| From | Blaze Sponsors <[email protected]> |

| Subject | Urgent: Nationwide Bank Deposit Delays Impact Major US Banks |

| Date | November 13, 2023 2:58 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Did you get this message recently?<a href=""><img src="[link removed]" alt="" border="0" /></a>

View this email in your browser <[link removed]>

Blaze Sponsors

Below is a message from our sponsor, American Alternative Assets.

Newsletter

Bank of America, Wells Fargo, Chase Deposit Delays.

WARNING SIGNS. TAKE NOTICE.

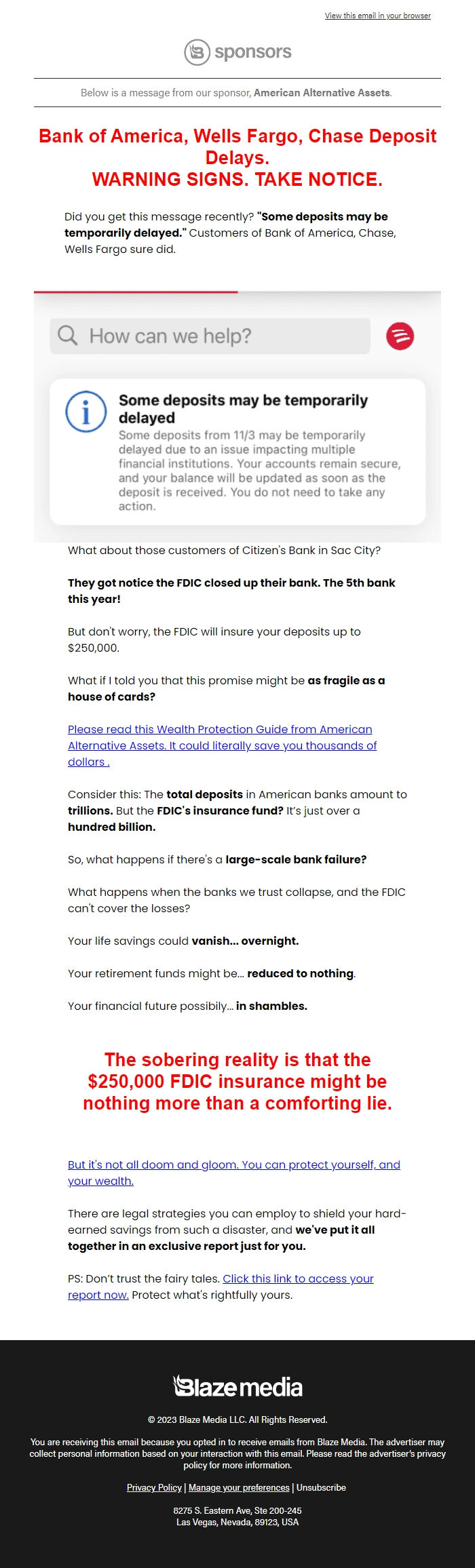

Did you get this message recently? "Some deposits may be temporarily delayed." Customers of Bank of America, Chase, Wells Fargo sure did.

<[link removed]>

What about those customers of Citizen's Bank in Sac City?

They got notice the FDIC closed up their bank. The 5th bank this year!

But don't worry, the FDIC will insure your deposits up to $250,000.

What if I told you that this promise might be as fragile as a house of cards?

Please read this Wealth Protection Guide from American Alternative Assets. It could literally save you thousands of dollars .

Consider this: The total deposits in American banks amount to trillions. But the FDIC's insurance fund? It’s just over a hundred billion.

So, what happens if there's a large-scale bank failure?

What happens when the banks we trust collapse, and the FDIC can't cover the losses?

Your life savings could vanish... overnight.

Your retirement funds might be... reduced to nothing.

Your financial future possibily... in shambles.

The sobering reality is that the $250,000 FDIC insurance might be nothing more than a comforting lie.

But it's not all doom and gloom. You can protect yourself, and your wealth.

There are legal strategies you can employ to shield your hard-earned savings from such a disaster, and we've put it all together in an exclusive report just for you.

PS: Don’t trust the fairy tales. Click this link to access your report now. <[link removed]> Protect what's rightfully yours.

View this email in your browser <[link removed]>

Blaze Sponsors

Below is a message from our sponsor, American Alternative Assets.

Newsletter

Bank of America, Wells Fargo, Chase Deposit Delays.

WARNING SIGNS. TAKE NOTICE.

Did you get this message recently? "Some deposits may be temporarily delayed." Customers of Bank of America, Chase, Wells Fargo sure did.

<[link removed]>

What about those customers of Citizen's Bank in Sac City?

They got notice the FDIC closed up their bank. The 5th bank this year!

But don't worry, the FDIC will insure your deposits up to $250,000.

What if I told you that this promise might be as fragile as a house of cards?

Please read this Wealth Protection Guide from American Alternative Assets. It could literally save you thousands of dollars .

Consider this: The total deposits in American banks amount to trillions. But the FDIC's insurance fund? It’s just over a hundred billion.

So, what happens if there's a large-scale bank failure?

What happens when the banks we trust collapse, and the FDIC can't cover the losses?

Your life savings could vanish... overnight.

Your retirement funds might be... reduced to nothing.

Your financial future possibily... in shambles.

The sobering reality is that the $250,000 FDIC insurance might be nothing more than a comforting lie.

But it's not all doom and gloom. You can protect yourself, and your wealth.

There are legal strategies you can employ to shield your hard-earned savings from such a disaster, and we've put it all together in an exclusive report just for you.

PS: Don’t trust the fairy tales. Click this link to access your report now. <[link removed]> Protect what's rightfully yours.

Message Analysis

- Sender: Blaze Media

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a