| From | Jerrick Adams <[email protected]> |

| Subject | Subject |

| Date | February 24, 2020 5:48 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

A closer look at expenditure originating outside of a candidate's own election organization.

------------------------------------------------------------

mailto:[email protected]?&subject=&body=[link removed] [blank] [link removed] %20https://go.ballotpedia.org/e/481201/ary-24-202020via20-ballotpedia/zkfvp/374059638?h=fvlqZUnfNxvsA35GnSg6H07GNm1WKrNDxANThxk4LFE [blank] [link removed] [blank] [link removed]

------------------------------------------------------------

Welcome to _The Disclosure Digest_, a weekly look at state and federal disclosure policies for nonprofit organizations and their donors.

** POLICY UNDER REVIEW: DONOR DISCLOSURE REQUIREMENTS FOR NON-PAC GROUPS MAKING INDEPENDENT EXPENDITURES

------------------------------------------------------------

Last month ([link removed]) , we explored state donor disclosure requirements for groups that sponsor electioneering communications. This week, let's take a closer look at donor disclosure requirements for non-PAC groups making independent expenditures.

AN INDEPENDENT EXPENDITURE ([link removed]) IS ANY MONEY SPENT ON POLITICAL ADVERTISING SUPPORTING OR OPPOSING A PARTICULAR CANDIDATE FOR ELECTIVE OFFICE. An independent expenditure originates outside of a candidate's own election organization and is not coordinated with that candidate's campaign, authorized candidate committee, or political party committee.

Individuals, political action committees ([link removed]) (PACs), super PACs ([link removed]) , select nonprofits (such as 501(c)(4) groups ([link removed])(4)) ), corporations, and labor unions can make independent expenditures. States cannot limit the dollar amounts of independent expenditures. States can, however, impose disclosure requirements on groups making these expenditures.

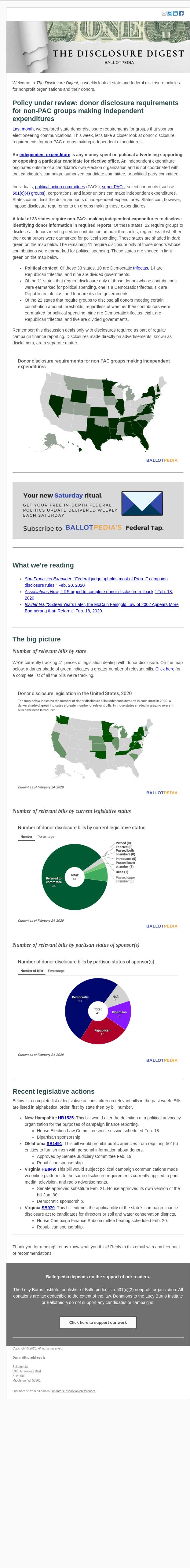

A TOTAL OF 33 STATES REQUIRE NON-PACS MAKING INDEPENDENT EXPENDITURES TO DISCLOSE IDENTIFYING DONOR INFORMATION IN REQUIRED REPORTS. Of these states, 22 require groups to disclose all donors meeting certain contribution amount thresholds, regardless of whether their contributors were earmarked for political spending. These states are shaded in dark green on the map below.The remaining 11 require disclosure only of those donors whose contributions were earmarked for political spending. These states are shaded in light green on the map below.

* POLITICAL CONTEXT: Of these 33 states, 10 are Democratic trifectas ([link removed]) , 14 are Republican trifectas, and nine are divided governments.

* Of the 11 states that require disclosure only of those donors whose contributions were earmarked for political spending, one is a Democratic trifectas, six are Republican trifectas, and four are divided governments.

* Of the 22 states that require groups to disclose all donors meeting certain contribution amount thresholds, regardless of whether their contributors were earmarked for political spending, nine are Democratic trifectas, eight are Republican trifectas, and five are divided governments.

Remember: this discussion deals only with disclosures required as part of regular campaign finance reporting. Disclosures made directly on advertisements, known as disclaimers, are a separate matter.

------------------------------------------------------------

------------------------------------------------------------

** WHAT WE'RE READING

------------------------------------------------------------

* San Francisco Examiner, "Federal judge upholds most of Prop. F campaign disclosure rules," Feb. 20, 2020 ([link removed])

* Associations Now, "IRS urged to complete donor disclosure rollback," Feb. 18, 2020 ([link removed])

* Insider NJ, "Sixteen Years Later, the McCain Feingold Law of 2002 Appears More Boomerang than Reform," Feb. 18, 2020 ([link removed])

------------------------------------------------------------

** THE BIG PICTURE

------------------------------------------------------------

** _NUMBER OF RELEVANT BILLS BY STATE_

------------------------------------------------------------

We're currently tracking 41 pieces of legislation dealing with donor disclosure. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here ([link removed]) for a complete list of all the bills we're tracking.

** _NUMBER OF RELEVANT BILLS BY CURRENT LEGISLATIVE STATUS_

------------------------------------------------------------

** _NUMBER OF RELEVANT BILLS BY PARTISAN STATUS OF SPONSOR(S)_

------------------------------------------------------------

------------------------------------------------------------

** RECENT LEGISLATIVE ACTIONS

------------------------------------------------------------

Below is a complete list of legislative actions taken on relevant bills in the past week. Bills are listed in alphabetical order, first by state then by bill number.

* NEW HAMPSHIRE HB1525 ([link removed]) : This bill would alter the definition of a political advocacy organization for the purposes of campaign finance reporting.

* House Election Law Committee work session scheduled Feb. 18.

* Bipartisan sponsorship.

* OKLAHOMA SB1491 ([link removed]) : This bill would prohibit public agencies from requiring 501(c) entities to furnish them with personal information about donors.

* Approved by Senate Judiciary Committee Feb. 19.

* Republican sponsorship.

* VIRGINIA HB849 ([link removed]) : This bill would subject political campaign communications made via online platforms to the same disclosure requirements currently applied to print media, television, and radio advertisements.

* Senate approved substitute Feb. 21. House approved its own version of the bill Jan. 30.

* Democratic sponsorship.

* VIRGINIA SB979 ([link removed]) : This bill extends the applicability of the state's campaign finance disclosure act to candidates for directors or soil and water conservation districts.

* House Campaign Finance Subcommittee hearing scheduled Feb. 20.

* Republican sponsorship.

------------------------------------------------------------

Thank you for reading! Let us know what you think! Reply to this email with any feedback or recommendations.

============================================================

BALLOTPEDIA DEPENDS ON THE SUPPORT OF OUR READERS.

The Lucy Burns Institute, publisher of Ballotpedia, is a 501(c)(3) nonprofit organization. All donations are tax deductible to the extent of the law. Donations to the Lucy Burns Institute or Ballotpedia do not support any candidates or campaigns.

** Click here to support our work ([link removed])

-------------------------

_Copyright © 2020, All rights reserved._

OUR MAILING ADDRESS IS:

Ballotpedia

8383 Greenway Blvd

Suite 600

Middleton, WI 53562

** unsubscribe from all emails ( [link removed] )

** update subscription preferences ( [link removed] )

------------------------------------------------------------

mailto:[email protected]?&subject=&body=[link removed] [blank] [link removed] %20https://go.ballotpedia.org/e/481201/ary-24-202020via20-ballotpedia/zkfvp/374059638?h=fvlqZUnfNxvsA35GnSg6H07GNm1WKrNDxANThxk4LFE [blank] [link removed] [blank] [link removed]

------------------------------------------------------------

Welcome to _The Disclosure Digest_, a weekly look at state and federal disclosure policies for nonprofit organizations and their donors.

** POLICY UNDER REVIEW: DONOR DISCLOSURE REQUIREMENTS FOR NON-PAC GROUPS MAKING INDEPENDENT EXPENDITURES

------------------------------------------------------------

Last month ([link removed]) , we explored state donor disclosure requirements for groups that sponsor electioneering communications. This week, let's take a closer look at donor disclosure requirements for non-PAC groups making independent expenditures.

AN INDEPENDENT EXPENDITURE ([link removed]) IS ANY MONEY SPENT ON POLITICAL ADVERTISING SUPPORTING OR OPPOSING A PARTICULAR CANDIDATE FOR ELECTIVE OFFICE. An independent expenditure originates outside of a candidate's own election organization and is not coordinated with that candidate's campaign, authorized candidate committee, or political party committee.

Individuals, political action committees ([link removed]) (PACs), super PACs ([link removed]) , select nonprofits (such as 501(c)(4) groups ([link removed])(4)) ), corporations, and labor unions can make independent expenditures. States cannot limit the dollar amounts of independent expenditures. States can, however, impose disclosure requirements on groups making these expenditures.

A TOTAL OF 33 STATES REQUIRE NON-PACS MAKING INDEPENDENT EXPENDITURES TO DISCLOSE IDENTIFYING DONOR INFORMATION IN REQUIRED REPORTS. Of these states, 22 require groups to disclose all donors meeting certain contribution amount thresholds, regardless of whether their contributors were earmarked for political spending. These states are shaded in dark green on the map below.The remaining 11 require disclosure only of those donors whose contributions were earmarked for political spending. These states are shaded in light green on the map below.

* POLITICAL CONTEXT: Of these 33 states, 10 are Democratic trifectas ([link removed]) , 14 are Republican trifectas, and nine are divided governments.

* Of the 11 states that require disclosure only of those donors whose contributions were earmarked for political spending, one is a Democratic trifectas, six are Republican trifectas, and four are divided governments.

* Of the 22 states that require groups to disclose all donors meeting certain contribution amount thresholds, regardless of whether their contributors were earmarked for political spending, nine are Democratic trifectas, eight are Republican trifectas, and five are divided governments.

Remember: this discussion deals only with disclosures required as part of regular campaign finance reporting. Disclosures made directly on advertisements, known as disclaimers, are a separate matter.

------------------------------------------------------------

------------------------------------------------------------

** WHAT WE'RE READING

------------------------------------------------------------

* San Francisco Examiner, "Federal judge upholds most of Prop. F campaign disclosure rules," Feb. 20, 2020 ([link removed])

* Associations Now, "IRS urged to complete donor disclosure rollback," Feb. 18, 2020 ([link removed])

* Insider NJ, "Sixteen Years Later, the McCain Feingold Law of 2002 Appears More Boomerang than Reform," Feb. 18, 2020 ([link removed])

------------------------------------------------------------

** THE BIG PICTURE

------------------------------------------------------------

** _NUMBER OF RELEVANT BILLS BY STATE_

------------------------------------------------------------

We're currently tracking 41 pieces of legislation dealing with donor disclosure. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here ([link removed]) for a complete list of all the bills we're tracking.

** _NUMBER OF RELEVANT BILLS BY CURRENT LEGISLATIVE STATUS_

------------------------------------------------------------

** _NUMBER OF RELEVANT BILLS BY PARTISAN STATUS OF SPONSOR(S)_

------------------------------------------------------------

------------------------------------------------------------

** RECENT LEGISLATIVE ACTIONS

------------------------------------------------------------

Below is a complete list of legislative actions taken on relevant bills in the past week. Bills are listed in alphabetical order, first by state then by bill number.

* NEW HAMPSHIRE HB1525 ([link removed]) : This bill would alter the definition of a political advocacy organization for the purposes of campaign finance reporting.

* House Election Law Committee work session scheduled Feb. 18.

* Bipartisan sponsorship.

* OKLAHOMA SB1491 ([link removed]) : This bill would prohibit public agencies from requiring 501(c) entities to furnish them with personal information about donors.

* Approved by Senate Judiciary Committee Feb. 19.

* Republican sponsorship.

* VIRGINIA HB849 ([link removed]) : This bill would subject political campaign communications made via online platforms to the same disclosure requirements currently applied to print media, television, and radio advertisements.

* Senate approved substitute Feb. 21. House approved its own version of the bill Jan. 30.

* Democratic sponsorship.

* VIRGINIA SB979 ([link removed]) : This bill extends the applicability of the state's campaign finance disclosure act to candidates for directors or soil and water conservation districts.

* House Campaign Finance Subcommittee hearing scheduled Feb. 20.

* Republican sponsorship.

------------------------------------------------------------

Thank you for reading! Let us know what you think! Reply to this email with any feedback or recommendations.

============================================================

BALLOTPEDIA DEPENDS ON THE SUPPORT OF OUR READERS.

The Lucy Burns Institute, publisher of Ballotpedia, is a 501(c)(3) nonprofit organization. All donations are tax deductible to the extent of the law. Donations to the Lucy Burns Institute or Ballotpedia do not support any candidates or campaigns.

** Click here to support our work ([link removed])

-------------------------

_Copyright © 2020, All rights reserved._

OUR MAILING ADDRESS IS:

Ballotpedia

8383 Greenway Blvd

Suite 600

Middleton, WI 53562

** unsubscribe from all emails ( [link removed] )

** update subscription preferences ( [link removed] )

Message Analysis

- Sender: Ballotpedia

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Litmus