| From | Civic Action <[email protected]> |

| Subject | The Tapback: The profit of doom |

| Date | December 5, 2023 9:03 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Logo for The Tapback from Civic Action [[link removed]]

THE PROFIT OF DOOM

Move over “quiet quitting," we have a new entrant in the competition for most ridiculous economic coinage out there: “doom spending.” This one seems to have been invented in a recent report [[link removed]] by CreditKarma, which attempted to reconcile ongoing strength in consumer spending with ongoing negative feelings about the state of the economy. And the phrase has already hit the headlines [[link removed]] because, well… that’s the entire reason people concoct terms like this.

“Doom spending” has been defined as the practice of “ spending money despite concerns about the economy and foreign affairs.” In other words: spending money despite being aware that other people and the rest of the world exist. Of course, consumer spending is what drives the economy, but apparently the idea now is that the merit of that spending is supposed to be assessed based on the particular emotional state of each individual consumer when they put money into the economy? And if you’re not spending money in a state of ignorance about trickle-down economics and global conflict, then it’s bad if you spend it?

Make it make sense.

Three Numbers [[link removed]]

13 carmakers [[link removed]] will see thousands [[link removed]] of workers push to form unions as part of a massive UAW organizing drive following the success of their historic strike this fall. Companies including Toyota, Nissan, BMW, and Honda operate non-union plants in the US, while these same companies have highly unionized workforces in the countries where they are based.

$440 billion [[link removed]] would be paid in taxes [[link removed]] by the richest thousand or so people in the country if President Biden’s billionaire minimum tax is enacted. The proposal would ensure that people with wealth greater than a billion dollars pay least 25% of their annual incomes in federal income tax .

$17.7 million [[link removed]] was awarded in damages [[link removed].] by a jury that found the largest egg producers in the country had schemed to fix prices from 2004 to 2008 . Kraft, Kellogg, Nestle, and other food corporations which brought the suit will receive the money as compensation for the higher prices they paid, but consumers will not.

A Chart [[link removed]]

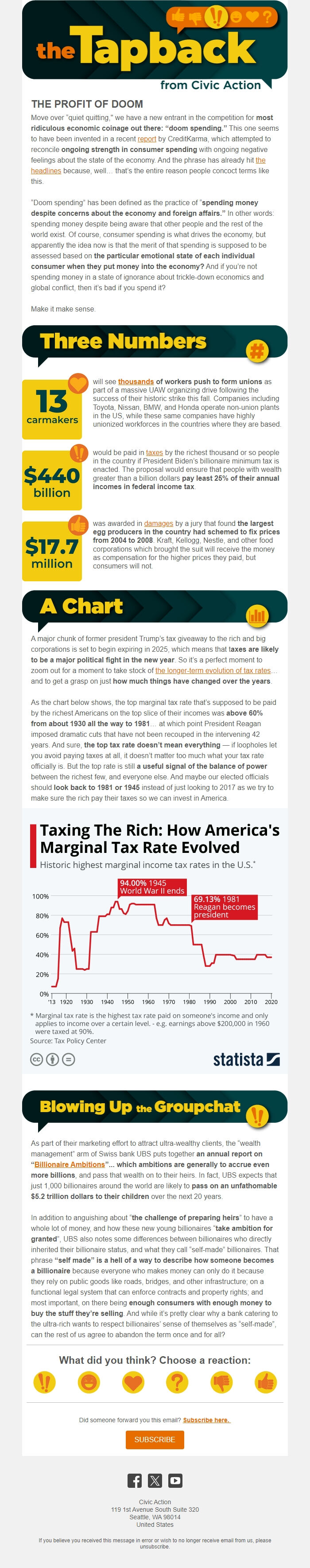

A major chunk of former president Trump’s tax giveaway to the rich and big corporations is set to begin expiring in 2025, which means that t axes are likely to be a major political fight in the new year . So it’s a perfect moment to zoom out for a moment to take stock of the longer-term evolution of tax rates [[link removed]] … and to get a grasp on just how much things have changed over the years .

As the chart below shows, the top marginal tax rate that’s supposed to be paid by the richest Americans on the top slice of their incomes was above 60% from about 1930 all the way to 1981 … at which point President Reagan imposed dramatic cuts that have not been recouped in the intervening 42 years. And sure, the top tax rate doesn’t mean everything — if loopholes let you avoid paying taxes at all, it doesn’t matter too much what your tax rate officially is. But the top rate is still a useful signal of the balance of power between the richest few, and everyone else. And maybe our elected officials should look back to 1981 or 1945 instead of just looking to 2017 as we try to make sure the rich pay their taxes so we can invest in America.

[link removed] [[link removed]]

Blowing up the Groupchat [[link removed]]

As part of their marketing effort to attract ultra-wealthy clients, the “wealth management” arm of Swiss bank UBS puts together an annual report on “ Billionaire Ambitions [[link removed]] ”... which ambitions are generally to accrue even more billions , and pass that wealth on to their heirs. In fact, UBS expects that just 1,000 billionaires around the world are likely to pass on an unfathomable $5.2 trillion dollars to their children over the next 20 years.

In addition to anguishing about “ the challenge of preparing heirs ” to have a whole lot of money, and how these new young billionaires “ take ambition for granted ”, UBS also notes some differences between billionaires who directly inherited their billionaire status, and what they call “self-made” billionaires. That phrase “self made” is a hell of a way to describe how someone becomes a billionaire because everyone who makes money can only do it because they rely on public goods like roads, bridges, and other infrastructure; on a functional legal system that can enforce contracts and property rights; and most important, on there being enough consumers with enough money to buy the stuff they’re selling . And while it’s pretty clear why a bank catering to the ultra-rich wants to respect billionaires’ sense of themselves as “self-made”, can the rest of us agree to abandon the term once and for all?

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

THE PROFIT OF DOOM

Move over “quiet quitting," we have a new entrant in the competition for most ridiculous economic coinage out there: “doom spending.” This one seems to have been invented in a recent report [[link removed]] by CreditKarma, which attempted to reconcile ongoing strength in consumer spending with ongoing negative feelings about the state of the economy. And the phrase has already hit the headlines [[link removed]] because, well… that’s the entire reason people concoct terms like this.

“Doom spending” has been defined as the practice of “ spending money despite concerns about the economy and foreign affairs.” In other words: spending money despite being aware that other people and the rest of the world exist. Of course, consumer spending is what drives the economy, but apparently the idea now is that the merit of that spending is supposed to be assessed based on the particular emotional state of each individual consumer when they put money into the economy? And if you’re not spending money in a state of ignorance about trickle-down economics and global conflict, then it’s bad if you spend it?

Make it make sense.

Three Numbers [[link removed]]

13 carmakers [[link removed]] will see thousands [[link removed]] of workers push to form unions as part of a massive UAW organizing drive following the success of their historic strike this fall. Companies including Toyota, Nissan, BMW, and Honda operate non-union plants in the US, while these same companies have highly unionized workforces in the countries where they are based.

$440 billion [[link removed]] would be paid in taxes [[link removed]] by the richest thousand or so people in the country if President Biden’s billionaire minimum tax is enacted. The proposal would ensure that people with wealth greater than a billion dollars pay least 25% of their annual incomes in federal income tax .

$17.7 million [[link removed]] was awarded in damages [[link removed].] by a jury that found the largest egg producers in the country had schemed to fix prices from 2004 to 2008 . Kraft, Kellogg, Nestle, and other food corporations which brought the suit will receive the money as compensation for the higher prices they paid, but consumers will not.

A Chart [[link removed]]

A major chunk of former president Trump’s tax giveaway to the rich and big corporations is set to begin expiring in 2025, which means that t axes are likely to be a major political fight in the new year . So it’s a perfect moment to zoom out for a moment to take stock of the longer-term evolution of tax rates [[link removed]] … and to get a grasp on just how much things have changed over the years .

As the chart below shows, the top marginal tax rate that’s supposed to be paid by the richest Americans on the top slice of their incomes was above 60% from about 1930 all the way to 1981 … at which point President Reagan imposed dramatic cuts that have not been recouped in the intervening 42 years. And sure, the top tax rate doesn’t mean everything — if loopholes let you avoid paying taxes at all, it doesn’t matter too much what your tax rate officially is. But the top rate is still a useful signal of the balance of power between the richest few, and everyone else. And maybe our elected officials should look back to 1981 or 1945 instead of just looking to 2017 as we try to make sure the rich pay their taxes so we can invest in America.

[link removed] [[link removed]]

Blowing up the Groupchat [[link removed]]

As part of their marketing effort to attract ultra-wealthy clients, the “wealth management” arm of Swiss bank UBS puts together an annual report on “ Billionaire Ambitions [[link removed]] ”... which ambitions are generally to accrue even more billions , and pass that wealth on to their heirs. In fact, UBS expects that just 1,000 billionaires around the world are likely to pass on an unfathomable $5.2 trillion dollars to their children over the next 20 years.

In addition to anguishing about “ the challenge of preparing heirs ” to have a whole lot of money, and how these new young billionaires “ take ambition for granted ”, UBS also notes some differences between billionaires who directly inherited their billionaire status, and what they call “self-made” billionaires. That phrase “self made” is a hell of a way to describe how someone becomes a billionaire because everyone who makes money can only do it because they rely on public goods like roads, bridges, and other infrastructure; on a functional legal system that can enforce contracts and property rights; and most important, on there being enough consumers with enough money to buy the stuff they’re selling . And while it’s pretty clear why a bank catering to the ultra-rich wants to respect billionaires’ sense of themselves as “self-made”, can the rest of us agree to abandon the term once and for all?

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Message Analysis

- Sender: Civic Action

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- EveryAction