| From | Civic Action <[email protected]> |

| Subject | The Tapback: Silver Spoons |

| Date | November 21, 2023 11:17 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Logo for The Tapback from Civic Action [[link removed]]

SILVER SPOONS

The Federal Reserve has been sharply raising interest rates since last March, and the rationale is a little bit complicated and more than a little bit weird . Basically, their goal is to slow economic growth by increasing the cost of borrowing money. The expectation is that slower growth will increase unemployment, and thus reduce consumer demand, which in turn is supposed to reduce inflation. It’s a long way around, but that’s the standard theory.

Here’s the thing: increasing interest rates makes purchasing a home more expensive [[link removed]] by directly raising monthly mortgage payments, which prices people out of homeownership and leads to higher rents. Higher interest rates also increase borrowing costs for housing developers, which puts additional upward pressure on rents. And the cost of housing makes up about a third of the data that goes into calculating the inflation rate they’re trying to lower! So in other words: the Fed is trying to reduce inflation by increasing interest rates, which increases the cost of housing, which increases inflation . And along the way, they’re planning to increase unemployment, too. And this is the plan.

Make it make sense.

Three Numbers [[link removed]]

one half [[link removed]] of US households own a combined 2.5% [[link removed]] of the total wealth in the country. The richest 1% of the country controls 31.4% of the wealth .

$1 million [[link removed]] has been spent on a last-ditch [[link removed]] local ad campaign by a major New York State business group attempting to push that state’s governor to veto a new law which would bar companies from imposing noncompete agreements on employees . Noncompetes are designed to stifle competition in the labor market, and cost workers an estimated $300 billion [[link removed].] a year in lost wages .

$20 [[link removed]] price reductions have been made on the Barbie Malibu House [[link removed]] by Walmart this year. The company’s CEO expects the price of Furbys, Thanksgiving dinners, and other items to also decline.

A Chart [[link removed]]

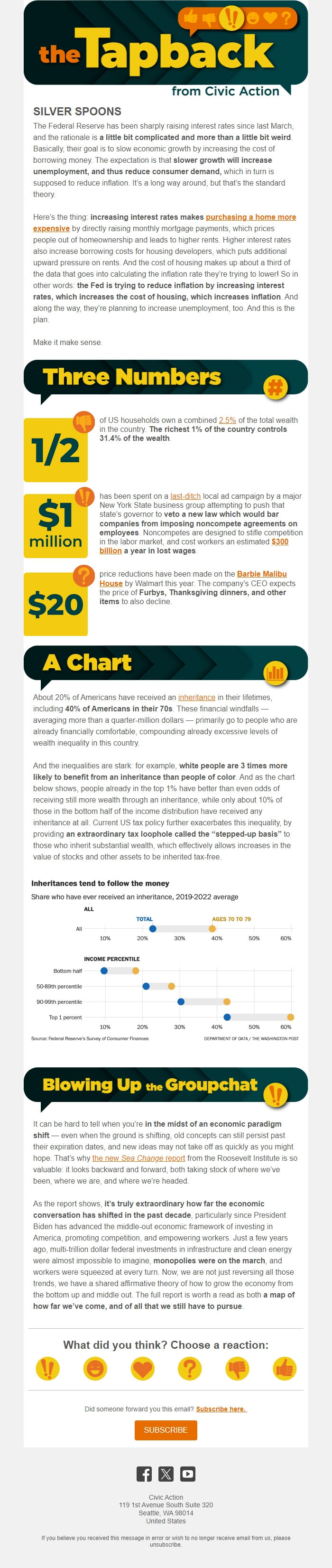

About 20% of Americans have received an inheritance [[link removed]] in their lifetimes, including 40% of Americans in their 70s . These financial windfalls — averaging more than a quarter-million dollars — primarily go to people who are already financially comfortable, compounding already excessive levels of wealth inequality in this country.

And the inequalities are stark: for example, white people are 3 times more likely to benefit from an inheritance than people of color . And as the chart below shows, people already in the top 1% have better than even odds of receiving still more wealth through an inheritance, while only about 10% of those in the bottom half of the income distribution have received any inheritance at all. Current US tax policy further exacerbates this inequality, by providing an extraordinary tax loophole called the “stepped-up basis” to those who inherit substantial wealth, which effectively allows increases in the value of stocks and other assets to be inherited tax-free.

[link removed] [[link removed]]

Blowing up the Groupchat [[link removed]]

It can be hard to tell when you’re in the midst of an economic paradigm shift — even when the ground is shifting, old concepts can still persist past their expiration dates, and new ideas may not take off as quickly as you might hope. That’s why the new Sea Change report [[link removed]] from the Roosevelt Institute is so valuable: it looks backward and forward, both taking stock of where we’ve been, where we are, and where we’re headed.

As the report shows, it’s truly extraordinary how far the economic conversation has shifted in the past decade , particularly since President Biden has advanced the middle-out economic framework of investing in America, promoting competition, and empowering workers. Just a few years ago, multi-trillion dollar federal investments in infrastructure and clean energy were almost impossible to imagine, monopolies were on the march , and workers were squeezed at every turn. Now, we are not just reversing all those trends, we have a shared affirmative theory of how to grow the economy from the bottom up and middle out. The full report is worth a read as both a map of how far we’ve come, and of all that we still have to pursue .

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

SILVER SPOONS

The Federal Reserve has been sharply raising interest rates since last March, and the rationale is a little bit complicated and more than a little bit weird . Basically, their goal is to slow economic growth by increasing the cost of borrowing money. The expectation is that slower growth will increase unemployment, and thus reduce consumer demand, which in turn is supposed to reduce inflation. It’s a long way around, but that’s the standard theory.

Here’s the thing: increasing interest rates makes purchasing a home more expensive [[link removed]] by directly raising monthly mortgage payments, which prices people out of homeownership and leads to higher rents. Higher interest rates also increase borrowing costs for housing developers, which puts additional upward pressure on rents. And the cost of housing makes up about a third of the data that goes into calculating the inflation rate they’re trying to lower! So in other words: the Fed is trying to reduce inflation by increasing interest rates, which increases the cost of housing, which increases inflation . And along the way, they’re planning to increase unemployment, too. And this is the plan.

Make it make sense.

Three Numbers [[link removed]]

one half [[link removed]] of US households own a combined 2.5% [[link removed]] of the total wealth in the country. The richest 1% of the country controls 31.4% of the wealth .

$1 million [[link removed]] has been spent on a last-ditch [[link removed]] local ad campaign by a major New York State business group attempting to push that state’s governor to veto a new law which would bar companies from imposing noncompete agreements on employees . Noncompetes are designed to stifle competition in the labor market, and cost workers an estimated $300 billion [[link removed].] a year in lost wages .

$20 [[link removed]] price reductions have been made on the Barbie Malibu House [[link removed]] by Walmart this year. The company’s CEO expects the price of Furbys, Thanksgiving dinners, and other items to also decline.

A Chart [[link removed]]

About 20% of Americans have received an inheritance [[link removed]] in their lifetimes, including 40% of Americans in their 70s . These financial windfalls — averaging more than a quarter-million dollars — primarily go to people who are already financially comfortable, compounding already excessive levels of wealth inequality in this country.

And the inequalities are stark: for example, white people are 3 times more likely to benefit from an inheritance than people of color . And as the chart below shows, people already in the top 1% have better than even odds of receiving still more wealth through an inheritance, while only about 10% of those in the bottom half of the income distribution have received any inheritance at all. Current US tax policy further exacerbates this inequality, by providing an extraordinary tax loophole called the “stepped-up basis” to those who inherit substantial wealth, which effectively allows increases in the value of stocks and other assets to be inherited tax-free.

[link removed] [[link removed]]

Blowing up the Groupchat [[link removed]]

It can be hard to tell when you’re in the midst of an economic paradigm shift — even when the ground is shifting, old concepts can still persist past their expiration dates, and new ideas may not take off as quickly as you might hope. That’s why the new Sea Change report [[link removed]] from the Roosevelt Institute is so valuable: it looks backward and forward, both taking stock of where we’ve been, where we are, and where we’re headed.

As the report shows, it’s truly extraordinary how far the economic conversation has shifted in the past decade , particularly since President Biden has advanced the middle-out economic framework of investing in America, promoting competition, and empowering workers. Just a few years ago, multi-trillion dollar federal investments in infrastructure and clean energy were almost impossible to imagine, monopolies were on the march , and workers were squeezed at every turn. Now, we are not just reversing all those trends, we have a shared affirmative theory of how to grow the economy from the bottom up and middle out. The full report is worth a read as both a map of how far we’ve come, and of all that we still have to pursue .

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Message Analysis

- Sender: Civic Action

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- EveryAction