Email

ESG... or BSG? The growing gap between Wendy’s promises of social responsibility and reality...

| From | Coalition of Immokalee Workers <[email protected]> |

| Subject | ESG... or BSG? The growing gap between Wendy’s promises of social responsibility and reality... |

| Date | January 30, 2020 2:38 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

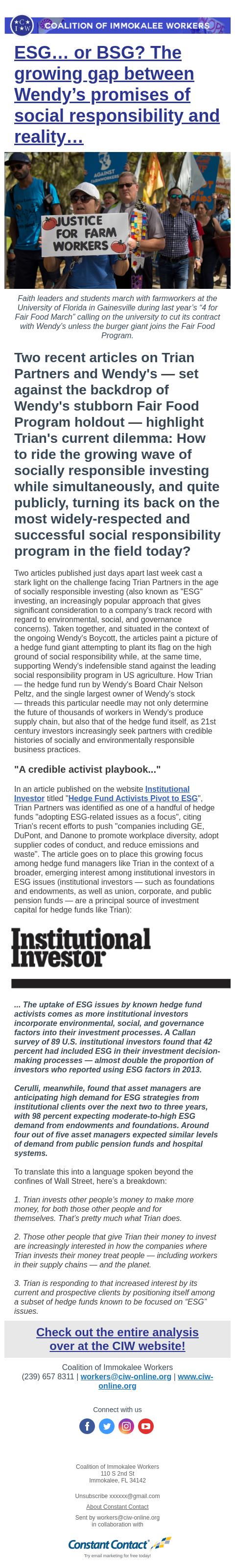

How can Trian Partners ride the growing wave of socially responsible investing while simultaneously turning its back on the most widely-respected and successful social responsibility program in the field today? ESG… or BSG? The growing gap between Wendy’s promises of social responsibility and reality… Faith leaders and students march with farmworkers at the University of Florida in Gainesville during last year’s “4 for Fair Food March” calling on the university to cut its contract with Wendy’s unless the burger giant joins the Fair Food Program. Two recent articles on Trian Partners and Wendy's — set against the backdrop of Wendy's stubborn Fair Food Program holdout — highlight Trian's current dilemma: How to ride the growing wave of socially responsible investing while simultaneously, and quite publicly, turning its back on the most widely-respected and successful social responsibility program in the field today? Two articles published just days apart last week cast a stark light on the challenge facing Trian Partners in the age of socially responsible investing (also known as "ESG" investing, an increasingly popular approach that gives significant consideration to a company's track record with regard to environmental, social, and governance concerns). Taken together, and situated in the context of the ongoing Wendy's Boycott, the articles paint a picture of a hedge fund giant attempting to plant its flag on the high ground of social responsibility while, at the same time, supporting Wendy's indefensible stand against the leading social responsibility program in US agriculture. How Trian — the hedge fund run by Wendy's Board Chair Nelson Peltz, and the single largest owner of Wendy's stock — threads this particular needle may not only determine the future of thousands of workers in Wendy's produce supply chain, but also that of the hedge fund itself, as 21st century investors increasingly seek partners with credible histories of socially and environmentally responsible business practices. "A credible activist playbook..." In an article published on the website Institutional Investor titled "Hedge Fund Activists Pivot to ESG", Trian Partners was identified as one of a handful of hedge funds "adopting ESG-related issues as a focus", citing Trian's recent efforts to push "companies including GE, DuPont, and Danone to promote workplace diversity, adopt supplier codes of conduct, and reduce emissions and waste". The article goes on to place this growing focus among hedge fund managers like Trian in the context of a broader, emerging interest among institutional investors in ESG issues (institutional investors — such as foundations and endowments, as well as union, corporate, and public pension funds — are a principal source of investment capital for hedge funds like Trian): ... The uptake of ESG issues by known hedge fund activists comes as more institutional investors incorporate environmental, social, and governance factors into their investment processes. A Callan survey of 89 U.S. institutional investors found that 42 percent had included ESG in their investment decision-making processes — almost double the proportion of investors who reported using ESG factors in 2013. Cerulli, meanwhile, found that asset managers are anticipating high demand for ESG strategies from institutional clients over the next two to three years, with 98 percent expecting moderate-to-high ESG demand from endowments and foundations. Around four out of five asset managers expected similar levels of demand from public pension funds and hospital systems. To translate this into a language spoken beyond the confines of Wall Street, here's a breakdown: 1. Trian invests other people’s money to make more money, for both those other people and for themselves. That’s pretty much what Trian does. 2. Those other people that give Trian their money to invest are increasingly interested in how the companies where Trian invests their money treat people — including workers in their supply chains — and the planet. 3. Trian is responding to that increased interest by its current and prospective clients by positioning itself among a subset of hedge funds known to be focused on “ESG” issues. Check out the entire analysis over at the CIW website! Coalition of Immokalee Workers (239) 657 8311 | [email protected] | www.ciw-online.org Connect with us Coalition of Immokalee Workers | 110 S 2nd St, Immokalee, FL 34142 Unsubscribe [email protected] About Constant Contact Sent by [email protected] in collaboration with Try email marketing for free today!

Message Analysis

- Sender: Coalition of Immokalee Workers

- Political Party: n/a

- Country: United States

- State/Locality: Florida Immokalee, Florida

- Office: n/a

-

Email Providers:

- Constant Contact