| From | Mike King at Volunteers of America <[email protected]> |

| Subject | Got compassion? Tonight's the night to share it [gifts doubled] |

| Date | November 28, 2023 10:27 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

/* ------------- EMAIL CLIENT SPECIFIC STYLES ------------- */

#outlook a { padding:0; } /* Force Outlook to provide a "view in

browser" message */

.ReadMsgBody { width:100%; } .ExternalClass { width:100%; } /* Force

Hotmail to display emails at full width */

.ExternalClass, .ExternalClass p, .ExternalClass span, .ExternalClass

font, .ExternalClass td, .ExternalClass div { line-height: 100%; } /*

Force Hotmail to display normal line spacing */

body, table, td, a { -webkit-text-size-adjust:100%;

-ms-text-size-adjust:100%; } /* Prevent WebKit and Windows mobile

changing default text sizes */

table, td { mso-table-lspace:0pt; mso-table-rspace:0pt; } /* Remove

spacing between tables in Outlook 2007 and up */

img { -ms-interpolation-mode:bicubic; } /* Allow smoother rendering of

resized image in Internet Explorer */

body { margin:0 !important; } div[style*="margin: 16px 0"] {

margin:0 !important; } /* Fix Android 4.4 body centering issue */

/* ------------- RESET STYLES ------------- */

* { -webkit-font-smoothing: antialiased; }

body { Margin: 0; margin:0; padding:0; min-width: 100%;

-webkit-font-smoothing: antialiased; mso-line-height-rule: exactly; }

img { border:0; height:auto; line-height:0px; outline:none;

text-decoration:none;}

table { border-spacing: 0; border-collapse:collapse !important; }

body { height:100% !important; margin:0; padding:0; width:100%

!important; }

/* ------------- UTLIITY CLASSES ------------- */

/* WHEN USING CUSOM FONTS */

[style*="Source Sans Pro"] { font-family: 'Source Sans Pro', Arial,

sans-serif !important } /* Override Outlook to not break on imported

fonts */

/* iOS BLUE LINKS */

.appleBody a { color:#B32317; text-decoration: none; }

.appleFooter a, .appleFooter p { color:#ffffff; text-decoration: none;

}

/* ------------- CUSTOM STYLES ------------- */

body, table, p {

font-family: 'Source Sans Pro', Arial, sans-serif;

}

table {

background-color: #ffffff;

color: #202224;

}

.wrapper {

width: 100%;

table-layout: fixed;

-webkit-text-size-adjust: 100%;

-ms-text-size-adjust: 100%;

}

.webkit {

max-width: 600px;

}

.outer {

Margin: 0 auto;

width: 100%;

max-width: 600px;

}

.full-width-image img {

width: 100%;

max-width: 600px;

height: auto;

}

.inner {

padding: 10px;

}

p, ul, li {

color: #202224;

font-size: 16px;

line-height: 30px;

Margin: 0;

margin-bottom: 25px;

}

p a, ul li a {

color: #B32317;

text-decoration: underline;

font-weight: bold;

}

h1, .h1 {

color: #001A70;

font-size: 32px;

line-height: 35px !important;

Margin-top: 0px;

Margin-bottom: 25px;

font-family: 'Source Sans Pro', Arial, sans-serif;

-webkit-font-smoothing: antialiased;

font-weight: 600;

}

h2, .h2 {

color: #001A70;

font-size: 24px;

line-height: 32px !important;

Margin-top: 0;

Margin-bottom: 20px;

font-family: 'Source Sans Pro', Arial, sans-serif;

-webkit-font-smoothing: antialiased;

font-weight: 500;

}

.img-align-vertical img {

display: inline-block;

vertical-align: middle;

}

/* MOBILE STYLES */

@media screen and (max-width: 600px) {

.logo, .logo img {

width: 250px !important;

}

.mobile-cta-padding {

padding: 15px 0 10px !important;

}

.mobile-body-padding {

padding: 15px 20px !important;

}

.mobile-footer-padding {

padding: 40px 20px 80px !important;

}

.mobile-top-padding {

padding-top: 20px !important;

}

.donate-button, .donate-button a {

width: 120px !important;

padding-left: 0 !important;

padding-right: 0 !important;

font-size: 16px !important;

}

#hero-mobile, #hero-mobile img, .logo {

display: block !important;

max-height: none !important;

overflow: visible !important;

width: 100% !important;

}

.header-second-column, .column, .column img {

width: 100% !important;

max-width: 100% !important;

}

.contents {

min-width: auto !important;

}

.mobile-sponsor-padding {

padding: 20px 0 0 !important;

}

.mobile-block {

display: block !important;

margin: 10px 0 !important;

}

.mobile-hide {

display: none !important;

}

.mobile-center {

text-align: center !important;

padding: 15px 0px !important;

}

.mobile-center-no-pad {

text-align: center !important;

}

.mobile-logo-padding {

padding: 0px 0px 0px 10px !important;

}

.mobile-cta-padding {

padding: 20px 15px !important;

}

.mobile-pad-bottom {

padding-bottom: 20px !important;

}

.mobile-pad-left-right {

padding: 0px 20px !important;

}

.mobile-cta-no-pad-left-right {

padding: 20px 0px !important;

}

.mobile-cta-width {

width: 100% !important;

max-width: 100% !important;

}

.mobile-no-border-link {

border: none !important;

text-decoration: underline !important;

}

}

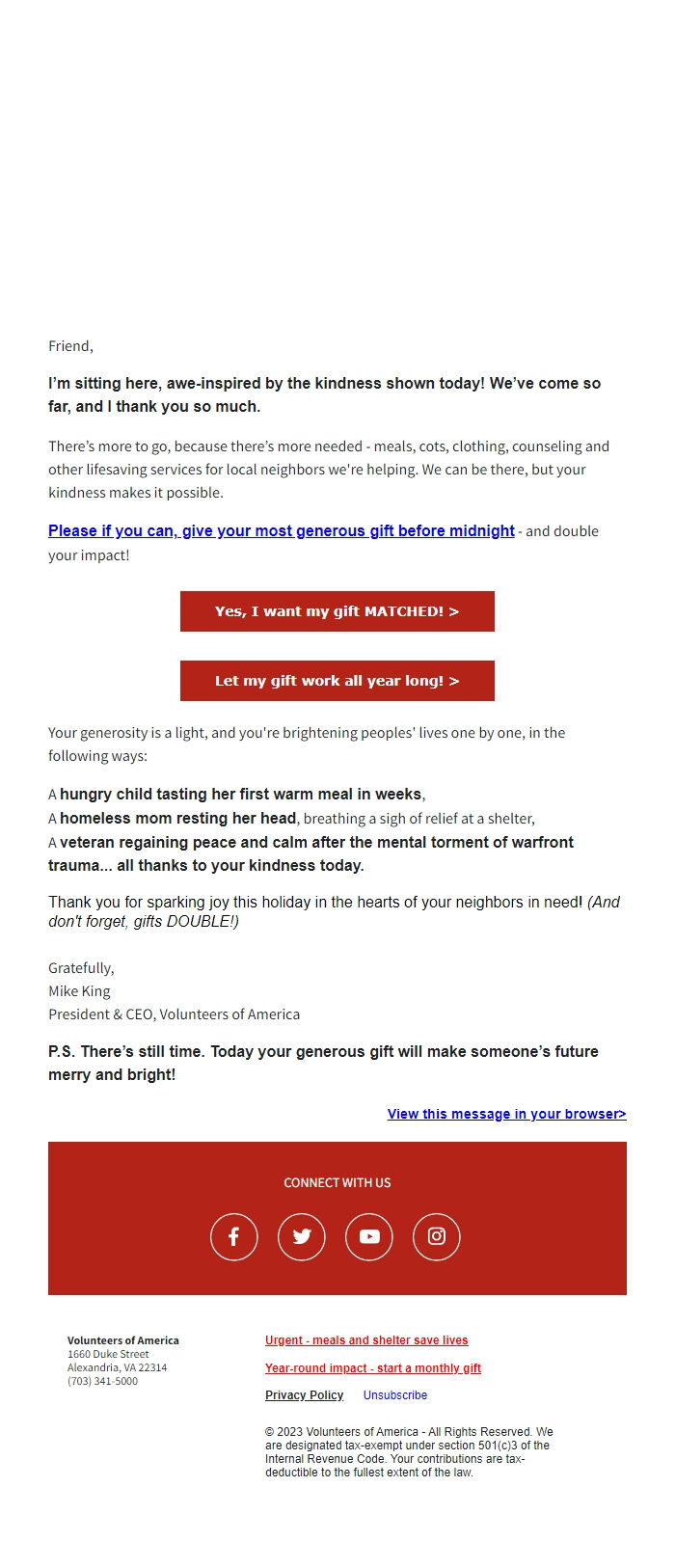

Little girl holding bread at winter shelter

[link removed]

Friend,

I'm sitting here, awe-inspired by the kindness shown today!

We've come so far, and I thank you so much.

There's more to go, because there's more needed - meals,

cots, clothing, counseling and other lifesaving services for local

neighbors we're helping. We can be there, but your kindness makes it

possible.

Please if you can, give your most generous gift before midnight - and

double your impact!

[link removed]

Yes, I want my gift MATCHED! >

[link removed]

Let my gift work all year long! >

[link removed]

Your generosity is a light, and you're brightening peoples' lives one

by one, in the following ways:

A hungry child tasting her first warm meal in weeks,

A homeless mom resting her head, breathing a sigh of relief at a

shelter,

A veteran regaining peace and calm after the mental torment of

warfront trauma... all thanks to your kindness today.

Thank you for sparking joy this holiday in the hearts of your

neighbors in need! (And don't forget, gifts DOUBLE!)

Gratefully,

Mike King

President & CEO, Volunteers of America

P.S. There's still time. Today your generous gift will make

someone's future merry and bright!

View this message in your browser>

[link removed]

CONNECT WITH US

Facebook

Twitter

YouTube

Instagram

[link removed]

[link removed]

[link removed]

[link removed]

Volunteers of America

1660 Duke Street

Alexandria, VA 22314

(703) 341-5000

This winter - meals and shelter save lives

[link removed]

Year-round impact - be a monthly supporter

[link removed]

Privacy Policy Unsubscribe

[link removed]

[link removed]

© 2023

Volunteers of America - All Rights Reserved. We are designated

tax-exempt under section 501(c)3 of the Internal Revenue Code. Your

contributions are tax-deductible to the fullest extent of the law.

#outlook a { padding:0; } /* Force Outlook to provide a "view in

browser" message */

.ReadMsgBody { width:100%; } .ExternalClass { width:100%; } /* Force

Hotmail to display emails at full width */

.ExternalClass, .ExternalClass p, .ExternalClass span, .ExternalClass

font, .ExternalClass td, .ExternalClass div { line-height: 100%; } /*

Force Hotmail to display normal line spacing */

body, table, td, a { -webkit-text-size-adjust:100%;

-ms-text-size-adjust:100%; } /* Prevent WebKit and Windows mobile

changing default text sizes */

table, td { mso-table-lspace:0pt; mso-table-rspace:0pt; } /* Remove

spacing between tables in Outlook 2007 and up */

img { -ms-interpolation-mode:bicubic; } /* Allow smoother rendering of

resized image in Internet Explorer */

body { margin:0 !important; } div[style*="margin: 16px 0"] {

margin:0 !important; } /* Fix Android 4.4 body centering issue */

/* ------------- RESET STYLES ------------- */

* { -webkit-font-smoothing: antialiased; }

body { Margin: 0; margin:0; padding:0; min-width: 100%;

-webkit-font-smoothing: antialiased; mso-line-height-rule: exactly; }

img { border:0; height:auto; line-height:0px; outline:none;

text-decoration:none;}

table { border-spacing: 0; border-collapse:collapse !important; }

body { height:100% !important; margin:0; padding:0; width:100%

!important; }

/* ------------- UTLIITY CLASSES ------------- */

/* WHEN USING CUSOM FONTS */

[style*="Source Sans Pro"] { font-family: 'Source Sans Pro', Arial,

sans-serif !important } /* Override Outlook to not break on imported

fonts */

/* iOS BLUE LINKS */

.appleBody a { color:#B32317; text-decoration: none; }

.appleFooter a, .appleFooter p { color:#ffffff; text-decoration: none;

}

/* ------------- CUSTOM STYLES ------------- */

body, table, p {

font-family: 'Source Sans Pro', Arial, sans-serif;

}

table {

background-color: #ffffff;

color: #202224;

}

.wrapper {

width: 100%;

table-layout: fixed;

-webkit-text-size-adjust: 100%;

-ms-text-size-adjust: 100%;

}

.webkit {

max-width: 600px;

}

.outer {

Margin: 0 auto;

width: 100%;

max-width: 600px;

}

.full-width-image img {

width: 100%;

max-width: 600px;

height: auto;

}

.inner {

padding: 10px;

}

p, ul, li {

color: #202224;

font-size: 16px;

line-height: 30px;

Margin: 0;

margin-bottom: 25px;

}

p a, ul li a {

color: #B32317;

text-decoration: underline;

font-weight: bold;

}

h1, .h1 {

color: #001A70;

font-size: 32px;

line-height: 35px !important;

Margin-top: 0px;

Margin-bottom: 25px;

font-family: 'Source Sans Pro', Arial, sans-serif;

-webkit-font-smoothing: antialiased;

font-weight: 600;

}

h2, .h2 {

color: #001A70;

font-size: 24px;

line-height: 32px !important;

Margin-top: 0;

Margin-bottom: 20px;

font-family: 'Source Sans Pro', Arial, sans-serif;

-webkit-font-smoothing: antialiased;

font-weight: 500;

}

.img-align-vertical img {

display: inline-block;

vertical-align: middle;

}

/* MOBILE STYLES */

@media screen and (max-width: 600px) {

.logo, .logo img {

width: 250px !important;

}

.mobile-cta-padding {

padding: 15px 0 10px !important;

}

.mobile-body-padding {

padding: 15px 20px !important;

}

.mobile-footer-padding {

padding: 40px 20px 80px !important;

}

.mobile-top-padding {

padding-top: 20px !important;

}

.donate-button, .donate-button a {

width: 120px !important;

padding-left: 0 !important;

padding-right: 0 !important;

font-size: 16px !important;

}

#hero-mobile, #hero-mobile img, .logo {

display: block !important;

max-height: none !important;

overflow: visible !important;

width: 100% !important;

}

.header-second-column, .column, .column img {

width: 100% !important;

max-width: 100% !important;

}

.contents {

min-width: auto !important;

}

.mobile-sponsor-padding {

padding: 20px 0 0 !important;

}

.mobile-block {

display: block !important;

margin: 10px 0 !important;

}

.mobile-hide {

display: none !important;

}

.mobile-center {

text-align: center !important;

padding: 15px 0px !important;

}

.mobile-center-no-pad {

text-align: center !important;

}

.mobile-logo-padding {

padding: 0px 0px 0px 10px !important;

}

.mobile-cta-padding {

padding: 20px 15px !important;

}

.mobile-pad-bottom {

padding-bottom: 20px !important;

}

.mobile-pad-left-right {

padding: 0px 20px !important;

}

.mobile-cta-no-pad-left-right {

padding: 20px 0px !important;

}

.mobile-cta-width {

width: 100% !important;

max-width: 100% !important;

}

.mobile-no-border-link {

border: none !important;

text-decoration: underline !important;

}

}

Little girl holding bread at winter shelter

[link removed]

Friend,

I'm sitting here, awe-inspired by the kindness shown today!

We've come so far, and I thank you so much.

There's more to go, because there's more needed - meals,

cots, clothing, counseling and other lifesaving services for local

neighbors we're helping. We can be there, but your kindness makes it

possible.

Please if you can, give your most generous gift before midnight - and

double your impact!

[link removed]

Yes, I want my gift MATCHED! >

[link removed]

Let my gift work all year long! >

[link removed]

Your generosity is a light, and you're brightening peoples' lives one

by one, in the following ways:

A hungry child tasting her first warm meal in weeks,

A homeless mom resting her head, breathing a sigh of relief at a

shelter,

A veteran regaining peace and calm after the mental torment of

warfront trauma... all thanks to your kindness today.

Thank you for sparking joy this holiday in the hearts of your

neighbors in need! (And don't forget, gifts DOUBLE!)

Gratefully,

Mike King

President & CEO, Volunteers of America

P.S. There's still time. Today your generous gift will make

someone's future merry and bright!

View this message in your browser>

[link removed]

CONNECT WITH US

YouTube

[link removed]

[link removed]

[link removed]

[link removed]

Volunteers of America

1660 Duke Street

Alexandria, VA 22314

(703) 341-5000

This winter - meals and shelter save lives

[link removed]

Year-round impact - be a monthly supporter

[link removed]

Privacy Policy Unsubscribe

[link removed]

[link removed]

© 2023

Volunteers of America - All Rights Reserved. We are designated

tax-exempt under section 501(c)3 of the Internal Revenue Code. Your

contributions are tax-deductible to the fullest extent of the law.

Message Analysis

- Sender: Volunteers of America

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Convio