| From | Fraser Institute <[email protected]> |

| Subject | BC debt, New Brunswick's spending restraint, and Measuring energy subsidies |

| Date | August 12, 2023 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email.

==============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

==============

Latest Research

-------------

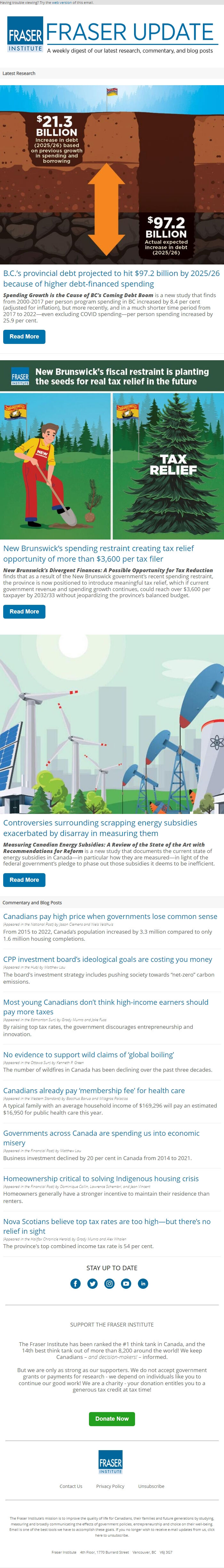

B.C.’s provincial debt projected to hit $97.2 billion by 2025/26 because of higher debt-financed spending

Spending Growth is the Cause of BC’s Coming Debt Boom is a new study that finds from 2000-2017 per person program spending in BC increased by 8.4 per cent (adjusted for inflation), but more recently, and in a much shorter time period from 2017 to 2022—even excluding COVID spending—per person spending increased by 25.9 per cent.

Read More [[link removed]]

New Brunswick’s spending restraint creating tax relief opportunity of more than $3,600 per tax filer

New Brunswick’s Divergent Finances: A Possible Opportunity for Tax Reduction finds that as a result of the New Brunswick government’s recent spending restraint, the province is now positioned to introduce meaningful tax relief, which if current government revenue and spending growth continues, could reach over $3,600 per taxpayer by 2032/33 without jeopardizing the province’s balanced budget.

Read More [[link removed]]

Controversies surrounding scrapping energy subsidies exacerbated by disarray in measuring them

Measuring Canadian Energy Subsidies: A Review of the State of the Art with Recommendations for Reform is a new study that documents the current state of energy subsidies in Canada—in particular how they are measured—in light of the federal government’s pledge to phase out those subsidies it deems to be inefficient.

Read More [[link removed]]

Commentary and Blog Posts

-------------

Canadians pay high price when governments lose common sense [[link removed]]

(Appeared in the National Post) by Jason Clemens and Niels Veldhuis

From 2015 to 2022, Canada’s population increased by 3.3 million compared to only 1.6 million housing completions.

CPP investment board’s ideological goals are costing you money [[link removed]]

(Appeared in the Hub) by Matthew Lau

The board's investment strategy includes pushing society towards “net-zero” carbon emissions.

Most young Canadians don’t think high-income earners should pay more taxes [[link removed]]

(Appeared in the Edmonton Sun) by Grady Munro and Jake Fuss

By raising top tax rates, the government discourages entrepreneurship and innovation.

No evidence to support wild claims of ‘global boiling’ [[link removed]]

(Appeared in the Ottawa Sun) by Kenneth P. Green

The number of wildfires in Canada has been declining over the past three decades.

Canadians already pay ‘membership fee’ for health care [[link removed]]

(Appeared in the Western Standard) by Bacchus Barua and Milagros Palacios

A typical family with an average household income of $169,296 will pay an estimated $16,950 for public health care this year.

Governments across Canada are spending us into economic misery [[link removed]]

(Appeared in the Financial Post) by Matthew Lau

Business investment declined by 20 per cent in Canada from 2014 to 2021.

Homeownership critical to solving Indigenous housing crisis [[link removed]]

(Appeared in the Financial Post) by Dominique Collin, Lawrence Schembri, and Jean Vincent

Homeowners generally have a stronger incentive to maintain their residence than renters.

Nova Scotians believe top tax rates are too high—but there’s no relief in sight [[link removed]]

(Appeared in the Halifax Chronicle Herald) by Grady Munro and Alex Whalen

The province's top combined income tax rate is 54 per cent.

SUPPORT THE FRASER INSTITUTE

-------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

==============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

==============

Latest Research

-------------

B.C.’s provincial debt projected to hit $97.2 billion by 2025/26 because of higher debt-financed spending

Spending Growth is the Cause of BC’s Coming Debt Boom is a new study that finds from 2000-2017 per person program spending in BC increased by 8.4 per cent (adjusted for inflation), but more recently, and in a much shorter time period from 2017 to 2022—even excluding COVID spending—per person spending increased by 25.9 per cent.

Read More [[link removed]]

New Brunswick’s spending restraint creating tax relief opportunity of more than $3,600 per tax filer

New Brunswick’s Divergent Finances: A Possible Opportunity for Tax Reduction finds that as a result of the New Brunswick government’s recent spending restraint, the province is now positioned to introduce meaningful tax relief, which if current government revenue and spending growth continues, could reach over $3,600 per taxpayer by 2032/33 without jeopardizing the province’s balanced budget.

Read More [[link removed]]

Controversies surrounding scrapping energy subsidies exacerbated by disarray in measuring them

Measuring Canadian Energy Subsidies: A Review of the State of the Art with Recommendations for Reform is a new study that documents the current state of energy subsidies in Canada—in particular how they are measured—in light of the federal government’s pledge to phase out those subsidies it deems to be inefficient.

Read More [[link removed]]

Commentary and Blog Posts

-------------

Canadians pay high price when governments lose common sense [[link removed]]

(Appeared in the National Post) by Jason Clemens and Niels Veldhuis

From 2015 to 2022, Canada’s population increased by 3.3 million compared to only 1.6 million housing completions.

CPP investment board’s ideological goals are costing you money [[link removed]]

(Appeared in the Hub) by Matthew Lau

The board's investment strategy includes pushing society towards “net-zero” carbon emissions.

Most young Canadians don’t think high-income earners should pay more taxes [[link removed]]

(Appeared in the Edmonton Sun) by Grady Munro and Jake Fuss

By raising top tax rates, the government discourages entrepreneurship and innovation.

No evidence to support wild claims of ‘global boiling’ [[link removed]]

(Appeared in the Ottawa Sun) by Kenneth P. Green

The number of wildfires in Canada has been declining over the past three decades.

Canadians already pay ‘membership fee’ for health care [[link removed]]

(Appeared in the Western Standard) by Bacchus Barua and Milagros Palacios

A typical family with an average household income of $169,296 will pay an estimated $16,950 for public health care this year.

Governments across Canada are spending us into economic misery [[link removed]]

(Appeared in the Financial Post) by Matthew Lau

Business investment declined by 20 per cent in Canada from 2014 to 2021.

Homeownership critical to solving Indigenous housing crisis [[link removed]]

(Appeared in the Financial Post) by Dominique Collin, Lawrence Schembri, and Jean Vincent

Homeowners generally have a stronger incentive to maintain their residence than renters.

Nova Scotians believe top tax rates are too high—but there’s no relief in sight [[link removed]]

(Appeared in the Halifax Chronicle Herald) by Grady Munro and Alex Whalen

The province's top combined income tax rate is 54 per cent.

SUPPORT THE FRASER INSTITUTE

-------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor