Email

SCOTUS asks solicitor general to weigh in on Calif. law requiring nonprofits to disclose donors

| From | Jerrick Adams <[email protected]> |

| Subject | SCOTUS asks solicitor general to weigh in on Calif. law requiring nonprofits to disclose donors |

| Date | March 2, 2020 6:33 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Four of the Supreme Court's nine justices must concur in order to call on the solicitor general for a brief.

------------------------------------------------------------

Welcome to _The Disclosure Digest_, a weekly look at state and federal disclosure policies for nonprofit organizations and their donors.

** FEATURE STORY

------------------------------------------------------------

On Feb. 24, the United States Supreme Court called on ([link removed]) United States Solicitor General Noel John Francisco ([link removed]) to file a brief expressing the federal government's views on two suits challenging a California law requiring nonprofits to disclose identifying information about their donors. The lawsuit names and docket numbers are _Americans for Prosperity Foundation v. Becerra_ (19-251) and _Thomas More Law Center v. Becerra_ (19-255).

** WHAT DOES IT MEAN WHEN THE SUPREME COURT CALLS ON THE SOLICITOR GENERAL TO SUBMIT A BRIEF, AND WHAT COMES NEXT?

------------------------------------------------------------

These orders are generally referred to as "Calls for the View of the Solicitor General" (CVSGs). Four of the Supreme Court's nine justices must concur in order to issue a CVSG. Before becoming a federal appellate court judge in 2013, Patricia Millett wrote ([link removed]) , "CVSGs are a unique feature of Supreme Court practice, and they underscore the special position of the Solicitor General in Supreme Court litigation. The Court is seeking the views of a non-party, not on the merits of the case, but on whether the Court should exercise its discretionary certiorari jurisdiction to hear the case at all."

In its Feb. 24 order, the Supreme Court did not set a deadline for the brief. According to Millett, "The Solicitor General’s Office strives to file pending CVSGs in time to meet the Court’s traditional cut-off dates for action each Term."

MORE ABOUT THE SOLICITOR GENERAL

* The office of the United States Solicitor General ([link removed]) is an agency of the U.S. Department of Justice that argues on behalf of the federal government before the Supreme Court and in all federal appellate courts. The federal government is involved either as a party or as an amicus curiae in approximately two-thirds of all cases before the Supreme Court.

** WHAT IS AT ISSUE?

------------------------------------------------------------

California law ([link removed]) requires nonprofits to file copies of their IRS 990 forms with the state. Schedule B of this form includes the names and addresses of all individuals who donated more than $5,000 to the nonprofit in a given tax year. The California law requires that nonprofits give the state copies of their Schedule B forms. Although the law does not allow public access of Schedule B information, court documents indicate inadvertent disclosures have occurred.

** AMERICANS FOR PROSPERITY FOUNDATION V. BECERRA ([link removed]) (19-251) AND THOMAS MORE LAW CENTER V. BECERRA ([link removed]) (19-255)

------------------------------------------------------------

In 2014, Americans for Prosperity Foundation (AFPF), a 501(c)(3) nonprofit, filed suit in U.S. district court, alleging violations of their First Amendment associational rights. In 2016, Judge Manuel Real ([link removed]) , of the United States District Court for the Central District of California, found ([link removed]) in favor of AFPF and enjoined the state from collecting Schedule B information from the group. Real was appointed to the court by Pres. Lyndon Johnson (D).

In 2015, Thomas More Law Center (TMLC), also a 501(c)(3) nonprofit, filed a similar suit in the same U.S. district court. In a separate 2016 ruling, Real also found ([link removed]) in favor of TMLC and enjoined the state from collecting Schedule B information from the group.

The two suits were combined on appeal. A three-judge panel of the U.S. Court of Appeals for the Ninth Circuit unanimously overturned ([link removed]) Real's rulings in 2018. Judges Raymond Fisher ([link removed]) , Richard Paez ([link removed]) , and Jacqueline Nguyen ([link removed]) issued the ruling. Fisher and Paez were appointed to the court by President Bill Clinton (D). Nguyen was appointed by President Barack Obama (D). The plaintiffs petitioned the Ninth Circuit for en banc review. That petition was rejected ([link removed]) March 29, with five judges dissenting. On Aug. 26, 2019, the plaintiffs appealed this decision to the Supreme Court.

------------------------------------------------------------

[link removed]

------------------------------------------------------------

** WHAT WE'RE READING

------------------------------------------------------------

* Nonprofit Quarterly, "Hiding Behind a Shield: Nonprofit Status Helps Conceal Political Money," Feb. 28, 2020 ([link removed])

* Law360, "Justices Ask US SG To Weigh In On Calif. Donor Privacy Row," Feb. 24, 2020 ([link removed])

* The Journal of Appellate Practice and Process, "'We're Your Government and We're Here to Help': Obtaining Amicus Support from the Federal Government in Supreme Court cases," Spring 2009 ([link removed])

------------------------------------------------------------

** THE BIG PICTURE

------------------------------------------------------------

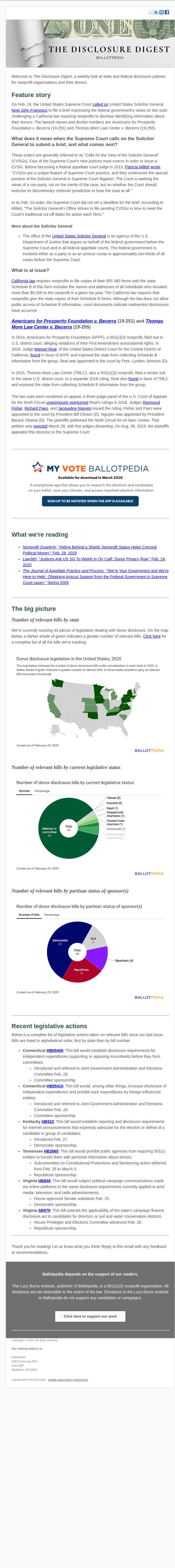

** _NUMBER OF RELEVANT BILLS BY STATE_

------------------------------------------------------------

We're currently tracking 44 pieces of legislation dealing with donor disclosure. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here ([link removed]) for a complete list of all the bills we're tracking.

** _NUMBER OF RELEVANT BILLS BY CURRENT LEGISLATIVE STATUS_

------------------------------------------------------------

** _NUMBER OF RELEVANT BILLS BY PARTISAN STATUS OF SPONSOR(S)_

------------------------------------------------------------

------------------------------------------------------------

** RECENT LEGISLATIVE ACTIONS

------------------------------------------------------------

Below is a complete list of legislative actions taken on relevant bills since our last issue. Bills are listed in alphabetical order, first by state then by bill number.

* CONNECTICUT HB05406 ([link removed]) : This bill would establish disclosure requirements for independent expenditures supporting or opposing incumbents before they form committees.

* Introduced and referred to Joint Government Administration and Elections Committee Feb. 28.

* Committee sponsorship.

* CONNECTICUT HB05410 ([link removed]) : This bill would, among other things, increase disclosure of independent expenditures and prohibit such expenditures by foreign-influenced entities.

* Introduced and referred to Joint Government Administration and Elections Committee Feb. 28.

* Committee sponsorship.

* KENTUCKY HB522 ([link removed]) : This bill would establish reporting and disclosure requirements for internet announcements that expressly advocate for the election or defeat of a candidate or group of candidates.

* Introduced Feb. 27.

* Democratic sponsorship.

* TENNESSEE HB2665 ([link removed]) : This bill would prohibit public agencies from requiring 501(c) entities to furnish them with personal information about donors.

* Subcommittee on Constitutional Protections and Sentencing action deferred from Feb. 25 to March 3.

* Republican sponsorship.

* VIRGINIA HB849 ([link removed]) : This bill would subject political campaign communications made via online platforms to the same disclosure requirements currently applied to print media, television, and radio advertisements.

* House approved Senate substitute Feb. 25.

* Democratic sponsorship.

* VIRGINIA SB979 ([link removed]) : This bill extends the applicability of the state's campaign finance disclosure act to candidates for directors or soil and water conservation districts.

* House Privileges and Elections Committee advanced Feb. 28.

* Republican sponsorship.

------------------------------------------------------------

Thank you for reading! Let us know what you think! Reply to this email with any feedback or recommendations.

============================================================

BALLOTPEDIA DEPENDS ON THE SUPPORT OF OUR READERS.

The Lucy Burns Institute, publisher of Ballotpedia, is a 501(c)(3) nonprofit organization. All donations are tax deductible to the extent of the law. Donations to the Lucy Burns Institute or Ballotpedia do not support any candidates or campaigns.

** Click here to support our work ([link removed])

-------------------------

_Copyright © 2020, All rights reserved._

OUR MAILING ADDRESS IS:

Ballotpedia

8383 Greenway Blvd

Suite 600

Middleton, WI 53562

** unsubscribe from all emails ( [link removed] )

** update subscription preferences ( [link removed] )

------------------------------------------------------------

Welcome to _The Disclosure Digest_, a weekly look at state and federal disclosure policies for nonprofit organizations and their donors.

** FEATURE STORY

------------------------------------------------------------

On Feb. 24, the United States Supreme Court called on ([link removed]) United States Solicitor General Noel John Francisco ([link removed]) to file a brief expressing the federal government's views on two suits challenging a California law requiring nonprofits to disclose identifying information about their donors. The lawsuit names and docket numbers are _Americans for Prosperity Foundation v. Becerra_ (19-251) and _Thomas More Law Center v. Becerra_ (19-255).

** WHAT DOES IT MEAN WHEN THE SUPREME COURT CALLS ON THE SOLICITOR GENERAL TO SUBMIT A BRIEF, AND WHAT COMES NEXT?

------------------------------------------------------------

These orders are generally referred to as "Calls for the View of the Solicitor General" (CVSGs). Four of the Supreme Court's nine justices must concur in order to issue a CVSG. Before becoming a federal appellate court judge in 2013, Patricia Millett wrote ([link removed]) , "CVSGs are a unique feature of Supreme Court practice, and they underscore the special position of the Solicitor General in Supreme Court litigation. The Court is seeking the views of a non-party, not on the merits of the case, but on whether the Court should exercise its discretionary certiorari jurisdiction to hear the case at all."

In its Feb. 24 order, the Supreme Court did not set a deadline for the brief. According to Millett, "The Solicitor General’s Office strives to file pending CVSGs in time to meet the Court’s traditional cut-off dates for action each Term."

MORE ABOUT THE SOLICITOR GENERAL

* The office of the United States Solicitor General ([link removed]) is an agency of the U.S. Department of Justice that argues on behalf of the federal government before the Supreme Court and in all federal appellate courts. The federal government is involved either as a party or as an amicus curiae in approximately two-thirds of all cases before the Supreme Court.

** WHAT IS AT ISSUE?

------------------------------------------------------------

California law ([link removed]) requires nonprofits to file copies of their IRS 990 forms with the state. Schedule B of this form includes the names and addresses of all individuals who donated more than $5,000 to the nonprofit in a given tax year. The California law requires that nonprofits give the state copies of their Schedule B forms. Although the law does not allow public access of Schedule B information, court documents indicate inadvertent disclosures have occurred.

** AMERICANS FOR PROSPERITY FOUNDATION V. BECERRA ([link removed]) (19-251) AND THOMAS MORE LAW CENTER V. BECERRA ([link removed]) (19-255)

------------------------------------------------------------

In 2014, Americans for Prosperity Foundation (AFPF), a 501(c)(3) nonprofit, filed suit in U.S. district court, alleging violations of their First Amendment associational rights. In 2016, Judge Manuel Real ([link removed]) , of the United States District Court for the Central District of California, found ([link removed]) in favor of AFPF and enjoined the state from collecting Schedule B information from the group. Real was appointed to the court by Pres. Lyndon Johnson (D).

In 2015, Thomas More Law Center (TMLC), also a 501(c)(3) nonprofit, filed a similar suit in the same U.S. district court. In a separate 2016 ruling, Real also found ([link removed]) in favor of TMLC and enjoined the state from collecting Schedule B information from the group.

The two suits were combined on appeal. A three-judge panel of the U.S. Court of Appeals for the Ninth Circuit unanimously overturned ([link removed]) Real's rulings in 2018. Judges Raymond Fisher ([link removed]) , Richard Paez ([link removed]) , and Jacqueline Nguyen ([link removed]) issued the ruling. Fisher and Paez were appointed to the court by President Bill Clinton (D). Nguyen was appointed by President Barack Obama (D). The plaintiffs petitioned the Ninth Circuit for en banc review. That petition was rejected ([link removed]) March 29, with five judges dissenting. On Aug. 26, 2019, the plaintiffs appealed this decision to the Supreme Court.

------------------------------------------------------------

[link removed]

------------------------------------------------------------

** WHAT WE'RE READING

------------------------------------------------------------

* Nonprofit Quarterly, "Hiding Behind a Shield: Nonprofit Status Helps Conceal Political Money," Feb. 28, 2020 ([link removed])

* Law360, "Justices Ask US SG To Weigh In On Calif. Donor Privacy Row," Feb. 24, 2020 ([link removed])

* The Journal of Appellate Practice and Process, "'We're Your Government and We're Here to Help': Obtaining Amicus Support from the Federal Government in Supreme Court cases," Spring 2009 ([link removed])

------------------------------------------------------------

** THE BIG PICTURE

------------------------------------------------------------

** _NUMBER OF RELEVANT BILLS BY STATE_

------------------------------------------------------------

We're currently tracking 44 pieces of legislation dealing with donor disclosure. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here ([link removed]) for a complete list of all the bills we're tracking.

** _NUMBER OF RELEVANT BILLS BY CURRENT LEGISLATIVE STATUS_

------------------------------------------------------------

** _NUMBER OF RELEVANT BILLS BY PARTISAN STATUS OF SPONSOR(S)_

------------------------------------------------------------

------------------------------------------------------------

** RECENT LEGISLATIVE ACTIONS

------------------------------------------------------------

Below is a complete list of legislative actions taken on relevant bills since our last issue. Bills are listed in alphabetical order, first by state then by bill number.

* CONNECTICUT HB05406 ([link removed]) : This bill would establish disclosure requirements for independent expenditures supporting or opposing incumbents before they form committees.

* Introduced and referred to Joint Government Administration and Elections Committee Feb. 28.

* Committee sponsorship.

* CONNECTICUT HB05410 ([link removed]) : This bill would, among other things, increase disclosure of independent expenditures and prohibit such expenditures by foreign-influenced entities.

* Introduced and referred to Joint Government Administration and Elections Committee Feb. 28.

* Committee sponsorship.

* KENTUCKY HB522 ([link removed]) : This bill would establish reporting and disclosure requirements for internet announcements that expressly advocate for the election or defeat of a candidate or group of candidates.

* Introduced Feb. 27.

* Democratic sponsorship.

* TENNESSEE HB2665 ([link removed]) : This bill would prohibit public agencies from requiring 501(c) entities to furnish them with personal information about donors.

* Subcommittee on Constitutional Protections and Sentencing action deferred from Feb. 25 to March 3.

* Republican sponsorship.

* VIRGINIA HB849 ([link removed]) : This bill would subject political campaign communications made via online platforms to the same disclosure requirements currently applied to print media, television, and radio advertisements.

* House approved Senate substitute Feb. 25.

* Democratic sponsorship.

* VIRGINIA SB979 ([link removed]) : This bill extends the applicability of the state's campaign finance disclosure act to candidates for directors or soil and water conservation districts.

* House Privileges and Elections Committee advanced Feb. 28.

* Republican sponsorship.

------------------------------------------------------------

Thank you for reading! Let us know what you think! Reply to this email with any feedback or recommendations.

============================================================

BALLOTPEDIA DEPENDS ON THE SUPPORT OF OUR READERS.

The Lucy Burns Institute, publisher of Ballotpedia, is a 501(c)(3) nonprofit organization. All donations are tax deductible to the extent of the law. Donations to the Lucy Burns Institute or Ballotpedia do not support any candidates or campaigns.

** Click here to support our work ([link removed])

-------------------------

_Copyright © 2020, All rights reserved._

OUR MAILING ADDRESS IS:

Ballotpedia

8383 Greenway Blvd

Suite 600

Middleton, WI 53562

** unsubscribe from all emails ( [link removed] )

** update subscription preferences ( [link removed] )

Message Analysis

- Sender: Ballotpedia

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Litmus