Email

Governor Lamont, Treasurer Russell, President Maric Announce UConn 2000 Bonds Receive Credit Rating Upgrade From Fitch

| From | Governor Lamont's Office <[email protected]> |

| Subject | Governor Lamont, Treasurer Russell, President Maric Announce UConn 2000 Bonds Receive Credit Rating Upgrade From Fitch |

| Date | October 26, 2023 3:19 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed]

Governor Lamont, Treasurer Russell, President Maric Announce UConn 2000 Bonds Receive Credit Rating Upgrade From Fitch [[link removed]]

Posted on October 26, 2023

(HARTFORD, CT) – Governor Ned Lamont, Treasurer Erick Russell, and University of Connecticut President Radenka Maric today announced that Fitch Ratings has upgraded [[link removed]] the credit rating for the State of Connecticut’s UConn General Obligation (GO) bonds, part of the UConn 2000 program, from “A+” to “AA-.”

In its announcement, Fitch cited the success and impact of recent budgetary reforms and the state’s commitment to higher education, saying in part: “Strong legal protections [on the bonds] are buttressed by the constitutional state priority of higher education and the expectation of continued strong support of the UConn system.” Fitch demonstrated confidence in both UConn and the state’s capacity to fulfill their debt service obligations in the future, deeming the UConn GO Bonds and Connecticut’s GO Bonds as “substantially similar.” Consequently, Fitch has assigned identical ratings of “AA-“ to both programs, indicating a high level of creditworthiness and stability.

“This credit rating increase is proof that the state’s fiscal guardrails, including spending cap, bond covenants, and a focus on paying down our long-term liabilities, is saving taxpayer dollars,” Governor Lamont said. “This is the third credit rating upgrade this year Connecticut has experienced, and it is a recognition by investors that we are on the right financial path. Strategic investments in the state’s flagship university benefit our business community to ensure they have a top-flight workforce, building a brighter future for all of Connecticut.”

“The UConn 2000 bond program has been transformative for our state’s flagship university, earning UConn a place among the elite public universities and generating economic opportunity across Connecticut,” Treasurer Russell said. “This credit upgrade will allow similar investments to continue, while lowering costs for taxpayers. It’s in our collective best interest to support UConn’s continued success and to maintain state government’s commitment to sustained fiscal discipline. This is a great example of how that work can overlap, benefitting our long-term economic health while making necessary investments in our state.”

“UConn is pleased with Fitch’s recognition of the strong partnership between UConn and the state, embodied in the UConn 2000 program,” President Maric said. “The state has provided unwavering commitment to the UConn 2000 program for over 27 years and counting, helping to push demand higher than ever for a UConn education. This Fitch upgrade will reduce UConn 2000 borrowing costs and support continued investment in UConn and the State’s economy.”

In early November, the Treasurer’s Office and UConn will offer approximately $227 million of bonds to fund new projects within the university system, including regional and satellite campuses. An additional $130 million of existing bonds are expected to be refunded at lower interest rates to generate savings.

This is the third credit rating upgrade Connecticut has received so far this year. Kroll Bond Rating Agency upgraded Connecticut’s General Obligation bonds in May [[link removed]] and its transportation bonds earlier this month [[link removed]]. All four of the state’s major bonding programs are now rated “AA” level or higher.

Since March 2021, Connecticut’s General Obligation, Special Tax Obligation (Transportation Purposes), and UConn General Obligation bonds have all received upgrades from the four main rating agencies, Moody’s, S&P, Fitch, and Kroll — several more than once.

For more information on the State of Connecticut’s bonding programs, visit buyCTbonds.com [[link removed]].

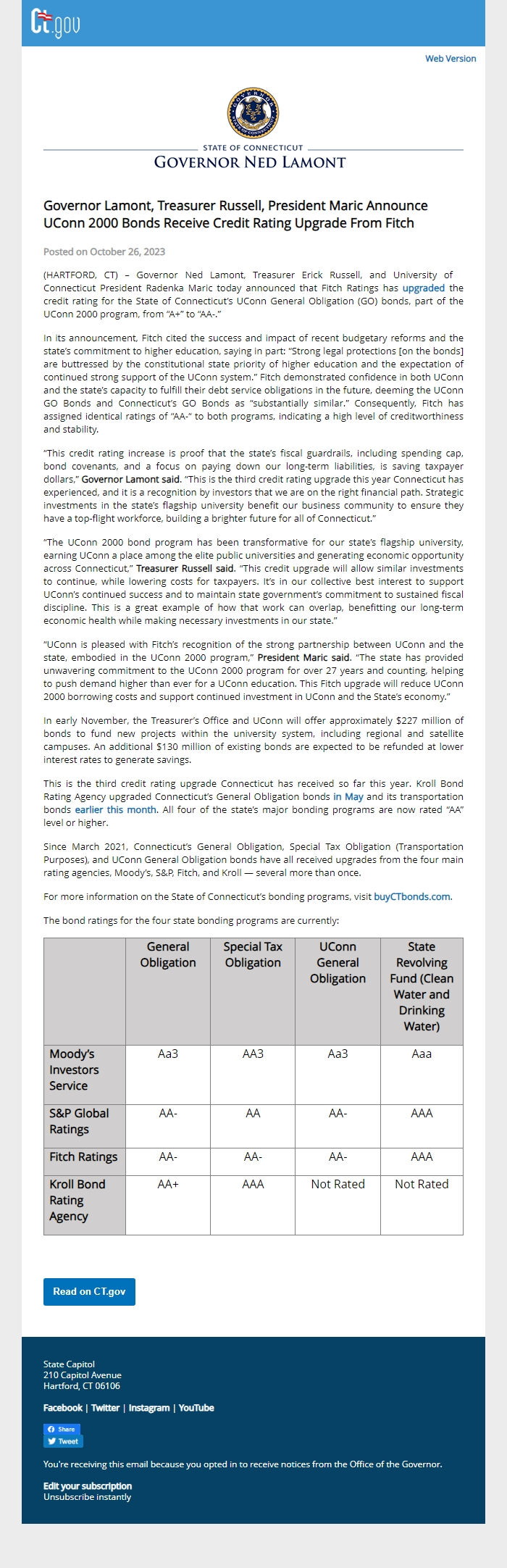

The bond ratings for the four state bonding programs are currently:

General Obligation

Special Tax Obligation

UConn General Obligation

State Revolving Fund (Clean Water and Drinking Water)

Moody’s Investors Service

Aa3

AA3

Aa3

Aaa

S&P Global Ratings

AA-

AA

AA-

AAA

Fitch Ratings

AA-

AA-

AA-

AAA

Kroll Bond Rating Agency

AA+

AAA

Not Rated

Not Rated

Read on CT.gov [[link removed]]

State Capitol

210 Capitol Avenue

Hartford, CT 06106

Facebook [[link removed]] | Twitter [[link removed]] | Instagram [[link removed]] | YouTube [[link removed]]

[link removed] [link removed]

You're receiving this email because you opted in to receive notices from the Office of the Governor.

Edit your subscription [link removed]

Unsubscribe instantly [link removed]

Governor Lamont, Treasurer Russell, President Maric Announce UConn 2000 Bonds Receive Credit Rating Upgrade From Fitch [[link removed]]

Posted on October 26, 2023

(HARTFORD, CT) – Governor Ned Lamont, Treasurer Erick Russell, and University of Connecticut President Radenka Maric today announced that Fitch Ratings has upgraded [[link removed]] the credit rating for the State of Connecticut’s UConn General Obligation (GO) bonds, part of the UConn 2000 program, from “A+” to “AA-.”

In its announcement, Fitch cited the success and impact of recent budgetary reforms and the state’s commitment to higher education, saying in part: “Strong legal protections [on the bonds] are buttressed by the constitutional state priority of higher education and the expectation of continued strong support of the UConn system.” Fitch demonstrated confidence in both UConn and the state’s capacity to fulfill their debt service obligations in the future, deeming the UConn GO Bonds and Connecticut’s GO Bonds as “substantially similar.” Consequently, Fitch has assigned identical ratings of “AA-“ to both programs, indicating a high level of creditworthiness and stability.

“This credit rating increase is proof that the state’s fiscal guardrails, including spending cap, bond covenants, and a focus on paying down our long-term liabilities, is saving taxpayer dollars,” Governor Lamont said. “This is the third credit rating upgrade this year Connecticut has experienced, and it is a recognition by investors that we are on the right financial path. Strategic investments in the state’s flagship university benefit our business community to ensure they have a top-flight workforce, building a brighter future for all of Connecticut.”

“The UConn 2000 bond program has been transformative for our state’s flagship university, earning UConn a place among the elite public universities and generating economic opportunity across Connecticut,” Treasurer Russell said. “This credit upgrade will allow similar investments to continue, while lowering costs for taxpayers. It’s in our collective best interest to support UConn’s continued success and to maintain state government’s commitment to sustained fiscal discipline. This is a great example of how that work can overlap, benefitting our long-term economic health while making necessary investments in our state.”

“UConn is pleased with Fitch’s recognition of the strong partnership between UConn and the state, embodied in the UConn 2000 program,” President Maric said. “The state has provided unwavering commitment to the UConn 2000 program for over 27 years and counting, helping to push demand higher than ever for a UConn education. This Fitch upgrade will reduce UConn 2000 borrowing costs and support continued investment in UConn and the State’s economy.”

In early November, the Treasurer’s Office and UConn will offer approximately $227 million of bonds to fund new projects within the university system, including regional and satellite campuses. An additional $130 million of existing bonds are expected to be refunded at lower interest rates to generate savings.

This is the third credit rating upgrade Connecticut has received so far this year. Kroll Bond Rating Agency upgraded Connecticut’s General Obligation bonds in May [[link removed]] and its transportation bonds earlier this month [[link removed]]. All four of the state’s major bonding programs are now rated “AA” level or higher.

Since March 2021, Connecticut’s General Obligation, Special Tax Obligation (Transportation Purposes), and UConn General Obligation bonds have all received upgrades from the four main rating agencies, Moody’s, S&P, Fitch, and Kroll — several more than once.

For more information on the State of Connecticut’s bonding programs, visit buyCTbonds.com [[link removed]].

The bond ratings for the four state bonding programs are currently:

General Obligation

Special Tax Obligation

UConn General Obligation

State Revolving Fund (Clean Water and Drinking Water)

Moody’s Investors Service

Aa3

AA3

Aa3

Aaa

S&P Global Ratings

AA-

AA

AA-

AAA

Fitch Ratings

AA-

AA-

AA-

AAA

Kroll Bond Rating Agency

AA+

AAA

Not Rated

Not Rated

Read on CT.gov [[link removed]]

State Capitol

210 Capitol Avenue

Hartford, CT 06106

Facebook [[link removed]] | Twitter [[link removed]] | Instagram [[link removed]] | YouTube [[link removed]]

[link removed] [link removed]

You're receiving this email because you opted in to receive notices from the Office of the Governor.

Edit your subscription [link removed]

Unsubscribe instantly [link removed]

Message Analysis

- Sender: Ned Lamont

- Political Party: Democratic

- Country: United States

- State/Locality: Connecticut

- Office: State Governor

-

Email Providers:

- Campaign Monitor