|

John,

Thanks to new IRS funding that we fought for and won last year, the IRS has already recovered $38 million from 175 high-income tax cheats, reduced wait times for taxpayer assistance from 27 minutes to 4 minutes, and cut the backlog of unprocessed tax returns by 80%.[1]

So, what do Republicans want to do? They want to claw back $67 billion of that $80 billion investment even though the Congressional Budget Office estimates that kind of cut would reduce tax revenues collected by the IRS by $186 billion.[2] So it’s not about saving money: Congressional Republicans just want their wealthy and corporate donors to continue evading taxes with impunity.

We’re fighting for a tax system that holds the wealthy and corporations accountable. Rush a donation today to demand Congress defend and increase IRS funding to allow the agency to continue to crack down on wealthy and corporate tax cheats.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately, with 100% going directly to

When we hold wealthy tax cheats accountable, we can invest billions more dollars in critical services for working people and lower costs on everything from healthcare to housing to nutrition and more.

Thank you for all that you do,

Sarah Christopherson

Legislative and Policy Director

Americans for Tax Fairness Action Fund

[1] NEW ANALYSIS SHOWS TRUMP-ERA IRS AUDITED LOW-INCOME WORKERS AT A HIGHER RATE THAN MILLIONAIRES

[2] Estimated Budgetary Effects of H.R. 23

-- David's email --

John,

A new report from Senate Finance Committee Chair Ron Wyden shows that “thousands of wealthy Americans are actively committing tax evasion” with nearly 1,000 millionaires owing roughly $34 billion in unpaid taxes.[1]

This level of tax evasion was made possible because of a decade of cuts to the IRS budget that resulted in a 43% reduction in agents capable of examining the complex tax returns of millionaires and billionaires.[2]

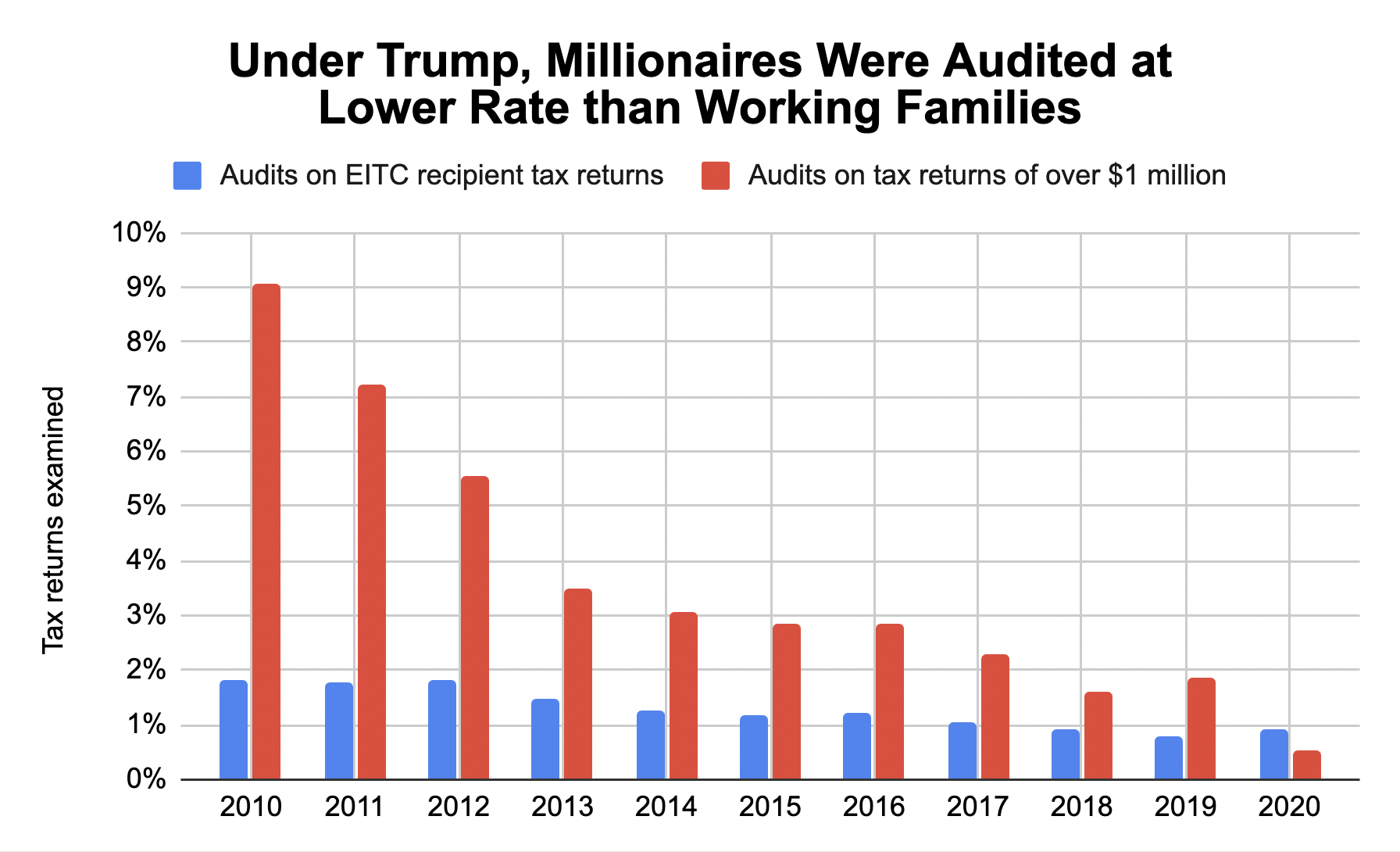

In fact, Americans for Tax Fairness research shows that during the Trump administration, audit rates on millionaires dropped so much that working families receiving the Earned Income Tax Credit were audited at a higher rate than millionaires for the first time in history:

Now, thanks to a 10-year, $80 billion investment in the IRS that we fought for and won last year, the agency is pursuing 1,600 millionaires who owe at least $250,000 each in taxes, and closely examining 75 corporations with assets averaging $10 billion.

We’re fighting to not only defend IRS funding, but to demand Congress continue to invest in the IRS to crack down on wealthy and corporate tax cheats. Donate today to power our research and activism, which are critical to holding millionaires, billionaires, and corporations accountable for the taxes they owe.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Every dollar invested in the IRS results in a 7-to-1 return because when the IRS is fully funded, they have the resources to make the rich and corporations pay what they owe.

Thank you for your continued support,

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] Finance Chair Wyden Reveals Shocking New Data About Wealthy Individuals Who Have Failed to File Tax Returns; Nearly 1,000 millionaires Have Not Filed Returns and Owe Estimated $34 billion in Taxes; Few Wealthy Non-Filers Are Prosecuted

[2] NEW ANALYSIS SHOWS TRUMP-ERA IRS AUDITED LOW-INCOME WORKERS AT A HIGHER RATE THAN MILLIONAIRES

|