| From | Fraser Institute <[email protected]> |

| Subject | Income tax rates, Canada's slow economic growth, and ESG disclosures |

| Date | July 15, 2023 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email.

==============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

==============

Latest Research

-------------

58% of Canadians believe personal income tax rates should not exceed 50%

A Poll of Canadians on the Fair Share of Taxes finds that the majority of Canadians (58 per cent) believe personal income tax rates should not exceed 50 per cent, and yet the top combined personal income tax rate in every province (except Alberta and Saskatchewan) currently exceeds 50 per cent.

Read More [[link removed]]

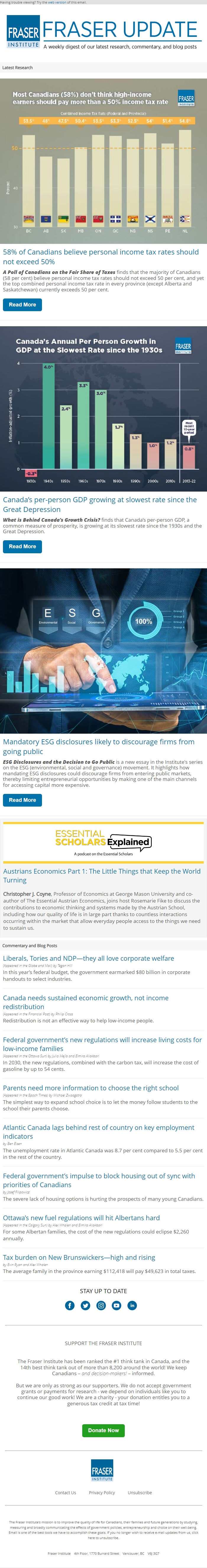

Canada’s per-person GDP growing at slowest rate since the Great Depression

What is Behind Canada’s Growth Crisis? finds that Canada’s per-person GDP, a common measure of prosperity, is growing at its slowest rate since the 1930s and the Great Depression.

Read More [[link removed]]

Mandatory ESG disclosures likely to discourage firms from going public

ESG Disclosures and the Decision to Go Public is a new essay in the Institute's series on the ESG (environmental, social and governance) movement. It highlights how mandating ESG disclosures could discourage firms from entering public markets, thereby limiting entrepreneurial opportunities by making one of the main channels for accessing capital more expensive.

Read More [[link removed]]

Essential Scholars Explained Podcast

-------------

Austrians Economics Part 1: The Little Things that Keep the World Turning [[link removed]]

Christopher J. Coyne, Professor of Economics at George Mason University and co-author of The Essential Austrian Economics, joins host Rosemarie Fike to discuss the contributions to economic thinking and systems made by the Austrian School, including how our quality of life is in large part thanks to countless interactions occurring within the market that allow everyday people access to the things we need to sustain us.

Commentary and Blog Posts

-------------

Liberals, Tories and NDP—they all love corporate welfare [[link removed]]

(Appeared in the Globe and Mail) by Tegan Hill

In this year’s federal budget, the government earmarked $80 billion in corporate handouts to select industries.

Canada needs sustained economic growth, not income redistribution [[link removed]]

(Appeared in the Financial Post) by Philip Cross

Redistribution is not an effective way to help low-income people.

Federal government’s new regulations will increase living costs for low-income families [[link removed]]

(Appeared in the Ottawa Sun) by Julio Mejía and Elmira Aliakbari

In 2030, the new regulations, combined with the carbon tax, will increase the cost of gasoline by up to 54 cents.

Parents need more information to choose the right school [[link removed]]

(Appeared in the Epoch Times) by Michael Zwaagstra

The simplest way to expand school choice is to let the money follow students to the school their parents choose.

Atlantic Canada lags behind rest of country on key employment indicators [[link removed]]

by Ben Eisen

The unemployment rate in Atlantic Canada was 8.7 per cent compared to 5.5 per cent in the rest of the country.

Federal government’s impulse to block housing out of sync with priorities of Canadians [[link removed]]

by Josef Filipowicz

The severe lack of housing options is hurting the prospects of many young Canadians.

Ottawa’s new fuel regulations will hit Albertans hard [[link removed]]

(Appeared in the Calgary Sun) by Alex Whalen and Elmira Aliakbari

For some Albertan families, the cost of the new regulations could eclipse $2,260 annually.

Tax burden on New Brunswickers—high and rising [[link removed]]

by Evin Ryan and Alex Whalen

The average family in the province earning $112,418 will pay $49,623 in total taxes.

SUPPORT THE FRASER INSTITUTE

-------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

==============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

==============

Latest Research

-------------

58% of Canadians believe personal income tax rates should not exceed 50%

A Poll of Canadians on the Fair Share of Taxes finds that the majority of Canadians (58 per cent) believe personal income tax rates should not exceed 50 per cent, and yet the top combined personal income tax rate in every province (except Alberta and Saskatchewan) currently exceeds 50 per cent.

Read More [[link removed]]

Canada’s per-person GDP growing at slowest rate since the Great Depression

What is Behind Canada’s Growth Crisis? finds that Canada’s per-person GDP, a common measure of prosperity, is growing at its slowest rate since the 1930s and the Great Depression.

Read More [[link removed]]

Mandatory ESG disclosures likely to discourage firms from going public

ESG Disclosures and the Decision to Go Public is a new essay in the Institute's series on the ESG (environmental, social and governance) movement. It highlights how mandating ESG disclosures could discourage firms from entering public markets, thereby limiting entrepreneurial opportunities by making one of the main channels for accessing capital more expensive.

Read More [[link removed]]

Essential Scholars Explained Podcast

-------------

Austrians Economics Part 1: The Little Things that Keep the World Turning [[link removed]]

Christopher J. Coyne, Professor of Economics at George Mason University and co-author of The Essential Austrian Economics, joins host Rosemarie Fike to discuss the contributions to economic thinking and systems made by the Austrian School, including how our quality of life is in large part thanks to countless interactions occurring within the market that allow everyday people access to the things we need to sustain us.

Commentary and Blog Posts

-------------

Liberals, Tories and NDP—they all love corporate welfare [[link removed]]

(Appeared in the Globe and Mail) by Tegan Hill

In this year’s federal budget, the government earmarked $80 billion in corporate handouts to select industries.

Canada needs sustained economic growth, not income redistribution [[link removed]]

(Appeared in the Financial Post) by Philip Cross

Redistribution is not an effective way to help low-income people.

Federal government’s new regulations will increase living costs for low-income families [[link removed]]

(Appeared in the Ottawa Sun) by Julio Mejía and Elmira Aliakbari

In 2030, the new regulations, combined with the carbon tax, will increase the cost of gasoline by up to 54 cents.

Parents need more information to choose the right school [[link removed]]

(Appeared in the Epoch Times) by Michael Zwaagstra

The simplest way to expand school choice is to let the money follow students to the school their parents choose.

Atlantic Canada lags behind rest of country on key employment indicators [[link removed]]

by Ben Eisen

The unemployment rate in Atlantic Canada was 8.7 per cent compared to 5.5 per cent in the rest of the country.

Federal government’s impulse to block housing out of sync with priorities of Canadians [[link removed]]

by Josef Filipowicz

The severe lack of housing options is hurting the prospects of many young Canadians.

Ottawa’s new fuel regulations will hit Albertans hard [[link removed]]

(Appeared in the Calgary Sun) by Alex Whalen and Elmira Aliakbari

For some Albertan families, the cost of the new regulations could eclipse $2,260 annually.

Tax burden on New Brunswickers—high and rising [[link removed]]

by Evin Ryan and Alex Whalen

The average family in the province earning $112,418 will pay $49,623 in total taxes.

SUPPORT THE FRASER INSTITUTE

-------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor