________________________

*1.??Three-day extension to submit sales reports for dealers and sellers of clean vehicles*

________________________________________________________________________

The IRS extended the due date to *Jan. 19, 2024*, for dealers and sellers of clean vehicles [ [link removed] ] to submit time-of-sale reports for vehicles sold Jan.1 through Jan. 16. The three-day grace period is provided in Revenue Procedure 2023-38.

The IRS recommends dealers and sellers to continue to submit time-of-sale reports through IRS Energy Credits Online (IRS ECO) [ [link removed] ].

Dealers and sellers can register for assistance at IRS office hours.?

Back to top [ #top ]

________________________________________________________________________

*2.??IRS updates FAQs for the new, previously owned and qualified commercial clean vehicle credit*

________________________________________________________________________

The IRS updated Fact Sheet 2023-29 [ [link removed] ] to provide guidance related to critical mineral and battery component requirements [ [link removed] ] for the new, previously owned and qualified commercial clean vehicle credits. Find more information about reliance [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*3.??Treasury, IRS issue guidance on the tax credit for the production of clean hydrogen*

________________________________________________________________________

The Treasury Department and IRS issued proposed regulations for the tax credit for the production of clean hydrogen [ [link removed] ].

The guidance also provides procedures to petition the IRS for provisional emissions rate, requirements for verifying the production and sale or use of hydrogen, and requirements for modifying an existing hydrogen production facility to obtain a new original placed in service date for purposes of the credit.

Back to top [ #top ]

________________________________________________________________________

*4.??IRS opens free IRA and CHIPS registration tool for organizations to register to monetize clean energy credits; pre-filing office hours*

________________________________________________________________________

The IRS announced qualifying businesses, tax exempt organizations or entities such as state, local and Indian Tribal governments can now register using the IRA/CHIPS Pre-filing Registration Tool, available free from the IRS to take advantage of the elective payment or transfer of credits [ [link removed] ].

*IRS offers office hours for help with the pre-filing registration process for elective payment and transfer of clean energy and CHIPS credits*

The IRS is excited to offer office hours (through Microsoft Teams) to help entities with the pre-filing registration process on the new IRA/CHIPS Pre-filing Registration Tool [ [link removed] ].

Pre-filing registration is a required step for applicable entities and eligible taxpayers to take advantage of elective payment or transfer of credits [ [link removed] ] available in the Inflation Reduction Act and CHIPS Act. Representatives from the IRS will be available to answer your pre-filing registration questions.

Registration for office hours is now open. Registration is required and can be completed by clicking on the links below.

January 16, 2024 1-2 pm ET Register here [ [link removed] ] January 19, 2024 1-2 pm ET? Register here [ [link removed] ] January 23, 2024 1-2 pm ET? Register here [ [link removed] ] January 26, 2024 1-2 pm ET? Register here [ [link removed] ] January 30, 2024 1-2 pm ET? Register here [ [link removed] ] February 2, 2024 1-2 pm ET? Register here [ [link removed] ] February 6, 2024 1-2 pm ET? Register here [ [link removed] ] February 9, 2024 1-2 pm ET? Register here [ [link removed] ]

Back to top [ #top ]

________________________________________________________________________

*5.??Get Ready with IRS filing resources for taxpayers*

________________________________________________________________________

Small businesses and self-employed taxpayers should check out IRS.gov for tips, tools and resources to get ready to file [ [link removed] ] their 2023 federal income tax returns. This is the third in a series of reminders to help taxpayers get ready for the upcoming filing season. The Get Ready [ [link removed] ] page on IRS.gov outlines steps taxpayers can take now to make filing easier in 2024.?

Back to top [ #top ]

________________________________________________________________________

*6.??Certain entities must report beneficial ownership information to Treasury*

________________________________________________________________________

Certain entities may be required to report beneficial ownership information [ [link removed] ] (BOI) to the U.S. Department of the Treasury?s Financial Crimes Enforcement Network (FinCEN). As of *Jan. 1, 2024*, certain types of corporations, limited liability companies and other similar entities created in or registered to do business in the United States must report information to FinCEN about their beneficial owners?the persons who ultimately own or control the company. BOI reporting is *not *an IRS program; all inquiries must be directed to FinCEN. FinCEN?s BOI E-Filing system is available for you to e-file the beneficial ownership information report.

Visit the Beneficial Ownership Information Reporting [ [link removed] ] webpage for information.

FinCEN news release - U.S. Beneficial Ownership Information Registry Now Accepting Reports [ [link removed] ] | FinCEN.gov

Back to top [ #top ]

________________________________________________________________________

*7.??Tennessee taxpayers impacted by storms and tornados qualify for tax relief ? deadlines postponed to June 17*

________________________________________________________________________

The IRS provided tax filing and payment relief for individuals and businesses in parts of Tennessee [ [link removed] ] affected by severe storms and tornados. These taxpayers now have until *June 17, 2024*, to file various federal individual and business tax returns and make tax payments. The relief pertains to areas designated by the Federal Emergency Management Agency (FEMA).

Taxpayers affected by disasters can find information on the most recent tax relief provisions on the IRS tax relief in disaster situations [ [link removed] ] page. The IRS will update the disaster relief page as any new localities are added later to the affected areas.

Back to top [ #top ]

________________________________________________________________________

*8.? Other tax news*

________________________________________________________________________

The following information may be of interest to related to small businesses:

* National Taxpayer Advocate?s 2023 Annual Report to Congress [ [link removed] ] is now available

* Tax season 2024: IRS launches Tax Professional Awareness Week [ [link removed] ]; focus on reminders, challenges and training opportunities for experienced and new tax professionals

* Treasury, IRS provides guidance for certain clean energy producers of domestic content [ [link removed] ] and requests comments on upcoming regulations

* Treasury, IRS request public comments on product identification number requirement to claim the Energy Efficient Home Improvement Credit [ [link removed] ]

Back to top [ #top ]

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery