January 11, 2024

Permission to republish original opeds and cartoons granted.

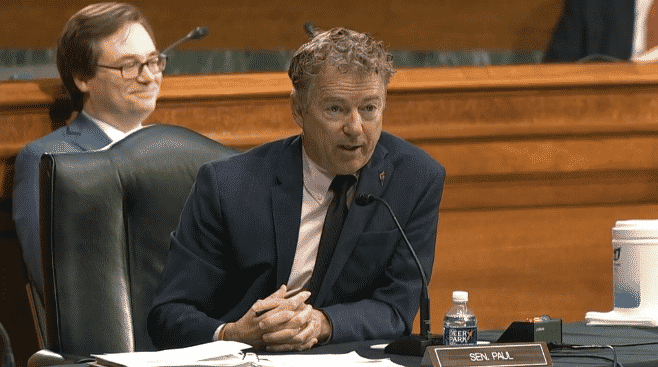

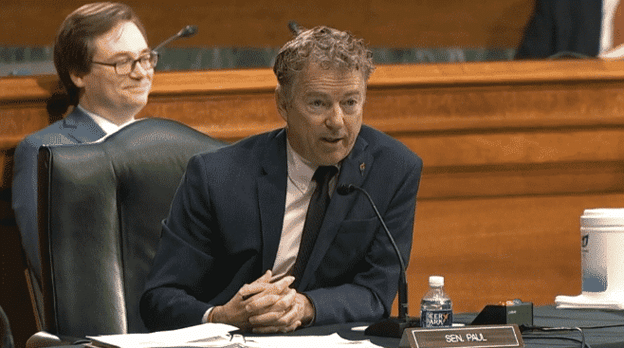

Sen. Rand Paul offers Fed audit as regional bank bailout hits $141 billion

By Robert Romano

Legislation offered by Sen. Rand Paul (R-Ky.), the “Federal Reserve Transparency Act of 2024,” would conduct an audit of the U.S. Federal Reserve by the Government Accountability Office (GAO) for the first time since the Dodd-Frank legislation of 2010 required an audit of the central bank’s purchases of mortgage-backed securities.

This time around, the GAO would look at the Fed’s entire balance sheet, including the recently enacted Bank Term Funding Program — now $141 billion according to the central bank’s latest H.4.1. release — that has been lending banks money in exchange for U.S. Treasuries after the spike in interest rates caused there to be a reported $620 billion of unreported losses including regional banks that experienced failures in the interest rate crunch.

According to Sen. Paul’s press description of the legislation the GAO will be a full audit and include “Transactions for or with a foreign central bank, government of a foreign country, or nonprivate international financing organization; Deliberations, decisions, or actions on monetary policy matters, including discount window operations, reserves of member banks, securities credit, interest on deposits, and open market operations; Transactions made under the direction of the Federal Open Market Committee; Discussions or communications among or between members of the Federal Reserve Board and officers and employees of the Federal Reserve System related to the actions listed above.”

In the context of the Bank Term Funding Program, the audit will reveal which banks have been dependent on the Fed to avoid losses due to overexposure to U.S. Treasuries — $26.9 trillion out of the $34 trillion national debt is publicly traded.

By 2033, the Office of Management and Budget (OMB) estimates that the total national debt will rise to more than $50 trillion.

In reality, it could be even worse than that. Since 1980, once recessions and wars have been factored in, the debt has been growing by about 8 percent a year. At that rate, it could hit $100 trillion by 2037 or so.

All of which raises the troubling questions: Who’s going to buy all of that debt over the next couple of decades? And at what interest rates?

The last time an audit was conducted, it was revealed of the $1.25 trillion of mortgage-backed securities (MBS) bought by the Fed during the financial crisis, foreign entities sold some $442.7 billion of their mortgage securities to the Fed. Now, the Fed holds some $2.4 trillion of MBS. Who did they buy those from? An audit will say.

Particularly examining the impacts of the Bank Term Funding Program is important from Congress’ perspective, as it plans Social Security, Medicare and Medicaid spending, which is ballooning. In just the next decade, OMB reports that Social Security will rise from $1.3 trillion to $2.4 trillion, Medicare from $821 billion to $1.8 trillion and Medicaid from $608 billion to $926 billion.

As a result, the annual deficit from $1.7 trillion annually to $2.5 trillion by 2033, and the amount that will need to be funded by Treasuries markets will rise from $1.65 trillion to $2.03 trillion by that time.

Therefore seeing how overexposure to treasuries is already impacting banks — and to what degree — is particularly important. Of the current $26.9 trillion publicly traded debt, $4.7 trillion is held by the Federal Reserve and $7.4 trillion is held by foreign central banks and financial institutions, leaving $14.8 trillion for U.S. financial institutions, pension funds, institutional investors and the like.

In the recent interest rate crunch, although the current net account for the Bank Term Funding Program is $141 billion, how many treasuries have flowed through it on a gross basis?

What if a decade from now we once again experience high inflation, necessitating higher interest rates, leading to another interest rate crunch? Shouldn’t we examine how that is occurring, and to what impact, before the debt reaches, say, $50 trillion or $100 trillion?

Only an audit of the Federal Reserve can answer these questions, and thankfully, Sen. Rand Paul is still willing to ask them.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.

To view online: https://dailytorch.com/2024/01/sen-rand-paul-offers-fed-audit-as-regional-bank-bailout-hits-141-billion/

Cartoon: Evil Recipe

By A.F. Branco

Click here for a higher level resolution version.

To view online: https://dailytorch.com/2024/01/cartoon-evil-recipe/

Hans von Spakovsky: Trump’s Ballot Disqualification Case Reaches Supreme Court

By Hans von Spakovsky

In what may turn out to be the most pivotal election case since Bush v. Gore, the U.S. Supreme Court issued a short order on Jan. 5 granting the request by former President Donald Trump asking the court to overturn the Colorado state Supreme Court’s Dec. 19 decision disqualifying him from appearing on the state’s presidential primary ballot. The U.S. Supreme Court moved with unprecedented speed; Trump filed his petition for certiorari on Jan. 3, and the court granted the appeal only two days later.

The case has been put on what, for the Supreme Court, is a “rocket docket.” Trump’s brief and any amicus briefs supporting the former president in Trump v. Anderson have to be filed by Jan. 18; the challengers’ brief and amicus briefs supporting Trump’s removal have to be filed by Jan. 31. Trump’s reply brief is due on Feb. 5, and oral arguments will be held on Feb. 8.

There is no doubt that getting into the Supreme Court for the Feb. 8 oral argument will be the hottest ticket in town since either the Dobbs case overturning Roe v. Wade or the case challenging the constitutionality of Obamacare, when people started lining up the night before at the court’s location behind the U.S. Capitol. The court is also sure to be flooded with amicus briefs on both sides, given the key importance of this case to the 2024 election.

In fact, just before the court issued its order late in the afternoon on Jan. 5 accepting the case, 27 states, led by the attorneys general of Indiana and West Virginia, Todd Rokita and Patrick Morrisey, filed an amicus brief on Trump’s side urging the court to take the case as soon as possible to “head off the chaos that the Colorado decision will produce” and “erase a standardless political judgment” that violates the Constitution.

The chaos the states warn about is very real given that there are more than a dozen of these challenges underway in different states. Moreover, like Colorado, the Maine secretary of state has also disqualified Trump from her state’s ballot, while other states like Minnesota and Michigan have rejected these challenges.

One thing to keep in mind: Trump will remain on the presidential primary ballot in Colorado despite the Colorado court’s 4-to-3 decision declaring that Trump was disqualified pursuant to Section 3 of the 14th Amendment.

In its Dec. 19 order, the Colorado court said that if review was sought in the U.S. Supreme Court by Jan. 4—the date the Colorado secretary of state had to certify the candidates’ names on the presidential primary ballot—the secretary would “be required to include President Trump’s name on the 2024 presidential primary ballot until the receipt of any order or mandate from the Supreme Court.” Since Trump filed his petition on Jan. 3 and the Supreme Court did not immediately reject it by the Jan. 4 deadline, his name will appear on the ballot.

As I have previously explained, there are numerous reasons, both constitutional and statutory, why the Colorado court’s decision was wrong. Section 3 of the 14th Amendment, which was aimed at preventing members of the Southern Confederacy who had engaged in insurrection and rebellion from serving in the federal or state governments, does not apply to Trump because he was never an “officer of the United States,” a precondition for the application of Section 3.

The Supreme Court has previously held that an “officer of the United States” is a term that only applies to individuals appointed to posts within the executive branch, not those elected. Furthermore, Congress has not passed any legislation providing a means to enforce Section 3, and there are serious questions of whether Section 3 is even still legally viable because of two amnesty acts passed by Congress in 1872 and 1898. The first in 1872 removed all “political disabilities” imposed by Section 3 with certain exceptions related to the Civil War, and the second in 1898 got rid of those remaining exceptions with no language preserving the disqualifications of Section 3 for future cases.

Additionally, Trump has never been convicted or even charged with insurrection or rebellion, and was, in fact, acquitted of “incitement of insurrection” by the Senate after his second impeachment.

Thus, there are numerous reasons for the court to overturn the Colorado court’s misinterpretation and misapplication of the 14th Amendment, a decision that effectively disenfranchised the almost 4.5 million registered voters in Colorado whose right to make their own choice about who should be a candidate for president was stolen by four judges. If the U.S. Supreme Court doesn’t overturn this misguided decision, millions of voters in other states will be similarly disenfranchised, striking a devastating blow to the democratic process.

To view online: https://www.dailysignal.com/2024/01/10/trumps-ballot-disqualification-case-reaches-supreme-court/