July 31, 2023

Permission to republish original opeds and cartoons granted.

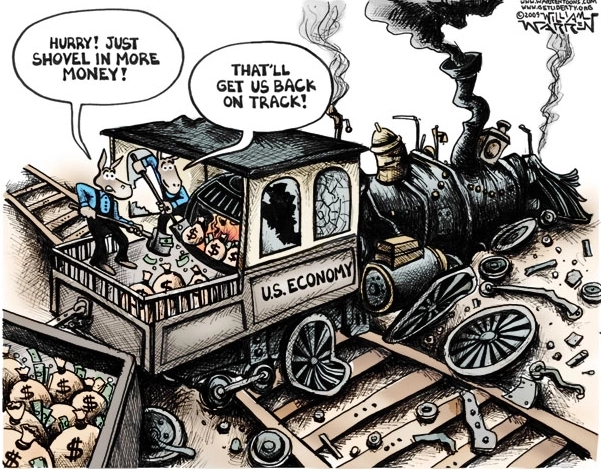

If the Inflation Reduction Act workedwhy is the Federal Reserve still hiking interest rates to fight inflation?

By Robert Romano

Another month, and another interest rate hike by theFederal Reserve on July 26, this time to 5.25 to 5.5 percent, to combat sticky inflation that hasbeleaguered the U.S. economy since 2021 when consumer inflation first rose above 5percent annualized in June 2021 to 5.4 percent, up to 7.5 percent by Jan. 2022 immediately prior to Russia’sinvasion of Ukraine, and peaking at 9.1 percent in June 2022.

Since then, as global oil and othermarkets have stabilized from the Covid recession, economic lockdowns andproduction halts from 2020 — wherein demand recovered sooner than supply,resulting in the inflation — annualized inflation has cooled hitting 4.9 percent in April, 4 percent in May and 3 percent in June.

With the price spikes of 2022 largelyin the rearview mirror, gasoline is now down 26.5 percent the past 12 months,fuel oil is down 36.6 percent and piped gas service is down 18.6 percent.

Unfortunately, core inflation stillremains quite sticky, that is, inflation minus food and energy, still coming inat 4.8 percent the past 12 months, although that is owed no thanks to food, theprices of which have grown by 5.7 percent the past 12 months.

Electricity is still up 5.4 percentthe past year.

New cars are up 4.1 percent.

Medical care commodities are up 4.2percent.

Shelter is up a whopping 7.8 percent.

And transportation services are up8.2 percent.

With that in mind, the Fed is stillhiking rates. Speaking at a press conferencefollowing the central bank’s rate hike on July 26, Federal Reserve Chairman JeromePowell stated, “My colleagues and I are acutely aware that high inflationimposes significant hardship as it erodes purchasing power, especially forthose least able to meet the higher costs of essentials like food, housing, andtransportation… We have been seeing the effects of our policy tightening ondemand in the most interest-rate-sensitive sectors of the economy, particularlyhousing and investment. It will take time, however, for the full effects of ourongoing monetary restraint to be realized, especially on inflation. Inaddition, the economy is facing headwinds from tighter credit conditions forhouseholds and businesses, which are likely to weigh on economic activity,hiring, and inflation.”

Powell added a word of warning,“Reducing inflation is likely to require a period of below-trend growth andsome softening of labor market conditions.”

That is, either an economic slowdownor even a recession. Unemployment is still near record lows, currently at 3.6 percent in June and the Federal Reserve in June projected it to keep rise steadily to 4.1percent this year and up to 4.5 percent in 2024, an implied 1.3 million jobslosses between then and now, as it sees inflation continuing to cool off fromits current levels. And it only sees 1 percent inflation-adjusted economicgrowth in 2023, 1.1 percent in 2024 and 1.8 percent in 2025.

However, those GDP estimates werefrom a month ago, and the minutes for the Fed’s July meeting are not yetavailable. Since then, the Bureau of Economic Analysis reported 2.4 percentinflation-adjusted growth in the second quarter, following a 2 percent increasein the first quarter. So, to hit just 1 percent growth for the entire yearwould require almost no growth or negative growth going forward.

At the press conference, Powellacknowledged that the June reading of consumer inflation was better thanexpected, and so was the second quarter economic growth numbers. And he alsonoted that stronger growth might lead to further inflation, and so is stillholding out for further rate hikes at future meetings, stating, “we're going tolook at two additional job reports, two additional CPI reports, lots ofactivity data, and that's what we're going to look at and we're going to makethat decision then. And that decision could mean another hike in September, orit could mean that we decide to maintain at that level…”

Meaning, the current business cyclecould still have some life left to it. Usually, disinflation or even deflationcoincide with upticks in the unemployment rate, but so far, that hasn’thappened — yet. But if inflation were about to do another set of upticks,necessitating more rate hikes, that could indicate that peak employment couldpersist for several more months before cooling off, leading to layoffs and theinevitable increase in unemployment.

Interestingly, nowhere in the pressconference was the 2022 Inflation Reduction Act passed by Congress even mentioned.Apparently, despite its moniker, the legislation, which included green energysubsidies, has nothing to do with monetary policy and the actions that acentral bank must take to curb inflation, including reducing or restricting thegrowth of the M2 money supply, which grew by almost $7 trillionfrom 2020 to 2022 thanks to Congress spending about that much and the national debt skyrocketing by $8 trillion, to counteract the effects ofthe economic lockdowns and productions halts and slowdowns from Covid.

Given how much was spent, borrowedand printed into existence, at the same time as production and economicactivity was slowing down, the most significant thing Congress could do wouldbe to cut spending and reduce deficits and borrowing, as it did with the most recent debt ceiling increase, which reinstated budgetsequestration to reduce the growth of spending by $1.5 trillion below theprevious baseline.

But even if spending was held steady —it won’t as Social Security and Medicarespending continue to skyrocket over the coming decade amid the Baby Boomer retirement wave— that still would not soak up all the additional dollars that were created byCongress and the Fed in the first place. The only mechanism we have right nowto destroy the dollars are higher interest rates charged to banks, which arepassed on to consumers. It’s called the hidden tax for a reason. And Powell issaying as long as the inflation persists, the Fed may keep on hiking, untilsuch time that economic activity and labor markets do respond. Stay tuned.

Robert Romano is the Vice Presidentof Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2023/07/if-the-inflation-reduction-act-worked-why-is-the-federal-reserve-still-hiking-interest-rates-to-fight-inflation/

Video: Jack Smith Doesn’t Get ToChoose Who’s Qualified To Be President

To view online: https://www.youtube.com/watch?v=k9EBtJViSkU

Video: Harriot Hageman Calls MayorkasA Tyrant To His Face

To view online: https://www.youtube.com/watch?v=hfW1Khem8sI

Video: DOJ Tries To Jail WitnessTestifying Against Hunter Biden