| From | Civic Action <[email protected]> |

| Subject | The Tapback: But Seriously |

| Date | July 11, 2023 3:52 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

BUT SERIOUSLY

If the recent New York Times editorial [[link removed]] calling on Serious People to treat the national debt as a Serious Problem requiring Painful Choices seemed familiar to you, that’s because they’ve been writing the same piece for the past 40 years or so. (Literally — in 1983 [[link removed]] the NYT carped that “large and growing deficits are unsustainable” and insisted that “anyone talking political sense in 1984 will address those choices.”) But 2023 is not 1983, and today we’re in an extraordinary moment where unemployment is down, wages are rising, and federal policymakers are rolling out billions of dollars of investments that are creating good jobs and strengthening local communities. To a human being that’s all good news and we need to keep it up… but in the trickle-down logic of Economics 101, good news is actually bad news because there’s a line on a graph that shows We Can’t Have Nice Things .

Here’s how today’s version plays out: inflation got too high, so “we” had to make the painful choice to raise interest rates to put people out of work and weaken the economy. Those higher interest rates increase the cost of servicing the national debt, so now “we” have to make the painful choice to cut Social Security and Medicare. Somehow the “painful choices” they urge are always painful for the same people .

Make it make sense.

Three Numbers [[link removed]]

75 companies [[link removed]] in France are being required by the government [[link removed]] to commit to cut specific prices on specific food items in order to reduce the strain of grocery bills on people’s budgets. The IMF recently estimated that higher profits are driving almost half the rise in prices in Europe.

$852 billion [[link removed]] in additional wealth [[link removed]] has been accumulated in the first half of this year by the 500 richest people in the world, only two of whom have publicly explored the possibility of a cage fight [[link removed]] . Our economy would be stronger if that money was instead circulating from worker paychecks to the cash registers of local restaurants to the paychecks of the wait staff, who then start the process all over again.

14 year olds [[link removed]] can now work legally in meat coolers in Iowa [[link removed]] , thanks to a recent rollback of child-labor protections in that state. But all is not lost: nobody has yet argued that the labor force begins at conception .

A Chart [[link removed]]

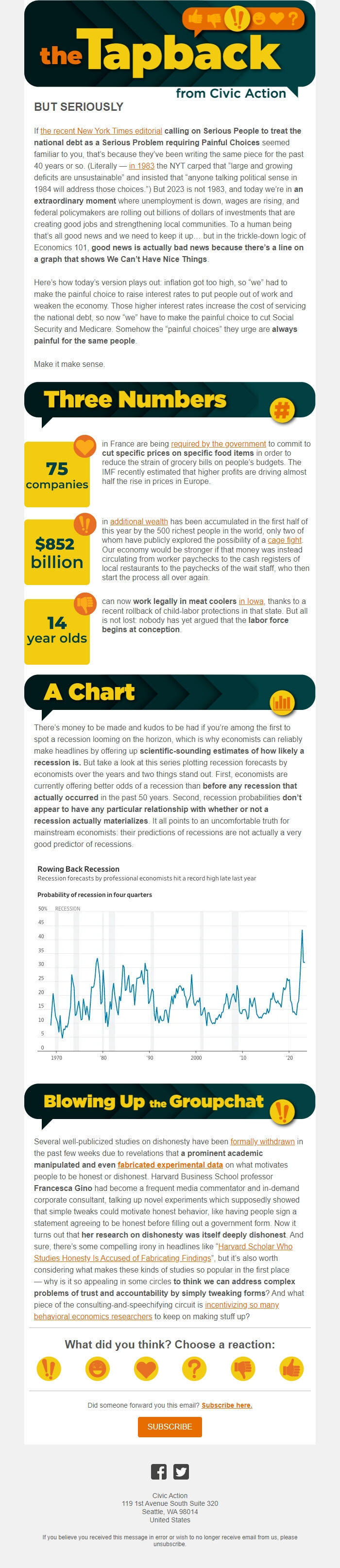

There’s money to be made and kudos to be had if you’re among the first to spot a recession looming on the horizon, which is why economists can reliably make headlines by offering up scientific-sounding estimates of how likely a recession is. But take a look at this series plotting recession forecasts by economists over the years and two things stand out. First, economists are currently offering better odds of a recession than before any recession that actually occurred in the past 50 years. Second, recession probabilities don’t appear to have any particular relationship with whether or not a recession actually materializes . It all points to an uncomfortable truth for mainstream economists: their predictions of recessions are not actually a very good predictor of recessions.

Chart showing recession forecasts by professional economists hitting a record low late last year [[link removed]]

Blowing up the Groupchat [[link removed]]

Several well-publicized studies on dishonesty have been formally withdrawn [[link removed]] in the past few weeks due to revelations that a prominent academic manipulated and even fabricated experimental data [[link removed]] on what motivates people to be honest or dishonest. Harvard Business School professor Francesca Gino had become a frequent media commentator and in-demand corporate consultant, talking up novel experiments which supposedly showed that simple tweaks could motivate honest behavior, like having people sign a statement agreeing to be honest before filling out a government form. Now it turns out that her research on dishonesty was itself deeply dishonest . And sure, there’s some compelling irony in headlines like “ Harvard Scholar Who Studies Honesty Is Accused of Fabricating Findings [[link removed]] ”, but it’s also worth considering what makes these kinds of studies so popular in the first place — why is it so appealing in some circles to think we can address complex problems of trust and accountability by simply tweaking forms ? And what piece of the consulting-and-speechifying circuit is incentivizing so many behavioral economics researchers [[link removed]] to keep on making stuff up?

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

If the recent New York Times editorial [[link removed]] calling on Serious People to treat the national debt as a Serious Problem requiring Painful Choices seemed familiar to you, that’s because they’ve been writing the same piece for the past 40 years or so. (Literally — in 1983 [[link removed]] the NYT carped that “large and growing deficits are unsustainable” and insisted that “anyone talking political sense in 1984 will address those choices.”) But 2023 is not 1983, and today we’re in an extraordinary moment where unemployment is down, wages are rising, and federal policymakers are rolling out billions of dollars of investments that are creating good jobs and strengthening local communities. To a human being that’s all good news and we need to keep it up… but in the trickle-down logic of Economics 101, good news is actually bad news because there’s a line on a graph that shows We Can’t Have Nice Things .

Here’s how today’s version plays out: inflation got too high, so “we” had to make the painful choice to raise interest rates to put people out of work and weaken the economy. Those higher interest rates increase the cost of servicing the national debt, so now “we” have to make the painful choice to cut Social Security and Medicare. Somehow the “painful choices” they urge are always painful for the same people .

Make it make sense.

Three Numbers [[link removed]]

75 companies [[link removed]] in France are being required by the government [[link removed]] to commit to cut specific prices on specific food items in order to reduce the strain of grocery bills on people’s budgets. The IMF recently estimated that higher profits are driving almost half the rise in prices in Europe.

$852 billion [[link removed]] in additional wealth [[link removed]] has been accumulated in the first half of this year by the 500 richest people in the world, only two of whom have publicly explored the possibility of a cage fight [[link removed]] . Our economy would be stronger if that money was instead circulating from worker paychecks to the cash registers of local restaurants to the paychecks of the wait staff, who then start the process all over again.

14 year olds [[link removed]] can now work legally in meat coolers in Iowa [[link removed]] , thanks to a recent rollback of child-labor protections in that state. But all is not lost: nobody has yet argued that the labor force begins at conception .

A Chart [[link removed]]

There’s money to be made and kudos to be had if you’re among the first to spot a recession looming on the horizon, which is why economists can reliably make headlines by offering up scientific-sounding estimates of how likely a recession is. But take a look at this series plotting recession forecasts by economists over the years and two things stand out. First, economists are currently offering better odds of a recession than before any recession that actually occurred in the past 50 years. Second, recession probabilities don’t appear to have any particular relationship with whether or not a recession actually materializes . It all points to an uncomfortable truth for mainstream economists: their predictions of recessions are not actually a very good predictor of recessions.

Chart showing recession forecasts by professional economists hitting a record low late last year [[link removed]]

Blowing up the Groupchat [[link removed]]

Several well-publicized studies on dishonesty have been formally withdrawn [[link removed]] in the past few weeks due to revelations that a prominent academic manipulated and even fabricated experimental data [[link removed]] on what motivates people to be honest or dishonest. Harvard Business School professor Francesca Gino had become a frequent media commentator and in-demand corporate consultant, talking up novel experiments which supposedly showed that simple tweaks could motivate honest behavior, like having people sign a statement agreeing to be honest before filling out a government form. Now it turns out that her research on dishonesty was itself deeply dishonest . And sure, there’s some compelling irony in headlines like “ Harvard Scholar Who Studies Honesty Is Accused of Fabricating Findings [[link removed]] ”, but it’s also worth considering what makes these kinds of studies so popular in the first place — why is it so appealing in some circles to think we can address complex problems of trust and accountability by simply tweaking forms ? And what piece of the consulting-and-speechifying circuit is incentivizing so many behavioral economics researchers [[link removed]] to keep on making stuff up?

What did you think? Choose a reaction:

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Did someone forward you this email? Subscribe here. [[link removed]]

SUBSCRIBE [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]]

Civic Action

119 1st Avenue South Suite 320

Seattle, WA 98014

United States

If you believe you received this message in error or wish to no longer receive email from us, please unsubscribe: [link removed] .

Message Analysis

- Sender: Civic Action

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- EveryAction