Email

What to Expect in Census Data Release Next Week: Poverty is a Policy Choice, Lawmakers Should do Better

| From | Center for Law and Social Policy <[email protected]> |

| Subject | What to Expect in Census Data Release Next Week: Poverty is a Policy Choice, Lawmakers Should do Better |

| Date | September 8, 2023 4:34 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

<img alt="" src="[link removed]" style="width: 250px; height: 76px;" />

[link removed] [[link removed]]

As CLASP anticipates next week’s release from the U.S. Census Bureau of 2022 data on poverty, income, and health insurance coverage, we’ve been blogging [[link removed]] about what we expect to see in the data and why policymakers should be concerned about the latest trends in economic inequality.

The Enduring Effects of Childhood Poverty

Childhood poverty has immediate and long-term effects, including impaired development, lower education, and health issues in adulthood. It costs the United States over $1 trillion annually, but investing in poverty reduction yields a sevenfold return. Childhood poverty is a pervasive issue with severe consequences for individuals, communities, and the economy. Lawmakers can and should do better.

read the full blog [[link removed]]

How to End Child Poverty for Good

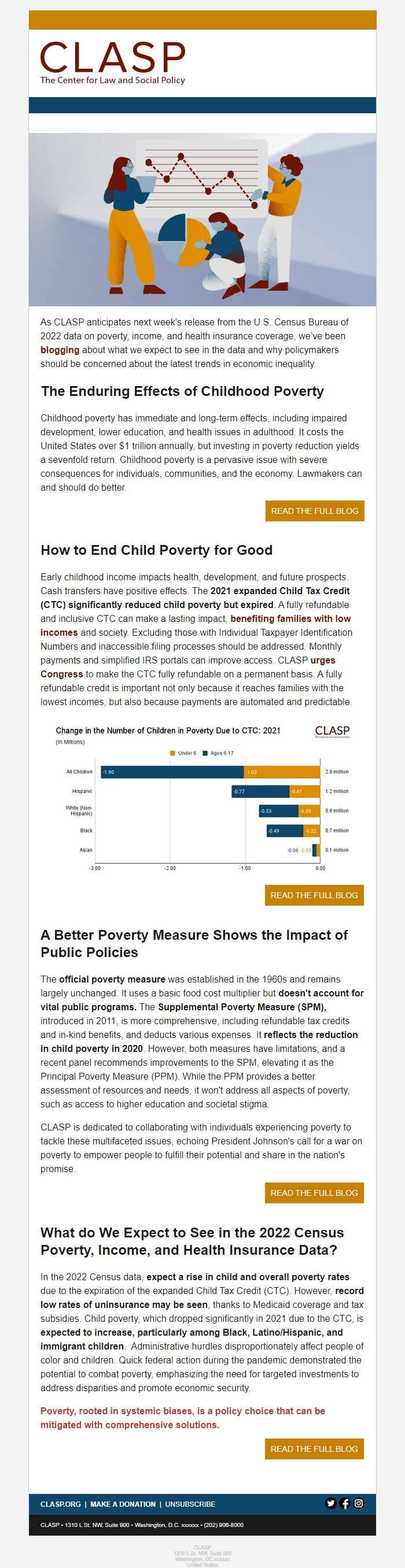

Early childhood income impacts health, development, and future prospects. Cash transfers have positive effects. The 2021 expanded Child Tax Credit (CTC) significantly reduced child poverty but expired . A fully refundable and inclusive CTC can make a lasting impact, benefiting families with low incomes [[link removed]] and society. Excluding those with Individual Taxpayer Identification Numbers and inaccessible filing processes should be addressed. Monthly payments and simplified IRS portals can improve access. CLASP urges Congress [[link removed]] to make the CTC fully refundable on a permanent basis. A fully refundable credit is important not only because it reaches families with the lowest incomes, but also because payments are automated and predictable.

www.clasp.org/blog/how-to-end-child-poverty-for-good/ [www.clasp.org/blog/how-to-end-child-poverty-for-good/]

read the full blog [[link removed]]

A Better Poverty Measure Shows the Impact of Public Policies

The official poverty measure was established in the 1960s and remains largely unchanged. It uses a basic food cost multiplier but doesn't account for vital public programs. The Supplemental Poverty Measure (SPM), introduced in 2011, is more comprehensive, including refundable tax credits and in-kind benefits, and deducts various expenses. It reflects the reduction in child poverty in 2020 . However, both measures have limitations, and a recent panel recommends improvements to the SPM, elevating it as the Principal Poverty Measure (PPM). While the PPM provides a better assessment of resources and needs, it won't address all aspects of poverty, such as access to higher education and societal stigma.

CLASP is dedicated to collaborating with individuals experiencing poverty to tackle these multifaceted issues, echoing President Johnson's call for a war on poverty to empower people to fulfill their potential and share in the nation's promise.

read the full blog [[link removed]]

What do We Expect to See in the 2022 Census Poverty, Income, and Health Insurance Data?

In the 2022 Census data, expect a rise in child and overall poverty rates due to the expiration of the expanded Child Tax Credit (CTC). However, record low rates of uninsurance may be seen , thanks to Medicaid coverage and tax subsidies. Child poverty, which dropped significantly in 2021 due to the CTC, is expected to increase, particularly among Black, Latino/Hispanic, and immigrant children . Administrative hurdles disproportionately affect people of color and children. Quick federal action during the pandemic demonstrated the potential to combat poverty, emphasizing the need for targeted investments to address disparities and promote economic security.

Poverty, rooted in systemic biases, is a policy choice that can be mitigated with comprehensive solutions.

read the full blog [[link removed]]

CLASP.ORG [[link removed]] | MAKE A DONATION [[link removed]] | UNSUBSCRIBE [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

CLASP • 1310 L St. NW, Suite 900 • Washington, D.C. xxxxxx • (202) 906-8000

CLASP

1310 L St. NW, Suite 900

Washington, DC xxxxxx

United States

[link removed] [[link removed]]

As CLASP anticipates next week’s release from the U.S. Census Bureau of 2022 data on poverty, income, and health insurance coverage, we’ve been blogging [[link removed]] about what we expect to see in the data and why policymakers should be concerned about the latest trends in economic inequality.

The Enduring Effects of Childhood Poverty

Childhood poverty has immediate and long-term effects, including impaired development, lower education, and health issues in adulthood. It costs the United States over $1 trillion annually, but investing in poverty reduction yields a sevenfold return. Childhood poverty is a pervasive issue with severe consequences for individuals, communities, and the economy. Lawmakers can and should do better.

read the full blog [[link removed]]

How to End Child Poverty for Good

Early childhood income impacts health, development, and future prospects. Cash transfers have positive effects. The 2021 expanded Child Tax Credit (CTC) significantly reduced child poverty but expired . A fully refundable and inclusive CTC can make a lasting impact, benefiting families with low incomes [[link removed]] and society. Excluding those with Individual Taxpayer Identification Numbers and inaccessible filing processes should be addressed. Monthly payments and simplified IRS portals can improve access. CLASP urges Congress [[link removed]] to make the CTC fully refundable on a permanent basis. A fully refundable credit is important not only because it reaches families with the lowest incomes, but also because payments are automated and predictable.

www.clasp.org/blog/how-to-end-child-poverty-for-good/ [www.clasp.org/blog/how-to-end-child-poverty-for-good/]

read the full blog [[link removed]]

A Better Poverty Measure Shows the Impact of Public Policies

The official poverty measure was established in the 1960s and remains largely unchanged. It uses a basic food cost multiplier but doesn't account for vital public programs. The Supplemental Poverty Measure (SPM), introduced in 2011, is more comprehensive, including refundable tax credits and in-kind benefits, and deducts various expenses. It reflects the reduction in child poverty in 2020 . However, both measures have limitations, and a recent panel recommends improvements to the SPM, elevating it as the Principal Poverty Measure (PPM). While the PPM provides a better assessment of resources and needs, it won't address all aspects of poverty, such as access to higher education and societal stigma.

CLASP is dedicated to collaborating with individuals experiencing poverty to tackle these multifaceted issues, echoing President Johnson's call for a war on poverty to empower people to fulfill their potential and share in the nation's promise.

read the full blog [[link removed]]

What do We Expect to See in the 2022 Census Poverty, Income, and Health Insurance Data?

In the 2022 Census data, expect a rise in child and overall poverty rates due to the expiration of the expanded Child Tax Credit (CTC). However, record low rates of uninsurance may be seen , thanks to Medicaid coverage and tax subsidies. Child poverty, which dropped significantly in 2021 due to the CTC, is expected to increase, particularly among Black, Latino/Hispanic, and immigrant children . Administrative hurdles disproportionately affect people of color and children. Quick federal action during the pandemic demonstrated the potential to combat poverty, emphasizing the need for targeted investments to address disparities and promote economic security.

Poverty, rooted in systemic biases, is a policy choice that can be mitigated with comprehensive solutions.

read the full blog [[link removed]]

CLASP.ORG [[link removed]] | MAKE A DONATION [[link removed]] | UNSUBSCRIBE [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

CLASP • 1310 L St. NW, Suite 900 • Washington, D.C. xxxxxx • (202) 906-8000

CLASP

1310 L St. NW, Suite 900

Washington, DC xxxxxx

United States

Message Analysis

- Sender: Center for Law and Social Policy (CLASP)

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- EveryAction