Sales taxes on food and other necessities add to the financial strain facing families who struggle to make ends meet. Fortunately, Alabama’s new grocery tax reduction will help ease that strain and make our state’s tax system more just. And Alabama Arise is ready to answer your questions about this change.

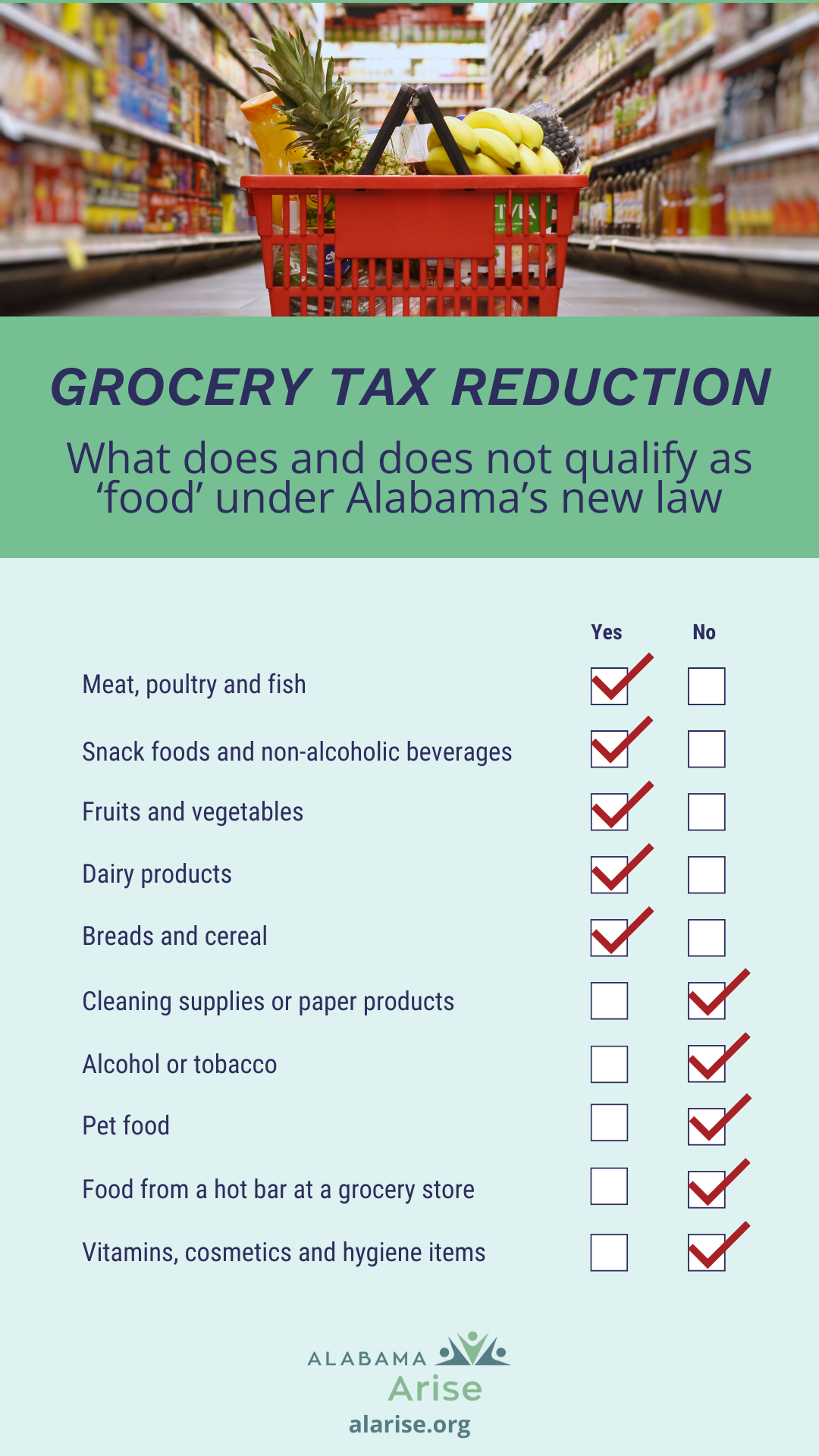

In our latest fact sheet and an accompanying video, Arise’s Carol Gundlach explains what items are and are not covered under the reduction. She explains how the new law will make life better for every Alabamian. And she explains what’s next in our ongoing work to untax groceries.

Read our new fact sheet and watch our new video on Alabama’s grocery tax reduction here.

HB 479 reduced the state portion of the sales tax on food from 4% to 3%, effective Sept. 1, 2023. That reduction will save Alabamians the equivalent of about half a week’s groceries each year. Another reduction to 2% will come in September 2024, or the first year afterward when education revenues grow by at least 3.5%.

The grocery tax reduction will benefit every Alabamian, and it happened thanks to determined advocacy by Arise members and supporters like you. Help us build on this momentum! Share our fact sheet and video about the new law, and encourage your friends and neighbors to join our movement for change. Together, we are building a better Alabama for all.