| From | Civic Action <[email protected]> |

| Subject | The Tapback: Something's Up |

| Date | August 1, 2023 7:44 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

A who’s who of economists have spent the last year arguing that in order to reduce inflation, millions of people had to be thrown out of work . To cite just two: former Treasury Secretary Larry Summers insisted [[link removed]] last June that “ we need five years of unemployment above 5% to contain inflation —in other words, we need two years of 7.5% unemployment or five years of 6% unemployment or one year of 10% unemployment.” Former White House economic advisor Jason Furman ran some numbers through a model [[link removed]] and had a similar take: by his analysis, lowering inflation would require “ 6.5% unemployment for two years .”

Jump ahead to today, and inflation has mellowed, wages are up, and unemployment remains at historic lows — suggesting to any conscious observer that the mainstream neoliberal consensus got something fundamentally wrong last year . But when Washington Post reporter Jeff Stein asked Furman if he had revised his projection on whether 6.5% unemployment was still “necessary” in the light of the wave of positive economic news, Furman replied that “ nothing in the data would cause you to revise your view [[link removed]] .” And sure, everybody is going to get some predictions wrong, but if real-world outcomes don’t force you to re-think your analysis — especially when that analysis led you to call for millions of people to lose their jobs — why should anyone turn to you for anything but comic relief?

Make it make sense.

Three Numbers [[link removed]]

870,000 new businesses [[link removed]] likely to hire employees [[link removed]] were created in the first half of this year. This is the second-highest pace of new business formation on record .

$38 million [[link removed]] in tax savings was banked by a single billionaire who “donated” his own mansion to his own private foundation [[link removed]] , part of a trend among the ultrawealthy to cut their tax bills by transferring real estate, paintings, and other artwork to supposedly charitable organizations under their control. Surprisingly, none have yet cut out the middleman and simply argued that tax avoidance itself is an art.

$49/hour [[link removed]] will be the top rate paid to UPS package car drivers under the new contract their union negotiated [[link removed]] with the company. Up against a strike deadline, UPS also agreed to air-condition cars , eliminate mandatory overtime on days off, and make other improvements.

A Chart [[link removed]]

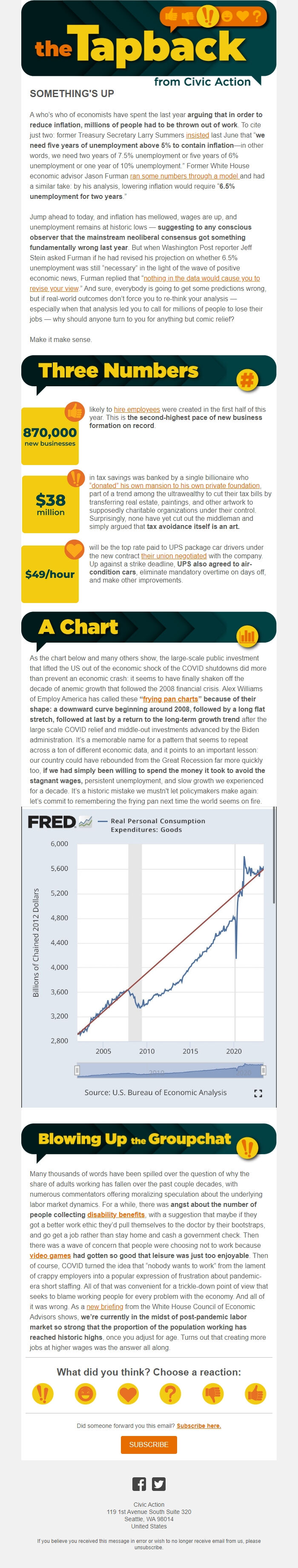

As the chart below and many others show, the large-scale public investment that lifted the US out of the economic shock of the COVID shutdowns did more than prevent an economic crash: it seems to have finally shaken off the decade of anemic growth that followed the 2008 financial crisis. Alex Williams of Employ America has called these “ frying pan charts [[link removed]] ” because of their shape: a downward curve beginning around 2008, followed by a long flat stretch, followed at last by a return to the long-term growth trend after the large scale COVID relief and middle-out investments advanced by the Biden administration. It’s a memorable name for a pattern that seems to repeat across a ton of different economic data, and it points to an important lesson: our country could have rebounded from the Great Recession far more quickly too, if we had simply been willing to spend the money it took to avoid the stagnant wages, persistent unemployment, and slow growth we experienced for a decade. It’s a historic mistake we mustn't let policymakers make again: let’s commit to remembering the frying pan next time the world seems on fire.

Chart showing Real Personal Consumption Expenditures: Goods. Source is FRED (Federal Reserve Economic Data) [[link removed]]

Blowing up the Groupchat [[link removed]]

Many thousands of words have been spilled over the question of why the share of adults working has fallen over the past couple decades, with numerous commentators offering moralizing speculation about the underlying labor market dynamics. For a while, there was angst about the number of people collecting disability benefits [[link removed]] , with a suggestion that maybe if they got a better work ethic they’d pull themselves to the doctor by their bootstraps, and go get a job rather than stay home and cash a government check. Then there was a wave of concern that people were choosing not to work because video games [[link removed]] had gotten so good that leisure was just too enjoyable . Then of course, COVID turned the idea that “nobody wants to work” from the lament of crappy employers into a popular expression of frustration about pandemic-era short staffing. All of that was convenient for a trickle-down point of view that seeks to blame working people for every problem with the economy. And all of it was wrong. As a new briefing [[link removed]] from the White House Council of Economic Advisors shows, we’re currently in the midst of post-pandemic labor market so strong that the proportion of the population working has reached historic highs , once you adjust for age. Turns out that creating more jobs at higher wages was the answer all along.

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Jump ahead to today, and inflation has mellowed, wages are up, and unemployment remains at historic lows — suggesting to any conscious observer that the mainstream neoliberal consensus got something fundamentally wrong last year . But when Washington Post reporter Jeff Stein asked Furman if he had revised his projection on whether 6.5% unemployment was still “necessary” in the light of the wave of positive economic news, Furman replied that “ nothing in the data would cause you to revise your view [[link removed]] .” And sure, everybody is going to get some predictions wrong, but if real-world outcomes don’t force you to re-think your analysis — especially when that analysis led you to call for millions of people to lose their jobs — why should anyone turn to you for anything but comic relief?

Make it make sense.

Three Numbers [[link removed]]

870,000 new businesses [[link removed]] likely to hire employees [[link removed]] were created in the first half of this year. This is the second-highest pace of new business formation on record .

$38 million [[link removed]] in tax savings was banked by a single billionaire who “donated” his own mansion to his own private foundation [[link removed]] , part of a trend among the ultrawealthy to cut their tax bills by transferring real estate, paintings, and other artwork to supposedly charitable organizations under their control. Surprisingly, none have yet cut out the middleman and simply argued that tax avoidance itself is an art.

$49/hour [[link removed]] will be the top rate paid to UPS package car drivers under the new contract their union negotiated [[link removed]] with the company. Up against a strike deadline, UPS also agreed to air-condition cars , eliminate mandatory overtime on days off, and make other improvements.

A Chart [[link removed]]

As the chart below and many others show, the large-scale public investment that lifted the US out of the economic shock of the COVID shutdowns did more than prevent an economic crash: it seems to have finally shaken off the decade of anemic growth that followed the 2008 financial crisis. Alex Williams of Employ America has called these “ frying pan charts [[link removed]] ” because of their shape: a downward curve beginning around 2008, followed by a long flat stretch, followed at last by a return to the long-term growth trend after the large scale COVID relief and middle-out investments advanced by the Biden administration. It’s a memorable name for a pattern that seems to repeat across a ton of different economic data, and it points to an important lesson: our country could have rebounded from the Great Recession far more quickly too, if we had simply been willing to spend the money it took to avoid the stagnant wages, persistent unemployment, and slow growth we experienced for a decade. It’s a historic mistake we mustn't let policymakers make again: let’s commit to remembering the frying pan next time the world seems on fire.

Chart showing Real Personal Consumption Expenditures: Goods. Source is FRED (Federal Reserve Economic Data) [[link removed]]

Blowing up the Groupchat [[link removed]]

Many thousands of words have been spilled over the question of why the share of adults working has fallen over the past couple decades, with numerous commentators offering moralizing speculation about the underlying labor market dynamics. For a while, there was angst about the number of people collecting disability benefits [[link removed]] , with a suggestion that maybe if they got a better work ethic they’d pull themselves to the doctor by their bootstraps, and go get a job rather than stay home and cash a government check. Then there was a wave of concern that people were choosing not to work because video games [[link removed]] had gotten so good that leisure was just too enjoyable . Then of course, COVID turned the idea that “nobody wants to work” from the lament of crappy employers into a popular expression of frustration about pandemic-era short staffing. All of that was convenient for a trickle-down point of view that seeks to blame working people for every problem with the economy. And all of it was wrong. As a new briefing [[link removed]] from the White House Council of Economic Advisors shows, we’re currently in the midst of post-pandemic labor market so strong that the proportion of the population working has reached historic highs , once you adjust for age. Turns out that creating more jobs at higher wages was the answer all along.

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Message Analysis

- Sender: Civic Action

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- EveryAction