| From | Dr. Tasha Green Cruzat <[email protected]> |

| Subject | Children's Advocates for Change Newsletter |

| Date | December 29, 2023 4:31 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

<[link removed]>

View this email in a browser

Championing the Well-Being of Illinois' Children

<[link removed]>

www.childrensadvocates.org

2023 Fall/Winter Newsletter

Message from the President

Dr. Tasha Green Cruzat

Dear Friends,

Happy Holidays! This is a time of year when we look back at all that has transpired during the year and examine the opportunities and challenges for the year ahead.

For Illinois children, 2023 held some significant victories with the start of the state’s Smart Start Program and the initial steps to create a new state agency for early childhood programs and funding. However, October U.S. Census Household Pulse data shows that 44.9% of Illinois households with children had difficulty paying usual household expenses in the last seven days, 20.3% living in rental housing were not caught up on rent payments, and 15.6% sometimes or often did not have enough to eat in the last seven days. Clearly, there’s still plenty of work to do to ensure every Illinois child thrives.

Budget Wins

Illinois took some very positive steps earlier this year on behalf of children with the approved Fiscal Year 2024 state budget. Just some of the investments in children included:

$250 million in new funding for the first year of the state’s “Smart Start” program to improve the lives of pre-Kindergarten children. This includes an increase in funding for the Early Childhood Block Grant Program, increased funding for early childhood workforce compensation contracts, and new investments in home visiting and early intervention programs

An additional $350 million for the K-12 evidence-based, school-funding formula

An additional $100 million in MAP (Monetary Assistance Program) funding to help young people attend college

A nearly $75 million increase for the Illinois Department of Children and Family Services to hire 192 staff, expand training and protection, increase scholarships for youth in care, and improve facilities; and

An additional $10 million to the Department of Human Services for Comprehensive Community Based Services to Youth.

New State Early Childhood Agency

In October, Governor J.B. Pritzker announced a proposal to create a new state agency for early childhood programs and funding. The proposal calls for the new agency to administer the Early Childhood Block Grant Program (now at the State Board of Education), Department of Human Service programs for Child Care Assistance, Home-Visiting and Early Intervention, and day care licensing (now administered by the Department of Children and Family Services). While the Governor has taken some initial steps with an Executive Order to start the planning process, creation of a new state agency will need legislative approval. In preparation of the upcoming legislative session, the Governor has established an

<[link removed]>

external advisory committee to gather input from stakeholders across the state.

From a November presentation by the Governor’s Office to the state’s Early Learning Council:

The state is preparing a website dedicated to the planning effort. In the meantime, individuals interested in finding out more about the effort are advised to go to the website for the state’s

<[link removed]>

Early Learning Council.

New DCFS and DHFS Directors

Another transition is under way at the Illinois Department of Children and Family Services. In October, Director Marc Smith announced his resignation. His last day as Director is December 31st. The Governor appointed Smith to the job in 2019. The Governor has indicated a national search will be conducted to find a new DCFS Director. According to the Chicago Sun-Times, DCFS has had 29 directors since 1964.

Theresa Eagleson, Director of the Department of Healthcare and Family Services is also leaving her job at the end of the year. The Governor has appointed Lizzy Whitehorn, currently First Assistant Deputy Governor for Health and Human Services to serve as the new HFS Director, pending Senate confirmation. HFS oversees the All Kids Program, which provides health insurance to qualifying children age 18 or younger. In Fiscal Year 2023, the state had 1.5 million children enrolled in its health insurance programs. That is more than half of the state’s age 18 or younger population.

A State Child Tax Credit

A significant factor in children’s health is poverty. Despite the investments noted above, more than 420,000 Illinois children lived below the official federal poverty level in 2022. Poverty impacts a child’s health, brain development, and educational attainment among other factors.

In 2021, the U.S. saw a dramatic cut in child poverty with a one-year increase in the federal

<[link removed]>

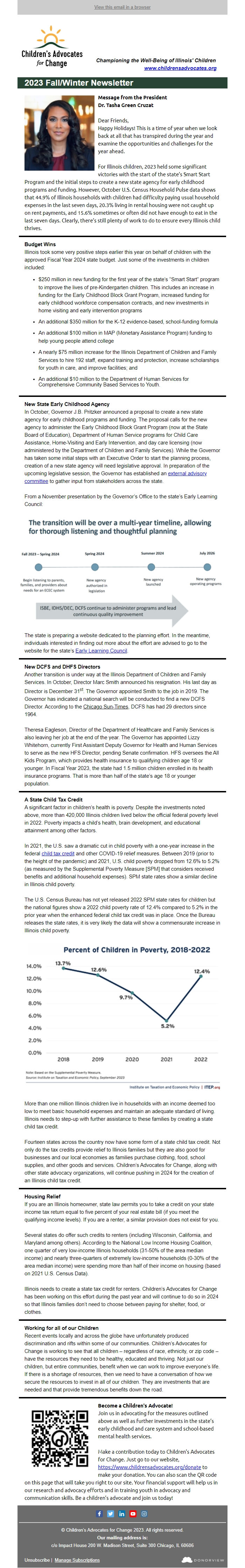

child tax credit and other COVID-19 relief measures. Between 2019 (prior to the height of the pandemic) and 2021, U.S. child poverty dropped from 12.6% to 5.2% (as measured by the Supplemental Poverty Measure [SPM] that considers received benefits and additional household expenses). SPM state rates show a similar decline in Illinois child poverty.

The U.S. Census Bureau has not yet released 2022 SPM state rates for children but the national figures show a 2022 child poverty rate of 12.4% compared to 5.2% in the prior year when the enhanced federal child tax credit was in place. Once the Bureau releases the state rates, it is very likely the data will show a commensurate increase in Illinois child poverty.

More than one million Illinois children live in households with an income deemed too low to meet basic household expenses and maintain an adequate standard of living. Illinois needs to step-up with further assistance to these families by creating a state child tax credit.

Fourteen states across the country now have some form of a state child tax credit. Not only do the tax credits provide relief to Illinois families but they are also good for businesses and our local economies as families purchase clothing, food, school supplies, and other goods and services. Children’s Advocates for Change, along with other state advocacy organizations, will continue pushing in 2024 for the creation of an Illinois child tax credit.

Housing Relief

If you are an Illinois homeowner, state law permits you to take a credit on your state income tax return equal to five percent of your real estate bill (if you meet the qualifying income levels). If you are a renter, a similar provision does not exist for you.

Several states do offer such credits to renters (including Wisconsin, California, and Maryland among others). According to the National Low Income Housing Coalition, one quarter of very low-income Illinois households (31-50% of the area median income) and nearly three-quarters of extremely low-income households (0-30% of the area median income) were spending more than half of their income on housing (based on 2021 U.S. Census Data).

Illinois needs to create a state tax credit for renters. Children’s Advocates for Change has been working on this effort during the past year and will continue to do so in 2024 so that Illinois families don’t need to choose between paying for shelter, food, or clothes.

Working for all of our Children

Recent events locally and across the globe have unfortunately produced discrimination and rifts within some of our communities. Children’s Advocates for Change is working to see that all children – regardless of race, ethnicity, or zip code – have the resources they need to be healthy, educated and thriving. Not just our children, but entire communities, benefit when we can work to improve everyone’s life. If there is a shortage of resources, then we need to have a conversation of how we secure the resources to invest in all of our children. They are investments that are needed and that provide tremendous benefits down the road.

Become a Children's Advocate!

Join us in advocating for the measures outlined above as well as further investments in the state’s early childhood and care system and school-based mental health services.

Make a contribution today to Children’s Advocates for Change. Just go to our website,

<[link removed]>

[link removed] to make your donation. You can also scan the QR code on this page that will take you right to our site. Your financial support will help us in our research and advocacy efforts and in training youth in advocacy and communication skills. Be a children’s advocate and join us today!

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

© Children’s Advocates for Change 2023. All rights reserved.

Our mailing address is:

c/o Impact House 200 W. Madison Street, Suite 300 Chicago, IL 60606

<[link removed]>

Unsubscribe |

<[link removed]>

Manage Subscriptions

<[link removed]>

View this email in a browser

Championing the Well-Being of Illinois' Children

<[link removed]>

www.childrensadvocates.org

2023 Fall/Winter Newsletter

Message from the President

Dr. Tasha Green Cruzat

Dear Friends,

Happy Holidays! This is a time of year when we look back at all that has transpired during the year and examine the opportunities and challenges for the year ahead.

For Illinois children, 2023 held some significant victories with the start of the state’s Smart Start Program and the initial steps to create a new state agency for early childhood programs and funding. However, October U.S. Census Household Pulse data shows that 44.9% of Illinois households with children had difficulty paying usual household expenses in the last seven days, 20.3% living in rental housing were not caught up on rent payments, and 15.6% sometimes or often did not have enough to eat in the last seven days. Clearly, there’s still plenty of work to do to ensure every Illinois child thrives.

Budget Wins

Illinois took some very positive steps earlier this year on behalf of children with the approved Fiscal Year 2024 state budget. Just some of the investments in children included:

$250 million in new funding for the first year of the state’s “Smart Start” program to improve the lives of pre-Kindergarten children. This includes an increase in funding for the Early Childhood Block Grant Program, increased funding for early childhood workforce compensation contracts, and new investments in home visiting and early intervention programs

An additional $350 million for the K-12 evidence-based, school-funding formula

An additional $100 million in MAP (Monetary Assistance Program) funding to help young people attend college

A nearly $75 million increase for the Illinois Department of Children and Family Services to hire 192 staff, expand training and protection, increase scholarships for youth in care, and improve facilities; and

An additional $10 million to the Department of Human Services for Comprehensive Community Based Services to Youth.

New State Early Childhood Agency

In October, Governor J.B. Pritzker announced a proposal to create a new state agency for early childhood programs and funding. The proposal calls for the new agency to administer the Early Childhood Block Grant Program (now at the State Board of Education), Department of Human Service programs for Child Care Assistance, Home-Visiting and Early Intervention, and day care licensing (now administered by the Department of Children and Family Services). While the Governor has taken some initial steps with an Executive Order to start the planning process, creation of a new state agency will need legislative approval. In preparation of the upcoming legislative session, the Governor has established an

<[link removed]>

external advisory committee to gather input from stakeholders across the state.

From a November presentation by the Governor’s Office to the state’s Early Learning Council:

The state is preparing a website dedicated to the planning effort. In the meantime, individuals interested in finding out more about the effort are advised to go to the website for the state’s

<[link removed]>

Early Learning Council.

New DCFS and DHFS Directors

Another transition is under way at the Illinois Department of Children and Family Services. In October, Director Marc Smith announced his resignation. His last day as Director is December 31st. The Governor appointed Smith to the job in 2019. The Governor has indicated a national search will be conducted to find a new DCFS Director. According to the Chicago Sun-Times, DCFS has had 29 directors since 1964.

Theresa Eagleson, Director of the Department of Healthcare and Family Services is also leaving her job at the end of the year. The Governor has appointed Lizzy Whitehorn, currently First Assistant Deputy Governor for Health and Human Services to serve as the new HFS Director, pending Senate confirmation. HFS oversees the All Kids Program, which provides health insurance to qualifying children age 18 or younger. In Fiscal Year 2023, the state had 1.5 million children enrolled in its health insurance programs. That is more than half of the state’s age 18 or younger population.

A State Child Tax Credit

A significant factor in children’s health is poverty. Despite the investments noted above, more than 420,000 Illinois children lived below the official federal poverty level in 2022. Poverty impacts a child’s health, brain development, and educational attainment among other factors.

In 2021, the U.S. saw a dramatic cut in child poverty with a one-year increase in the federal

<[link removed]>

child tax credit and other COVID-19 relief measures. Between 2019 (prior to the height of the pandemic) and 2021, U.S. child poverty dropped from 12.6% to 5.2% (as measured by the Supplemental Poverty Measure [SPM] that considers received benefits and additional household expenses). SPM state rates show a similar decline in Illinois child poverty.

The U.S. Census Bureau has not yet released 2022 SPM state rates for children but the national figures show a 2022 child poverty rate of 12.4% compared to 5.2% in the prior year when the enhanced federal child tax credit was in place. Once the Bureau releases the state rates, it is very likely the data will show a commensurate increase in Illinois child poverty.

More than one million Illinois children live in households with an income deemed too low to meet basic household expenses and maintain an adequate standard of living. Illinois needs to step-up with further assistance to these families by creating a state child tax credit.

Fourteen states across the country now have some form of a state child tax credit. Not only do the tax credits provide relief to Illinois families but they are also good for businesses and our local economies as families purchase clothing, food, school supplies, and other goods and services. Children’s Advocates for Change, along with other state advocacy organizations, will continue pushing in 2024 for the creation of an Illinois child tax credit.

Housing Relief

If you are an Illinois homeowner, state law permits you to take a credit on your state income tax return equal to five percent of your real estate bill (if you meet the qualifying income levels). If you are a renter, a similar provision does not exist for you.

Several states do offer such credits to renters (including Wisconsin, California, and Maryland among others). According to the National Low Income Housing Coalition, one quarter of very low-income Illinois households (31-50% of the area median income) and nearly three-quarters of extremely low-income households (0-30% of the area median income) were spending more than half of their income on housing (based on 2021 U.S. Census Data).

Illinois needs to create a state tax credit for renters. Children’s Advocates for Change has been working on this effort during the past year and will continue to do so in 2024 so that Illinois families don’t need to choose between paying for shelter, food, or clothes.

Working for all of our Children

Recent events locally and across the globe have unfortunately produced discrimination and rifts within some of our communities. Children’s Advocates for Change is working to see that all children – regardless of race, ethnicity, or zip code – have the resources they need to be healthy, educated and thriving. Not just our children, but entire communities, benefit when we can work to improve everyone’s life. If there is a shortage of resources, then we need to have a conversation of how we secure the resources to invest in all of our children. They are investments that are needed and that provide tremendous benefits down the road.

Become a Children's Advocate!

Join us in advocating for the measures outlined above as well as further investments in the state’s early childhood and care system and school-based mental health services.

Make a contribution today to Children’s Advocates for Change. Just go to our website,

<[link removed]>

[link removed] to make your donation. You can also scan the QR code on this page that will take you right to our site. Your financial support will help us in our research and advocacy efforts and in training youth in advocacy and communication skills. Be a children’s advocate and join us today!

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

© Children’s Advocates for Change 2023. All rights reserved.

Our mailing address is:

c/o Impact House 200 W. Madison Street, Suite 300 Chicago, IL 60606

<[link removed]>

Unsubscribe |

<[link removed]>

Manage Subscriptions

<[link removed]>

Message Analysis

- Sender: Children’s Advocates for Change

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailJet