Email

Rising Titans: How Mega Cap Stocks are Shaping the Market (Weekly Cheat Sheet)

| From | Irving Wilkinson <[email protected]> |

| Subject | Rising Titans: How Mega Cap Stocks are Shaping the Market (Weekly Cheat Sheet) |

| Date | November 13, 2023 2:22 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Good morning,

Last week’s financial market showed a generally positive trend across various sectors. The Dow Jones Industrial Average (DJI) experienced a notable uplift, trading higher with a 1.15% increase, reaching 34,283.10. In the commodities market, gold prices also saw an upward movement, registering a 0.38% rise, with the price standing at $1,939.90. Similarly, Brent crude oil prices exhibited a positive trend, increasing by 0.28% to $81.66.

Table of Contents

Mega Cap Stocks: The Titans of the Market

S&P 500: A Display of Resilience

The Struggle of Smaller Indices

Sector Performance: Tech and Communication in the Lead

Influence of Market Rates and Federal Reserve

Daily Market Movements: A Closer Look

Concluding Thoughts

CALENDAR & MOVERS

Key Economic Event: Consumer Price Index Report

Earnings Calendar

Dividend Watch

COMMODITIES

ENERGY

GOLD AND PRECIOUS METALS

CRYPTOCURRENCY

MEGA CAP STOCKS: THE TITANS OF THE MARKET

The spotlight this week was firmly on the mega cap stocks. The Vanguard Mega Cap Growth ETF (MGK) saw an impressive jump of 3.4%, significantly outperforming the S&P 500’s gain of 1.3%. This disparity highlights the substantial influence these large companies have on the market.

S&P 500: A DISPLAY OF RESILIENCE

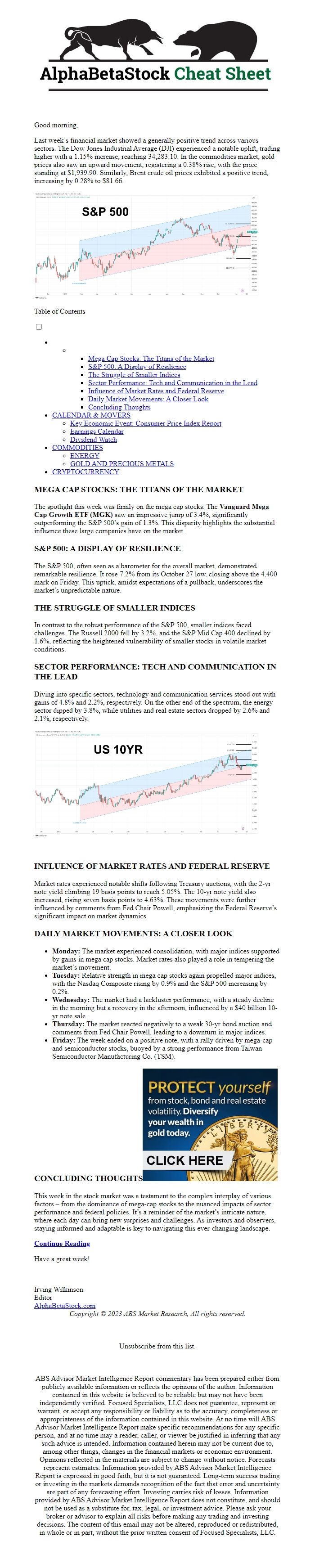

The S&P 500, often seen as a barometer for the overall market, demonstrated remarkable resilience. It rose 7.2% from its October 27 low, closing above the 4,400 mark on Friday. This uptick, amidst expectations of a pullback, underscores the market’s unpredictable nature.

THE STRUGGLE OF SMALLER INDICES

In contrast to the robust performance of the S&P 500, smaller indices faced challenges. The Russell 2000 fell by 3.2%, and the S&P Mid Cap 400 declined by 1.6%, reflecting the heightened vulnerability of smaller stocks in volatile market conditions.

SECTOR PERFORMANCE: TECH AND COMMUNICATION IN THE LEAD

Diving into specific sectors, technology and communication services stood out with gains of 4.8% and 2.2%, respectively. On the other end of the spectrum, the energy sector dipped by 3.8%, while utilities and real estate sectors dropped by 2.6% and 2.1%, respectively.

INFLUENCE OF MARKET RATES AND FEDERAL RESERVE

Market rates experienced notable shifts following Treasury auctions, with the 2-yr note yield climbing 19 basis points to reach 5.05%. The 10-yr note yield also increased, rising seven basis points to 4.63%. These movements were further influenced by comments from Fed Chair Powell, emphasizing the Federal Reserve’s significant impact on market dynamics.

DAILY MARKET MOVEMENTS: A CLOSER LOOK

Monday: The market experienced consolidation, with major indices supported by gains in mega cap stocks. Market rates also played a role in tempering the market’s movement.

Tuesday: Relative strength in mega cap stocks again propelled major indices, with the Nasdaq Composite rising by 0.9% and the S&P 500 increasing by 0.2%.

Wednesday: The market had a lackluster performance, with a steady decline in the morning but a recovery in the afternoon, influenced by a $40 billion 10-yr note sale.

Thursday: The market reacted negatively to a weak 30-yr bond auction and comments from Fed Chair Powell, leading to a downturn in major indices.

Friday: The week ended on a positive note, with a rally driven by mega-cap and semiconductor stocks, buoyed by a strong performance from Taiwan Semiconductor Manufacturing Co. (TSM).

CONCLUDING THOUGHTS

This week in the stock market was a testament to the complex interplay of various factors – from the dominance of mega-cap stocks to the nuanced impacts of sector performance and federal policies. It’s a reminder of the market’s intricate nature, where each day can bring new surprises and challenges. As investors and observers, staying informed and adaptable is key to navigating this ever-changing landscape.

Continue Reading

Have a great week!

Irving Wilkinson

Editor

AlphaBetaStock.com

Copyright © 2023 ABS Market Research, All rights reserved.

Unsubscribe from this list.

ABS Advisor Market Intelligence Report commentary has been prepared either from publicly available information or reflects the opinions of the author. Information contained in this website is believed to be reliable but may not have been independently verified. Focused Specialists, LLC does not guarantee, represent or warrant, or accept any responsibility or liability as to the accuracy, completeness or appropriateness of the information contained in this website. At no time will ABS Advisor Market Intelligence Report make specific recommendations for any specific person, and at no time may a reader, caller, or viewer be justified in inferring that any such advice is intended. Information contained herein may not be current due to, among other things, changes in the financial markets or economic environment. Opinions reflected in the materials are subject to change without notice. Forecasts represent estimates. Information provided by ABS Advisor Market Intelligence Report is expressed in good faith, but it is not guaranteed. Long-term success trading or investing in the markets demands recognition of the fact that error and uncertainty are part of any forecasting effort. Investing carries risk of losses. Information provided by ABS Advisor Market Intelligence Report does not constitute, and should not be used as a substitute for, tax, legal, or investment advice. Please ask your broker or advisor to explain all risks before making any trading and investing decisions. The content of this email may not be altered, reproduced or redistributed, in whole or in part, without the prior written consent of Focused Specialists, LLC.

Last week’s financial market showed a generally positive trend across various sectors. The Dow Jones Industrial Average (DJI) experienced a notable uplift, trading higher with a 1.15% increase, reaching 34,283.10. In the commodities market, gold prices also saw an upward movement, registering a 0.38% rise, with the price standing at $1,939.90. Similarly, Brent crude oil prices exhibited a positive trend, increasing by 0.28% to $81.66.

Table of Contents

Mega Cap Stocks: The Titans of the Market

S&P 500: A Display of Resilience

The Struggle of Smaller Indices

Sector Performance: Tech and Communication in the Lead

Influence of Market Rates and Federal Reserve

Daily Market Movements: A Closer Look

Concluding Thoughts

CALENDAR & MOVERS

Key Economic Event: Consumer Price Index Report

Earnings Calendar

Dividend Watch

COMMODITIES

ENERGY

GOLD AND PRECIOUS METALS

CRYPTOCURRENCY

MEGA CAP STOCKS: THE TITANS OF THE MARKET

The spotlight this week was firmly on the mega cap stocks. The Vanguard Mega Cap Growth ETF (MGK) saw an impressive jump of 3.4%, significantly outperforming the S&P 500’s gain of 1.3%. This disparity highlights the substantial influence these large companies have on the market.

S&P 500: A DISPLAY OF RESILIENCE

The S&P 500, often seen as a barometer for the overall market, demonstrated remarkable resilience. It rose 7.2% from its October 27 low, closing above the 4,400 mark on Friday. This uptick, amidst expectations of a pullback, underscores the market’s unpredictable nature.

THE STRUGGLE OF SMALLER INDICES

In contrast to the robust performance of the S&P 500, smaller indices faced challenges. The Russell 2000 fell by 3.2%, and the S&P Mid Cap 400 declined by 1.6%, reflecting the heightened vulnerability of smaller stocks in volatile market conditions.

SECTOR PERFORMANCE: TECH AND COMMUNICATION IN THE LEAD

Diving into specific sectors, technology and communication services stood out with gains of 4.8% and 2.2%, respectively. On the other end of the spectrum, the energy sector dipped by 3.8%, while utilities and real estate sectors dropped by 2.6% and 2.1%, respectively.

INFLUENCE OF MARKET RATES AND FEDERAL RESERVE

Market rates experienced notable shifts following Treasury auctions, with the 2-yr note yield climbing 19 basis points to reach 5.05%. The 10-yr note yield also increased, rising seven basis points to 4.63%. These movements were further influenced by comments from Fed Chair Powell, emphasizing the Federal Reserve’s significant impact on market dynamics.

DAILY MARKET MOVEMENTS: A CLOSER LOOK

Monday: The market experienced consolidation, with major indices supported by gains in mega cap stocks. Market rates also played a role in tempering the market’s movement.

Tuesday: Relative strength in mega cap stocks again propelled major indices, with the Nasdaq Composite rising by 0.9% and the S&P 500 increasing by 0.2%.

Wednesday: The market had a lackluster performance, with a steady decline in the morning but a recovery in the afternoon, influenced by a $40 billion 10-yr note sale.

Thursday: The market reacted negatively to a weak 30-yr bond auction and comments from Fed Chair Powell, leading to a downturn in major indices.

Friday: The week ended on a positive note, with a rally driven by mega-cap and semiconductor stocks, buoyed by a strong performance from Taiwan Semiconductor Manufacturing Co. (TSM).

CONCLUDING THOUGHTS

This week in the stock market was a testament to the complex interplay of various factors – from the dominance of mega-cap stocks to the nuanced impacts of sector performance and federal policies. It’s a reminder of the market’s intricate nature, where each day can bring new surprises and challenges. As investors and observers, staying informed and adaptable is key to navigating this ever-changing landscape.

Continue Reading

Have a great week!

Irving Wilkinson

Editor

AlphaBetaStock.com

Copyright © 2023 ABS Market Research, All rights reserved.

Unsubscribe from this list.

ABS Advisor Market Intelligence Report commentary has been prepared either from publicly available information or reflects the opinions of the author. Information contained in this website is believed to be reliable but may not have been independently verified. Focused Specialists, LLC does not guarantee, represent or warrant, or accept any responsibility or liability as to the accuracy, completeness or appropriateness of the information contained in this website. At no time will ABS Advisor Market Intelligence Report make specific recommendations for any specific person, and at no time may a reader, caller, or viewer be justified in inferring that any such advice is intended. Information contained herein may not be current due to, among other things, changes in the financial markets or economic environment. Opinions reflected in the materials are subject to change without notice. Forecasts represent estimates. Information provided by ABS Advisor Market Intelligence Report is expressed in good faith, but it is not guaranteed. Long-term success trading or investing in the markets demands recognition of the fact that error and uncertainty are part of any forecasting effort. Investing carries risk of losses. Information provided by ABS Advisor Market Intelligence Report does not constitute, and should not be used as a substitute for, tax, legal, or investment advice. Please ask your broker or advisor to explain all risks before making any trading and investing decisions. The content of this email may not be altered, reproduced or redistributed, in whole or in part, without the prior written consent of Focused Specialists, LLC.

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a