|

John,

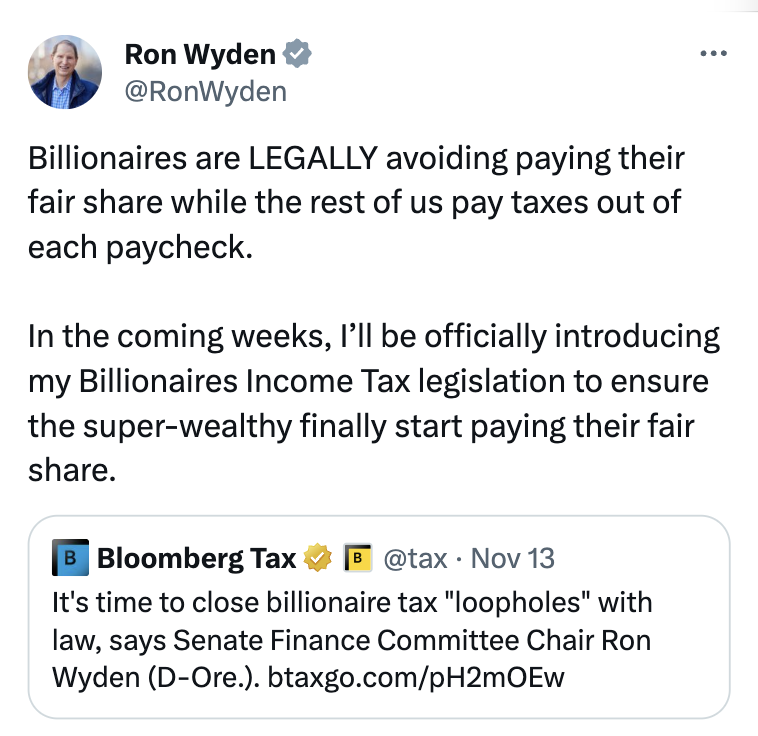

Next week, Senate Finance Committee Chair Ron Wyden (D-OR) is widely expected to introduce his Billionaires Income Tax to correct the absurdity of billionaires paying lower income-tax rates than most working people―and sometimes paying nothing at all.

According to Americans for Tax Fairness research, 26 top billionaires paid an average income tax rate of just 4.8% over 6 recent years when all their income is counted―far less than the top income tax rate of 37%.[1]

Before Senator Wyden introduces the Billionaires Income Tax, will you write to your senators and urge them to become original co-sponsors?

This is a critical piece of legislation that would not only ensure that America’s 748 billionaires are paying income taxes each year―just like working people do―it would also help close the widening wealth gap in America: the richest 1% hold almost one-third (31%) of U.S. wealth while the bottom 50% has just 2.5%.[2]

Check out Maura’s email below for more details on the Billionaires Income Tax, then take action today!

Sarah Christopherson

Legislative and Policy Director

Americans for Tax Fairness Action Fund

[1] BASED ON THEIR WEALTH GROWTH, 26 TOP BILLIONAIRES PAID AN AVERAGE INCOME TAX RATE OF JUST 4.8% OVER 6 RECENT YEARS

[2] https://twitter.com/JStein_WaPo/status/1725228522040406193

-- Maura's email --

John,

Since 2018, when the Trump-GOP tax scam went into effect, America’s 748 billionaires have seen their wealth skyrocket by an astounding $2.2 trillion―or 77%.[1] Combined, America’s wealthiest households are now worth $5 trillion, but they don’t pay anywhere close to their fair share of taxes.

According to Americans for Tax Fairness research, 26 top billionaires paid an average income tax rate of just 4.8% over 6 recent years when their biggest source of income―the growth in their wealth―is included.[2]

Meanwhile, we know that a number of billionaires—including Elon Musk, Jeff Bezos, and Michael Bloomberg—have gamed the system to pay $0 in federal income taxes in recent years, even when their income from their wealth was skyrocketing.[3] That’s not just a lower tax rate than nurses, firefighters, and teachers—that’s a lower dollar amount in those years.

What can we do about these runaway fortunes that are the ultimate symbols of wealth inequality and that starve the federal government of the resources needed to invest in working people?

Very soon, Senate Finance Committee Chair Ron Wyden (D-OR) is expected to introduce the Billionaires Income Tax (BIT), which would ensure that billionaires start paying taxes on their wealth gains each year, just like workers pay on their paychecks.

Click here to send a message to your U.S. senators urging them to become original co-sponsors of the Billionaires Income Tax.

According to the Joint Committee on Taxation, the BIT would raise $557 billion in revenue over 10 years.[4] It would be applied annually to the growth in value of easily priced assets such as stocks, and to the growth in value of harder to price assets like private businesses when they’re sold.

This new tax would only apply to taxpayers whose net worth either exceeds $1 billion or whose income exceeds $100 million for three consecutive years.

At a time when the richest 1% holds almost one-third (31%) of U.S. wealth while the bottom 50% has just 2.5%,[5] we need a tax on billionaire wealth gains to ensure the very richest Americans are paying their fair share in taxes each and every year.

Click here to send a message to your U.S. senators and tell them to become original co-sponsors of the Billionaires Income Tax before it’s introduced as early as next week.

Together, we’re working to level the playing field for working people, and that starts with America’s 748 billionaires paying income taxes every year, just like working people do.

Thank you for taking action today,

Maura Quint

Campaign Director

Americans for Tax Fairness Action Fund

[1] BILLIONAIRES ARE $2.2 TRILLION RICHER SINCE 2017 TRUMP-GOP TAX LAW

[2] BASED ON THEIR WEALTH GROWTH, 26 TOP BILLIONAIRES PAID AN AVERAGE INCOME TAX RATE OF JUST 4.8% OVER 6 RECENT YEARS

[3] The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax

[4] Wyden Statement on Billionaires Income Tax Score

[5] https://twitter.com/JStein_WaPo/status/1725228522040406193

|