|

John,

We’re less than a week away from a partial government shutdown unless Congress acts. And what are Republicans demanding? Cuts to the IRS.

Research shows that for every $1 spent on making sure that wealthy tax cheats pay what they owe, we see, on average, a $22 return.[1] Cuts to IRS funding will result in less revenue to pay for critical services liking housing assistance, nutrition assistance, Head Start, healthcare affordability, and more while increasing the federal deficit by at least $114 billion over 10 years.[2]

Speaker MAGA Mike Johnson’s attempts to cut this vital IRS funding make one thing very clear: he will sacrifice anything, including the deficit and hard-working Americans, just to protect mega-rich tax cheats.

Right now, in an agreement being finalized in Congress, Republicans have secured a $20 billion cut in IRS funding, but they want even more.

Rush a donation today to fight back against GOP attempts to gut the IRS just to protect their wealthy tax cheat donors from having to pay their fair share in taxes.

The $80 billion investment that we helped secure for the IRS over 10 years is already working. It has allowed the IRS to:

-

Cut phone wait times from 28 minutes to just 3 minutes and allowed the IRS to answer 3 million more phone calls in 2023 than the year before;[3]

-

Develop additional services for taxpayers such as the Direct File pilot program, which will allow taxpayers to keep more of their tax returns by using a free easy-to-use system instead of a paid tax filing system while also ensuring more working people are able to access the Earned Income Tax Credit and Child Tax Credit;

-

Crack down on wealthy and corporate tax cheats, collecting $500 million from millionaire tax cheats so far,[4] notifying Microsoft that it owes $29 billion in taxes,[5] and announcing the audits of 60 giant corporations that together make more than $500 billion in profits each year.[6]

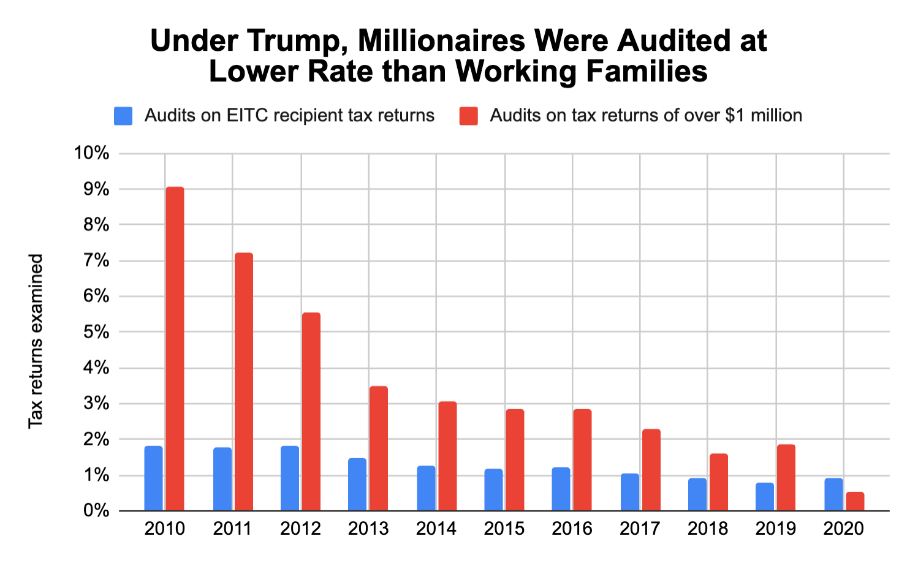

Over the last decade, Republicans’ obsession with cutting critical resources for the IRS resulted in a massive cut to IRS staff. This caused the audit rates of millionaires to drop to the point where low-income families were being audited at higher rates than the ultra-wealthy:

Our efforts have turned this around. Now we need to fight to maintain this progress.

Donate today to fight back against Republican attempts to further cut IRS funding just to protect their wealthy donors and corporate sponsors.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Thank you for fighting for a tax system where the rich and corporations finally pay their fair share.

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] CONSERVATIVE EFFORTS TO PAD WEALTHY TAX CHEATS’ POCKETS

[2] Estimated Budgetary Effects of H.R. 23, the Family and Small Business Taxpayer Protection Act, as Posted on the Website of the Clerk of the House of Representatives on January 9, 2023 as an Item That May Be Considered Pursuant to a Rule

[3] Modernizing the IRS

[4] The IRS crackdown on high-end taxpayers is already raking in millions in back taxes — here’s how much

[5] IRS says Microsoft owes an additional $29 billion in back taxes

[6] IRS Investment Update: Business Account Launches, Noncompliant US Subsidiaries Targeted

|