| From | Civic Action <[email protected]> |

| Subject | The Tapback: Will power |

| Date | December 12, 2023 11:12 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Logo for The Tapback from Civic Action [[link removed]]

WILL POWER

For the last couple years, the public conversation about high inflation rates has provided corporate executives an easy excuse to raise prices further… regardless of what was actually going on with their own costs. But this phenomenon of “greedflation” has now been widely acknowledged, and the mood has shifted, and companies have begun to see more resistance to price increases . In other words: much like discourse about out-of-control inflation can make it easier for corporations to raise prices further, discourse about out-of-control corporate greed can make it harder to raise prices without a consumer backlash.

So now mainstream economic commentators have moved on to one of their favorite tricks: they’re coming up with ridiculous turns of phrase to try and obfuscate the situation. A recent standout is this description from an economist quoted in the Wall Street Journal [[link removed]] , who opined that prices were stabilizing because “ consumers are less willing to support profit margin expansion .” Yup, that's what they said: basically, the implication is that consumers had willingly made a conscious choice to boost corporate profit margins… and then changed their minds. Because we're supposed to believe that consumers volunteering to throw some more money up the income distribution is a thing that definitely happens, but corporations raising prices to pad profits is not.

Make it make sense.

Three Numbers [[link removed]]

$3,455,305 [[link removed]] is the total lifetime cost of “the American dream” according to Investopedia [[link removed]] , which defined the term to mean a household of two adults buying a home, raising two kids, buying cars, saving for retirement, and the like. This is significantly more than the average American earns in a lifetime .

$45 billion [[link removed]] was the extraordinary amount of inventory loss which had been attributed to “organized retail crime” by the National Retail Federation [[link removed]] , as part of their push to crack down on shoplifting. The figure was widely cited in the media, but had no basis, and has now been retracted by the giant retail lobby group.

25% of workers [[link removed]] say they are confident they could get a raise if they asked for one , according to a poll by Morning Consult [[link removed]] . They probably should just ask then.

A Chart [[link removed]]

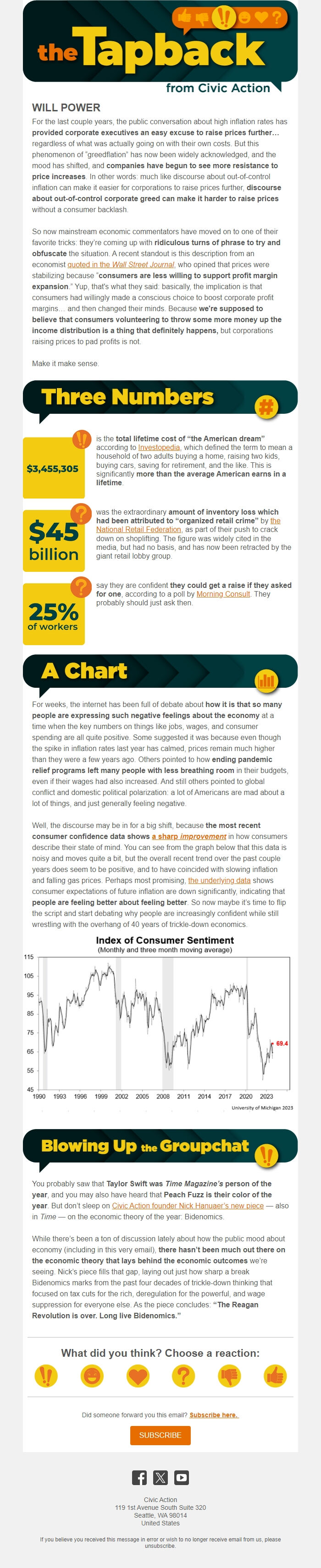

For weeks, the internet has been full of debate about how it is that so many people are expressing such negative feelings about the economy at a time when the key numbers on things like jobs, wages, and consumer spending are all quite positive. Some suggested it was because even though the spike in inflation rates last year has calmed, prices remain much higher than they were a few years ago. Others pointed to how ending pandemic relief programs left many people with less breathing room in their budgets, even if their wages had also increased. And still others pointed to global conflict and domestic political polarization: a lot of Americans are mad about a lot of things, and just generally feeling negative.

Well, the discourse may be in for a big shift, because the most recent consumer confidence data shows a sharp improvement [[link removed]] in how consumers describe their state of mind. You can see from the graph below that this data is noisy and moves quite a bit, but the overall recent trend over the past couple years does seem to be positive, and to have coincided with slowing inflation and falling gas prices. Perhaps most promising, the underlying data [[link removed]] shows consumer expectations of future inflation are down significantly, indicating that people are feeling better about feeling better . So now maybe it’s time to flip the script and start debating why people are increasingly confident while still wrestling with the overhang of 40 years of trickle-down economics.

[link removed] [[link removed]]

Blowing up the Groupchat [[link removed]]

You probably saw that Taylor Swift was Time Magazine’s person of the year , and you may also have heard that Peach Fuzz is their color of the year . But don’t sleep on Civic Action founder Nick Hanuaer’s new piece [[link removed]] — also in Time — on the economic theory of the year: Bidenomics.

While there’s been a ton of discussion lately about how the public mood about economy (including in this very email), there hasn’t been much out there on the economic theory that lays behind the economic outcomes we’re seeing. Nick’s piece fills that gap, laying out just how sharp a break Bidenomics marks from the past four decades of trickle-down thinking that focused on tax cuts for the rich, deregulation for the powerful, and wage suppression for everyone else. As the piece concludes: “The Reagan Revolution is over. Long live Bidenomics.”

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

WILL POWER

For the last couple years, the public conversation about high inflation rates has provided corporate executives an easy excuse to raise prices further… regardless of what was actually going on with their own costs. But this phenomenon of “greedflation” has now been widely acknowledged, and the mood has shifted, and companies have begun to see more resistance to price increases . In other words: much like discourse about out-of-control inflation can make it easier for corporations to raise prices further, discourse about out-of-control corporate greed can make it harder to raise prices without a consumer backlash.

So now mainstream economic commentators have moved on to one of their favorite tricks: they’re coming up with ridiculous turns of phrase to try and obfuscate the situation. A recent standout is this description from an economist quoted in the Wall Street Journal [[link removed]] , who opined that prices were stabilizing because “ consumers are less willing to support profit margin expansion .” Yup, that's what they said: basically, the implication is that consumers had willingly made a conscious choice to boost corporate profit margins… and then changed their minds. Because we're supposed to believe that consumers volunteering to throw some more money up the income distribution is a thing that definitely happens, but corporations raising prices to pad profits is not.

Make it make sense.

Three Numbers [[link removed]]

$3,455,305 [[link removed]] is the total lifetime cost of “the American dream” according to Investopedia [[link removed]] , which defined the term to mean a household of two adults buying a home, raising two kids, buying cars, saving for retirement, and the like. This is significantly more than the average American earns in a lifetime .

$45 billion [[link removed]] was the extraordinary amount of inventory loss which had been attributed to “organized retail crime” by the National Retail Federation [[link removed]] , as part of their push to crack down on shoplifting. The figure was widely cited in the media, but had no basis, and has now been retracted by the giant retail lobby group.

25% of workers [[link removed]] say they are confident they could get a raise if they asked for one , according to a poll by Morning Consult [[link removed]] . They probably should just ask then.

A Chart [[link removed]]

For weeks, the internet has been full of debate about how it is that so many people are expressing such negative feelings about the economy at a time when the key numbers on things like jobs, wages, and consumer spending are all quite positive. Some suggested it was because even though the spike in inflation rates last year has calmed, prices remain much higher than they were a few years ago. Others pointed to how ending pandemic relief programs left many people with less breathing room in their budgets, even if their wages had also increased. And still others pointed to global conflict and domestic political polarization: a lot of Americans are mad about a lot of things, and just generally feeling negative.

Well, the discourse may be in for a big shift, because the most recent consumer confidence data shows a sharp improvement [[link removed]] in how consumers describe their state of mind. You can see from the graph below that this data is noisy and moves quite a bit, but the overall recent trend over the past couple years does seem to be positive, and to have coincided with slowing inflation and falling gas prices. Perhaps most promising, the underlying data [[link removed]] shows consumer expectations of future inflation are down significantly, indicating that people are feeling better about feeling better . So now maybe it’s time to flip the script and start debating why people are increasingly confident while still wrestling with the overhang of 40 years of trickle-down economics.

[link removed] [[link removed]]

Blowing up the Groupchat [[link removed]]

You probably saw that Taylor Swift was Time Magazine’s person of the year , and you may also have heard that Peach Fuzz is their color of the year . But don’t sleep on Civic Action founder Nick Hanuaer’s new piece [[link removed]] — also in Time — on the economic theory of the year: Bidenomics.

While there’s been a ton of discussion lately about how the public mood about economy (including in this very email), there hasn’t been much out there on the economic theory that lays behind the economic outcomes we’re seeing. Nick’s piece fills that gap, laying out just how sharp a break Bidenomics marks from the past four decades of trickle-down thinking that focused on tax cuts for the rich, deregulation for the powerful, and wage suppression for everyone else. As the piece concludes: “The Reagan Revolution is over. Long live Bidenomics.”

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Message Analysis

- Sender: Civic Action

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- EveryAction