Email

Market Drops As Interest Rates Rise On Hawkish Fed Talk (Weekly Cheat Sheet)

| From | Irving Wilkinson <[email protected]> |

| Subject | Market Drops As Interest Rates Rise On Hawkish Fed Talk (Weekly Cheat Sheet) |

| Date | January 8, 2024 2:35 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View image: ([link removed])

Caption:

Good morning,

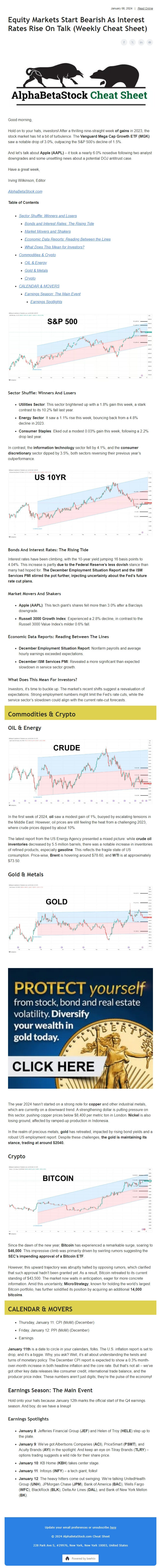

Hold on to your hats, investors! After a thrilling nine-straight week** of gains** in 2023, the stock market has hit a bit of turbulence. The **Vanguard Mega Cap Growth ETF (MGK)** saw a notable drop of 3.0%, outpacing the S&P 500’s decline of 1.5%.

And let’s talk about **Apple (AAPL)** – it took a nearly 6.0% nosedive following two analyst downgrades and some unsettling news about a potential DOJ antitrust case.

Have a great week,

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

**Table of Contents**

* [Sector Shuffle: Winners and Losers]([link removed])

* [Bonds and Interest Rates: The Rising Tide]([link removed])

* [Market Movers and Shakers]([link removed])

* [Economic Data Reports: Reading Between the Lines]([link removed])

* [What Does This Mean for Investors?]([link removed])

* [Commodities & Crypto]([link removed])

* [OIL & Energy]([link removed])

* [Gold & Metals]([link removed])

* [Crypto]([link removed])

* [CALENDAR & MOVERS]([link removed])

* [Earnings Season: The Main Event]([link removed])

* [Earnings Spotlights]([link removed])

View image: ([link removed])

Caption:

#### **Sector Shuffle: Winners And Losers**

* **Utilities Sector**: This sector brightened up with a 1.8% gain this week, a stark contrast to its 10.2% fall last year.

* **Energy Sector**: It saw a 1.1% rise this week, bouncing back from a 4.8% decline in 2023.

* **Consumer Staples**: Eked out a modest 0.03% gain this week, following a 2.2% drop last year.

In contrast, the **information technology** sector fell by 4.1%, and the **consumer discretionary** sector dipped by 3.5%, both sectors reversing their previous year’s outperformance.

View image: ([link removed])

Caption:

#### **Bonds And Interest Rates: The Rising Tide**

Interest rates have been climbing, with the 10-year yield jumping 16 basis points to 4.04%. This increase is partly **due to the Federal Reserve’s less dovish** stance than many had hoped for. **The December Employment Situation Report and the ISM Services PMI stirred the pot further, injecting uncertainty about the Fed’s future rate cut plans.**

#### **Market Movers And Shakers**

* **Apple (AAPL)**: This tech giant’s shares fell more than 3.0% after a Barclays downgrade.

* **Russell 3000 Growth Index**: Experienced a 2.8% decline, in contrast to the Russell 3000 Value Index’s milder 0.6% fall.

#### **Economic Data Reports: Reading Between The Lines**

* **December Employment Situation Report**: Nonfarm payrolls and average hourly earnings exceeded expectations.

* **December ISM Services PMI**: Revealed a more significant than expected slowdown in service sector growth.

#### **What Does This Mean For Investors?**

Investors, it’s time to buckle up. The market’s recent shifts suggest a reevaluation of expectations. Strong employment numbers might limit the Fed’s rate cuts, while the service sector’s slowdown could align with the current rate-cut forecasts.

----------

# **Commodities & Crypto**

----------## **OIL & Energy**

View image: ([link removed])

Caption:

In the first week of 2024, **oil** saw a modest gain of 1%, buoyed by escalating tensions in the Middle East. However, oil prices are still feeling the heat from a challenging 2023, where crude prices dipped by about 10%.

The latest report from the US Energy Agency presented a mixed picture: while **crude oil inventories** decreased by 5.5 million barrels, there was a notable increase in inventories of refined products, especially **gasoline**. This reflects the fragile state of US consumption. Price-wise, **Brent** is hovering around $78.60, and **WTI** is at approximately $73.50.

## **Gold & Metals**

View image: ([link removed])

Caption:

View image: ([link removed])

Caption:

The year 2024 hasn’t started on a strong note for **copper** and other industrial metals, which are currently on a downward trend. A strengthening dollar is putting pressure on this sector, pushing copper prices below $8,400 per metric ton in London. **Nickel** is also losing ground, affected by ramped-up production in Indonesia.

In the realm of precious metals, **gold** has retreated, impacted by rising bond yields and a robust US employment report. Despite these challenges,** the gold is maintaining its stance, trading at around $2040.**

## **Crypto**

View image: ([link removed])

Caption:

Since the dawn of the new year, **Bitcoin** has experienced a remarkable surge, soaring to **$46,000**. This impressive climb was primarily driven by swirling rumors suggesting the **SEC’s impending approval of a Bitcoin ETF**.

However, this upward trajectory was abruptly halted by opposing rumors, which clarified that such approval hadn’t been granted yet. As a result, Bitcoin retreated to its current standing of $43,500. The market now waits in anticipation, eager for more concrete information. Amid this uncertainty, **MicroStrategy**, known for holding the world’s largest Bitcoin portfolio, has further solidified its position by acquiring an additional **14,000 bitcoins**.

----------

# **CALENDAR & MOVERS**

----------* Thursday, January 11: CPI (MoM) (December)

* Friday, January 12: PPI (MoM) (December)

* Earnings

**January 11th** is a date to circle in your calendars, folks. The U.S. inflation report is set to drop, and it’s a biggie. Why, you ask? Well, it’s all about understanding the twists and turns of monetary policy. The December CPI report is expected to show a 0.3% month-over-month increase in both headline inflation and the core rate. But that’s not all – we’ve got other key data releases like consumer credit, international trade balance, and the producer price index. These numbers aren’t just digits; they’re the pulse of the economy!

## **Earnings Season: The Main Event**

Hold onto your hats because January 12th marks the official start of the Q4 earnings season. And boy, do we have a lineup!

### **Earnings Spotlights**

* **January 8**: Jefferies Financial Group (**JEF**) and Helen of Troy (**HELE**) step up to the plate.

* **January 9**: We’ve got Albertsons Companies (**ACI**), PriceSmart (**PSMT**), and Acuity Brands (**AYI**) in the spotlight. And keep an eye on Tilray Brands (**TLRY**) – options trading suggests a wild ride for their share price.

* **January 10**: KB Home (**KBH**) takes center stage.

* **January 11**: Infosys (**INFY**) – a tech giant, folks!

* **January 12**: The heavy hitters come out swinging. We’re talking UnitedHealth Group (**UNH**), JPMorgan Chase (**JPM**), Bank of America (**BAC**), Wells Fargo (**WFC**), BlackRock (**BLK**), Delta Air Lines (**DAL**), and Bank of New York Mellon (**BK**).

Free AlphaBetaStock's Cheat Sheet (No

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Caption:

Good morning,

Hold on to your hats, investors! After a thrilling nine-straight week** of gains** in 2023, the stock market has hit a bit of turbulence. The **Vanguard Mega Cap Growth ETF (MGK)** saw a notable drop of 3.0%, outpacing the S&P 500’s decline of 1.5%.

And let’s talk about **Apple (AAPL)** – it took a nearly 6.0% nosedive following two analyst downgrades and some unsettling news about a potential DOJ antitrust case.

Have a great week,

Irving Wilkinson, Editor

[AlphaBetaStock.com]([link removed])

**Table of Contents**

* [Sector Shuffle: Winners and Losers]([link removed])

* [Bonds and Interest Rates: The Rising Tide]([link removed])

* [Market Movers and Shakers]([link removed])

* [Economic Data Reports: Reading Between the Lines]([link removed])

* [What Does This Mean for Investors?]([link removed])

* [Commodities & Crypto]([link removed])

* [OIL & Energy]([link removed])

* [Gold & Metals]([link removed])

* [Crypto]([link removed])

* [CALENDAR & MOVERS]([link removed])

* [Earnings Season: The Main Event]([link removed])

* [Earnings Spotlights]([link removed])

View image: ([link removed])

Caption:

#### **Sector Shuffle: Winners And Losers**

* **Utilities Sector**: This sector brightened up with a 1.8% gain this week, a stark contrast to its 10.2% fall last year.

* **Energy Sector**: It saw a 1.1% rise this week, bouncing back from a 4.8% decline in 2023.

* **Consumer Staples**: Eked out a modest 0.03% gain this week, following a 2.2% drop last year.

In contrast, the **information technology** sector fell by 4.1%, and the **consumer discretionary** sector dipped by 3.5%, both sectors reversing their previous year’s outperformance.

View image: ([link removed])

Caption:

#### **Bonds And Interest Rates: The Rising Tide**

Interest rates have been climbing, with the 10-year yield jumping 16 basis points to 4.04%. This increase is partly **due to the Federal Reserve’s less dovish** stance than many had hoped for. **The December Employment Situation Report and the ISM Services PMI stirred the pot further, injecting uncertainty about the Fed’s future rate cut plans.**

#### **Market Movers And Shakers**

* **Apple (AAPL)**: This tech giant’s shares fell more than 3.0% after a Barclays downgrade.

* **Russell 3000 Growth Index**: Experienced a 2.8% decline, in contrast to the Russell 3000 Value Index’s milder 0.6% fall.

#### **Economic Data Reports: Reading Between The Lines**

* **December Employment Situation Report**: Nonfarm payrolls and average hourly earnings exceeded expectations.

* **December ISM Services PMI**: Revealed a more significant than expected slowdown in service sector growth.

#### **What Does This Mean For Investors?**

Investors, it’s time to buckle up. The market’s recent shifts suggest a reevaluation of expectations. Strong employment numbers might limit the Fed’s rate cuts, while the service sector’s slowdown could align with the current rate-cut forecasts.

----------

# **Commodities & Crypto**

----------## **OIL & Energy**

View image: ([link removed])

Caption:

In the first week of 2024, **oil** saw a modest gain of 1%, buoyed by escalating tensions in the Middle East. However, oil prices are still feeling the heat from a challenging 2023, where crude prices dipped by about 10%.

The latest report from the US Energy Agency presented a mixed picture: while **crude oil inventories** decreased by 5.5 million barrels, there was a notable increase in inventories of refined products, especially **gasoline**. This reflects the fragile state of US consumption. Price-wise, **Brent** is hovering around $78.60, and **WTI** is at approximately $73.50.

## **Gold & Metals**

View image: ([link removed])

Caption:

View image: ([link removed])

Caption:

The year 2024 hasn’t started on a strong note for **copper** and other industrial metals, which are currently on a downward trend. A strengthening dollar is putting pressure on this sector, pushing copper prices below $8,400 per metric ton in London. **Nickel** is also losing ground, affected by ramped-up production in Indonesia.

In the realm of precious metals, **gold** has retreated, impacted by rising bond yields and a robust US employment report. Despite these challenges,** the gold is maintaining its stance, trading at around $2040.**

## **Crypto**

View image: ([link removed])

Caption:

Since the dawn of the new year, **Bitcoin** has experienced a remarkable surge, soaring to **$46,000**. This impressive climb was primarily driven by swirling rumors suggesting the **SEC’s impending approval of a Bitcoin ETF**.

However, this upward trajectory was abruptly halted by opposing rumors, which clarified that such approval hadn’t been granted yet. As a result, Bitcoin retreated to its current standing of $43,500. The market now waits in anticipation, eager for more concrete information. Amid this uncertainty, **MicroStrategy**, known for holding the world’s largest Bitcoin portfolio, has further solidified its position by acquiring an additional **14,000 bitcoins**.

----------

# **CALENDAR & MOVERS**

----------* Thursday, January 11: CPI (MoM) (December)

* Friday, January 12: PPI (MoM) (December)

* Earnings

**January 11th** is a date to circle in your calendars, folks. The U.S. inflation report is set to drop, and it’s a biggie. Why, you ask? Well, it’s all about understanding the twists and turns of monetary policy. The December CPI report is expected to show a 0.3% month-over-month increase in both headline inflation and the core rate. But that’s not all – we’ve got other key data releases like consumer credit, international trade balance, and the producer price index. These numbers aren’t just digits; they’re the pulse of the economy!

## **Earnings Season: The Main Event**

Hold onto your hats because January 12th marks the official start of the Q4 earnings season. And boy, do we have a lineup!

### **Earnings Spotlights**

* **January 8**: Jefferies Financial Group (**JEF**) and Helen of Troy (**HELE**) step up to the plate.

* **January 9**: We’ve got Albertsons Companies (**ACI**), PriceSmart (**PSMT**), and Acuity Brands (**AYI**) in the spotlight. And keep an eye on Tilray Brands (**TLRY**) – options trading suggests a wild ride for their share price.

* **January 10**: KB Home (**KBH**) takes center stage.

* **January 11**: Infosys (**INFY**) – a tech giant, folks!

* **January 12**: The heavy hitters come out swinging. We’re talking UnitedHealth Group (**UNH**), JPMorgan Chase (**JPM**), Bank of America (**BAC**), Wells Fargo (**WFC**), BlackRock (**BLK**), Delta Air Lines (**DAL**), and Bank of New York Mellon (**BK**).

Free AlphaBetaStock's Cheat Sheet (No

———

You are reading a plain text version of this post. For the best experience, copy and paste this link in your browser to view the post online:

[link removed]

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a