|

|

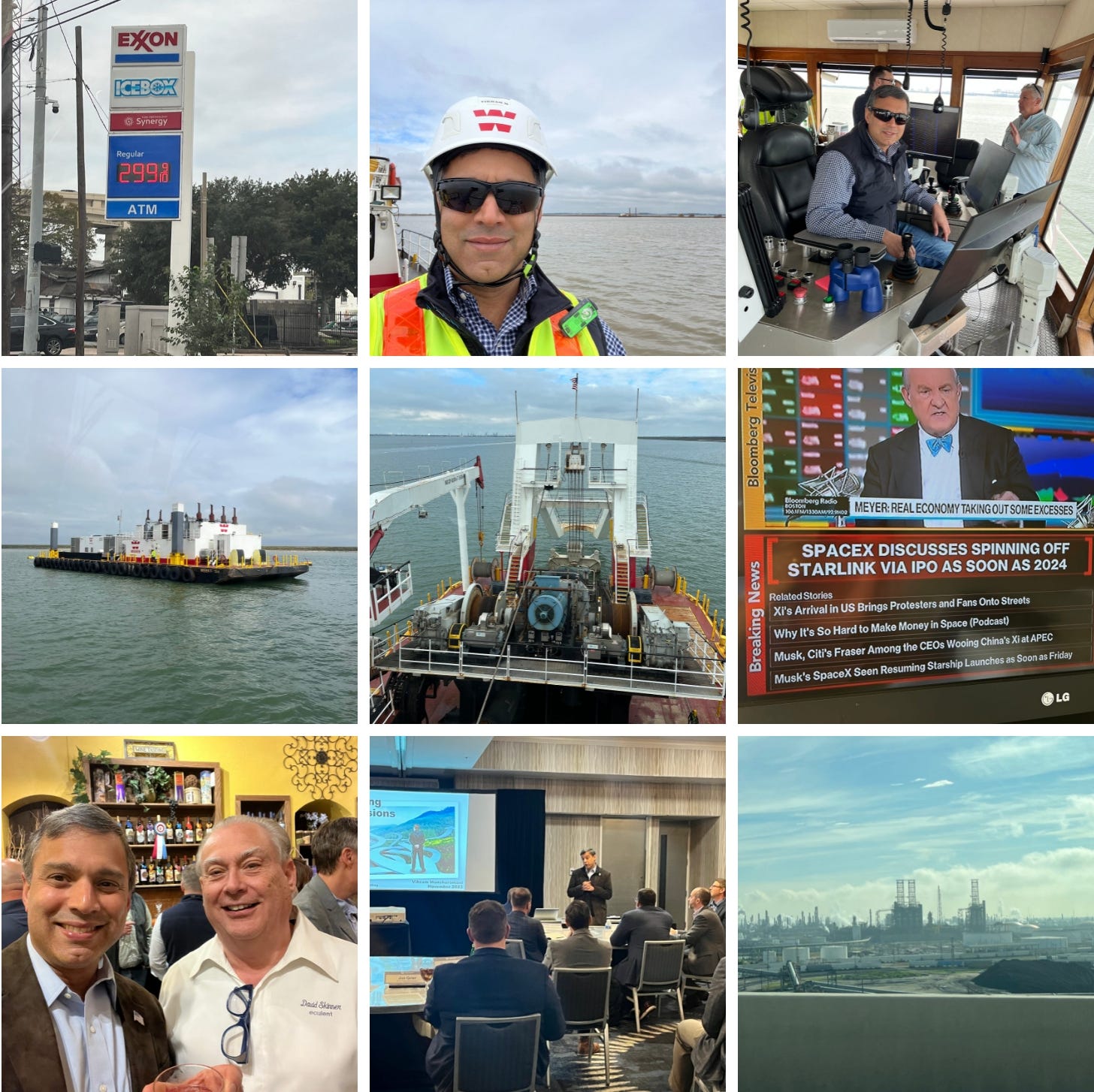

Travel Tales Part 2: Las Vegas, Chapel Hill, and Houston

Learning from Advising, Speaking and Teaching

As I mentioned last week, I’m often introduced as a global trend-watcher and analyst and regularly get asked questions about geopolitical and geo-economic developments. Lately, those questions have focused disproportionately on Russia/Ukraine, China/Taiwan, inflation, energy markets, housing markets, the US economy, and upcoming elections in Mexico, Taiwan and the United States. I’m also regularly asked about cryptocurrencies, gold, equity markets, and the US dollar.

To repeat from last week, “Every now and then, I’m asked about my approach to making sense of the world (rather than my thoughts about what is currently happening). I love these questions as they provide an opportunity for me to describe the process I use to generate insights.” As a follow-up to the travelogue of three recent international trips that I shared last week in “Travel Tales: Canada, UAE, Brazil,” I am going to share a bit about three domestic trips…

Las Vegas, Nevada

In October, I attended the Forbes | Shook Top Advisor Summit, a gathering of some of America’s leading investment advisors that took place in Las Vegas. While I had the opportunity to meet with several interesting investment managers (as well as RJ Shook, founder of Shook Research and the event organizer), I spent most of my time speaking with investors and management teams related to the space industry. Specifically, I met with the principals of Balerion Space Ventures, a space and defense technologies focused venture capital firm that I’ve been advising; Charles Miller, the co-founder and CEO of Lynk Global, an innovative satellite services company that I’ve invested in; and Jim Cantrell and Mike D’Angelo, co-founders of Phantom Space, a launch company that’s looking to become the “Henry Ford” of the new space industry by democratizing access to launch services.

So What?

My trip to Las Vegas spurred my thinking about a few different topics:

On my way to Vegas, my flight flew over Lake Mead. As you can see from the picture above, water levels are well below historical levels as seen by the light-colored bands on the shorelines. But because I’ve flown over Lake Mead dozens of times in the past few years, what I noticed was that water levels seem to have been rising, which is in direct contradiction to the prevailing narrative I had been hearing about ever falling water levels. Sure enough, upon further investigation, water levels had in fact risen 22 feet in the past year, even if they remain below ideal heights. Is this the start of a corrective process whereby water levels rise back to historically normal (whatever that means!) levels? Or is this merely a blip in the ongoing fall in Lake Mead’s level?

As a result of meeting with many senior wealth advisors, I came to appreciate their excitement for the investment opportunities presented by the commercialization of space. The investment community’s reaction to the Balerion, Lynk and Phantom stories was overwhelmingly positive with deep and genuine interest. Despite this enthusiasm, however, many of the largest investment advisors expressed concerned about the relatively small size of the space market today. They seemed content to watch the industry from the sidelines until it grew large enough to enable the allocation of significant capital. I interpreted this as a massively bullish sign to invest in space today as there appears to be a significant follow-on demand as the set of opportunities grow. Pardon the pun, but the industry’s second stage booster seems ready to fire and will surely accelerate new space to new heights in due course.

Chapel Hill, North Carolina

In late October, I joined Andrea Szigethy and her amazing team at the Academy for Institutional Investors in Chapel Hill, North Carolina for their Fall Investment Academy Forum. I had the opportunity to speak with a large audience of investment professionals from asset management firms, public pension funds, endowments, foundations, and family offices.

I spoke about the many cross-currents facing the world today. Yes, I spoke about inflation, but I also discussed the risks of deflation by highlighting the global outlook for demographics, technology and the supply of energy. I also spoke about the US-China War and the various manifestations of the conflict visible in the world today (energy competition, death of multilateralism, currency wars, the Israel-Hamas conflict, the global food fight, and other forms of influence operations).

Interestingly, the topics that generated the most conversation after my presentation fell into three main buckets: (1) energy dynamics and whether technological innovation would make the current carbon focus look silly a few decades from now, (2) the bifurcating global economy and whether it was really possible for the US and China to decouple, and (3) the tensions between inflation and deflation in the short, medium, and long term.

So What?

A few insights from my trip to Chapel Hill:

I found the timing of the inflation to deflation transition to be worthy of more consideration. While technology and demographics produce long run deflationary pressures, they are being offset in the short run by inflationary friend-shoring efforts. Further, as I noted in my piece about the impact of rapidly rising mortgage rates, there are offsetting pressures that may lessen the deflation caused by falling real estate prices. With that said, the market is unlikely to have well-behaved incremental moves. Is it possible that we’re going to have massive volatility in price levels? Could we have sticky inflation that persists until we hit a tipping point that pushes us rapidly into a vicious deflationary cycle? How might a political or social shift away from electrification impact the timing of a transition from inflation to deflation?

Although I had spent some time during the conference speaking with attendees about the potential for technology to displace labor, I hadn’t fully appreciated how the lack of labor may spur innovation. Yet that’s exactly what I saw in action as I was leaving the conference to fly home and noticed the REEF virtual food hall at the Raleigh Durham airport. By centralizing kitchen and service staff, the virtual food hall allowed patrons to purchase food from one of several restaurants and pick it up at a centralized locker. One of the managers who was running the virtual food hall shared the idea for REEF was driven in part by the need to overcome labor shortages (as well as a desire to give consumers more choice). Many of us focus on how technology can eliminate jobs, but could a shortage of workers spur innovation? What does this mean for a country like Japan that’s facing what most analysts call a demographic time bomb? Could it mean Japan can incorporate job displacing technology without social unrest? Or might it even serve as a catalyst for Japan to turn into an innovation superpower? Are we thinking about technology and jobs correctly?

Houston, TX

In November, I had the opportunity to visit a dredging job being run by Weeks Marine, a subsidiary of Omaha-based Kiewit. The scale and scope of the operations was enormous and it was stunning to learn of the specialized equipment used in the operation! And the folks running the project were among the most dedicated, professional and hard-working workers I have encountered anywhere in the construction industry.

I also had the opportunity while in Texas to run a small executive education seminar about behavioral biases and how they make us (as individuals and professionals) vulnerable to poor decision-making. After discussing how most of us are overconfident and let seemingly irrelevant data impact our thinking processes, I had the executives in the class head out into the real world to observe how marketers utilize these biases to nudge our behavior towards their objectives.

Lastly, and somewhat appropriately given the historical relationship between the US space industry and Houston, news broke that SpaceX was discussing a possible IPO of their Starlink satellite services business while I was in Texas. This led to several conversations with current and former NASA officials about implications of SpaceX’s forthcoming Starship rocket lowering the cost of access to space even further.

So What?

Some insights from this trip:

My time on the dredging vessels led to thinking about mining. As humans have already used many of the easiest-to-reach deposits of materials used to enhance the quality of our lives, will we have to begin mining the ocean? And surely doing so would be easier than mining asteroids, correct? The dredging efforts and this thinking reminded me of my 2020 prediction that raised the possibility that seabed mining would gain some traction.

Although promising in concept, asteroid mining remains impractical and fails to generate momentum; seabed mining, however, gains significant traction as the International Seabed Authority continues granting exploration permits and makes progress (with reluctant and qualified support from environmentalists) towards an Underwater Mining Code.

One of the highlights of my trip to Texas was a dinner I had with several friends and clients at eculent. The restaurant has been called “One of the best restaurants in the world” despite its low profile. I had the opportunity to speak with Chef David Skinner about his multi-sensory approach to gastronomy. It was a fascinating conversation that led me to appreciate why the Washington Post called him “A chef with a flair for the avant-garde [who] serves up three hours of sorcery.” The dinner got me thinking about two big topics. First, America is blessed with having amazing talent everywhere. I simply couldn’t stop thinking about the potential of the untapped talent we have outside of elite institutions and coastal cities. Second, the dinner validated my deep belief that we simply cannot fully appreciate or understand anything (including food) by solely relying on a single perspective. What Chef Skinner taught and demonstrated was that taste, appearance, texture, smell, and temperature all interact in complex ways to enhance our enjoyment of food.

Wandering and Wondering

As you can tell from a few of my most recent trips, I wander between industries, functions, geographies and topics. Along the way I collect all sorts of data that may prove useful, but also may be worthless. I think about what I observe and try to constantly incorporate my findings into an ever-evolving worldview. I also find this approach of wandering and wondering to be a fulfilling, interesting, informative, and fun way to generate insights.

Because I remain convinced more than ever before that each perspective is limited, biased and incomplete, I remain convinced the only hope we have to understand the dynamics driving our world today is to triangulate using many lenses. Adopting a generalist perspective, an approach accessible to all of us, may very well be the most powerful tool we have to navigating uncertainty.

About Vikram Mansharamani

Dr. Mansharamani is a global generalist who tries to look beyond the short term view that tends to dominate today’s agenda. He spends his time speaking with leaders in business, government, academia, and journalism…and prides himself on voraciously consuming a wide variety of books, magazines, articles, TV shows, and podcasts. LinkedIn twice listed him as their #1 Top Voice for Global Economics and Worth profiled him on their list of the 100 Most Powerful People in Global Finance. He has taught at Yale and Harvard and has a PhD and two masters degrees from MIT. He is also the author of THINK FOR YOURSELF: Restoring Common Sense in an Age of Experts and Artificial Intelligence as well as BOOMBUSTOLOGY: Spotting Financial Bubbles Before They Burst. Follow him on Twitter or LinkedIn.

You're currently a free subscriber to Navigating Uncertainty. For the full experience, upgrade your subscription.