Email

More families can take advantage of valuable tax benefits by saving back-to-school shopping receipts

| From | Minnesota Department of Revenue <[email protected]> |

| Subject | More families can take advantage of valuable tax benefits by saving back-to-school shopping receipts |

| Date | August 8, 2023 6:51 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

General header

*More families can take advantage of valuable tax benefits by saving back-to-school shopping receipts *

*ST. PAUL, Minn.* ? Back-to-school time can also be tax savings time for Minnesota families who save receipts on school supply purchases. The Minnesota Department of Revenue reminds parents and caregivers to save receipts on school supply purchases to claim valuable K-12 tax benefits when filing their taxes next year. In addition, due to changes made during the legislative session, over 31,000 more Minnesota families will be able to claim the credit this year.

Two tax benefits can help Minnesota families pay expenses related to their child?s education: the refundable K-12 Education Credit [ [link removed] ] (income limits apply) and the K-12 Education Subtraction [ [link removed] ] (no income limits).

?As a parent and grandparent, I know the strain that families feel during back-to-school time trying to balance the need for new school supplies with other family expenses,? said Revenue Commissioner Paul Marquart. ?Saving school supply shopping receipts and claiming either the K-12 Education Subtraction or the expanded K-12 Education Credit will help Minnesota families save some money when filing their taxes next year.?

Last year, more than 17,000 families received the K-12 Education Credit for an average credit of $280. Over 134,000 families received the K-12 Education Subtraction for an average subtraction of $1,266.

These programs reduce the tax parents pay and could deliver a larger refund when filing a Minnesota income tax return. To qualify, the purchases must be for educational services or required materials. The child must be attending kindergarten through 12th grade at a public, private, or qualified home school and meet other qualifications.

*Save those receipts*

Remember to save your receipts to claim the credit or subtraction. Use a folder or envelope to store receipts for the upcoming tax filing season or pick up a special envelope at our State Fair booth, located in the Education Building.

?Most expenses [ [link removed] ] for educational instruction or materials qualify, including:

* Paper

* Pens and notebooks

* Textbooks

* Rental or purchases of educational equipment such as musical instruments

* Computer hardware (hotspots, modems, and routers) and educational software (up to $200 for the subtraction and $200 for the credit) *

* After-school tutoring and educational summer camps taught by a qualified instructor

*Fees for internet service do not qualify

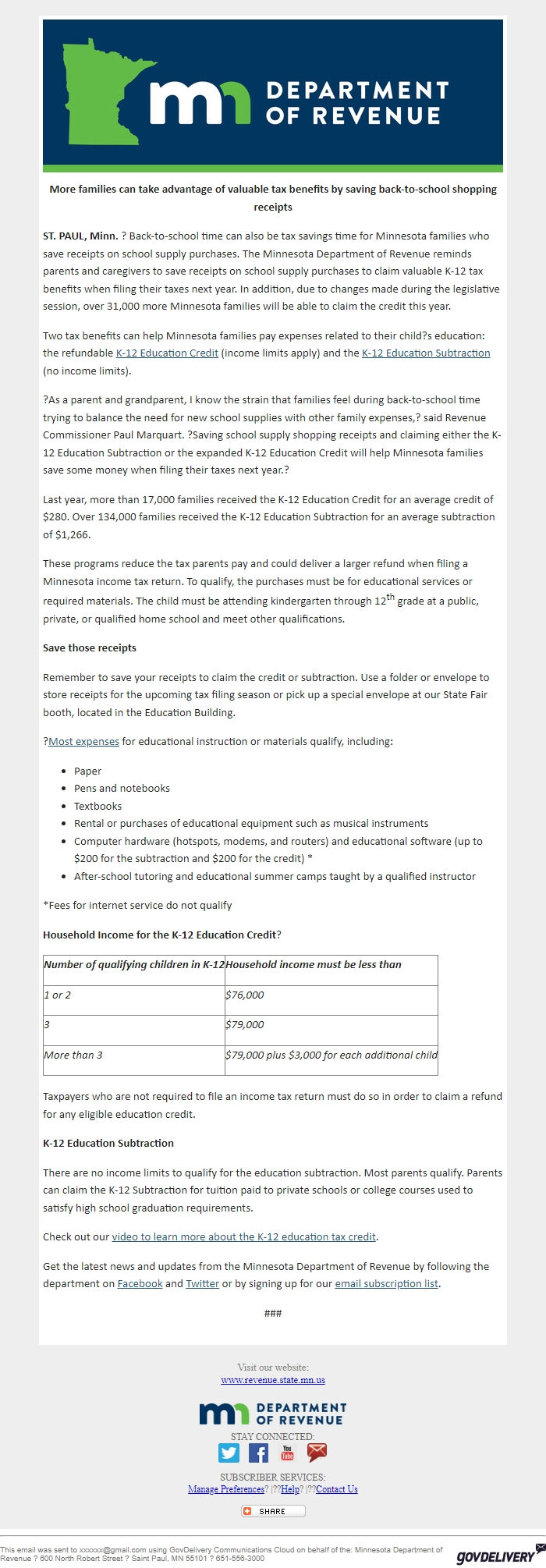

*Household Income for the K-12 Education Credit*?

"*Number of qualifying children in K-12*"

"*Household income must be less than*"

"1 or 2"

"$7""6,000"

"3"

"$7""9,000"

"M""ore than 3"

"$""79,000 plus"" $3,000 for each additional child"

Taxpayers who are not required to file an income tax return must do so in order to claim a refund for any eligible education credit.

*K-12 Education Subtraction*

There are no income limits to qualify for the education subtraction. Most parents qualify. Parents can claim the K-12 Subtraction for tuition paid to private schools or college courses used to satisfy high school graduation requirements.

Check out our video to learn more about the K-12 education tax credit [ [link removed] ].

Get the latest news and updates from the Minnesota Department of Revenue by following the department on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for our email subscription list [ [link removed] ].

###

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

*More families can take advantage of valuable tax benefits by saving back-to-school shopping receipts *

*ST. PAUL, Minn.* ? Back-to-school time can also be tax savings time for Minnesota families who save receipts on school supply purchases. The Minnesota Department of Revenue reminds parents and caregivers to save receipts on school supply purchases to claim valuable K-12 tax benefits when filing their taxes next year. In addition, due to changes made during the legislative session, over 31,000 more Minnesota families will be able to claim the credit this year.

Two tax benefits can help Minnesota families pay expenses related to their child?s education: the refundable K-12 Education Credit [ [link removed] ] (income limits apply) and the K-12 Education Subtraction [ [link removed] ] (no income limits).

?As a parent and grandparent, I know the strain that families feel during back-to-school time trying to balance the need for new school supplies with other family expenses,? said Revenue Commissioner Paul Marquart. ?Saving school supply shopping receipts and claiming either the K-12 Education Subtraction or the expanded K-12 Education Credit will help Minnesota families save some money when filing their taxes next year.?

Last year, more than 17,000 families received the K-12 Education Credit for an average credit of $280. Over 134,000 families received the K-12 Education Subtraction for an average subtraction of $1,266.

These programs reduce the tax parents pay and could deliver a larger refund when filing a Minnesota income tax return. To qualify, the purchases must be for educational services or required materials. The child must be attending kindergarten through 12th grade at a public, private, or qualified home school and meet other qualifications.

*Save those receipts*

Remember to save your receipts to claim the credit or subtraction. Use a folder or envelope to store receipts for the upcoming tax filing season or pick up a special envelope at our State Fair booth, located in the Education Building.

?Most expenses [ [link removed] ] for educational instruction or materials qualify, including:

* Paper

* Pens and notebooks

* Textbooks

* Rental or purchases of educational equipment such as musical instruments

* Computer hardware (hotspots, modems, and routers) and educational software (up to $200 for the subtraction and $200 for the credit) *

* After-school tutoring and educational summer camps taught by a qualified instructor

*Fees for internet service do not qualify

*Household Income for the K-12 Education Credit*?

"*Number of qualifying children in K-12*"

"*Household income must be less than*"

"1 or 2"

"$7""6,000"

"3"

"$7""9,000"

"M""ore than 3"

"$""79,000 plus"" $3,000 for each additional child"

Taxpayers who are not required to file an income tax return must do so in order to claim a refund for any eligible education credit.

*K-12 Education Subtraction*

There are no income limits to qualify for the education subtraction. Most parents qualify. Parents can claim the K-12 Subtraction for tuition paid to private schools or college courses used to satisfy high school graduation requirements.

Check out our video to learn more about the K-12 education tax credit [ [link removed] ].

Get the latest news and updates from the Minnesota Department of Revenue by following the department on Facebook [ [link removed] ] and Twitter [ [link removed] ] or by signing up for our email subscription list [ [link removed] ].

###

Visit our website:

www.revenue.state.mn.us [ [link removed] ]

Logo

STAY CONNECTED: Visit us on Twitter [ [link removed] ] Find us on Facebook [ [link removed] ] Visit us on YouTube [ [link removed] ] Sign up for email updates [ [link removed] ]

SUBSCRIBER SERVICES:

Manage Preferences [ [link removed] ]? |??Help [ [link removed] ]? |??Contact Us [ [link removed] ]

Bookmark and Share [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of the: Minnesota Department of Revenue ? 600 North Robert Street ? Saint Paul, MN 55101 ? 651-556-3000 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Minnesota Department of Revenue

- Political Party: n/a

- Country: United States

- State/Locality: Minnesota

- Office: n/a

-

Email Providers:

- govDelivery