| From | Texas Workforce Commission <[email protected]> |

| Subject | Texas Business Today - December 2023 |

| Date | December 14, 2023 3:42 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Updates from the Office of the Commissioner Representing Employers

________________________________________________________________________

December 2023 TBT Header No Holly

Texas Employers,

Welcome to the December issue of "Texas Business Today". My name is Joe Esparza and I am the new Commissioner Representing Employers at the Texas Workforce Commission. Prior to this appointment, I served as the Texas Deputy Secretary of State since 2018. In addition, I served as a Senior Appointments Manager in the Office of the Governor, overseeing numerous gubernatorial appointments during Governor Abbott's first term.

I am looking forward to working on behalf of Texas employers, large and small, on employment issues, workforce development, unemployment taxes and claims, and the business and legal climate affecting public and private employers.?

In other news, our 2024 Texas Conference for Employers schedule is up and open for registration. We will continue to add more dates and locations throughout the year, so please check back periodically. To review the current list of cities and dates, please visit: Texas Conference for Employers - Texas Workforce Commission [ [link removed] ]

As we approach 2024, please know that we are always here for you as your number one resource. Do not hesitate to contact me or my office if you need assistance.

Wishing you and your families a very happy holiday season and best wishes for the new year!

CJE headshot and signature

Joe Esparza

Commissioner Representing Employers

Texas Workforce Commission

________________________________________________________________________

Mario Hernandez Headshot

*Exclusions from Unemployment Chargebacks: What Are They?*

By: Mario Hernandez

Legal Counsel to Commissioner Joe Esparza

Employers in our great state know that unemployment claims arise from all kinds of different job separations. Typically, if a claimant receives unemployment benefits, those benefits are charged back to the taxed employers who have reported ?base period wages? for that claimant. This is what is known as a chargeback, and it affects the employer?s unemployment tax rate. A higher unemployment tax rate means that the employer pays more in unemployment taxes. But if a claimant receives unemployment benefits, will it "always "result in a chargeback to the employer?s account?

*_A Quick Note for Reimbursing Employers_*

The exclusions from chargebacks that will be discussed will not apply to reimbursing employer accounts. Please see Texas Labor Code Section 205.0125 [ [link removed] ] for the law on the exceptions from a reimbursing employer?s duty to pay a reimbursement.

*_Exclusions from Chargebacks_*

The list of exclusions from chargebacks can be found in Texas Labor Code Section 204.022 [ [link removed] ], but this article will focus on those exclusions that tend to come up more frequently in unemployment claims.

Piggy Bank with Umbrella

*_Separation Caused by a Medically Verifiable Illness_*

Sometimes job separations are the result of an employee being out for too many days due to illness. Similarly, job separations can occur for attendance violations that were caused because the claimant needed to care for a sick minor child. For these types of job separations, Section 204.022(a)(5) of the Texas Labor Code may provide chargeback protection for taxed employers.

However, as noted in our online Texas Guidebook for Employers [ [link removed] ], medical separations could have consequences for employers beyond an unemployment claim. Sometimes employees with medical issues could be protected by laws such as the Americans with Disabilities Act, Family and Medical Leave Act, and Workers? Compensation. Employers should consult with private legal counsel if the employer is thinking of discharging these employees.

*_Separation Caused by the Operation of Federal or State Law_*

Chargeback protection is also available to taxed employers for job separations that were necessary to comply with federal or state law. For instance, this type of job separation can arise if a claimant fails to maintain a credential or license that either federal or state law requires to perform the job. Sections 204.022(a)(1) and 204.022(a)(2) of the Texas Labor Code outline these exclusions from chargebacks.

*_Will these Exclusions from Chargebacks be Applied Automatically?_*

In short, the answer is no. If the employer?s position on an unemployment claim is that the job separation was the result of something that would qualify as an exclusion from chargeback, the employer should not assume the Texas Workforce Commission (TWC) will automatically apply the protection.

Remember, the burden of establishing that any kind of exclusion from chargeback is applicable to an unemployment claim is on the party so claiming the exclusion. In other words, if the employer believes that the job separation was the result of one of the above-mentioned exclusions from chargebacks (or any other) the employer should clearly state that in its response to the unemployment claim. Remember to respond timely as well!

*_Conclusion_*

Sometimes an unemployment claim can result in benefits for the claimant and chargeback protection for the employer. This ?pay and protect? scenario can emerge from the employer successfully establishing that the job separation was the result of an exclusion from chargeback found in Section 204.022 of the Texas Labor Code [ [link removed] ].?

________________________________________________________________________

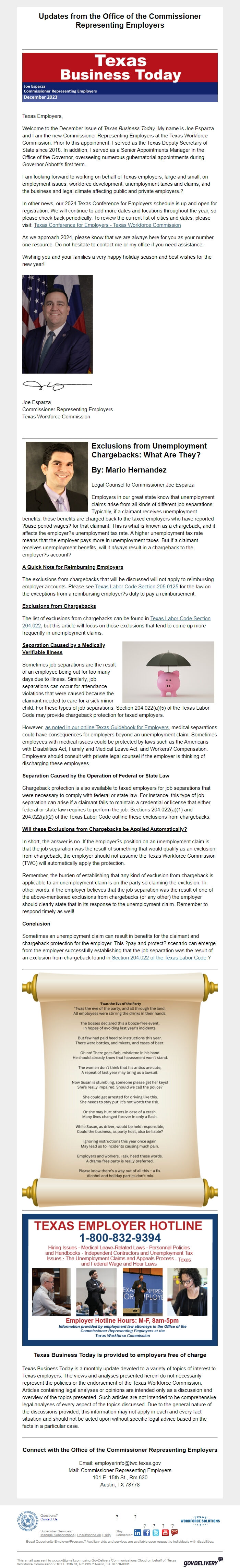

Christmas Party Rules_1

________________________________________________________________________

Employer Hotline 2024

Texas Business Today is provided to employers free of charge

Texas Business Today is a monthly update devoted to a variety of topics of interest to Texas employers. The views and analyses presented herein do not necessarily represent the policies or the endorsement of the Texas Workforce Commission. Articles containing legal analyses or opinions are intended only as a discussion and overview of the topics presented. Such articles are not intended to be comprehensive legal analyses of every aspect of the topics discussed. Due to the general nature of the discussions provided, this information may not apply in each and every fact situation and should not be acted upon without specific legal advice based on the facts in a particular case.

________________________________________________________________________

Connect with the Office of the Commissioner Representing Employers

Email: [email protected]

Mail: Commissioner Representing Employers

101 E. 15th St., Rm 630

Austin, TX 78778

Texas Workforce Commission Questions?

Contact Us [ [link removed] ] ? ?

?

?

?

?

Texas Workforce Solutions Subscriber Services:

Manage Subscriptions [ [link removed] ] | Unsubscribe All [ [link removed] ] | Help [ [link removed] ] Stay Connected: LinkedIn logo [ [link removed] ] [ [link removed] ] Facebook [ [link removed] ] Twitter [ [link removed] ] Youtube [ [link removed] ] GovDelivery [ [link removed] ]

Equal Opportunity Employer/Program.? Auxiliary aids and services are available upon request to individuals with disabilities.

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Texas Workforce Commission ? 101 E 15th St, Rm 665 ? Austin, TX 78778-0001 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

________________________________________________________________________

December 2023 TBT Header No Holly

Texas Employers,

Welcome to the December issue of "Texas Business Today". My name is Joe Esparza and I am the new Commissioner Representing Employers at the Texas Workforce Commission. Prior to this appointment, I served as the Texas Deputy Secretary of State since 2018. In addition, I served as a Senior Appointments Manager in the Office of the Governor, overseeing numerous gubernatorial appointments during Governor Abbott's first term.

I am looking forward to working on behalf of Texas employers, large and small, on employment issues, workforce development, unemployment taxes and claims, and the business and legal climate affecting public and private employers.?

In other news, our 2024 Texas Conference for Employers schedule is up and open for registration. We will continue to add more dates and locations throughout the year, so please check back periodically. To review the current list of cities and dates, please visit: Texas Conference for Employers - Texas Workforce Commission [ [link removed] ]

As we approach 2024, please know that we are always here for you as your number one resource. Do not hesitate to contact me or my office if you need assistance.

Wishing you and your families a very happy holiday season and best wishes for the new year!

CJE headshot and signature

Joe Esparza

Commissioner Representing Employers

Texas Workforce Commission

________________________________________________________________________

Mario Hernandez Headshot

*Exclusions from Unemployment Chargebacks: What Are They?*

By: Mario Hernandez

Legal Counsel to Commissioner Joe Esparza

Employers in our great state know that unemployment claims arise from all kinds of different job separations. Typically, if a claimant receives unemployment benefits, those benefits are charged back to the taxed employers who have reported ?base period wages? for that claimant. This is what is known as a chargeback, and it affects the employer?s unemployment tax rate. A higher unemployment tax rate means that the employer pays more in unemployment taxes. But if a claimant receives unemployment benefits, will it "always "result in a chargeback to the employer?s account?

*_A Quick Note for Reimbursing Employers_*

The exclusions from chargebacks that will be discussed will not apply to reimbursing employer accounts. Please see Texas Labor Code Section 205.0125 [ [link removed] ] for the law on the exceptions from a reimbursing employer?s duty to pay a reimbursement.

*_Exclusions from Chargebacks_*

The list of exclusions from chargebacks can be found in Texas Labor Code Section 204.022 [ [link removed] ], but this article will focus on those exclusions that tend to come up more frequently in unemployment claims.

Piggy Bank with Umbrella

*_Separation Caused by a Medically Verifiable Illness_*

Sometimes job separations are the result of an employee being out for too many days due to illness. Similarly, job separations can occur for attendance violations that were caused because the claimant needed to care for a sick minor child. For these types of job separations, Section 204.022(a)(5) of the Texas Labor Code may provide chargeback protection for taxed employers.

However, as noted in our online Texas Guidebook for Employers [ [link removed] ], medical separations could have consequences for employers beyond an unemployment claim. Sometimes employees with medical issues could be protected by laws such as the Americans with Disabilities Act, Family and Medical Leave Act, and Workers? Compensation. Employers should consult with private legal counsel if the employer is thinking of discharging these employees.

*_Separation Caused by the Operation of Federal or State Law_*

Chargeback protection is also available to taxed employers for job separations that were necessary to comply with federal or state law. For instance, this type of job separation can arise if a claimant fails to maintain a credential or license that either federal or state law requires to perform the job. Sections 204.022(a)(1) and 204.022(a)(2) of the Texas Labor Code outline these exclusions from chargebacks.

*_Will these Exclusions from Chargebacks be Applied Automatically?_*

In short, the answer is no. If the employer?s position on an unemployment claim is that the job separation was the result of something that would qualify as an exclusion from chargeback, the employer should not assume the Texas Workforce Commission (TWC) will automatically apply the protection.

Remember, the burden of establishing that any kind of exclusion from chargeback is applicable to an unemployment claim is on the party so claiming the exclusion. In other words, if the employer believes that the job separation was the result of one of the above-mentioned exclusions from chargebacks (or any other) the employer should clearly state that in its response to the unemployment claim. Remember to respond timely as well!

*_Conclusion_*

Sometimes an unemployment claim can result in benefits for the claimant and chargeback protection for the employer. This ?pay and protect? scenario can emerge from the employer successfully establishing that the job separation was the result of an exclusion from chargeback found in Section 204.022 of the Texas Labor Code [ [link removed] ].?

________________________________________________________________________

Christmas Party Rules_1

________________________________________________________________________

Employer Hotline 2024

Texas Business Today is provided to employers free of charge

Texas Business Today is a monthly update devoted to a variety of topics of interest to Texas employers. The views and analyses presented herein do not necessarily represent the policies or the endorsement of the Texas Workforce Commission. Articles containing legal analyses or opinions are intended only as a discussion and overview of the topics presented. Such articles are not intended to be comprehensive legal analyses of every aspect of the topics discussed. Due to the general nature of the discussions provided, this information may not apply in each and every fact situation and should not be acted upon without specific legal advice based on the facts in a particular case.

________________________________________________________________________

Connect with the Office of the Commissioner Representing Employers

Email: [email protected]

Mail: Commissioner Representing Employers

101 E. 15th St., Rm 630

Austin, TX 78778

Texas Workforce Commission Questions?

Contact Us [ [link removed] ] ? ?

?

?

?

?

Texas Workforce Solutions Subscriber Services:

Manage Subscriptions [ [link removed] ] | Unsubscribe All [ [link removed] ] | Help [ [link removed] ] Stay Connected: LinkedIn logo [ [link removed] ] [ [link removed] ] Facebook [ [link removed] ] Twitter [ [link removed] ] Youtube [ [link removed] ] GovDelivery [ [link removed] ]

Equal Opportunity Employer/Program.? Auxiliary aids and services are available upon request to individuals with disabilities.

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Texas Workforce Commission ? 101 E 15th St, Rm 665 ? Austin, TX 78778-0001 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Texas Workforce Commission

- Political Party: n/a

- Country: United States

- State/Locality: Texas

- Office: n/a

-

Email Providers:

- govDelivery