Email

IR-2024-02: IRS announces more time for dealers and sellers of clean vehicles to submit time-of-sale reports

| From | IRS Newswire <[email protected]> |

| Subject | IR-2024-02: IRS announces more time for dealers and sellers of clean vehicles to submit time-of-sale reports |

| Date | January 5, 2024 4:12 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

IRS Newswire January 5, 2024

News Essentials

What's Hot [ [link removed] ]

News Releases [ [link removed] ]

IRS - The Basics [ [link removed] ]

IRS Guidance [ [link removed] ]

Media Contacts [ [link removed] ]

Facts & Figures [ [link removed] ]

Around The Nation [ [link removed] ]

e-News Subscriptions [ [link removed] ]

________________________________________________________________________

The Newsroom Topics

Multimedia Center [ [link removed] ]

Noticias en Espa?ol [ [link removed] ]

Radio PSAs [ [link removed] ]

Tax Scams [ [link removed] ]

The Tax Gap [ [link removed] ]

Fact Sheets [ [link removed] ]

IRS Tax Tips [ [link removed] ]

Armed Forces [ [link removed] ]

Latest News Home [ [link removed] ]

________________________________________________________________________

IRS Resources

Contact My Local Office [ [link removed] ]

Filing Options [ [link removed] ]

Forms & Instructions [ [link removed] ]

Frequently Asked Questions [ [link removed] ]

News [ [link removed] ]

Taxpayer Advocate [ [link removed] ]

Where to File [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Issue Number: ???IR-2024-02

Inside This Issue

________________________________________________________________________

*IRS announces more time for dealers and sellers of clean vehicles to submit time-of-sale reports*??

WASHINGTON ? Following the launch of a new online portal and to help industry, the Internal Revenue Service today announced an extension for dealers and sellers of clean vehicles to submit time-of-sale reports.?

Seller reporting in IRS Energy Credits Online [ [link removed] ] (IRS ECO) became available on Jan. 1, 2024. To provide dealers and the IRS more time to submit and intake seller reports into this new system, the IRS is temporarily extending the 3-day time period to submit time-of-sale reports provided in Revenue Procedure 2023-38 [ [link removed] ] through Jan. 16.?

This means dealers and sellers have until Jan. 19 to submit a time-of-sale report for vehicles sold Jan. 1 through Jan. 16.?

While the IRS fine-tunes this new system and the intake of time-of-sale reports, dealers and sellers should continue to submit time-of-reports using IRS ECO. We encourage sellers to use this extension only if they are unable to successfully submit a time-of-sale report when the vehicle is for a customer who intends to claim the tax credit on their tax return. ??

The IRS is committed to resolving any issues facing manufacturers, dealers and sellers navigating the IRS' new ECO tool.?

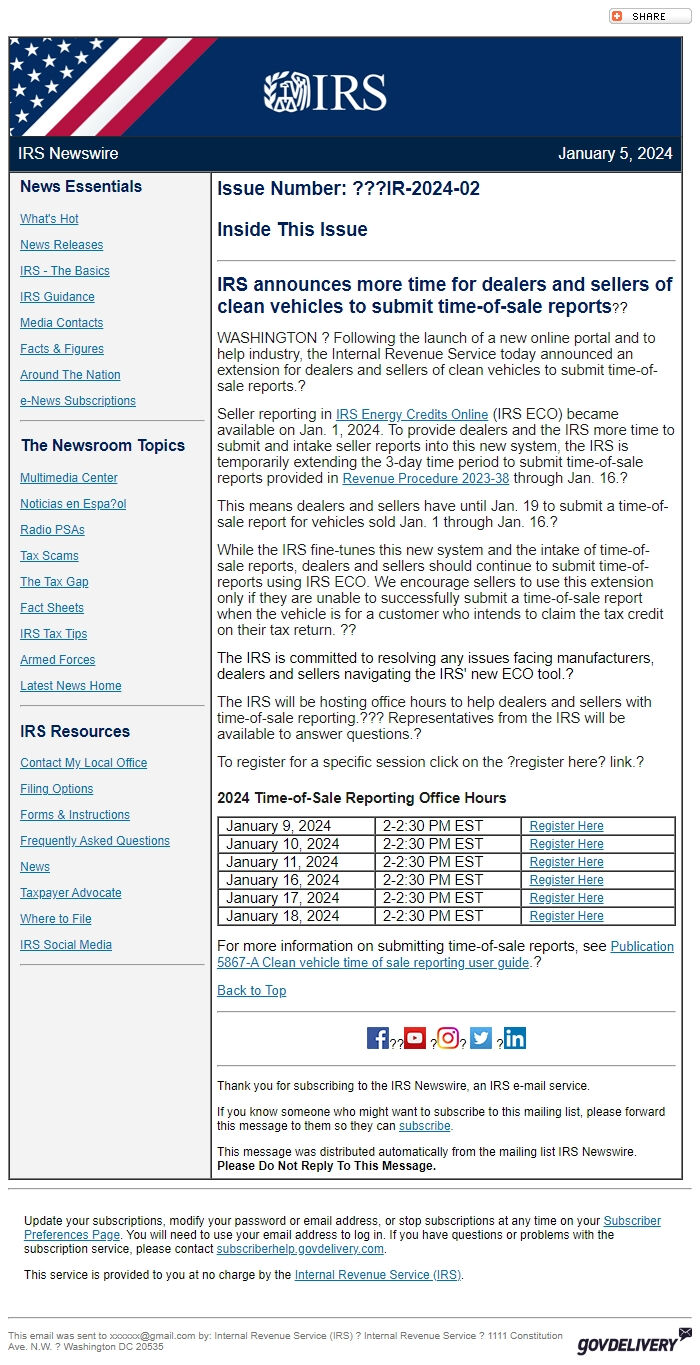

The IRS will be hosting office hours to help dealers and sellers with time-of-sale reporting.??? Representatives from the IRS will be available to answer questions.?

To register for a specific session click on the ?register here? link.?

*2024 Time-of-Sale Reporting Office Hours*

January 9, 2024

2-2:30 PM EST

Register Here [ [link removed] ]

January 10, 2024

2-2:30 PM EST

Register Here [ [link removed] ]

January 11, 2024

2-2:30 PM EST

Register Here [ [link removed] ]

January 16, 2024

2-2:30 PM EST

Register Here [ [link removed] ]

January 17, 2024

2-2:30 PM EST

Register Here [ [link removed] ]

January 18, 2024

2-2:30 PM EST

Register Here [ [link removed] ]

For more information on submitting time-of-sale reports, see Publication 5867-A Clean vehicle time of sale reporting user guide [ [link removed] ].?

Back to Top [ #Fifteenth ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to the IRS Newswire, an IRS e-mail service.

If you know someone who might want to subscribe to this mailing list, please forward this message to them so they can subscribe [ [link removed] ].

This message was distributed automatically from the mailing list IRS Newswire. *Please Do Not Reply To This Message.*

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

IRS Newswire January 5, 2024

News Essentials

What's Hot [ [link removed] ]

News Releases [ [link removed] ]

IRS - The Basics [ [link removed] ]

IRS Guidance [ [link removed] ]

Media Contacts [ [link removed] ]

Facts & Figures [ [link removed] ]

Around The Nation [ [link removed] ]

e-News Subscriptions [ [link removed] ]

________________________________________________________________________

The Newsroom Topics

Multimedia Center [ [link removed] ]

Noticias en Espa?ol [ [link removed] ]

Radio PSAs [ [link removed] ]

Tax Scams [ [link removed] ]

The Tax Gap [ [link removed] ]

Fact Sheets [ [link removed] ]

IRS Tax Tips [ [link removed] ]

Armed Forces [ [link removed] ]

Latest News Home [ [link removed] ]

________________________________________________________________________

IRS Resources

Contact My Local Office [ [link removed] ]

Filing Options [ [link removed] ]

Forms & Instructions [ [link removed] ]

Frequently Asked Questions [ [link removed] ]

News [ [link removed] ]

Taxpayer Advocate [ [link removed] ]

Where to File [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Issue Number: ???IR-2024-02

Inside This Issue

________________________________________________________________________

*IRS announces more time for dealers and sellers of clean vehicles to submit time-of-sale reports*??

WASHINGTON ? Following the launch of a new online portal and to help industry, the Internal Revenue Service today announced an extension for dealers and sellers of clean vehicles to submit time-of-sale reports.?

Seller reporting in IRS Energy Credits Online [ [link removed] ] (IRS ECO) became available on Jan. 1, 2024. To provide dealers and the IRS more time to submit and intake seller reports into this new system, the IRS is temporarily extending the 3-day time period to submit time-of-sale reports provided in Revenue Procedure 2023-38 [ [link removed] ] through Jan. 16.?

This means dealers and sellers have until Jan. 19 to submit a time-of-sale report for vehicles sold Jan. 1 through Jan. 16.?

While the IRS fine-tunes this new system and the intake of time-of-sale reports, dealers and sellers should continue to submit time-of-reports using IRS ECO. We encourage sellers to use this extension only if they are unable to successfully submit a time-of-sale report when the vehicle is for a customer who intends to claim the tax credit on their tax return. ??

The IRS is committed to resolving any issues facing manufacturers, dealers and sellers navigating the IRS' new ECO tool.?

The IRS will be hosting office hours to help dealers and sellers with time-of-sale reporting.??? Representatives from the IRS will be available to answer questions.?

To register for a specific session click on the ?register here? link.?

*2024 Time-of-Sale Reporting Office Hours*

January 9, 2024

2-2:30 PM EST

Register Here [ [link removed] ]

January 10, 2024

2-2:30 PM EST

Register Here [ [link removed] ]

January 11, 2024

2-2:30 PM EST

Register Here [ [link removed] ]

January 16, 2024

2-2:30 PM EST

Register Here [ [link removed] ]

January 17, 2024

2-2:30 PM EST

Register Here [ [link removed] ]

January 18, 2024

2-2:30 PM EST

Register Here [ [link removed] ]

For more information on submitting time-of-sale reports, see Publication 5867-A Clean vehicle time of sale reporting user guide [ [link removed] ].?

Back to Top [ #Fifteenth ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to the IRS Newswire, an IRS e-mail service.

If you know someone who might want to subscribe to this mailing list, please forward this message to them so they can subscribe [ [link removed] ].

This message was distributed automatically from the mailing list IRS Newswire. *Please Do Not Reply To This Message.*

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery