Good morning, David Rumsey here. It’s been a wild year for ESPN, which has navigated layoffs, strategic partner discussions with the biggest sports leagues in the world, and crucial negotiations for media rights. Now, 2023 is about to get even wilder for the network, which is taking a massive gamble by entering the sports betting space with PENN Entertainment.

Alongside my colleagues Eric Fisher, Mike McCarthy, and Doug Greenberg, we’re breaking down every aspect of one of the biggest stories of the year in the business of sports.

|

|

|

|

Ron Chenoy-USA TODAY Sports

|

|

ESPN’s $2 billion deal with PENN Entertainment to create ESPN Bet represents a massive bet on its ability to break what has quickly become a U.S. sports betting duopoly between FanDuel and DraftKings.

In the five years since the U.S. Supreme Court allowed individual states to set their own sports betting rules, FanDuel and DraftKings have used large marketing spends and their existing presence in fantasy sports to collectively control more than 70% of the domestic online sports wagering market. Including Caesars and BetMGM, the combined market share reaches about 90%, leaving any other operator competing for scraps.

Even as key new states such as New York have entered the market over the past two years, FanDuel and DraftKings quickly established the same level of market dominance, helping lead to the demise of a growing series of former challengers including MaximBet, Fubo Sportsbook, Churchill Downs, theScore, and most recently, Fox Bet.

“Best case, at least in the short term, is ESPN and PENN getting on the podium,” into third place, Dustin Gouker, a sports betting consultant and longtime gaming journalist, told Front Office Sports. “PENN clearly calculated there was far greater upside in this deal than staying with Barstool, and they may have already hit a ceiling with Barstool. So PENN is clearly saying ESPN is the bigger brand, which it obviously is, and that they can go further now.”

Exactly how much further rests in large part on how aggressively ESPN puts its marketing muscle behind the pact. The PENN Entertainment deal specifically calls for high levels of content integration for ESPN Bet within ESPN’s ecosystem and access to network talent.

But the forthcoming NFL season — set to be a major sports betting event and roughly coinciding with the fall debut of ESPN Bet — will serve as a critical indicator on the depth of ESPN’s intentions with this deal.

“What I’m looking to see is how motivated ESPN really is in helping to convert users,” Gouker said. “If they really get behind this, there’s certainly room for growth.”

That growth, however, could be additionally challenged by not only the established incumbents, but by Fanatics, newly buttressed with its $225 million purchase of PointsBet’s U.S. operations.

|

|

|

|

|

Graphic by FOS Design Team

|

|

ESPN and PENN Entertainment have branded their $2 billion deal to create ESPN Bet no less than “The Future of Sports Media & Betting” and laid out its vision for the agreement in a detailed presentation to investors.

The deal deck, filed with the U.S. Securities & Exchange Commission, provides a window into the ambition the Disney-owned sports media giant and Pennsylvania-based gaming company have for the pact.

Perhaps most notable in the deck is a projection that ESPN Bet will reach as high as a 20% share of the domestic online sports betting market by 2027, an ambitious goal likely requiring breaking into the solid duopoly currently held by FanDuel and DraftKings.

Among the other key deal terms:

- PENN Entertainment will oversee the daily operations of the Sportsbook and retain all customer data.

- The agreement looks to leverage PENN Entertainment’s database of 27 million customers and ESPN’s digital portfolio of 370 million social media followers, more than 100 million monthly digital unique users, more than 25 million subscribers of ESPN+, and 11 million for its fantasy mobile app.

- In addition to the $500 million in committed stock warrants in PENN Entertainment, ESPN can also earn performance warrants of up to 6.4 million additional shares, currently worth about $159 million, based on ESPN Bet market share. Achieving those performance warrants would require ESPN Bet to gain at least 20% market share.

- PENN Entertainment believes the pact will provide an estimated $500 million to $1 billion in annual, long-term adjusted earnings potential in its interactive segment.

- ESPN holds an option to appoint a member to the PENN Entertainment board after the deal’s third year or a non-voting observer at any time.

Jay Snowden, PENN CEO and president, called the deal “another major milestone in Penn’s evolution from a pure-play U.S. regional gaming operator to a North American entertainment leader.”

|

|

|

|

|

Christopher Hanewinckel-USA TODAY Sports

|

|

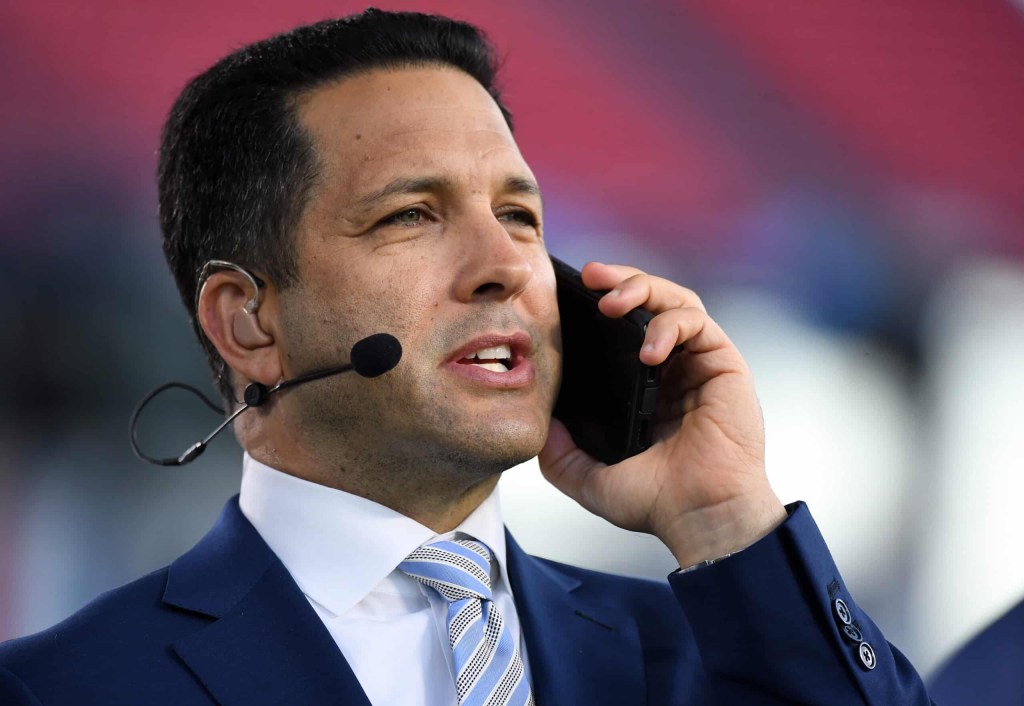

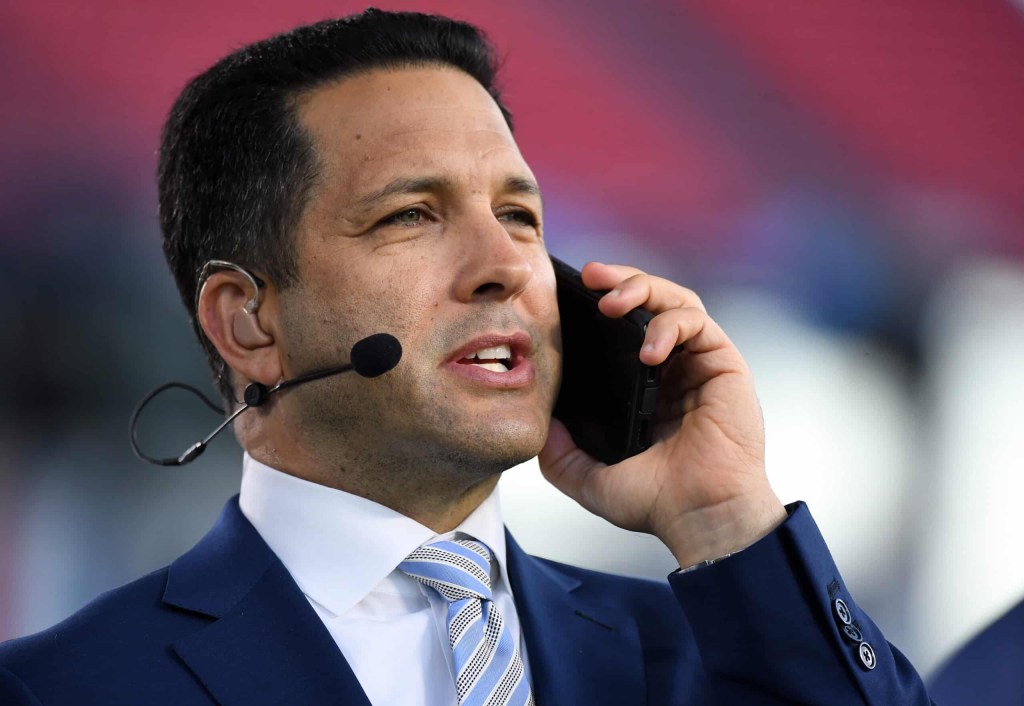

During the NBA Draft, sports bettors cried foul when hoops insider Shams Charania seemingly moved betting lines around a top draft pick.

Charania’s credentials as a reporter weren’t in question. It was his part-time job with FanDuel Sportsbook that led to conflict-of-interest charges.

The next player to step into the minefield will be ESPN. The sports giant — home of league insiders like Adam Schefter (NFL), Adrian Wojnarowski (NBA), and Jeff Passan (MLB) — will now face the responsibility that comes with the power to impact markets with a single tweet.

ESPN’s $2 billion, 10-year deal with PENN Entertainment to rebrand Barstool Sportsbooks “ESPN Bet” is a giant gamble — and one that raises questions.

Will we see Wojnarowski touting picks on ESPN’s “Daily Wager?” What roles, if any, will Woj, Schefter, Passan, and others play with ESPN Bet?

The word out of ESPN is that it will implement strict lines of demarcation between journalism and sports betting. The network’s insiders will be kept far away from gambling-focused programs like “Daily Wager,” sources told Front Office Sports.

On Tuesday, ESPN vowed to continue its “high standard of journalistic integrity when covering the sports betting space.” It also promised to develop a committee on “responsible gaming.”

But things get murky quickly when it comes to sports betting. Ever since the NFL backtracked on its long-standing opposition to sports betting, it has struggled with an outbreak of gambling violations by players. And more than a year ago, it was Wojnarowski who apparently changed the odds on Draft night.

As the saying goes, the next best thing to playing and winning is playing and losing. ESPN is about to roll the dice.

|

|

|

|

|

David Butler II-USA TODAY Sports

|

|

Beyond its wide-ranging impact on the sports betting space, Tuesday’s bombshell ESPN-PENN Entertainment deal also has huge ramifications in sports media — especially for Dave Portnoy, who will regain 100% ownership of Barstool Sports, the company he founded in 2003.

PENN said it sold Barstool back to Portnoy “in exchange for certain non-compete and other restrictive covenants” and has the right to receive 50% of the gross proceeds received by Portnoy “in any subsequent sale or other monetization event of Barstool.”

From that language, it appears Portnoy is essentially getting back Barstool — sans the betting businesses — for “free,” and has no plans for new investors.

“I am never going to sell Barstool Sports, ever,” Portnoy said in a video that gained six million views on Twitter in just 90 minutes on Tuesday. “I’ll hold it until I die.”

In February, PENN completed its purchase of Barstool for a total of $550 million. At the time, PENN Entertainment CEO and president Jay Snowden said that, “Barstool, combined with theScore’s reach and highly engaged user base, creates a massive digital footprint and ecosystem that will serve to propel Barstool Sportsbook and our uniquely integrated media and gaming business.”

If it was unclear whether Portnoy would be a part of Barstool long-term under PENN’s ownership, that question is now irrelevant. “Everytime I think I’m out, they pull me back in,” Portnoy said.

Portnoy will emphasize content as Barstool pivots from running sports betting operations.

|

|

|

|

- Alabama head coach Nick Saban’s newly purchased $17.5 million oceanfront home in Jupiter Island, Florida has some serious specs. The 6,200-square-foot property boasts six bedrooms, floor-to-ceiling windows, a private garden, and a dock and boat lift. Check it out.

- In January, Georgia recruiting staffer Victoria Bowles survived the crash that killed DL Devin Willock and another staff member. Less than a month ago, she filed a lawsuit against the university’s athletic association — and was fired.

|

|

| Penn is turning to ESPN after three years of Barstool branding. |

| Presidents from the ACC reportedly met on Tuesday morning. |

| Redick spoke to FOS about ESPN's layoffs, NBA coverage

outlook. |

|

|

Would you place a bet on an ESPN-branded sportsbook?

|

|

Tuesday’s Answer

51% of respondents attend 1-3 concerts a year, and 24% of respondents attend 4+ concerts a year.

|

|

|