Email

Research Release: This year Ottawa will spend more on federal interest payments than on employment insurance benefits

| From | Niels Veldhuis <[email protected]> |

| Subject | Research Release: This year Ottawa will spend more on federal interest payments than on employment insurance benefits |

| Date | February 19, 2020 12:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Dear John,

Today, the Fraser Institute released a new study, Interest Costs and their Growing Burden on Canadians([link removed]).

This study finds that in fiscal year 2019-20, Ottawa will spend more than $24 billion on federal debt interest payments, as the federal debt has increased by more than $260 billion since the 2008-09 recession. The study also compares government debt interest costs among provinces.

Below is the news release and accompanying infographic. Please share with your colleagues and friends.

Best,

Niels

Niels Veldhuis | President

The Fraser Institute

1770 Burrard Street, 4thFloor, Vancouver, BC V6J 3G7

www.fraserinstitute.org ([link removed])

Follow the Fraser Institute on Twitter ([link removed]), Facebook ([link removed])and YouTube ([link removed])

Visit our newEssential Scholars website ([link removed])

+++++++++++++++++++++++++++++++

This year Ottawa will spend more on federal interest payments than on employment insurance benefits

VANCOUVER—In fiscal year 2019-20, Ottawa will spend more than $24 billion on federal interest payments, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Since the 2008-09 recession, the federal debt has increased by more than $260 billion, and taxpayers are on the hook for the increased interest costs,” said Jake Fuss, Fraser Institute economist and coauthor of Interest Costs and their Growing Burden on Canadians ([link removed]).

For example, this year the federal government will spend a projected $24.4 billion on interest payments on the federal debt—considerably more than Ottawa expects to spend on employment insurance benefits ($19.3 billion). And more than this year’s projection for the Canada Child Benefit ($24.1 billion), a monthly payment made to eligible families with children.

Consequently, interest costs on the federal debt will consume 7.2 per cent of federal revenues in 2019-20, despite historically low interest rates. Put differently, federal interest costs will equal $649 per Canadian.

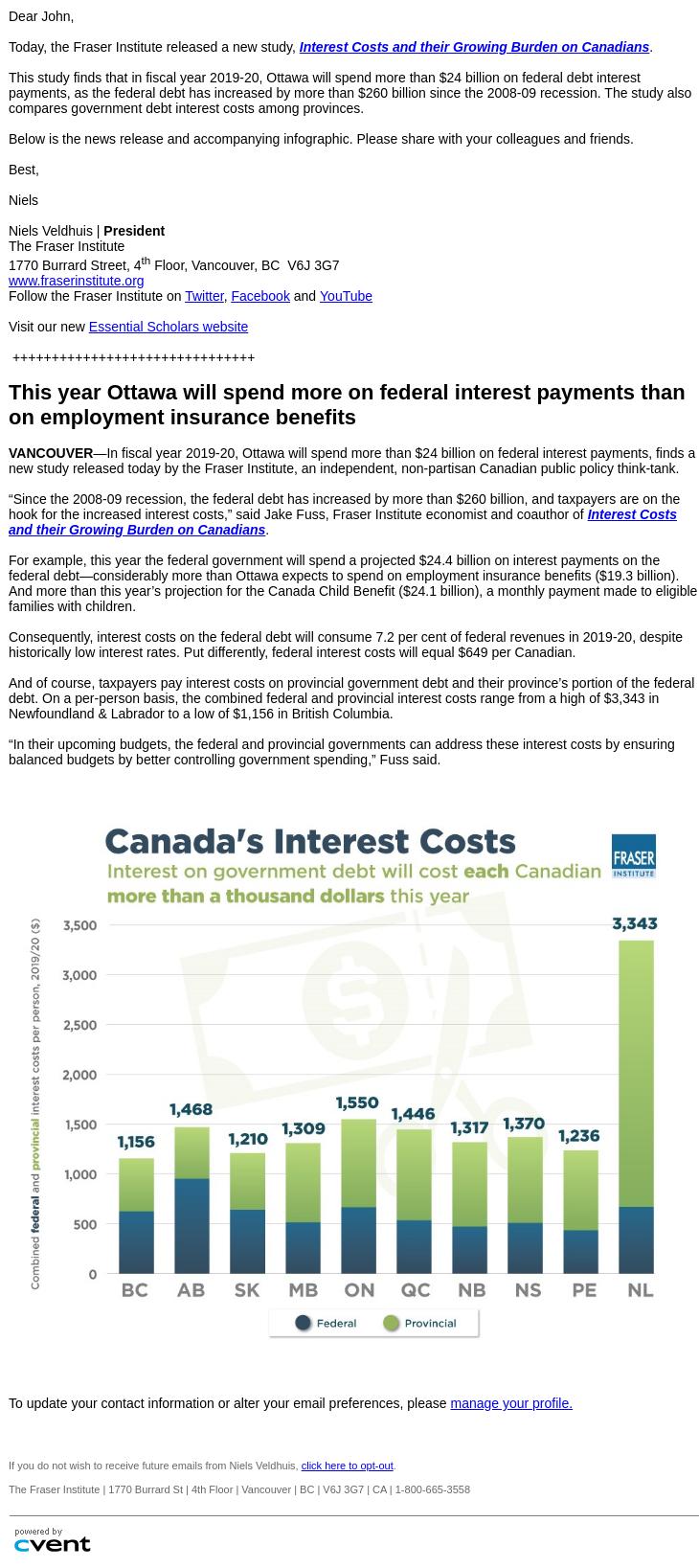

And of course, taxpayers pay interest costs on provincial government debt and their province’s portion of the federal debt. On a per-person basis, the combined federal and provincial interest costs range from a high of $3,343 in Newfoundland & Labrador to a low of $1,156 in British Columbia.

“In their upcoming budgets, the federal and provincial governments can address these interest costs by ensuring balanced budgets by better controlling government spending,” Fuss said.

To update your contact information or alter your emailpreferences, please [link removed] (manage your profile.)

If you do not wish to receive future emails from Niels Veldhuis, go to:

[link removed] (click here to opt-out)

The Fraser Institute | 1770 Burrard St | 4th Floor | Vancouver | BC | V6J 3G7 | CA | 1-800-665-3558

Powered by Cvent

Today, the Fraser Institute released a new study, Interest Costs and their Growing Burden on Canadians([link removed]).

This study finds that in fiscal year 2019-20, Ottawa will spend more than $24 billion on federal debt interest payments, as the federal debt has increased by more than $260 billion since the 2008-09 recession. The study also compares government debt interest costs among provinces.

Below is the news release and accompanying infographic. Please share with your colleagues and friends.

Best,

Niels

Niels Veldhuis | President

The Fraser Institute

1770 Burrard Street, 4thFloor, Vancouver, BC V6J 3G7

www.fraserinstitute.org ([link removed])

Follow the Fraser Institute on Twitter ([link removed]), Facebook ([link removed])and YouTube ([link removed])

Visit our newEssential Scholars website ([link removed])

+++++++++++++++++++++++++++++++

This year Ottawa will spend more on federal interest payments than on employment insurance benefits

VANCOUVER—In fiscal year 2019-20, Ottawa will spend more than $24 billion on federal interest payments, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Since the 2008-09 recession, the federal debt has increased by more than $260 billion, and taxpayers are on the hook for the increased interest costs,” said Jake Fuss, Fraser Institute economist and coauthor of Interest Costs and their Growing Burden on Canadians ([link removed]).

For example, this year the federal government will spend a projected $24.4 billion on interest payments on the federal debt—considerably more than Ottawa expects to spend on employment insurance benefits ($19.3 billion). And more than this year’s projection for the Canada Child Benefit ($24.1 billion), a monthly payment made to eligible families with children.

Consequently, interest costs on the federal debt will consume 7.2 per cent of federal revenues in 2019-20, despite historically low interest rates. Put differently, federal interest costs will equal $649 per Canadian.

And of course, taxpayers pay interest costs on provincial government debt and their province’s portion of the federal debt. On a per-person basis, the combined federal and provincial interest costs range from a high of $3,343 in Newfoundland & Labrador to a low of $1,156 in British Columbia.

“In their upcoming budgets, the federal and provincial governments can address these interest costs by ensuring balanced budgets by better controlling government spending,” Fuss said.

To update your contact information or alter your emailpreferences, please [link removed] (manage your profile.)

If you do not wish to receive future emails from Niels Veldhuis, go to:

[link removed] (click here to opt-out)

The Fraser Institute | 1770 Burrard St | 4th Floor | Vancouver | BC | V6J 3G7 | CA | 1-800-665-3558

Powered by Cvent

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a