| From | Fraser Institute <[email protected]> |

| Subject | Interest costs and Alberta's lost advantage |

| Date | February 22, 2020 6:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

==============

FRASER UPDATE

==============

A weekly digest of our latest research, commentary, and blog posts.

-----------------

Latest Research Feb 17-23, 2020

-----------------

This year Ottawa will spend more on federal interest payments than on employment insurance benefits

Interest Costs and their Growing Burden on Canadians finds that in fiscal year 2019-20, Ottawa will spend more than $24 billion on federal debt interest payments, as the federal debt has increased by more than $260 billion since the 2008-09 recession. The study also compares government debt interest costs among provinces.

Read More ([link removed])

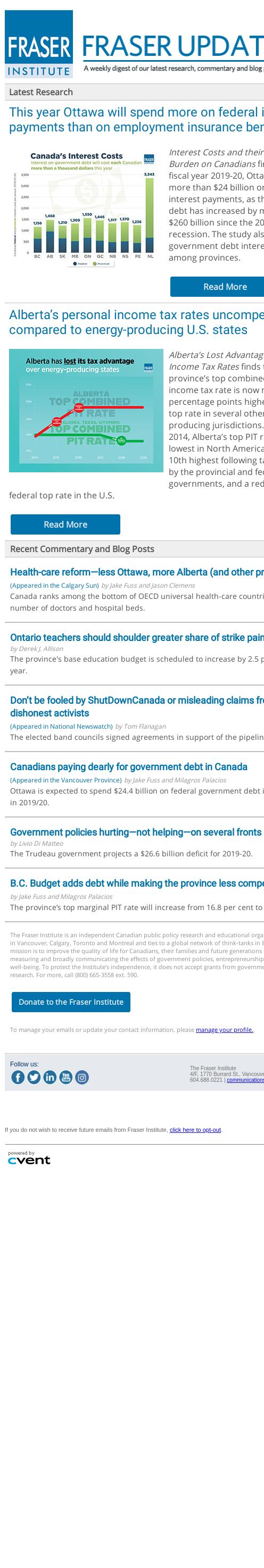

Alberta’s personal income tax rates uncompetitive compared to energy-producing U.S. states

Alberta’s Lost Advantage on Personal Income Tax Rates finds that the province’s top combined personal income tax rate is now more than 10 percentage points higher than the top rate in several other energy-producing jurisdictions. Whereas in 2014, Alberta’s top PIT rate was the lowest in North America, now it is the 10th highest following tax increases by the provincial and federal governments, and a reduction of the federal top rate in the U.S.

Read More ([link removed])

Recent Commentary and Blog Posts

-----------------

Health-care reform—less Ottawa, more Alberta (and other provinces) ([link removed])

(Appeared in the Calgary Sun) by Jake Fuss and Jason Clemens.

Canada ranks among the bottom of OECD universal health-care countries for the number of doctors and hospital beds.

Ontario teachers should shoulder greater share of strike pain ([link removed])

by Derek J. Allison.

The province's base education budget is scheduled to increase by 2.5 per cent this year.

Don’t be fooled by ShutDownCanada or misleading claims from dishonest activists ([link removed])

(Appeared in National Newswatch) by Tom Flanagan.

The elected band councils signed agreements in support of the pipeline.

Canadians paying dearly for government debt in Canada ([link removed])

(Appeared in the Vancouver Province) by Jake Fuss and Milagros Palacios.

Ottawa is expected to spend $24.4 billion on federal government debt interest costs in 2019/20.

Government policies hurting—not helping—on several fronts ([link removed])

by Livio Di Matteo.

The Trudeau government projects a $26.6 billion deficit for 2019-20.

B.C. Budget adds debt while making the province less competitive ([link removed])

by Jake Fuss and Milagros Palacios.

The province’s top marginal PIT rate will increase from 16.8 per cent to 20.5 per cent.

The Fraser Institute is an independent Canadian public policy research and educational organization with offices in Vancouver, Calgary, Toronto and Montreal and ties to a global network of think-tanks in 87 countries. Its mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. To protect the Institute's independence, it does not accept grants from governments or contracts for research. For more, call (800) 665-3558 ext. 590.

Donate to the Fraser Institute ([link removed])

To manage your emails or update your contact information, please [link removed] (manage your profile.).

The Fraser Institute

4/F, 1770 Burrard St., Vancouver BC V6J 3G7 Canada

604.688.0221 | [email protected]

If you do not wish to receive future emails from Fraser Institute, go to:

[link removed] (click here to opt-out)

Powered by Cvent

FRASER UPDATE

==============

A weekly digest of our latest research, commentary, and blog posts.

-----------------

Latest Research Feb 17-23, 2020

-----------------

This year Ottawa will spend more on federal interest payments than on employment insurance benefits

Interest Costs and their Growing Burden on Canadians finds that in fiscal year 2019-20, Ottawa will spend more than $24 billion on federal debt interest payments, as the federal debt has increased by more than $260 billion since the 2008-09 recession. The study also compares government debt interest costs among provinces.

Read More ([link removed])

Alberta’s personal income tax rates uncompetitive compared to energy-producing U.S. states

Alberta’s Lost Advantage on Personal Income Tax Rates finds that the province’s top combined personal income tax rate is now more than 10 percentage points higher than the top rate in several other energy-producing jurisdictions. Whereas in 2014, Alberta’s top PIT rate was the lowest in North America, now it is the 10th highest following tax increases by the provincial and federal governments, and a reduction of the federal top rate in the U.S.

Read More ([link removed])

Recent Commentary and Blog Posts

-----------------

Health-care reform—less Ottawa, more Alberta (and other provinces) ([link removed])

(Appeared in the Calgary Sun) by Jake Fuss and Jason Clemens.

Canada ranks among the bottom of OECD universal health-care countries for the number of doctors and hospital beds.

Ontario teachers should shoulder greater share of strike pain ([link removed])

by Derek J. Allison.

The province's base education budget is scheduled to increase by 2.5 per cent this year.

Don’t be fooled by ShutDownCanada or misleading claims from dishonest activists ([link removed])

(Appeared in National Newswatch) by Tom Flanagan.

The elected band councils signed agreements in support of the pipeline.

Canadians paying dearly for government debt in Canada ([link removed])

(Appeared in the Vancouver Province) by Jake Fuss and Milagros Palacios.

Ottawa is expected to spend $24.4 billion on federal government debt interest costs in 2019/20.

Government policies hurting—not helping—on several fronts ([link removed])

by Livio Di Matteo.

The Trudeau government projects a $26.6 billion deficit for 2019-20.

B.C. Budget adds debt while making the province less competitive ([link removed])

by Jake Fuss and Milagros Palacios.

The province’s top marginal PIT rate will increase from 16.8 per cent to 20.5 per cent.

The Fraser Institute is an independent Canadian public policy research and educational organization with offices in Vancouver, Calgary, Toronto and Montreal and ties to a global network of think-tanks in 87 countries. Its mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. To protect the Institute's independence, it does not accept grants from governments or contracts for research. For more, call (800) 665-3558 ext. 590.

Donate to the Fraser Institute ([link removed])

To manage your emails or update your contact information, please [link removed] (manage your profile.).

The Fraser Institute

4/F, 1770 Burrard St., Vancouver BC V6J 3G7 Canada

604.688.0221 | [email protected]

If you do not wish to receive future emails from Fraser Institute, go to:

[link removed] (click here to opt-out)

Powered by Cvent

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a