Email

[Treasurer of the State of Iowa] State Treasurer of Iowa News 2020 First Quarter Newsletter

| From | Treasurer of the State of Iowa <[email protected]> |

| Subject | [Treasurer of the State of Iowa] State Treasurer of Iowa News 2020 First Quarter Newsletter |

| Date | March 3, 2020 7:33 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

State Treasurer of Iowa News 2020 First Quarter Newsletter

Looking Forward with 2020 Vision

As 2020 kicks off the start of a new decade, I have big expectations on what I want to achieve and look forward to what lies ahead. However, before we can talk about the future, it’s essential to reflect on our prior successes in the treasurer’s office.

In May, I announced Iowa’s AAA credit rating was affirmed and a portion of Iowa’s IJOBS bonds had been refinanced. The new borrowing rate came in at 2.64%, nearly 2% less than the original bonds issued in 2009. In the first year, the state will save over $3 million and a total of $113.5 million over 15 years. Talk about big savings!

Invest in Iowa’s online auction continues to be a popular event for financial institutions across the state. In October we had the highest number of bids since October 2018. We currently have over $285 million invested through this program and over the past seventeen years the program has earned over $43 million in interest. Visit our website for more information on the Invest in Iowa program.

Iowa had a record fiscal year with earnings of over $56 million in its investment pool, the largest amount in over a decade. The money earned each year funds state programs and reduces the need to collect money from other sources. That’s $56 million saved!

Last year marked the 36 anniversary of the Great Iowa Treasure Hunt. Since I created the program in 1983, we’ve returned over $277 million of unclaimed property to their rightful owners. That’s enough money to buy more than 2.5 million tickets to Disney World!

College Savings Iowa is right there alongside the Great Iowa Treasure Hunt with astounding statistics of its own. Since its inception in 1998, College Savings Iowa account owners have used over $3 billion for qualified educational expenses. With that amount of savings, over 321,000 students could pay for one year of tuition at Iowa State University without having to take out a loan.

It’s only been three short years since IAble’s launch in 2017, but the plan has already grown to over 670 accounts with more than $4.6 million in assets. It’s difficult for us to think about a time where individuals with disabilities were not given opportunities to save without the possibility of losing eligibility for federal benefits like Medicaid or Supplemental Security Income (SSI). I am optimistic that we will continue to overcome the concept that individuals with disabilities are limited on what they can achieve.

Looking towards the next decade, I am expecting to see continued financial stability, high amounts of investment income, more treasures returned, and large growth in our 529 and IAble plans. Keep up to date with us into the next decade by following our Facebook and Twitter pages.

A New Outlook on Iowa’s Debt

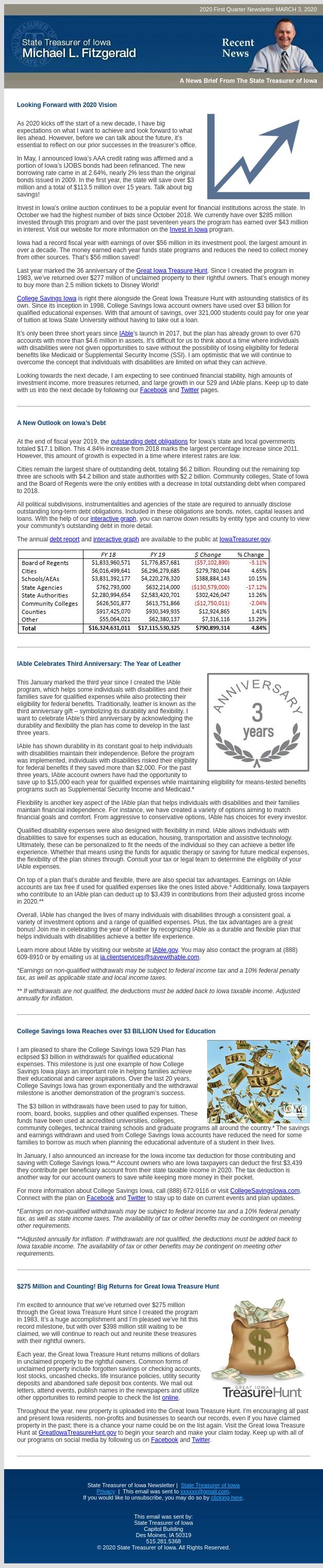

At the end of fiscal year 2019, the outstanding debt obligations for Iowa’s state and local governments totaled $17.1 billion. This 4.84% increase from 2018 marks the largest percentage increase since 2011. However, this amount of growth is expected in a time where interest rates are low.

Cities remain the largest share of outstanding debt, totaling $6.2 billion. Rounding out the remaining top three are schools with $4.2 billion and state authorities with $2.2 billion. Community colleges, State of Iowa and the Board of Regents were the only entities with a decrease in total outstanding debt when compared to 2018.

All political subdivisions, instrumentalities and agencies of the state are required to annually disclose outstanding long-term debt obligations. Included in these obligations are bonds, notes, capital leases and loans. With the help of our interactive graph, you can narrow down results by entity type and county to view your community’s outstanding debt in more detail.

The annual debt report and interactive graph are available to the public at IowaTreasurer.gov.

IAble Celebrates Third Anniversary: The Year of Leather

This January marked the third year since I created the IAble program, which helps some individuals with disabilities and their families save for qualified expenses while also protecting their eligibility for federal benefits. Traditionally, leather is known as the third anniversary gift – symbolizing its durability and flexibility. I want to celebrate IAble’s third anniversary by acknowledging the durability and flexibility the plan has come to develop in the last three years.

IAble has shown durability in its constant goal to help individuals with disabilities maintain their independence. Before the program was implemented, individuals with disabilities risked their eligibility for federal benefits if they saved more than $2,000. For the past three years, IAble account owners have had the opportunity to save up to $15,000 each year for qualified expenses while maintaining eligibility for means-tested benefits programs such as Supplemental Security Income and Medicaid.*

Flexibility is another key aspect of the IAble plan that helps individuals with disabilities and their families maintain financial independence. For instance, we have created a variety of options aiming to match financial goals and comfort. From aggressive to conservative options, IAble has choices for every investor.

Qualified disability expenses were also designed with flexibility in mind. IAble allows individuals with disabilities to save for expenses such as education, housing, transportation and assistive technology. Ultimately, these can be personalized to fit the needs of the individual so they can achieve a better life experience. Whether that means using the funds for aquatic therapy or saving for future medical expenses, the flexibility of the plan shines through. Consult your tax or legal team to determine the eligibility of your IAble expenses.

On top of a plan that’s durable and flexible, there are also special tax advantages. Earnings on IAble accounts are tax free if used for qualified expenses like the ones listed above.* Additionally, Iowa taxpayers who contribute to an IAble plan can deduct up to $3,439 in contributions from their adjusted gross income in 2020.**

Overall, IAble has changed the lives of many individuals with disabilities through a consistent goal, a variety of investment options and a range of qualified expenses. Plus, the tax advantages are a great bonus! Join me in celebrating the year of leather by recognizing IAble as a durable and flexible plan that helps individuals with disabilities achieve a better life experience.

Learn more about IAble by visiting our website at IAble.gov. You may also contact the program at (888) 609-8910 or by emailing us at [email protected].

*Earnings on non-qualified withdrawals may be subject to federal income tax and a 10% federal penalty tax, as well as applicable state and local income taxes.

** If withdrawals are not qualified, the deductions must be added back to Iowa taxable income. Adjusted annually for inflation.

College Savings Iowa Reaches over $3 BILLION Used for Education

I am pleased to share the College Savings Iowa 529 Plan has eclipsed $3 billion in withdrawals for qualified educational expenses. This milestone is just one example of how College Savings Iowa plays an important role in helping families achieve their educational and career aspirations. Over the last 20 years, College Savings Iowa has grown exponentially and the withdrawal milestone is another demonstration of the program’s success.

The $3 billion in withdrawals have been used to pay for tuition, room, board, books, supplies and other qualified expenses. These funds have been used at accredited universities, colleges, community colleges, technical training schools and graduate programs all around the country.* The savings and earnings withdrawn and used from College Savings Iowa accounts have reduced the need for some families to borrow as much when planning the educational adventure of a student in their lives.

In January, I also announced an increase for the Iowa income tax deduction for those contributing and saving with College Savings Iowa.** Account owners who are Iowa taxpayers can deduct the first $3,439 they contribute per beneficiary account from their state taxable income in 2020. The tax deduction is another way for our account owners to save while keeping more money in their pocket.

For more information about College Savings Iowa, call (888) 672-9116 or visit CollegeSavingsIowa.com. Connect with the plan on Facebook and Twitter to stay up to date on current events and plan updates.

*Earnings on non-qualified withdrawals may be subject to federal income tax and a 10% federal penalty tax, as well as state income taxes. The availability of tax or other benefits may be contingent on meeting other requirements.

**Adjusted annually for inflation. If withdrawals are not qualified, the deductions must be added back to Iowa taxable income. The availability of tax or other benefits may be contingent on meeting other requirements.

$275 Million and Counting! Big Returns for Great Iowa Treasure Hunt

I’m excited to announce that we’ve returned over $275 million through the Great Iowa Treasure Hunt since I created the program in 1983. It’s a huge accomplishment and I’m pleased we’ve hit this record milestone, but with over $398 million still waiting to be claimed, we will continue to reach out and reunite these treasures with their rightful owners.

Each year, the Great Iowa Treasure Hunt returns millions of dollars in unclaimed property to the rightful owners. Common forms of unclaimed property include forgotten savings or checking accounts, lost stocks, uncashed checks, life insurance policies, utility security deposits and abandoned safe deposit box contents. We mail out letters, attend events, publish names in the newspapers and utilize other opportunities to remind people to check the list online.

Throughout the year, new property is uploaded into the Great Iowa Treasure Hunt. I’m encouraging all past and present Iowa residents, non-profits and businesses to search our records, even if you have claimed property in the past; there is a chance your name could be on the list again. Visit the Great Iowa Treasure Hunt at GreatIowaTreasureHunt.gov to begin your search and make your claim today. Keep up with all of our programs on social media by following us on Facebook and Twitter.

You are receiving this email because [email protected] is signed up to receive Treasurer of the State of Iowa communications.

If you wish to unsubscribe from future Treasurer of the State of Iowa emails, you can always unsubscribe at

[link removed].

Please don't reply to this email.

Copyright 2020 Treasurer of the State of Iowa. All rights reserved.

Looking Forward with 2020 Vision

As 2020 kicks off the start of a new decade, I have big expectations on what I want to achieve and look forward to what lies ahead. However, before we can talk about the future, it’s essential to reflect on our prior successes in the treasurer’s office.

In May, I announced Iowa’s AAA credit rating was affirmed and a portion of Iowa’s IJOBS bonds had been refinanced. The new borrowing rate came in at 2.64%, nearly 2% less than the original bonds issued in 2009. In the first year, the state will save over $3 million and a total of $113.5 million over 15 years. Talk about big savings!

Invest in Iowa’s online auction continues to be a popular event for financial institutions across the state. In October we had the highest number of bids since October 2018. We currently have over $285 million invested through this program and over the past seventeen years the program has earned over $43 million in interest. Visit our website for more information on the Invest in Iowa program.

Iowa had a record fiscal year with earnings of over $56 million in its investment pool, the largest amount in over a decade. The money earned each year funds state programs and reduces the need to collect money from other sources. That’s $56 million saved!

Last year marked the 36 anniversary of the Great Iowa Treasure Hunt. Since I created the program in 1983, we’ve returned over $277 million of unclaimed property to their rightful owners. That’s enough money to buy more than 2.5 million tickets to Disney World!

College Savings Iowa is right there alongside the Great Iowa Treasure Hunt with astounding statistics of its own. Since its inception in 1998, College Savings Iowa account owners have used over $3 billion for qualified educational expenses. With that amount of savings, over 321,000 students could pay for one year of tuition at Iowa State University without having to take out a loan.

It’s only been three short years since IAble’s launch in 2017, but the plan has already grown to over 670 accounts with more than $4.6 million in assets. It’s difficult for us to think about a time where individuals with disabilities were not given opportunities to save without the possibility of losing eligibility for federal benefits like Medicaid or Supplemental Security Income (SSI). I am optimistic that we will continue to overcome the concept that individuals with disabilities are limited on what they can achieve.

Looking towards the next decade, I am expecting to see continued financial stability, high amounts of investment income, more treasures returned, and large growth in our 529 and IAble plans. Keep up to date with us into the next decade by following our Facebook and Twitter pages.

A New Outlook on Iowa’s Debt

At the end of fiscal year 2019, the outstanding debt obligations for Iowa’s state and local governments totaled $17.1 billion. This 4.84% increase from 2018 marks the largest percentage increase since 2011. However, this amount of growth is expected in a time where interest rates are low.

Cities remain the largest share of outstanding debt, totaling $6.2 billion. Rounding out the remaining top three are schools with $4.2 billion and state authorities with $2.2 billion. Community colleges, State of Iowa and the Board of Regents were the only entities with a decrease in total outstanding debt when compared to 2018.

All political subdivisions, instrumentalities and agencies of the state are required to annually disclose outstanding long-term debt obligations. Included in these obligations are bonds, notes, capital leases and loans. With the help of our interactive graph, you can narrow down results by entity type and county to view your community’s outstanding debt in more detail.

The annual debt report and interactive graph are available to the public at IowaTreasurer.gov.

IAble Celebrates Third Anniversary: The Year of Leather

This January marked the third year since I created the IAble program, which helps some individuals with disabilities and their families save for qualified expenses while also protecting their eligibility for federal benefits. Traditionally, leather is known as the third anniversary gift – symbolizing its durability and flexibility. I want to celebrate IAble’s third anniversary by acknowledging the durability and flexibility the plan has come to develop in the last three years.

IAble has shown durability in its constant goal to help individuals with disabilities maintain their independence. Before the program was implemented, individuals with disabilities risked their eligibility for federal benefits if they saved more than $2,000. For the past three years, IAble account owners have had the opportunity to save up to $15,000 each year for qualified expenses while maintaining eligibility for means-tested benefits programs such as Supplemental Security Income and Medicaid.*

Flexibility is another key aspect of the IAble plan that helps individuals with disabilities and their families maintain financial independence. For instance, we have created a variety of options aiming to match financial goals and comfort. From aggressive to conservative options, IAble has choices for every investor.

Qualified disability expenses were also designed with flexibility in mind. IAble allows individuals with disabilities to save for expenses such as education, housing, transportation and assistive technology. Ultimately, these can be personalized to fit the needs of the individual so they can achieve a better life experience. Whether that means using the funds for aquatic therapy or saving for future medical expenses, the flexibility of the plan shines through. Consult your tax or legal team to determine the eligibility of your IAble expenses.

On top of a plan that’s durable and flexible, there are also special tax advantages. Earnings on IAble accounts are tax free if used for qualified expenses like the ones listed above.* Additionally, Iowa taxpayers who contribute to an IAble plan can deduct up to $3,439 in contributions from their adjusted gross income in 2020.**

Overall, IAble has changed the lives of many individuals with disabilities through a consistent goal, a variety of investment options and a range of qualified expenses. Plus, the tax advantages are a great bonus! Join me in celebrating the year of leather by recognizing IAble as a durable and flexible plan that helps individuals with disabilities achieve a better life experience.

Learn more about IAble by visiting our website at IAble.gov. You may also contact the program at (888) 609-8910 or by emailing us at [email protected].

*Earnings on non-qualified withdrawals may be subject to federal income tax and a 10% federal penalty tax, as well as applicable state and local income taxes.

** If withdrawals are not qualified, the deductions must be added back to Iowa taxable income. Adjusted annually for inflation.

College Savings Iowa Reaches over $3 BILLION Used for Education

I am pleased to share the College Savings Iowa 529 Plan has eclipsed $3 billion in withdrawals for qualified educational expenses. This milestone is just one example of how College Savings Iowa plays an important role in helping families achieve their educational and career aspirations. Over the last 20 years, College Savings Iowa has grown exponentially and the withdrawal milestone is another demonstration of the program’s success.

The $3 billion in withdrawals have been used to pay for tuition, room, board, books, supplies and other qualified expenses. These funds have been used at accredited universities, colleges, community colleges, technical training schools and graduate programs all around the country.* The savings and earnings withdrawn and used from College Savings Iowa accounts have reduced the need for some families to borrow as much when planning the educational adventure of a student in their lives.

In January, I also announced an increase for the Iowa income tax deduction for those contributing and saving with College Savings Iowa.** Account owners who are Iowa taxpayers can deduct the first $3,439 they contribute per beneficiary account from their state taxable income in 2020. The tax deduction is another way for our account owners to save while keeping more money in their pocket.

For more information about College Savings Iowa, call (888) 672-9116 or visit CollegeSavingsIowa.com. Connect with the plan on Facebook and Twitter to stay up to date on current events and plan updates.

*Earnings on non-qualified withdrawals may be subject to federal income tax and a 10% federal penalty tax, as well as state income taxes. The availability of tax or other benefits may be contingent on meeting other requirements.

**Adjusted annually for inflation. If withdrawals are not qualified, the deductions must be added back to Iowa taxable income. The availability of tax or other benefits may be contingent on meeting other requirements.

$275 Million and Counting! Big Returns for Great Iowa Treasure Hunt

I’m excited to announce that we’ve returned over $275 million through the Great Iowa Treasure Hunt since I created the program in 1983. It’s a huge accomplishment and I’m pleased we’ve hit this record milestone, but with over $398 million still waiting to be claimed, we will continue to reach out and reunite these treasures with their rightful owners.

Each year, the Great Iowa Treasure Hunt returns millions of dollars in unclaimed property to the rightful owners. Common forms of unclaimed property include forgotten savings or checking accounts, lost stocks, uncashed checks, life insurance policies, utility security deposits and abandoned safe deposit box contents. We mail out letters, attend events, publish names in the newspapers and utilize other opportunities to remind people to check the list online.

Throughout the year, new property is uploaded into the Great Iowa Treasure Hunt. I’m encouraging all past and present Iowa residents, non-profits and businesses to search our records, even if you have claimed property in the past; there is a chance your name could be on the list again. Visit the Great Iowa Treasure Hunt at GreatIowaTreasureHunt.gov to begin your search and make your claim today. Keep up with all of our programs on social media by following us on Facebook and Twitter.

You are receiving this email because [email protected] is signed up to receive Treasurer of the State of Iowa communications.

If you wish to unsubscribe from future Treasurer of the State of Iowa emails, you can always unsubscribe at

[link removed].

Please don't reply to this email.

Copyright 2020 Treasurer of the State of Iowa. All rights reserved.

Message Analysis

- Sender: Office of the Iowa Treasurer

- Political Party: n/a

- Country: United States

- State/Locality: Iowa

- Office: n/a