| From | Civic Action <[email protected]> |

| Subject | The Tapback: Takes guts |

| Date | November 28, 2023 11:46 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Logo for The Tapback from Civic Action [[link removed]]

TAKES GUTS

This year, the Wall Street Journal decided to mark the day after Thanksgiving with a bizarre recitation of the reasons why they say it just makes good sense to let people buy and sell kidneys [[link removed]] . You might think this is the kind of weird one-off thing that happens when all the bosses are out on holiday vacations , but it turns out kidney sales have been a frequent topic of interest at the nation’s financial paper of record . For example, in 2006, they published an op-ed [[link removed]] arguing for “ a more imaginative approach ” to increasing transplants, including paying for organs. In 2007, they ran a piece [[link removed]] titled “Kidney Shortage Inspires a Radical Idea: Organ Sales ” and then hosted an editorial discussion [[link removed]] on it. In 2008, they reported that “ Pay for Organ Donation Gains Traction , but Not at Kidney Foundation [[link removed]] .” In 2010, they explored “ innovative new programs [[link removed]] to boost organ donation,” again including “ paying donors for kidneys .” In 2011, they argued for “ a modest proposal [[link removed]] ” of providing tax breaks and tuition vouchers as compensation for kidney donation . And in 2014, they ran a piece titled “ Cash for Kidneys : The Case for a Market for Organs [[link removed]] .”

A human being not employed by the Wall Street Journal might think that before we ponder again legalizing the purchase and sale of human bodies , we might want to prioritize the prevention and treatment of diabetes, or even take a run at reducing the rates of poverty and medical crisis. So why on earth has the Wall Street Journal been trying so hard for so long to make the free market in kidneys into a thing? Perhaps it’s because of the point made in their most recent piece: that arguments about organ sales “go to the heart of the debate about capitalism.” But then how exactly does the very pro-trickle-down WSJ think it reflects on capitalism to eternally return to the idea of rich people farming poor people to grow them backup organs for sale at a fair price?

Make it make sense.

Three Numbers [[link removed]]

90% of claims [[link removed]] denied [[link removed]] by giant insurance company UnitedHealth’s AI algorithm are reversed and approved on appeal. But because few patients go through the appeals process and the company has developed the algorithm to reduce spending on health care, this remarkably high error rate is a feature, not a bug .

900,000 union members [[link removed]] received immediate pay increases of 10% or more [[link removed]] this year, including thousands of workers at GM, Ford, UPS, Kaiser Permanente, American Airlines, and other major employers. Thousands of non-union workers also saw significant pay increases as these landmark union contracts raised industry standards across the board.

$20,000 or more [[link removed]] would be owed by an immigrant caregiver to their employer if they left their job before three years elapsed. The so-called “ stay or pay [[link removed]] ” contracts which impose such conditions have been compared to indentured servitude, and there is a growing push to outlaw them.

A Chart [[link removed]]

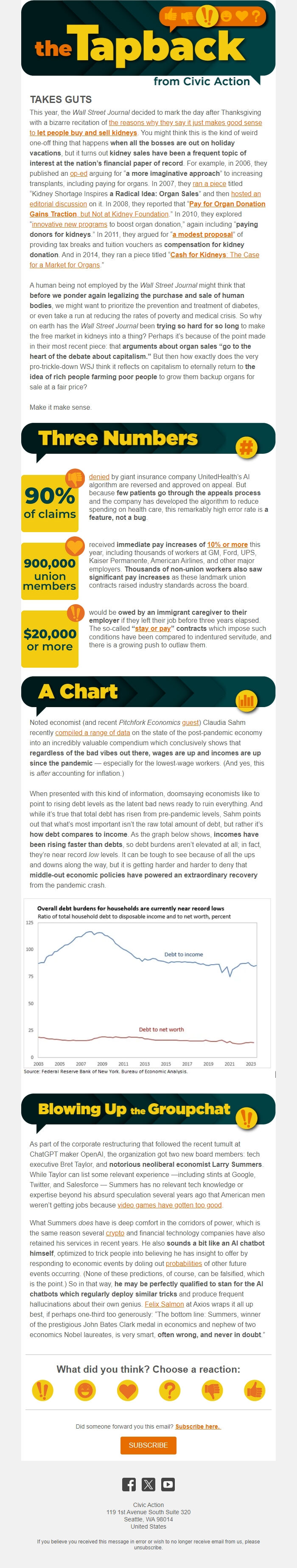

Noted economist (and recent Pitchfork Economics guest [[link removed]] ) Claudia Sahm recently compiled a range of data [[link removed]] on the state of the post-pandemic economy into an incredibly valuable compendium which conclusively shows that regardless of the bad vibes out there, wages are up and incomes are up since the pandemic — especially for the lowest-wage workers. (And yes, this is after accounting for inflation.)

When presented with this kind of information, doomsaying economists like to point to rising debt levels as the latent bad news ready to ruin everything. And while it’s true that total debt has risen from pre-pandemic levels, Sahm points out that what’s most important isn’t the raw total amount of debt, but rather it’s how debt compares to income . As the graph below shows, incomes have been rising faster than debts , so debt burdens aren’t elevated at all; in fact, they’re near record low levels. It can be tough to see because of all the ups and downs along the way, but it is getting harder and harder to deny that middle-out economic policies have powered an extraordinary recovery from the pandemic crash.

[link removed] [[link removed]]

Blowing up the Groupchat [[link removed]]

As part of the corporate restructuring that followed the recent tumult at ChatGPT maker OpenAI, the organization got two new board members: tech executive Bret Taylor, and notorious neoliberal economist Larry Summers . While Taylor can list some relevant experience —including stints at Google, Twitter, and Salesforce — Summers has no relevant tech knowledge or expertise beyond his absurd speculation several years ago that American men weren’t getting jobs because video games have gotten too good [[link removed]] .

What Summers does have is deep comfort in the corridors of power, which is the same reason several crypto [[link removed]] and financial technology companies have also retained his services in recent years. He also sounds a bit like an AI chatbot himself , optimized to trick people into believing he has insight to offer by responding to economic events by doling out probabilities [[link removed]] of other future events occurring. (None of these predictions, of course, can be falsified, which is the point.) So in that way, he may be perfectly qualified to stan for the AI chatbots which regularly deploy similar tricks and produce frequent hallucinations about their own genius. Felix Salmon [[link removed]] at Axios wraps it all up best, if perhaps one-third too generously: “The bottom line: Summers, winner of the prestigious John Bates Clark medal in economics and nephew of two economics Nobel laureates, is very smart, often wrong, and never in doubt .”

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

TAKES GUTS

This year, the Wall Street Journal decided to mark the day after Thanksgiving with a bizarre recitation of the reasons why they say it just makes good sense to let people buy and sell kidneys [[link removed]] . You might think this is the kind of weird one-off thing that happens when all the bosses are out on holiday vacations , but it turns out kidney sales have been a frequent topic of interest at the nation’s financial paper of record . For example, in 2006, they published an op-ed [[link removed]] arguing for “ a more imaginative approach ” to increasing transplants, including paying for organs. In 2007, they ran a piece [[link removed]] titled “Kidney Shortage Inspires a Radical Idea: Organ Sales ” and then hosted an editorial discussion [[link removed]] on it. In 2008, they reported that “ Pay for Organ Donation Gains Traction , but Not at Kidney Foundation [[link removed]] .” In 2010, they explored “ innovative new programs [[link removed]] to boost organ donation,” again including “ paying donors for kidneys .” In 2011, they argued for “ a modest proposal [[link removed]] ” of providing tax breaks and tuition vouchers as compensation for kidney donation . And in 2014, they ran a piece titled “ Cash for Kidneys : The Case for a Market for Organs [[link removed]] .”

A human being not employed by the Wall Street Journal might think that before we ponder again legalizing the purchase and sale of human bodies , we might want to prioritize the prevention and treatment of diabetes, or even take a run at reducing the rates of poverty and medical crisis. So why on earth has the Wall Street Journal been trying so hard for so long to make the free market in kidneys into a thing? Perhaps it’s because of the point made in their most recent piece: that arguments about organ sales “go to the heart of the debate about capitalism.” But then how exactly does the very pro-trickle-down WSJ think it reflects on capitalism to eternally return to the idea of rich people farming poor people to grow them backup organs for sale at a fair price?

Make it make sense.

Three Numbers [[link removed]]

90% of claims [[link removed]] denied [[link removed]] by giant insurance company UnitedHealth’s AI algorithm are reversed and approved on appeal. But because few patients go through the appeals process and the company has developed the algorithm to reduce spending on health care, this remarkably high error rate is a feature, not a bug .

900,000 union members [[link removed]] received immediate pay increases of 10% or more [[link removed]] this year, including thousands of workers at GM, Ford, UPS, Kaiser Permanente, American Airlines, and other major employers. Thousands of non-union workers also saw significant pay increases as these landmark union contracts raised industry standards across the board.

$20,000 or more [[link removed]] would be owed by an immigrant caregiver to their employer if they left their job before three years elapsed. The so-called “ stay or pay [[link removed]] ” contracts which impose such conditions have been compared to indentured servitude, and there is a growing push to outlaw them.

A Chart [[link removed]]

Noted economist (and recent Pitchfork Economics guest [[link removed]] ) Claudia Sahm recently compiled a range of data [[link removed]] on the state of the post-pandemic economy into an incredibly valuable compendium which conclusively shows that regardless of the bad vibes out there, wages are up and incomes are up since the pandemic — especially for the lowest-wage workers. (And yes, this is after accounting for inflation.)

When presented with this kind of information, doomsaying economists like to point to rising debt levels as the latent bad news ready to ruin everything. And while it’s true that total debt has risen from pre-pandemic levels, Sahm points out that what’s most important isn’t the raw total amount of debt, but rather it’s how debt compares to income . As the graph below shows, incomes have been rising faster than debts , so debt burdens aren’t elevated at all; in fact, they’re near record low levels. It can be tough to see because of all the ups and downs along the way, but it is getting harder and harder to deny that middle-out economic policies have powered an extraordinary recovery from the pandemic crash.

[link removed] [[link removed]]

Blowing up the Groupchat [[link removed]]

As part of the corporate restructuring that followed the recent tumult at ChatGPT maker OpenAI, the organization got two new board members: tech executive Bret Taylor, and notorious neoliberal economist Larry Summers . While Taylor can list some relevant experience —including stints at Google, Twitter, and Salesforce — Summers has no relevant tech knowledge or expertise beyond his absurd speculation several years ago that American men weren’t getting jobs because video games have gotten too good [[link removed]] .

What Summers does have is deep comfort in the corridors of power, which is the same reason several crypto [[link removed]] and financial technology companies have also retained his services in recent years. He also sounds a bit like an AI chatbot himself , optimized to trick people into believing he has insight to offer by responding to economic events by doling out probabilities [[link removed]] of other future events occurring. (None of these predictions, of course, can be falsified, which is the point.) So in that way, he may be perfectly qualified to stan for the AI chatbots which regularly deploy similar tricks and produce frequent hallucinations about their own genius. Felix Salmon [[link removed]] at Axios wraps it all up best, if perhaps one-third too generously: “The bottom line: Summers, winner of the prestigious John Bates Clark medal in economics and nephew of two economics Nobel laureates, is very smart, often wrong, and never in doubt .”

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Message Analysis

- Sender: Civic Action

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- EveryAction