|

John,

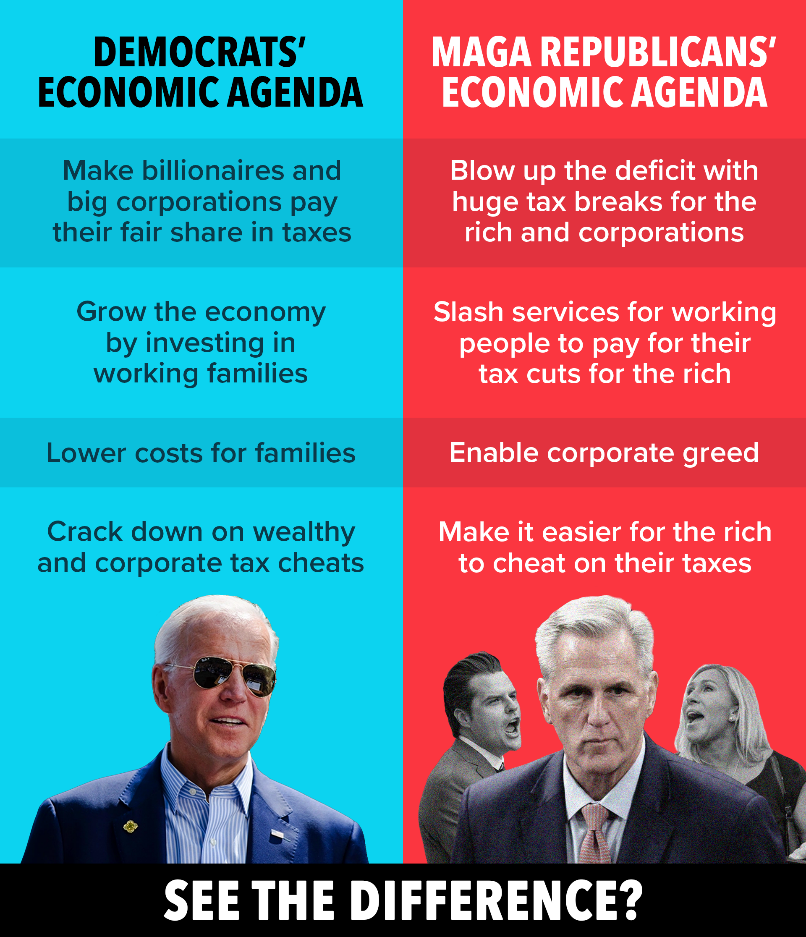

When Republicans are in control in Washington, their priorities are completely out of step with the desires of the American people.

They pass tax cuts for the rich and corporations while slashing funding for public services working families need and deserve. And even after cutting taxes for their wealthy donors, they also hobble IRS enforcement to make it easier for their rich contributors to evade the taxes they still owe.

Democrats, on the other hand, have implemented a 15% corporate profits minimum tax and are fighting for a Billionaire Minimum Income Tax –so that no billionaire or billion-dollar corporation ever gets away again with paying $0 in federal income taxes.

As Kevin McCarthy and his dysfunctional caucus attempt to pass multiple spending bills this week that slash services for working people in order to pay for another round of tax cuts for the rich, we’re reminding the American people who’s fighting for them and ensuring the rich and major corporations pay their fair share.

We’re building massive support for an agenda that invests in working people―paid for by taxing the rich and corporations.

Donate today to help bring our latest infographic, below, to people across the country and fight for an economic agenda that puts working people first.

One of MAGA Republicans’ top demands in the government shutdown standoff is repealing $67 billion of the $80 billion investment that Democrats made last year in the IRS. They don’t like that Democrats’ investment in wealthy-taxpayer accountability is already paying off.

In the first half of this year, the IRS already collected $38 million from 175+ wealthy tax cheats.[1] And, they’ve announced plans to crack down on 1,600 more millionaires to collect millions more owed in back taxes.[2]

This is exactly why every dollar spent on the IRS produces a 7-to-1 return on investment. Not to mention allowing the IRS to better serve everyday taxpayers.

Donate today to hold Republicans accountable for an economic agenda that slashes services for working people while enriching their wealthy tax-cheat donors.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Thank you for fighting by our side for an agenda that puts working people, not the rich and corporations, first.

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] “IRS says it collected $38 million from more than 175 high-income tax delinquents,” ABC News, July 14, 2023

[2] “The IRS plans to crack down on 1,600 millionaires to collect millions of dollars in back taxes,” Associated Press, Sep. 8, 2023

|