Email

Duke Energy doubles down on gas in updated NC Carbon Plan, despite unreliability during Winter Storm Elliott

| From | Energy and Policy Institute <[email protected]> |

| Subject | Duke Energy doubles down on gas in updated NC Carbon Plan, despite unreliability during Winter Storm Elliott |

| Date | October 25, 2023 12:06 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

** Duke Energy doubles down on gas in updated NC Carbon Plan, despite unreliability during Winter Storm Elliott ([link removed])

------------------------------------------------------------

By Shelby Green on Oct 24, 2023 09:00 am

Duke Energy plans to deepen its reliance on methane gas, the volatile fuel responsible for consumers’ skyrocketing bills ([link removed]) , according to the utility’s mid-August proposal ([link removed]) to comply with North Carolina’s new carbon reduction law. By 2035, Duke plans ([link removed]) to build more than 6,000 MW of new methane gas, also known as natural gas, despite the company’s claim ([link removed]) that it will reach net zero emissions by 2050.

Duke says in its filings that ([link removed]) rapid electrification, population growth, and a higher reserve margin are forcing the utility to procure more power, a large portion of which the utility wants to meet with new gas. Methane gas emits carbon dioxide when burned and is a contributor to climate change ([link removed]) .

Duke’s need for a higher reserve margin stems at least in part from rolling blackouts the utility’s customers suffered in December 2022 when many of its coal and gas plants failed and were unable to generate power ([link removed]) . Imports from neighboring electricity markets like PJM kept power flowing ([link removed]) , preventing more catastrophic failures on Duke Energy’s grid. Despite that, Duke is proposing further gas investments, which will drive profits for the company, while actively opposing ([link removed]) any effort to create, or even study, an electricity market in the Carolinas.

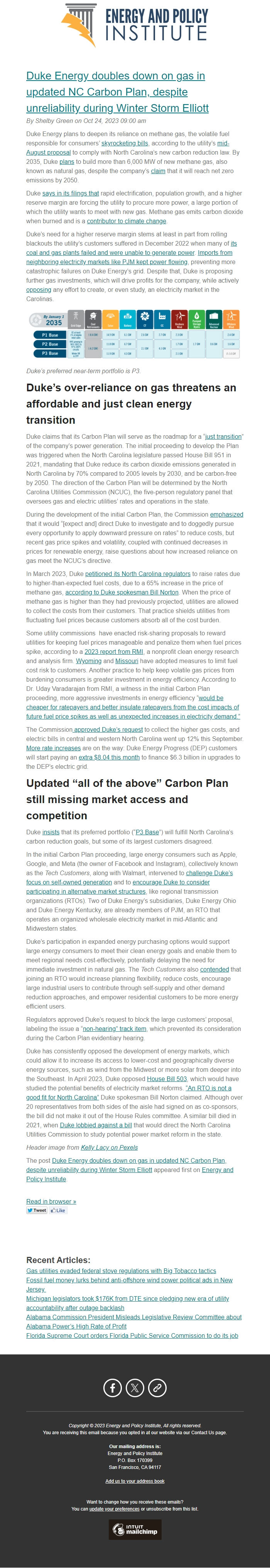

[link removed]

Duke’s preferred near-term portfolio is P3.

** Duke’s over-reliance on gas threatens an affordable and just clean energy transition

------------------------------------------------------------

Duke claims that its Carbon Plan will serve as the roadmap for a “just transition ([link removed]) ” of the company’s power generation. The initial proceeding to develop the Plan was triggered when the North Carolina legislature passed House Bill 951 in 2021, mandating that Duke reduce its carbon dioxide emissions generated in North Carolina by 70% compared to 2005 levels by 2030, and be carbon-free by 2050. The direction of the Carbon Plan will be determined by the North Carolina Utilities Commission (NCUC), the five-person regulatory panel that oversees gas and electric utilities’ rates and operations in the state.

During the development of the initial Carbon Plan, the Commission emphasized ([link removed]) that it would “[expect and] direct Duke to investigate and to doggedly pursue every opportunity to apply downward pressure on rates” to reduce costs, but recent gas price spikes and volatility, coupled with continued decreases in prices for renewable energy, raise questions about how increased reliance on gas meet the NCUC’s directive.

In March 2023, Duke petitioned its North Carolina regulators ([link removed]) to raise rates due to higher-than-expected fuel costs, due to a 65% increase in the price of methane gas, according to Duke spokesman Bill Norton ([link removed]) . When the price of methane gas is higher than they had previously projected, utilities are allowed to collect the costs from their customers. That practice shields utilities from fluctuating fuel prices because customers absorb all of the cost burden.

Some utility commissions have enacted risk-sharing proposals to reward utilities for keeping fuel prices manageable and penalize them when fuel prices spike, according to a 2023 report from RMI ([link removed]) , a nonprofit clean energy research and analysis firm. Wyoming ([link removed]) and Missouri ([link removed]) have adopted measures to limit fuel cost risk to customers. Another practice to help keep volatile gas prices from burdening consumers is greater investment in energy efficiency. According to Dr. Uday Varadarajan from RMI, a witness in the initial Carbon Plan proceeding, more aggressive investments in energy efficiency “would be cheaper for ratepayers and better insulate ratepayers from the cost

impacts of future fuel price spikes as well as unexpected increases in electricity demand.” ([link removed])

The Commissionapproved Duke’s request ([link removed]) to collect the higher gas costs, and electric bills in central and western North Carolina went up 12% this September. More rate increases ([link removed]) are on the way: Duke Energy Progress (DEP) customers will start paying an extra $8.04 this month ([link removed]) to finance $6.3 billion in upgrades to the DEP’s electric grid.

** Updated “all of the above” Carbon Plan still missing market access and competition

------------------------------------------------------------

Duke insists ([link removed]) that its preferred portfolio (“P3 Base ([link removed]) ”) will fulfill North Carolina’s carbon reduction goals, but some of its largest customers disagreed.

In the initial Carbon Plan proceeding, large energy consumers such as Apple, Google, and Meta (the owner of Facebook and Instagram), collectively known as the Tech Customers, along with Walmart, intervened to challenge Duke’s focus on self-owned generation ([link removed]) and to encourage Duke to consider participating in alternative market structures ([link removed]) , like regional transmission organizations (RTOs). Two of Duke Energy’s subsidiaries, Duke Energy Ohio and Duke Energy Kentucky, are already members of PJM, an RTO that operates an organized wholesale electricity market in mid-Atlantic and Midwestern states.

Duke’s participation in expanded energy purchasing options would support large energy consumers to meet their clean energy goals and enable them to meet regional needs cost-effectively, potentially delaying the need for immediate investment in natural gas. The Tech Customers also contended ([link removed]) that joining an RTO would increase planning flexibility, reduce costs, encourage large industrial users to contribute through self-supply and other demand reduction approaches, and empower residential customers to be more energy efficient users.

Regulators approved Duke’s request to block the large customers’ proposal, labeling the issue a “non-hearing” track item ([link removed]) , which prevented its consideration during the Carbon Plan evidentiary hearing.

Duke has consistently opposed the development of energy markets, which could allow it to increase its access to lower-cost and geographically diverse energy sources, such as wind from the Midwest or more solar from deeper into the Southeast. In April 2023, Duke opposed House Bill 503 ([link removed]) , which would have studied the potential benefits of electricity market reforms. “An RTO is not a good fit for North Carolina” ([link removed]) Duke spokesman Bill Norton claimed. Although over 20 representatives from both sides of the aisle had signed on as co-sponsors, the bill did not make it out of the House Rules committee. A similar bill died in 2021, when Duke lobbied against a bill ([link removed])

that would direct the North Carolina Utilities Commission to study potential power market reform in the state.

Header image from Kelly Lacy on Pexels ([link removed])

The post Duke Energy doubles down on gas in updated NC Carbon Plan, despite unreliability during Winter Storm Elliott ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** Gas utilities evaded federal stove regulations with Big Tobacco tactics ([link removed])

** Fossil fuel money lurks behind anti-offshore wind power political ads in New Jersey ([link removed])

** Michigan legislators took $176K from DTE since pledging new era of utility accountability after outage backlash ([link removed])

** Alabama Commission President Misleads Legislative Review Committee about Alabama Power’s High Rate of Profit ([link removed])

** Florida Supreme Court orders Florida Public Service Commission to do its job ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2023 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

------------------------------------------------------------

By Shelby Green on Oct 24, 2023 09:00 am

Duke Energy plans to deepen its reliance on methane gas, the volatile fuel responsible for consumers’ skyrocketing bills ([link removed]) , according to the utility’s mid-August proposal ([link removed]) to comply with North Carolina’s new carbon reduction law. By 2035, Duke plans ([link removed]) to build more than 6,000 MW of new methane gas, also known as natural gas, despite the company’s claim ([link removed]) that it will reach net zero emissions by 2050.

Duke says in its filings that ([link removed]) rapid electrification, population growth, and a higher reserve margin are forcing the utility to procure more power, a large portion of which the utility wants to meet with new gas. Methane gas emits carbon dioxide when burned and is a contributor to climate change ([link removed]) .

Duke’s need for a higher reserve margin stems at least in part from rolling blackouts the utility’s customers suffered in December 2022 when many of its coal and gas plants failed and were unable to generate power ([link removed]) . Imports from neighboring electricity markets like PJM kept power flowing ([link removed]) , preventing more catastrophic failures on Duke Energy’s grid. Despite that, Duke is proposing further gas investments, which will drive profits for the company, while actively opposing ([link removed]) any effort to create, or even study, an electricity market in the Carolinas.

[link removed]

Duke’s preferred near-term portfolio is P3.

** Duke’s over-reliance on gas threatens an affordable and just clean energy transition

------------------------------------------------------------

Duke claims that its Carbon Plan will serve as the roadmap for a “just transition ([link removed]) ” of the company’s power generation. The initial proceeding to develop the Plan was triggered when the North Carolina legislature passed House Bill 951 in 2021, mandating that Duke reduce its carbon dioxide emissions generated in North Carolina by 70% compared to 2005 levels by 2030, and be carbon-free by 2050. The direction of the Carbon Plan will be determined by the North Carolina Utilities Commission (NCUC), the five-person regulatory panel that oversees gas and electric utilities’ rates and operations in the state.

During the development of the initial Carbon Plan, the Commission emphasized ([link removed]) that it would “[expect and] direct Duke to investigate and to doggedly pursue every opportunity to apply downward pressure on rates” to reduce costs, but recent gas price spikes and volatility, coupled with continued decreases in prices for renewable energy, raise questions about how increased reliance on gas meet the NCUC’s directive.

In March 2023, Duke petitioned its North Carolina regulators ([link removed]) to raise rates due to higher-than-expected fuel costs, due to a 65% increase in the price of methane gas, according to Duke spokesman Bill Norton ([link removed]) . When the price of methane gas is higher than they had previously projected, utilities are allowed to collect the costs from their customers. That practice shields utilities from fluctuating fuel prices because customers absorb all of the cost burden.

Some utility commissions have enacted risk-sharing proposals to reward utilities for keeping fuel prices manageable and penalize them when fuel prices spike, according to a 2023 report from RMI ([link removed]) , a nonprofit clean energy research and analysis firm. Wyoming ([link removed]) and Missouri ([link removed]) have adopted measures to limit fuel cost risk to customers. Another practice to help keep volatile gas prices from burdening consumers is greater investment in energy efficiency. According to Dr. Uday Varadarajan from RMI, a witness in the initial Carbon Plan proceeding, more aggressive investments in energy efficiency “would be cheaper for ratepayers and better insulate ratepayers from the cost

impacts of future fuel price spikes as well as unexpected increases in electricity demand.” ([link removed])

The Commissionapproved Duke’s request ([link removed]) to collect the higher gas costs, and electric bills in central and western North Carolina went up 12% this September. More rate increases ([link removed]) are on the way: Duke Energy Progress (DEP) customers will start paying an extra $8.04 this month ([link removed]) to finance $6.3 billion in upgrades to the DEP’s electric grid.

** Updated “all of the above” Carbon Plan still missing market access and competition

------------------------------------------------------------

Duke insists ([link removed]) that its preferred portfolio (“P3 Base ([link removed]) ”) will fulfill North Carolina’s carbon reduction goals, but some of its largest customers disagreed.

In the initial Carbon Plan proceeding, large energy consumers such as Apple, Google, and Meta (the owner of Facebook and Instagram), collectively known as the Tech Customers, along with Walmart, intervened to challenge Duke’s focus on self-owned generation ([link removed]) and to encourage Duke to consider participating in alternative market structures ([link removed]) , like regional transmission organizations (RTOs). Two of Duke Energy’s subsidiaries, Duke Energy Ohio and Duke Energy Kentucky, are already members of PJM, an RTO that operates an organized wholesale electricity market in mid-Atlantic and Midwestern states.

Duke’s participation in expanded energy purchasing options would support large energy consumers to meet their clean energy goals and enable them to meet regional needs cost-effectively, potentially delaying the need for immediate investment in natural gas. The Tech Customers also contended ([link removed]) that joining an RTO would increase planning flexibility, reduce costs, encourage large industrial users to contribute through self-supply and other demand reduction approaches, and empower residential customers to be more energy efficient users.

Regulators approved Duke’s request to block the large customers’ proposal, labeling the issue a “non-hearing” track item ([link removed]) , which prevented its consideration during the Carbon Plan evidentiary hearing.

Duke has consistently opposed the development of energy markets, which could allow it to increase its access to lower-cost and geographically diverse energy sources, such as wind from the Midwest or more solar from deeper into the Southeast. In April 2023, Duke opposed House Bill 503 ([link removed]) , which would have studied the potential benefits of electricity market reforms. “An RTO is not a good fit for North Carolina” ([link removed]) Duke spokesman Bill Norton claimed. Although over 20 representatives from both sides of the aisle had signed on as co-sponsors, the bill did not make it out of the House Rules committee. A similar bill died in 2021, when Duke lobbied against a bill ([link removed])

that would direct the North Carolina Utilities Commission to study potential power market reform in the state.

Header image from Kelly Lacy on Pexels ([link removed])

The post Duke Energy doubles down on gas in updated NC Carbon Plan, despite unreliability during Winter Storm Elliott ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** Gas utilities evaded federal stove regulations with Big Tobacco tactics ([link removed])

** Fossil fuel money lurks behind anti-offshore wind power political ads in New Jersey ([link removed])

** Michigan legislators took $176K from DTE since pledging new era of utility accountability after outage backlash ([link removed])

** Alabama Commission President Misleads Legislative Review Committee about Alabama Power’s High Rate of Profit ([link removed])

** Florida Supreme Court orders Florida Public Service Commission to do its job ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2023 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Message Analysis

- Sender: Energy and Policy Institute

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp