| From | Fraser Institute <[email protected]> |

| Subject | 2023 Consumer tax index, and Comparing median employment incomes |

| Date | August 26, 2023 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email. Latest Research The average Canadian family paid more in 2022 on taxes than it did on housing, food and clothing combined [[link removed]]

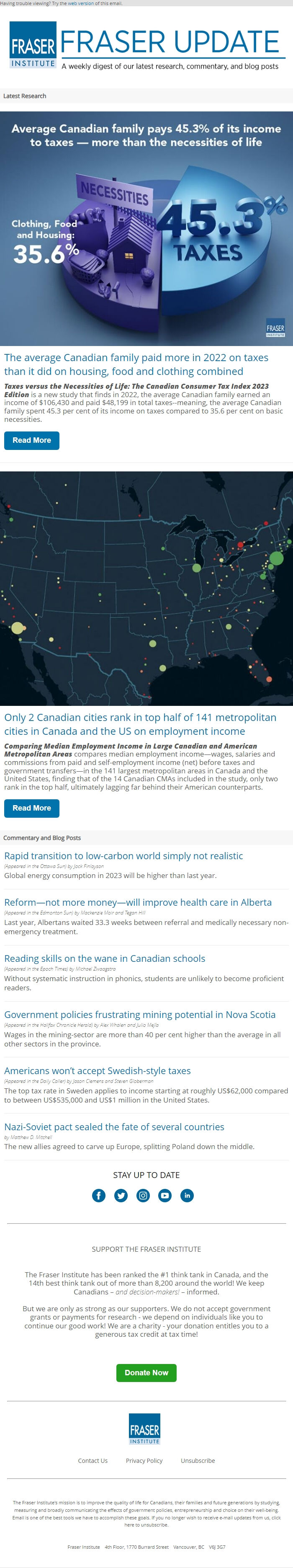

Taxes versus the Necessities of Life: The Canadian Consumer Tax Index 2023 Edition is a new study that finds in 2022, the average Canadian family earned an income of $106,430 and paid $48,199 in total taxes--meaning, the average Canadian family spent 45.3 per cent of its income on taxes compared to 35.6 per cent on basic necessities.

Read More [[link removed]] Only 2 Canadian cities rank in top half of 141 metropolitan cities in Canada and the US on employment income [[link removed]]

Comparing Median Employment Income in Large Canadian and American Metropolitan Areas compares median employment income—wages, salaries and commissions from paid and self-employment income (net) before taxes and government transfers—in the 141 largest metropolitan areas in Canada and the United States, finding that of the 14 Canadian CMAs included in the study, only two rank in the top half, ultimately lagging far behind their American counterparts.

Read More [[link removed]] Commentary and Blog Posts Rapid transition to low-carbon world simply not realistic [[link removed]] (Appeared in the Ottawa Sun) by Jock Finlayson

Global energy consumption in 2023 will be higher than last year.

Reform—not more money—will improve health care in Alberta [[link removed]] (Appeared in the Edmonton Sun) by Mackenzie Moir and Tegan Hill

Last year, Albertans waited 33.3 weeks between referral and medically necessary non-emergency treatment.

Reading skills on the wane in Canadian schools [[link removed]] (Appeared in the Epoch Times) by Michael Zwaagstra

Without systematic instruction in phonics, students are unlikely to become proficient readers.

Government policies frustrating mining potential in Nova Scotia [[link removed]] (Appeared in the Halifax Chronicle Herald) by Alex Whalen and Julio Mejía

Wages in the mining-sector are more than 40 per cent higher than the average in all other sectors in the province.

Americans won’t accept Swedish-style taxes [[link removed]] (Appeared in the Daily Caller) by Jason Clemens and Steven Globerman

The top tax rate in Sweden applies to income starting at roughly US$62,000 compared to between US$535,000 and US$1 million in the United States.

Nazi-Soviet pact sealed the fate of several countries [[link removed]] by Matthew D. Mitchell

The new allies agreed to carve up Europe, splitting Poland down the middle.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Taxes versus the Necessities of Life: The Canadian Consumer Tax Index 2023 Edition is a new study that finds in 2022, the average Canadian family earned an income of $106,430 and paid $48,199 in total taxes--meaning, the average Canadian family spent 45.3 per cent of its income on taxes compared to 35.6 per cent on basic necessities.

Read More [[link removed]] Only 2 Canadian cities rank in top half of 141 metropolitan cities in Canada and the US on employment income [[link removed]]

Comparing Median Employment Income in Large Canadian and American Metropolitan Areas compares median employment income—wages, salaries and commissions from paid and self-employment income (net) before taxes and government transfers—in the 141 largest metropolitan areas in Canada and the United States, finding that of the 14 Canadian CMAs included in the study, only two rank in the top half, ultimately lagging far behind their American counterparts.

Read More [[link removed]] Commentary and Blog Posts Rapid transition to low-carbon world simply not realistic [[link removed]] (Appeared in the Ottawa Sun) by Jock Finlayson

Global energy consumption in 2023 will be higher than last year.

Reform—not more money—will improve health care in Alberta [[link removed]] (Appeared in the Edmonton Sun) by Mackenzie Moir and Tegan Hill

Last year, Albertans waited 33.3 weeks between referral and medically necessary non-emergency treatment.

Reading skills on the wane in Canadian schools [[link removed]] (Appeared in the Epoch Times) by Michael Zwaagstra

Without systematic instruction in phonics, students are unlikely to become proficient readers.

Government policies frustrating mining potential in Nova Scotia [[link removed]] (Appeared in the Halifax Chronicle Herald) by Alex Whalen and Julio Mejía

Wages in the mining-sector are more than 40 per cent higher than the average in all other sectors in the province.

Americans won’t accept Swedish-style taxes [[link removed]] (Appeared in the Daily Caller) by Jason Clemens and Steven Globerman

The top tax rate in Sweden applies to income starting at roughly US$62,000 compared to between US$535,000 and US$1 million in the United States.

Nazi-Soviet pact sealed the fate of several countries [[link removed]] by Matthew D. Mitchell

The new allies agreed to carve up Europe, splitting Poland down the middle.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor