| From | USAFacts <[email protected]> |

| Subject | US credit rating downgrade: what it means |

| Date | August 15, 2023 1:30 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Plus, data on wildfires.

View this email in your browser ([link removed])

[link removed]

** Credit complaints are growing…and growing

------------------------------------------------------------

Consumer dissatisfaction with credit reporting and repair services has grown recently, capturing the attention of the Consumer Financial Protection Bureau (CFPB). While complaints concerning other consumer services monitored by the CFPB (mortgage lending, debt collection) have remained relatively stable, credit reporting complaints rose by 336% between 2019 and 2022. USAFacts has an exploration ([link removed]) of the causes of this surge.

* Credit reporting involves compiling and maintaining one’s credit history to assess creditworthiness. Credit repair services aim to help people improve their credit standing by disputing inaccuracies and removing negative items.

Was this forwarded to you? Subscribe here. ([link removed])

[link removed]

In 2022, the three major credit reporting services – Equifax, Experian, and TransUnion – received 542,673 complaints that consumers filed with the CFPB. This was about 90% of all consumer complaints the CFPB received last year.

* People made about 8,100 complaints a month in 2017. The average increased over the years, reaching 74,300 monthly complaints during the first five months of 2023.

* Data from the Federal Trade Commission shows that consumers reported losing nearly $8.8 billion in fraud in 2022, an increase of more than 30% from the year prior.

* The CFPB received many “fraud or scamming” complaints against credit repair services. It notes that some services use deceptive practices that sometimes result in no significant credit score alterations.

See more here ([link removed]) , including what the CFPB director said about the big three credit reporting agencies.

** New at USAFacts: What’s the health of your state?

------------------------------------------------------------

USAFacts is collecting metrics for a data snapshot of health in every state. Select your state ([link removed]) and see how much money is spent on healthcare, how many people don’t have insurance, the death rates for certain diseases, life expectancy, birth rates, and much more. Use these facts to compare your state to the national average ([link removed]) and make choices about your health, public policy, and lawmakers.

[link removed]

** What does a US credit rating downgrade mean?

------------------------------------------------------------

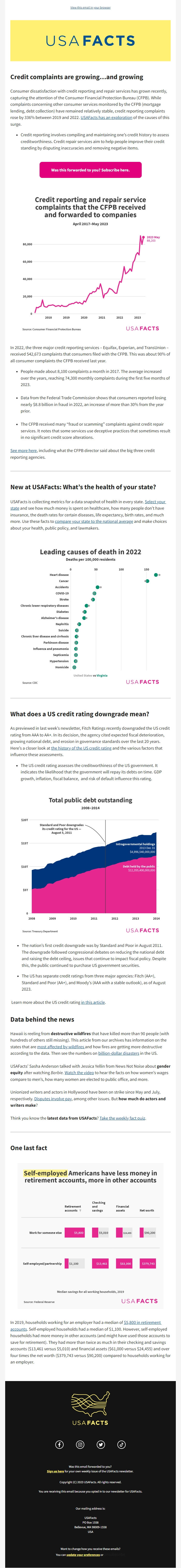

As previewed in last week’s newsletter, Fitch Ratings recently downgraded the US credit rating from AAA to AA+. In its decision, the agency cited expected fiscal deterioration, growing national debt, and erosion in governance standards over the last 20 years. Here’s a closer look at the history of the US credit rating ([link removed]) and the various factors that influence these assessments.

* The US credit rating assesses the creditworthiness of the US government. It indicates the likelihood that the government will repay its debts on time. GDP growth, inflation, fiscal balance, and risk of default influence this rating.

[link removed]

* The nation’s first credit downgrade was by Standard and Poor in August 2011. The downgrade followed congressional debates on reducing the national debt and raising the debt ceiling, issues that continue to impact fiscal policy. Despite this, the public continued to purchase US government securities.

* The US has separate credit ratings from three major agencies: Fitch (AA+), Standard and Poor (AA+), and Moody’s (AAA with a stable outlook), as of August 2023.

Learn more about the US credit rating in this article ([link removed]) .

** Data behind the news

------------------------------------------------------------

Hawaii is reeling from destructive wildfires that have killed more than 90 people (with hundreds of others still missing). This article from our archives has information on the states that are most affected by wildfires ([link removed]) and how fires are getting more destructive according to the data. Then see the numbers on billion-dollar disasters ([link removed]) in the US.

USAFacts’ Sasha Anderson talked with Jessica Yellin from News Not Noise about gender equity after watching Barbie. Watch the video ([link removed]) to hear the facts on how women’s wages compare to men’s, how many women are elected to public office, and more.

Unionized writers and actors in Hollywood have been on strike since May and July, respectively. Disputes involve pay ([link removed]) , among other issues. But how much do actors and writers make?

Think you know the latest data from USAFacts? Take the weekly fact quiz ([link removed]) .

** One last fact

------------------------------------------------------------

[link removed]

In 2019, households working for an employer had a median of $5,800 in retirement accounts ([link removed]) . Self-employed households had a median of $1,100. However, self-employed households had more money in other accounts (and might have used those accounts to save for retirement). They had more than twice as much in their checking and savings accounts ($13,461 versus $5,010) and financial assets ($61,000 versus $24,455) and over four times the net worth ($379,743 versus $90,200) compared to households working for an employer.

[link removed] [link removed] [link removed] [link removed]

Was this email forwarded to you?

Sign up here ([link removed]) for your own weekly issue of the USAFacts newsletter.

Copyright (C) 2023 USAFacts. All rights reserved.

You are receiving this email because you opted in to our newsletter for USAFacts.

Our mailing address is:

USAFacts

PO Box 1558

Bellevue, WA 98009-1558

USA

Want to change how you receive these emails?

You can

update your preferences ([link removed]) or unsubscribe ([link removed])

View this email in your browser ([link removed])

[link removed]

** Credit complaints are growing…and growing

------------------------------------------------------------

Consumer dissatisfaction with credit reporting and repair services has grown recently, capturing the attention of the Consumer Financial Protection Bureau (CFPB). While complaints concerning other consumer services monitored by the CFPB (mortgage lending, debt collection) have remained relatively stable, credit reporting complaints rose by 336% between 2019 and 2022. USAFacts has an exploration ([link removed]) of the causes of this surge.

* Credit reporting involves compiling and maintaining one’s credit history to assess creditworthiness. Credit repair services aim to help people improve their credit standing by disputing inaccuracies and removing negative items.

Was this forwarded to you? Subscribe here. ([link removed])

[link removed]

In 2022, the three major credit reporting services – Equifax, Experian, and TransUnion – received 542,673 complaints that consumers filed with the CFPB. This was about 90% of all consumer complaints the CFPB received last year.

* People made about 8,100 complaints a month in 2017. The average increased over the years, reaching 74,300 monthly complaints during the first five months of 2023.

* Data from the Federal Trade Commission shows that consumers reported losing nearly $8.8 billion in fraud in 2022, an increase of more than 30% from the year prior.

* The CFPB received many “fraud or scamming” complaints against credit repair services. It notes that some services use deceptive practices that sometimes result in no significant credit score alterations.

See more here ([link removed]) , including what the CFPB director said about the big three credit reporting agencies.

** New at USAFacts: What’s the health of your state?

------------------------------------------------------------

USAFacts is collecting metrics for a data snapshot of health in every state. Select your state ([link removed]) and see how much money is spent on healthcare, how many people don’t have insurance, the death rates for certain diseases, life expectancy, birth rates, and much more. Use these facts to compare your state to the national average ([link removed]) and make choices about your health, public policy, and lawmakers.

[link removed]

** What does a US credit rating downgrade mean?

------------------------------------------------------------

As previewed in last week’s newsletter, Fitch Ratings recently downgraded the US credit rating from AAA to AA+. In its decision, the agency cited expected fiscal deterioration, growing national debt, and erosion in governance standards over the last 20 years. Here’s a closer look at the history of the US credit rating ([link removed]) and the various factors that influence these assessments.

* The US credit rating assesses the creditworthiness of the US government. It indicates the likelihood that the government will repay its debts on time. GDP growth, inflation, fiscal balance, and risk of default influence this rating.

[link removed]

* The nation’s first credit downgrade was by Standard and Poor in August 2011. The downgrade followed congressional debates on reducing the national debt and raising the debt ceiling, issues that continue to impact fiscal policy. Despite this, the public continued to purchase US government securities.

* The US has separate credit ratings from three major agencies: Fitch (AA+), Standard and Poor (AA+), and Moody’s (AAA with a stable outlook), as of August 2023.

Learn more about the US credit rating in this article ([link removed]) .

** Data behind the news

------------------------------------------------------------

Hawaii is reeling from destructive wildfires that have killed more than 90 people (with hundreds of others still missing). This article from our archives has information on the states that are most affected by wildfires ([link removed]) and how fires are getting more destructive according to the data. Then see the numbers on billion-dollar disasters ([link removed]) in the US.

USAFacts’ Sasha Anderson talked with Jessica Yellin from News Not Noise about gender equity after watching Barbie. Watch the video ([link removed]) to hear the facts on how women’s wages compare to men’s, how many women are elected to public office, and more.

Unionized writers and actors in Hollywood have been on strike since May and July, respectively. Disputes involve pay ([link removed]) , among other issues. But how much do actors and writers make?

Think you know the latest data from USAFacts? Take the weekly fact quiz ([link removed]) .

** One last fact

------------------------------------------------------------

[link removed]

In 2019, households working for an employer had a median of $5,800 in retirement accounts ([link removed]) . Self-employed households had a median of $1,100. However, self-employed households had more money in other accounts (and might have used those accounts to save for retirement). They had more than twice as much in their checking and savings accounts ($13,461 versus $5,010) and financial assets ($61,000 versus $24,455) and over four times the net worth ($379,743 versus $90,200) compared to households working for an employer.

[link removed] [link removed] [link removed] [link removed]

Was this email forwarded to you?

Sign up here ([link removed]) for your own weekly issue of the USAFacts newsletter.

Copyright (C) 2023 USAFacts. All rights reserved.

You are receiving this email because you opted in to our newsletter for USAFacts.

Our mailing address is:

USAFacts

PO Box 1558

Bellevue, WA 98009-1558

USA

Want to change how you receive these emails?

You can

update your preferences ([link removed]) or unsubscribe ([link removed])

Message Analysis

- Sender: USAFacts

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp