|

John,

From protecting wealthy tax cheats to maintaining the obscene profits of tax-prep corporations, MAGA Republicans are putting the interests of their wealthy donors over the needs of millions of U.S. taxpayers.

That’s because, out of the total $80 billion investment in the IRS that we fought for and won last year, House Republicans have repeatedly attempted to rescind $67 billion.

That money is meant to help the IRS crack down on wealthy and corporate tax evaders, answer taxpayer phone calls and process tax returns more quickly, and create the first-ever free, online tax-filing system without the tricks and traps created by tax prep corporations like TurboTax and H&R Block.

Republicans don’t care that every dollar spent on the IRS produces a 7-to-1 return on investment. In fact, they don’t want any investments in the IRS that allow it to better serve the American people or crack down on wealthy tax cheats.

Take action today and add your name to demand Congress fully fund the IRS and make millionaires, billionaires, and corporations pay what they owe in taxes.

Thanks to last year’s historic investment included in the Inflation Reduction Act, the IRS has been able to increase over-the-phone assistance by more than 2 million calls from the year before. They are now more-fully staffed and have reopened 362 Taxpayer Assistance Centers across the country and added 15 more this past tax filing season.[1]

Together, let’s keep fighting for a tax system that works for everyday people, not wealthy and corporate tax cheats.

Sarah Christopherson

Legislative and Policy Director

Americans for Tax Fairness Action Fund

[1] “How A Transformed IRS Will Provide World-Class Customer Service,” U.S. Department of the Treasury

-- David's email --

John,

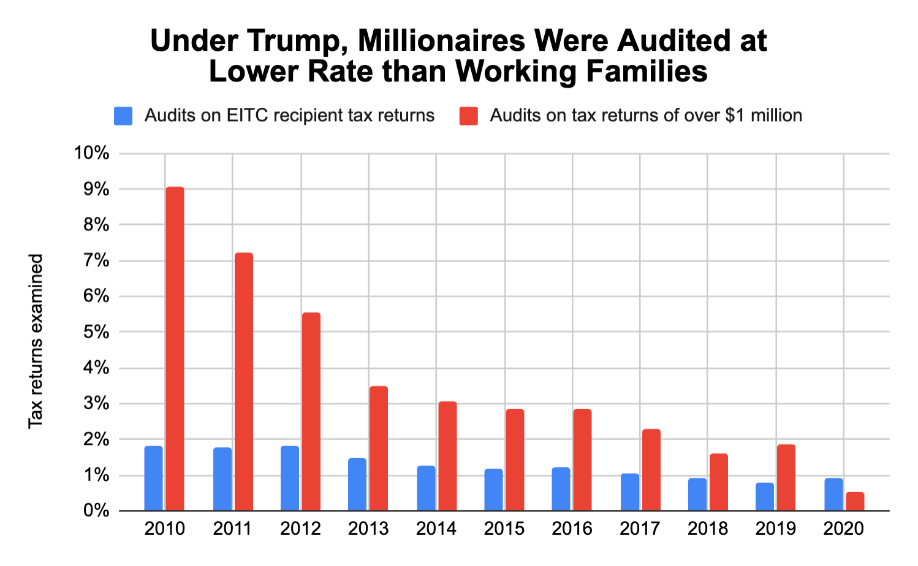

For more than a decade, the audit rates of millionaires plummeted as the IRS lacked the resources to hold wealthy tax cheats accountable:

This resulted in low-income people―disproportionately people of color―being audited at higher rates than millionaires!

But now, thanks to investments made last year by congressional Democrats and President Biden, the IRS is going after 1,600 millionaires who owe at least $250,000 each in taxes while taking a closer look at corporations with assets averaging $10 billion.[1] And, just last month, we got this update:

But even as the IRS uses its mandate to crack down on wealthy and corporate tax cheats, Republicans continue to attack the IRS. In fact, in the first legislative business under new right-wing Speaker of the House MAGA Mike Johnson, the House voted to claw back billions of dollars in IRS funding.

Sign now to demand Congress fully fund the IRS and make millionaires, billionaires, and corporations pay what they owe in taxes.

And restored IRS funding isn’t just about catching rich and corporate tax cheats. As working people and businesses prepare to close the books on 2023, we need an IRS in 2024 that is properly staffed and ready to help everyday taxpayers and small businesses file their tax returns on time.

Last tax season, as a result of this historic 10-year investment, the IRS was able to increase over-the-phone assistance by more than 2 million calls.[2] That’s an investment worth protecting!

Thank you for taking action today,

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] “The IRS plans to crack down on 1,600 millionaires to collect millions of dollars in back taxes,” Associated Press, Sep. 8, 2023

[2] “How A Transformed IRS Will Provide World-Class Customer Service,” U.S. Department of the Treasury

|