| From | Mary Sagatelova <[email protected]> |

| Subject | On the Grid: It's the Economy! 📊 |

| Date | August 25, 2023 4:07 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Central bank officials, experts on monetary policy, and a cadre of journalists gather in Jackson Hole, Wyoming, for the Federal Reserve’s annual economic symposium.

View this email in your browser

[link removed]

[link removed]

Hi John,

This week, central bank officials, experts on monetary policy, and a cadre of journalists gather in Jackson Hole, Wyoming, for the Federal Reserve’s annual economic symposium

[link removed]

. During last summer’s conference, Chair Jerome Powell gave a stark warning that the Fed would continue to hike interest rates to fight inflation. Since then, the Fed has raised its key policy rate to 5.5%, the highest level in 22 years. With inflation on a downward trend for over 12 months to the latest reading of 3.2%, we’re looking forward to hearing how conversations unfold and to tune into discussions on monetary policy and economic growth.

To prepare, I sat down with Dr. Ellen Hughes-Cromwick

[link removed]

, Senior Resident Fellow and resident economist for Third Way’s Climate and Energy Program. With an illustrious career as Chief Economist of the Department of Commerce and former Chief Global Economist at Ford, Ellen bridges public and private sector insights, offering an unparalleled perspective on economic issues. Here’s the scoop from our conversation.

How’s the current economic landscape shaping up?

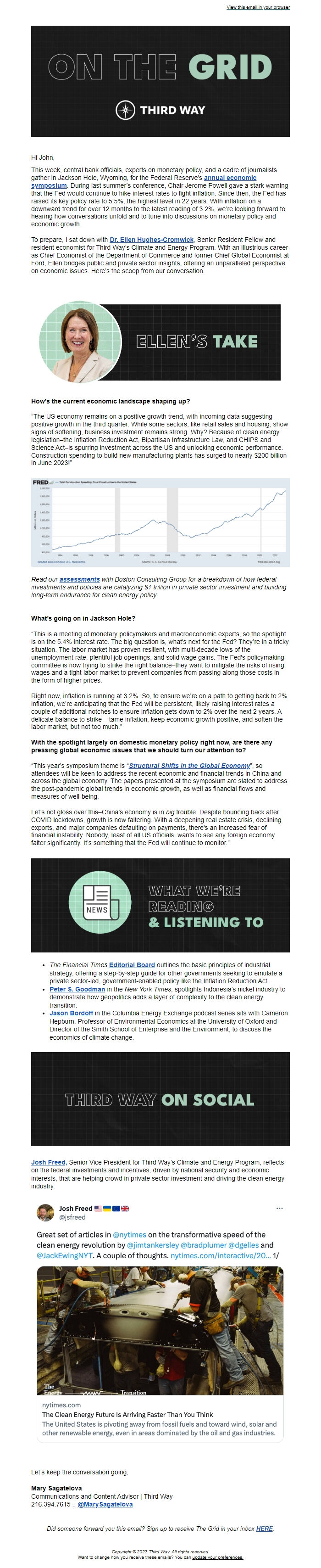

“The US economy remains on a positive growth trend, with incoming data suggesting positive growth in the third quarter. While some sectors, like retail sales and housing, show signs of softening, business investment remains strong. Why? Because of clean energy legislation–the Inflation Reduction Act, Bipartisan Infrastructure Law, and CHIPS and Science Act–is spurring investment across the US and unlocking economic performance. Construction spending to build new manufacturing plants has surged to nearly $200 billion in June 2023!”

[link removed]

Read our assessments

[link removed]

with Boston Consulting Group for a breakdown of how federal investments and policies are catalyzing $1 trillion in private sector investment and building long-term endurance for clean energy policy.

What’s going on in Jackson Hole?

“This is a meeting of monetary policymakers and macroeconomic experts, so the spotlight is on the 5.4% interest rate. The big question is, what's next for the Fed? They’re in a tricky situation. The labor market has proven resilient, with multi-decade lows of the unemployment rate, plentiful job openings, and solid wage gains. The Fed's policymaking committee is now trying to strike the right balance–they want to mitigate the risks of rising wages and a tight labor market to prevent companies from passing along those costs in the form of higher prices.

Right now, inflation is running at 3.2%. So, to ensure we’re on a path to getting back to 2% inflation, we’re anticipating that the Fed will be persistent, likely raising interest rates a couple of additional notches to ensure inflation gets down to 2% over the next 2 years. A delicate balance to strike – tame inflation, keep economic growth positive, and soften the labor market, but not too much.”

With the spotlight largely on domestic monetary policy right now, are there any pressing global economic issues that we should turn our attention to?

“This year’s symposium theme is “Structural Shifts in the Global Economy

[link removed]

”, so attendees will be keen to address the recent economic and financial trends in China and across the global economy. The papers presented at the symposium are slated to address the post-pandemic global trends in economic growth, as well as financial flows and measures of well-being.

Let’s not gloss over this–China’s economy is in big trouble. Despite bouncing back after COVID lockdowns, growth is now faltering. With a deepening real estate crisis, declining exports, and major companies defaulting on payments, there's an increased fear of financial instability. Nobody, least of all US officials, wants to see any foreign economy falter significantly. It’s something that the Fed will continue to monitor.”

The Financial Times Editorial Board

[link removed]

outlines the basic principles of industrial strategy, offering a step-by-step guide for other governments seeking to emulate a private sector-led, government-enabled policy like the Inflation Reduction Act.

Peter S. Goodman

[link removed]

in the New York Times, spotlights Indonesia’s nickel industry to demonstrate how geopolitics adds a layer of complexity to the clean energy transition.

Jason Bordoff

[link removed]

in the Columbia Energy Exchange podcast series sits with Cameron Hepburn, Professor of Environmental Economics at the University of Oxford and Director of the Smith School of Enterprise and the Environment, to discuss the economics of climate change.

Josh Freed,

[link removed]

Senior Vice President for Third Way’s Climate and Energy Program, reflects on the federal investments and incentives, driven by national security and economic interests, that are helping crowd in private sector investment and driving the clean energy industry.

[link removed]

Let’s keep the conversation going,

Mary Sagatelova

Communications and Content Advisor | Third Way

216.394.7615 :: @MarySagatelova

[link removed]

Did someone forward you this email? Sign up to receive The Grid in your inbox HERE

[link removed]

.

Copyright © 2023 Third Way. All rights reserved.

Want to change how you receive these emails? You can update your preferences.

[link removed]

View this email in your browser

[link removed]

[link removed]

Hi John,

This week, central bank officials, experts on monetary policy, and a cadre of journalists gather in Jackson Hole, Wyoming, for the Federal Reserve’s annual economic symposium

[link removed]

. During last summer’s conference, Chair Jerome Powell gave a stark warning that the Fed would continue to hike interest rates to fight inflation. Since then, the Fed has raised its key policy rate to 5.5%, the highest level in 22 years. With inflation on a downward trend for over 12 months to the latest reading of 3.2%, we’re looking forward to hearing how conversations unfold and to tune into discussions on monetary policy and economic growth.

To prepare, I sat down with Dr. Ellen Hughes-Cromwick

[link removed]

, Senior Resident Fellow and resident economist for Third Way’s Climate and Energy Program. With an illustrious career as Chief Economist of the Department of Commerce and former Chief Global Economist at Ford, Ellen bridges public and private sector insights, offering an unparalleled perspective on economic issues. Here’s the scoop from our conversation.

How’s the current economic landscape shaping up?

“The US economy remains on a positive growth trend, with incoming data suggesting positive growth in the third quarter. While some sectors, like retail sales and housing, show signs of softening, business investment remains strong. Why? Because of clean energy legislation–the Inflation Reduction Act, Bipartisan Infrastructure Law, and CHIPS and Science Act–is spurring investment across the US and unlocking economic performance. Construction spending to build new manufacturing plants has surged to nearly $200 billion in June 2023!”

[link removed]

Read our assessments

[link removed]

with Boston Consulting Group for a breakdown of how federal investments and policies are catalyzing $1 trillion in private sector investment and building long-term endurance for clean energy policy.

What’s going on in Jackson Hole?

“This is a meeting of monetary policymakers and macroeconomic experts, so the spotlight is on the 5.4% interest rate. The big question is, what's next for the Fed? They’re in a tricky situation. The labor market has proven resilient, with multi-decade lows of the unemployment rate, plentiful job openings, and solid wage gains. The Fed's policymaking committee is now trying to strike the right balance–they want to mitigate the risks of rising wages and a tight labor market to prevent companies from passing along those costs in the form of higher prices.

Right now, inflation is running at 3.2%. So, to ensure we’re on a path to getting back to 2% inflation, we’re anticipating that the Fed will be persistent, likely raising interest rates a couple of additional notches to ensure inflation gets down to 2% over the next 2 years. A delicate balance to strike – tame inflation, keep economic growth positive, and soften the labor market, but not too much.”

With the spotlight largely on domestic monetary policy right now, are there any pressing global economic issues that we should turn our attention to?

“This year’s symposium theme is “Structural Shifts in the Global Economy

[link removed]

”, so attendees will be keen to address the recent economic and financial trends in China and across the global economy. The papers presented at the symposium are slated to address the post-pandemic global trends in economic growth, as well as financial flows and measures of well-being.

Let’s not gloss over this–China’s economy is in big trouble. Despite bouncing back after COVID lockdowns, growth is now faltering. With a deepening real estate crisis, declining exports, and major companies defaulting on payments, there's an increased fear of financial instability. Nobody, least of all US officials, wants to see any foreign economy falter significantly. It’s something that the Fed will continue to monitor.”

The Financial Times Editorial Board

[link removed]

outlines the basic principles of industrial strategy, offering a step-by-step guide for other governments seeking to emulate a private sector-led, government-enabled policy like the Inflation Reduction Act.

Peter S. Goodman

[link removed]

in the New York Times, spotlights Indonesia’s nickel industry to demonstrate how geopolitics adds a layer of complexity to the clean energy transition.

Jason Bordoff

[link removed]

in the Columbia Energy Exchange podcast series sits with Cameron Hepburn, Professor of Environmental Economics at the University of Oxford and Director of the Smith School of Enterprise and the Environment, to discuss the economics of climate change.

Josh Freed,

[link removed]

Senior Vice President for Third Way’s Climate and Energy Program, reflects on the federal investments and incentives, driven by national security and economic interests, that are helping crowd in private sector investment and driving the clean energy industry.

[link removed]

Let’s keep the conversation going,

Mary Sagatelova

Communications and Content Advisor | Third Way

216.394.7615 :: @MarySagatelova

[link removed]

Did someone forward you this email? Sign up to receive The Grid in your inbox HERE

[link removed]

.

Copyright © 2023 Third Way. All rights reserved.

Want to change how you receive these emails? You can update your preferences.

[link removed]

Message Analysis

- Sender: Third Way

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Pardot

- Litmus