| From | Wesley Harris <[email protected]> |

| Subject | Our tax system just isn’t fair |

| Date | January 12, 2024 3:12 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

[link removed] [[link removed]]

Hey, John,

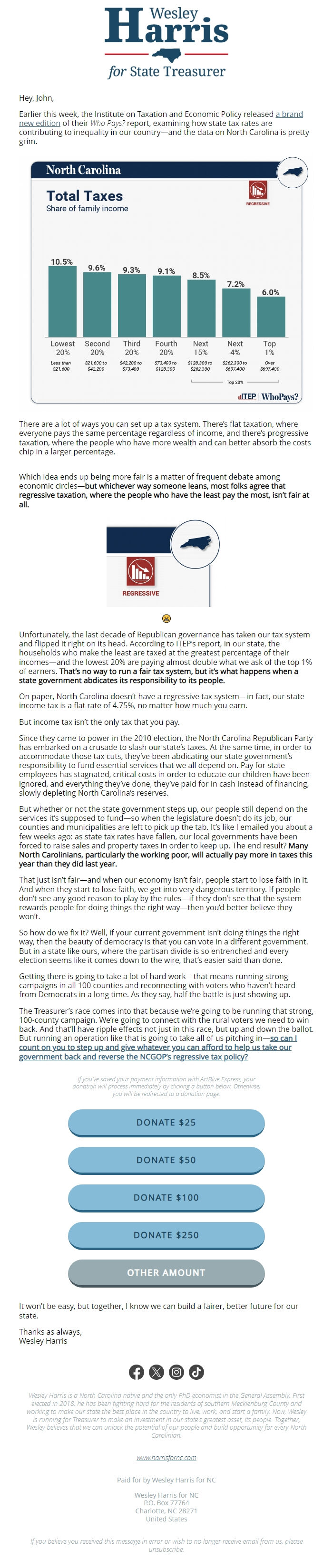

Earlier this week, the Institute on Taxation and Economic Policy released a brand new edition [[link removed]] of their Who Pays? report, examining how state tax rates are contributing to inequality in our country—and the data on North Carolina is pretty grim.

North Carolina Total Taxes as Share of Family Income graph [[link removed]]

There are a lot of ways you can set up a tax system. There’s flat taxation, where everyone pays the same percentage regardless of income, and there’s progressive taxation, where the people who have more wealth and can better absorb the costs chip in a larger percentage.

Which idea ends up being more fair is a matter of frequent debate among economic circles— but whichever way someone leans, most folks agree that regressive taxation, where the people who have the least pay the most, isn’t fair at all.

Cropped screenshot of the above graph showing that NC''s taxes are regressive [[link removed]]

😬

Unfortunately, the last decade of Republican governance has taken our tax system and flipped it right on its head. According to ITEP’s report, in our state, the households who make the least are taxed at the greatest percentage of their incomes—and the lowest 20% are paying almost double what we ask of the top 1% of earners. That’s no way to run a fair tax system, but it’s what happens when a state government abdicates its responsibility to its people.

On paper, North Carolina doesn’t have a regressive tax system—in fact, our state income tax is a flat rate of 4.75%, no matter how much you earn.

But income tax isn’t the only tax that you pay.

Since they came to power in the 2010 election, the North Carolina Republican Party has embarked on a crusade to slash our state’s taxes. At the same time, in order to accommodate those tax cuts, they’ve been abdicating our state government’s responsibility to fund essential services that we all depend on. Pay for state employees has stagnated, critical costs in order to educate our children have been ignored, and everything they’ve done, they’ve paid for in cash instead of financing, slowly depleting North Carolina’s reserves.

But whether or not the state government steps up, our people still depend on the services it’s supposed to fund—so when the legislature doesn’t do its job, our counties and municipalities are left to pick up the tab. It’s like I emailed you about a few weeks ago: as state tax rates have fallen, our local governments have been forced to raise sales and property taxes in order to keep up. The end result? Many North Carolinians, particularly the working poor, will actually pay more in taxes this year than they did last year.

That just isn’t fair—and when our economy isn’t fair, people start to lose faith in it. And when they start to lose faith, we get into very dangerous territory. If people don’t see any good reason to play by the rules—if they don’t see that the system rewards people for doing things the right way—then you’d better believe they won’t.

So how do we fix it? Well, if your current government isn’t doing things the right way, then the beauty of democracy is that you can vote in a different government. But in a state like ours, where the partisan divide is so entrenched and every election seems like it comes down to the wire, that’s easier said than done.

Getting there is going to take a lot of hard work—that means running strong campaigns in all 100 counties and reconnecting with voters who haven’t heard from Democrats in a long time. As they say, half the battle is just showing up.

The Treasurer’s race comes into that because we’re going to be running that strong, 100-county campaign. We’re going to connect with the rural voters we need to win back. And that’ll have ripple effects not just in this race, but up and down the ballot. But running an operation like that is going to take all of us pitching in— so can I count on you to step up and give whatever you can afford to help us take our government back and reverse the NCGOP’s regressive tax policy? [[link removed]]

If you've saved your payment information with ActBlue Express, your donation will process immediately by clicking a button below. Otherwise, you will be redirected to a donation page.

DONATE $25 [[link removed]]

DONATE $50 [[link removed]]

DONATE $100 [[link removed]]

DONATE $250 [[link removed]]

OTHER AMOUNT [[link removed]]

It won’t be easy, but together, I know we can build a fairer, better future for our state.

Thanks as always,

Wesley Harris

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Wesley Harris is a North Carolina native and the only PhD economist in the General Assembly. First elected in 2018, he has been fighting hard for the residents of southern Mecklenburg County and working to make our state the best place in the country to live, work, and start a family. Now, Wesley is running for Treasurer to make an investment in our state's greatest asset, its people. Together, Wesley believes that we can unlock the potential of our people and build opportunity for every North Carolinian.

www.harrisfornc.com [[link removed]]

Paid for by Wesley Harris for NC

Wesley Harris for NC

P.O. Box 77764

Charlotte, NC 28271

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Hey, John,

Earlier this week, the Institute on Taxation and Economic Policy released a brand new edition [[link removed]] of their Who Pays? report, examining how state tax rates are contributing to inequality in our country—and the data on North Carolina is pretty grim.

North Carolina Total Taxes as Share of Family Income graph [[link removed]]

There are a lot of ways you can set up a tax system. There’s flat taxation, where everyone pays the same percentage regardless of income, and there’s progressive taxation, where the people who have more wealth and can better absorb the costs chip in a larger percentage.

Which idea ends up being more fair is a matter of frequent debate among economic circles— but whichever way someone leans, most folks agree that regressive taxation, where the people who have the least pay the most, isn’t fair at all.

Cropped screenshot of the above graph showing that NC''s taxes are regressive [[link removed]]

😬

Unfortunately, the last decade of Republican governance has taken our tax system and flipped it right on its head. According to ITEP’s report, in our state, the households who make the least are taxed at the greatest percentage of their incomes—and the lowest 20% are paying almost double what we ask of the top 1% of earners. That’s no way to run a fair tax system, but it’s what happens when a state government abdicates its responsibility to its people.

On paper, North Carolina doesn’t have a regressive tax system—in fact, our state income tax is a flat rate of 4.75%, no matter how much you earn.

But income tax isn’t the only tax that you pay.

Since they came to power in the 2010 election, the North Carolina Republican Party has embarked on a crusade to slash our state’s taxes. At the same time, in order to accommodate those tax cuts, they’ve been abdicating our state government’s responsibility to fund essential services that we all depend on. Pay for state employees has stagnated, critical costs in order to educate our children have been ignored, and everything they’ve done, they’ve paid for in cash instead of financing, slowly depleting North Carolina’s reserves.

But whether or not the state government steps up, our people still depend on the services it’s supposed to fund—so when the legislature doesn’t do its job, our counties and municipalities are left to pick up the tab. It’s like I emailed you about a few weeks ago: as state tax rates have fallen, our local governments have been forced to raise sales and property taxes in order to keep up. The end result? Many North Carolinians, particularly the working poor, will actually pay more in taxes this year than they did last year.

That just isn’t fair—and when our economy isn’t fair, people start to lose faith in it. And when they start to lose faith, we get into very dangerous territory. If people don’t see any good reason to play by the rules—if they don’t see that the system rewards people for doing things the right way—then you’d better believe they won’t.

So how do we fix it? Well, if your current government isn’t doing things the right way, then the beauty of democracy is that you can vote in a different government. But in a state like ours, where the partisan divide is so entrenched and every election seems like it comes down to the wire, that’s easier said than done.

Getting there is going to take a lot of hard work—that means running strong campaigns in all 100 counties and reconnecting with voters who haven’t heard from Democrats in a long time. As they say, half the battle is just showing up.

The Treasurer’s race comes into that because we’re going to be running that strong, 100-county campaign. We’re going to connect with the rural voters we need to win back. And that’ll have ripple effects not just in this race, but up and down the ballot. But running an operation like that is going to take all of us pitching in— so can I count on you to step up and give whatever you can afford to help us take our government back and reverse the NCGOP’s regressive tax policy? [[link removed]]

If you've saved your payment information with ActBlue Express, your donation will process immediately by clicking a button below. Otherwise, you will be redirected to a donation page.

DONATE $25 [[link removed]]

DONATE $50 [[link removed]]

DONATE $100 [[link removed]]

DONATE $250 [[link removed]]

OTHER AMOUNT [[link removed]]

It won’t be easy, but together, I know we can build a fairer, better future for our state.

Thanks as always,

Wesley Harris

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Wesley Harris is a North Carolina native and the only PhD economist in the General Assembly. First elected in 2018, he has been fighting hard for the residents of southern Mecklenburg County and working to make our state the best place in the country to live, work, and start a family. Now, Wesley is running for Treasurer to make an investment in our state's greatest asset, its people. Together, Wesley believes that we can unlock the potential of our people and build opportunity for every North Carolinian.

www.harrisfornc.com [[link removed]]

Paid for by Wesley Harris for NC

Wesley Harris for NC

P.O. Box 77764

Charlotte, NC 28271

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Message Analysis

- Sender: Wesley Harris

- Political Party: Democratic

- Country: United States

- State/Locality: North Carolina

- Office: State Treasurer