|

John,

It’s a sad fact: the U.S. tax code worsens inequality.

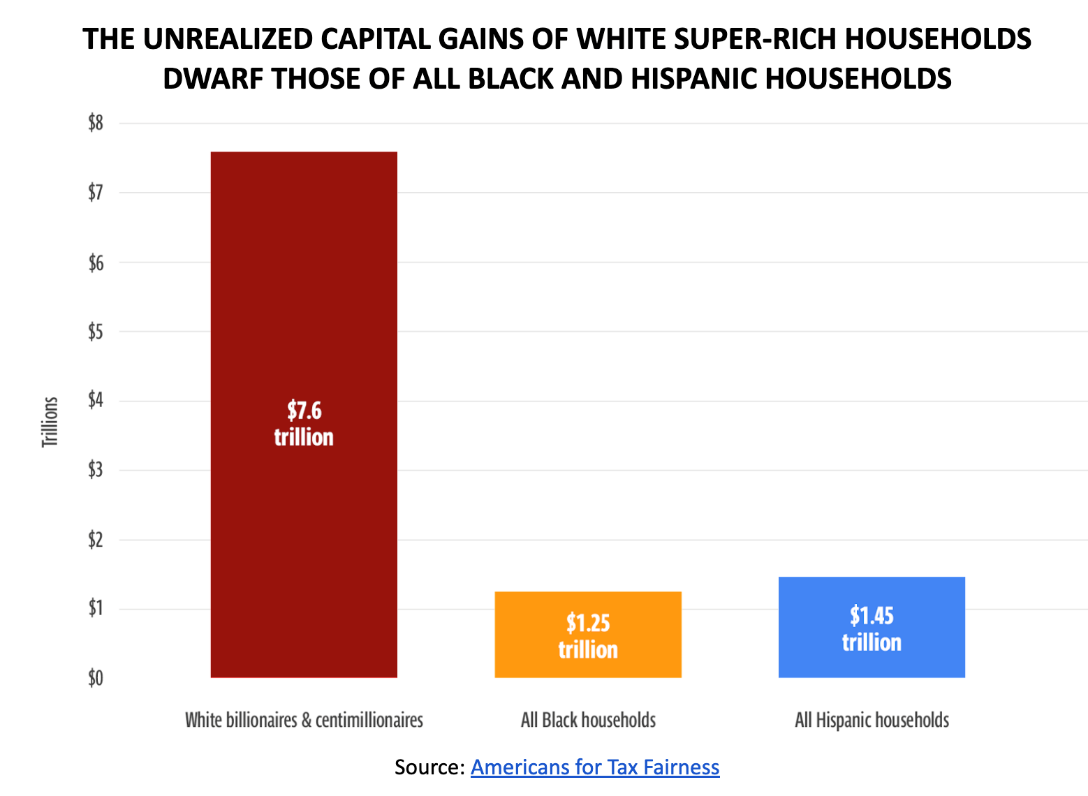

According to a new report by Americans for Tax Fairness, not only do the handful of American billionaires and ultra-millionaires (those worth over $100 million) hold more unrealized gains than everyone in the country younger than 49 years old, they also hold nearly 3 times as much wealth as ALL Black and Latino households combined.[1]

In order to address wealth inequality in the U.S., it’s time that the very richest households start paying their fair share in taxes. That starts by taxing unrealized wealth gains each year―the rise in value of unsold investments―that are the single largest source of income for the super-rich.

Donate today to fight for the Billionaires Income Tax in the Senate and the Billionaire Minimum Income Tax in the House to ensure billionaires and ultra-millionaires pay taxes on their wealth gains each year, just like working people pay on their wages.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Thank you for fighting for a tax system that closes the racial wealth gap and that puts working people first.

Maura Quint

Campaign Director

Americans for Tax Fairness Action Fund

[1] The Ultra-Wealthy’s $8.5 Trillion of Untaxed Income

-- David's email --

John,

A brand new report from Americans for Tax Fairness highlights the critical need to tax billionaires’ wealth gains.

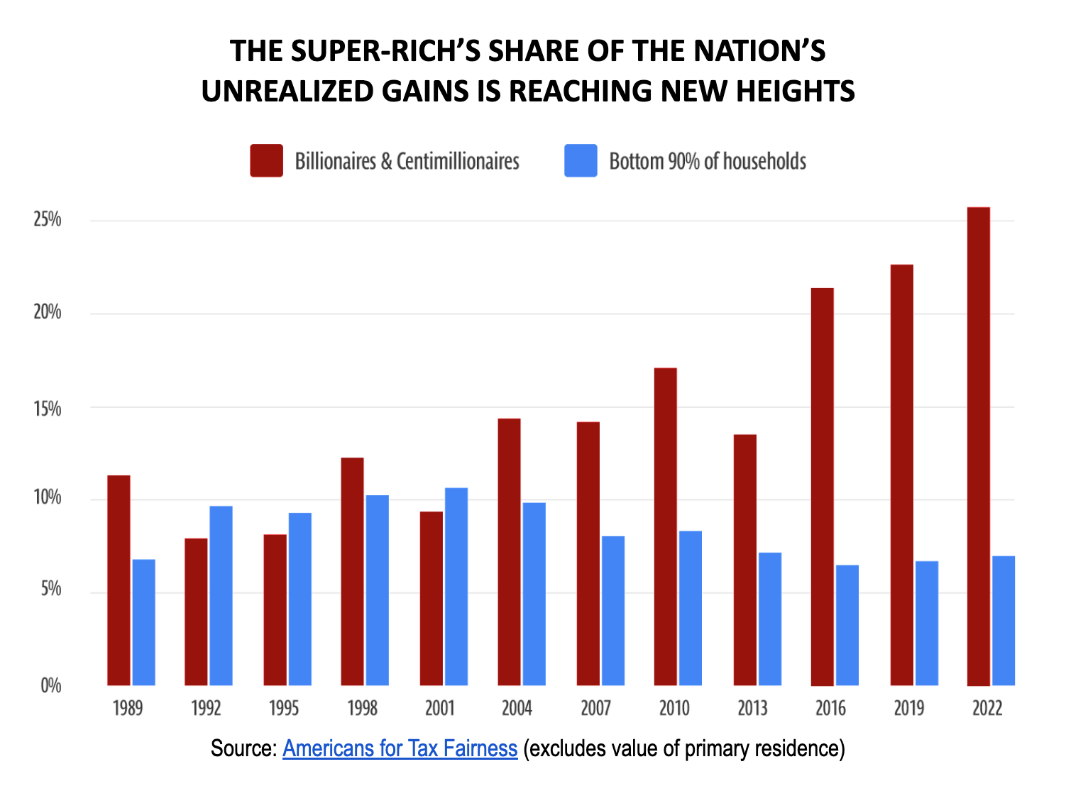

Using new data from the Federal Reserve, we’ve determined that America’s billionaires and ultra-millionaires worth $100 million or more held $8.5 TRILLION in untaxed wealth gains in 2022.[1] These profits from unsold investments constitute the largest source of income for the super-rich.

Under current rules, these profits are only taxed when the investments in stocks, bonds, real estate, and more are sold. But the ultrawealthy don’t need to sell their assets to benefit: they can live luxuriously off low-cost loans secured against their rising fortunes. And when those gains are inherited by the next generation, they completely disappear for tax purposes.

This is exactly why we’re fighting for the Billionaires Income Tax in the Senate and the Billionaire Minimum Income Tax in the House. Both bills would raise hundreds of billions of dollars in tax revenue by taxing the wealth gains of the nation’s very richest households each year.

Donate today to power our campaign demanding billionaires and ultra-millionaires pay their fair share of income taxes each year just like working people do on their wages.

Our latest research also shows that this tiny handful of super-rich individuals, who represent just 0.05% of the population, hold as much unrealized capital gains as the entire bottom 84% of American society―or 110 million households.

But it gets even more unequal.

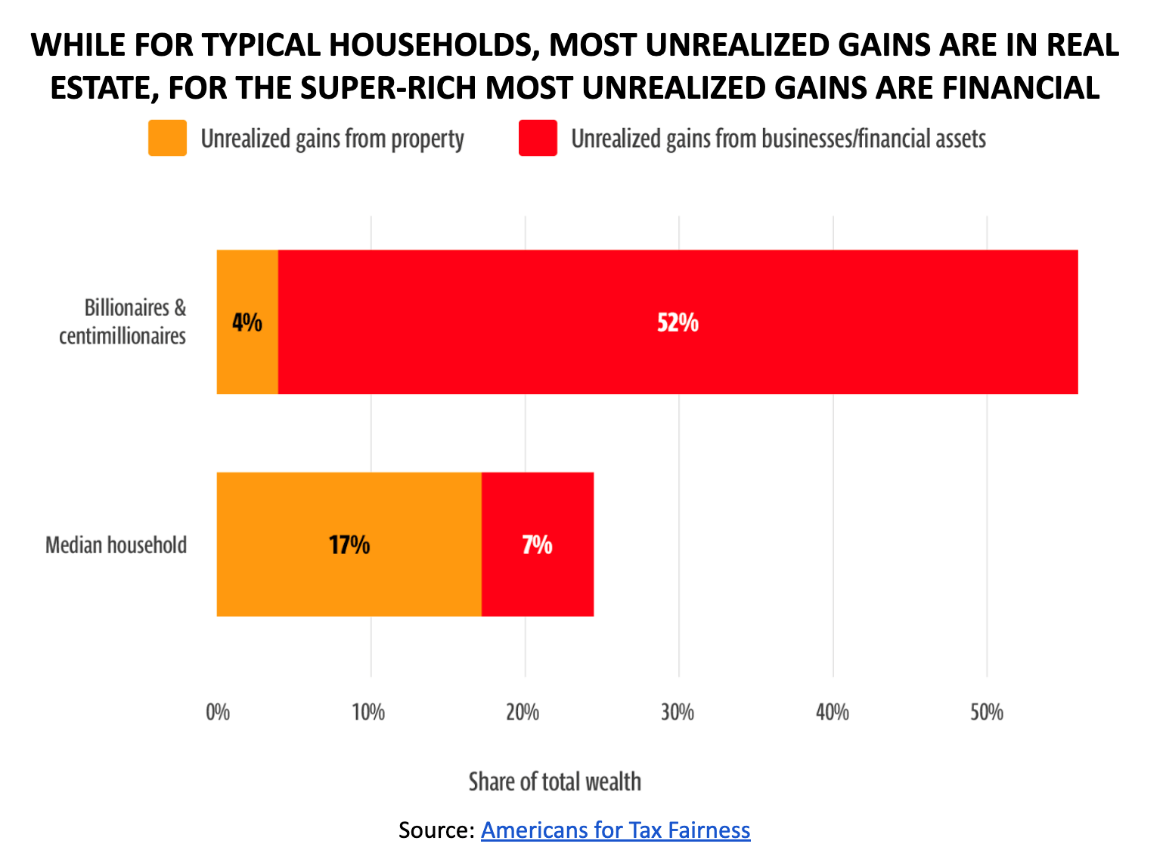

Most of the capital gains held by the median American household is in their PRIMARY RESIDENCE—the rise in value of which is reflected in yearly state and local property taxes.

Meanwhile, less than 4% of unrealized capital gains held by the ultra-wealthy is in real estate.

Donate today to fight for a tax on billionaires’ wealth gains to ensure the ultra-wealthy are paying taxes each year on their largest source of income: unrealized capital gains.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Together, we’re fighting to level the playing field for working people by demanding the wealthy pay their fair share in taxes.

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] The Ultra-Wealthy’s $8.5 Trillion of Untaxed Income

|