|

John,

Last year we fought for and won the largest-ever investment in the IRS. This has allowed the agency to start cracking down on wealthy and corporate tax cheats, collecting $38 million from 175+ millionaires in the first half of this year.[1] And now they’re really cranking up their campaign against wealthy tax cheats: [2]

But that’s not all! This $80 billion investment is also allowing the IRS to better serve everyday taxpayers, processing tax returns more quickly and answering 2.4 million more calls this year than the year before.[3]

What is the GOP’s response? They want to claw back $67 billion of that $80 billion investment to allow their wealthy and corporate tax cheat donors to continue avoiding what they owe in taxes. And they’re trying to include that claw back in a deal to keep the government open―going back on a budget deal made earlier this year between President Biden and Speaker McCarthy.

To fight back against GOP attacks on the IRS, we’re joining with our national allies and going on offense. Add your name today to our new demand: instead of cutting funding for the IRS, Congress should increase IRS funding now!

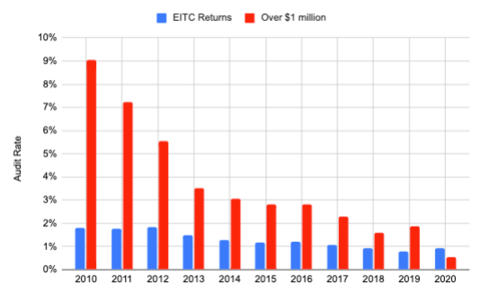

Revoking this investment in the IRS is nothing more than a huge gift to rich and corporate tax cheats. More than a decade of cuts to the IRS caused audit rates on the wealthy to plummet between 2010 and 2020, to the point that low-income workers receiving the Earned Income Tax Credit were being audited at a higher rate than taxpayers earning over $1 million a year!

And if you’re worried about deficits―as the Republicans claim to be―you should know that every dollar invested in the IRS results in $7 in added revenue. That’s a 7-1 return on investment!

Add your name now and urge Congress to increase, not cut, IRS funding.

When the IRS is fully funded, we can crack down on wealthy tax cheats and collect the money we’re due to invest in critical services for working families.

Thank you for taking action today,

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] “IRS says it collected $38 million from more than 175 high-income tax delinquents,” ABC News, July 14, 2023

[2] “The IRS plans to crack down on 1,600 millionaires to collect millions of dollars in back taxes,” Associated Press, Sep. 8, 2023

[3] “How A Transformed IRS Will Provide World-Class Customer Service,” U.S. Department of the Treasury

|