|

John,

The IRS is preparing to crack down on 1,600 millionaires who each owe $250,000 or more in back taxes, and 75 corporations that are worth, on average, $10 billion each.[1]

They’re able to perform these audits on the richest 1% and large corporations thanks to the historic investment in the IRS that we fought for and won last year. But MAGA Republicans are attempting to claw back $67 billion of that $80 billion investment in order to protect their wealthy tax-cheat donors.

This is part of the ransom that MAGA Republicans are demanding in return for not shutting down the government.

We’re sending tens of thousands of messages to Congress, putting the pressure on representatives to reject cuts to the IRS. Power our campaign with a donation today and hold wealthy and corporate tax cheats accountable.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

Thank you for fighting back against Republican attempts to gut the IRS.

Sarah Christopherson

Legislative and Policy Director

Americans for Tax Fairness Action Fund

[1] “The IRS plans to crack down on 1,600 millionaires to collect millions of dollars in back taxes,” Associated Press, Sep. 8, 2023

-- David's email --

John,

For years, congressional Republicans stripped resources from the IRS, which predictably caused the audit rates of the wealthy and corporations to plummet.

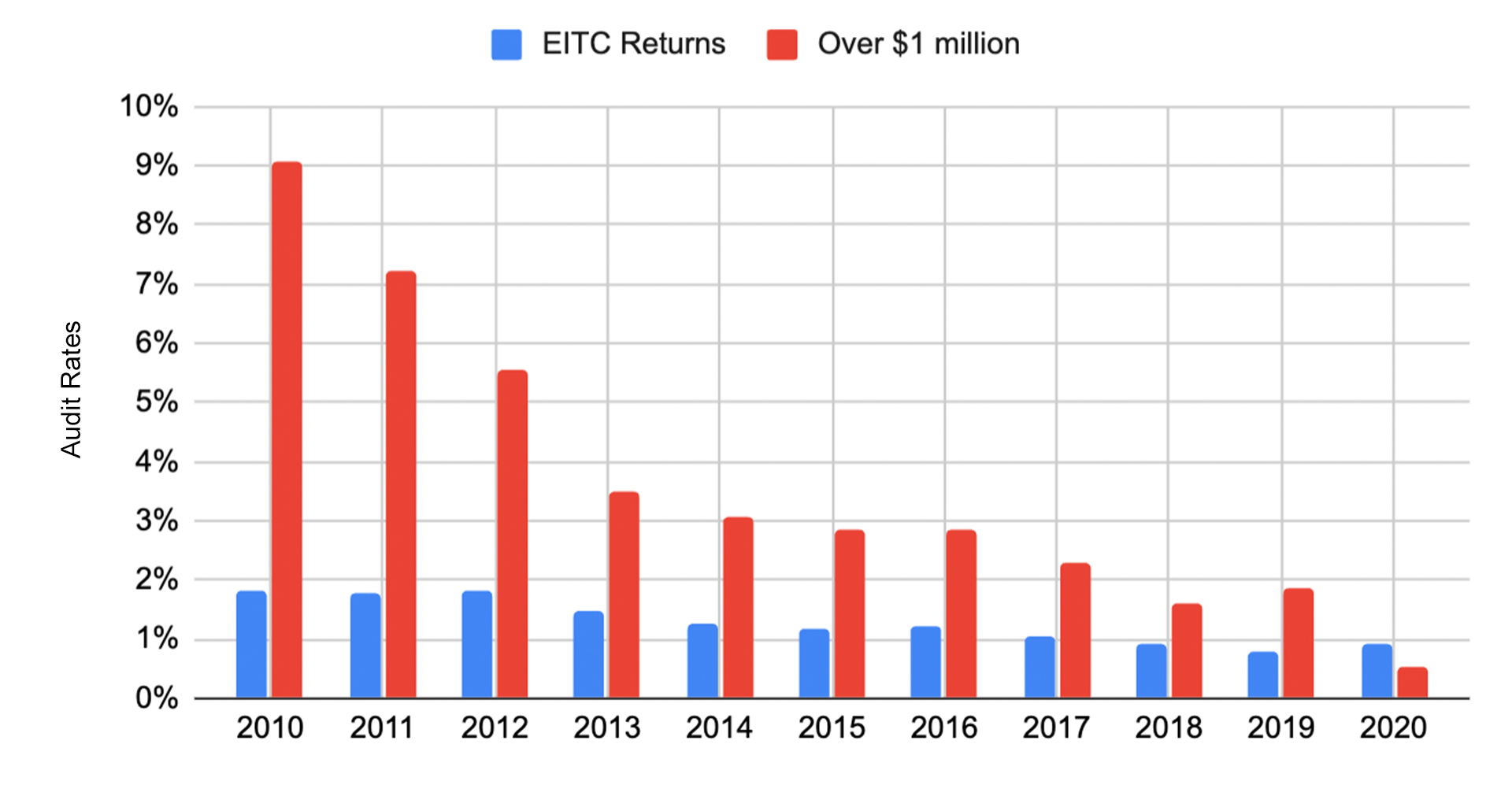

Just look at this new ATF chart, which shows how between 2010 and 2020, audit rates of millionaires and billionaires fell so far that by the end of that period the IRS was actually auditing low-income workers at a higher rate than the highest-income elites:

Now, thanks to the $80 billion investment in the IRS that we fought for and won last year, things are changing at the IRS:[1]

Already, in the first half of the year, the IRS collected $38 million from 175+ rich tax cheats. And it’s just getting started![2]

In response, in order to protect their wealthy tax-cheat donors, House Republicans are demanding Congress claw back $67 billion of that $80 billion investment. They don’t care that every dollar spent on the IRS produces a 7-to-1 return on investment.

Already, we’ve sent more than 8,000 letters to U.S. representatives demanding the House reject GOP attempts to cut critical investments in the IRS. And we’re rallying our national allies to keep the pressure on.

Donate today to fight back against attacks on the IRS, which protect wealthy tax cheats at the expense of investments in working people.

According to new reporting by the Associated Press, it’s not just 1,600 millionaires who owe at least $250,000 each in back taxes that the IRS is pursuing. They’re also going after 75 corporations worth roughly $10 billion each.

Because the tax returns of the wealthy and corporations are more complicated than those of working people, before its renewed funding the IRS was unable to effectively hold them accountable for their tax dodging. But now that the IRS is staffing up for the first time in over a decade, they’re able to crack down on wealthy and corporate tax cheats and better serve everyday taxpayers.

Donate today to defend the IRS from Republican attacks and ensure they’re able to hold wealthy and corporate tax cheats accountable.

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

When the IRS is able to function at a high level, the wealthy and corporations start paying more of their fair share.

Thank you,

David Kass

Executive Director

Americans for Tax Fairness Action Fund

[1] “The IRS plans to crack down on 1,600 millionaires to collect millions of dollars in back taxes,” Associated Press, Sep. 8, 2023

[2] “IRS says it collected $38 million from more than 175 high-income tax delinquents,” ABC News, July 14, 2023

|