July 7, 2023

Permission to republish original opeds and cartoons granted.

Biden’s Favorability Plummets as a Third of Biden Voters Say They Support Robert F. Kennedy Jr.

By Bill Wilson

Joe Biden’s favorability rating is plunging deeper underwater in recent polls, with the latest Reuters and YouGov polls showing his approval rating sits at about 41% while 54% of Americans disapprove of the job he is doing as president.

It isn’t surprising, given that the Biden economy is barely sputtering along, inflation remains elevated, the border is as porous as sieve and the globalists continue to entangle us in the Russia-Ukraine conflict despite the majority of Americans wanting to reduce our expenditures there.

As much as the Democratic elite are attempting to downplay Biden’s weaknesses on virtually all fronts and drive him through another election cycle, alternative Democratic challengers are unsurprisingly looking like a better option to many Democrats. A recent poll conducted for Newsweek found a third of Democrats who voted for Biden in 2020 now support Robert F. Kennedy Jr. and his bid for the Democratic nomination.

This comes on top of a recent Echelon Insights poll showing only 60% of Democrats would “definitely” or “probably” back Joe Biden in the Democratic Primaries, with 33% saying they would back someone other than Biden and 7 percent undecided.

Within the group of alternative Democratic contenders, alt-left candidate Robert F. Kennedy Jr. is arguably Biden’s biggest threat at the moment. Kennedy has drawn the support of 14 percent of Democrats, but his favorability ratings indicate those numbers could increase substantially.

A recent YouGov poll found 49 percent of Americans hold a favorable view of Kennedy, while 30 percent hold an unfavorable opinion, giving him a net favorable rating of 19 points compared to Biden’s which is -11 points.

On top of that, Kennedy’s favorability ratings are rising in the same groups Biden is struggling with. YouGov polls show minorities, younger voters, and middle-income Americans are Kennedy’s biggest supporters.

Half of voters aged 18-29 view Kennedy in a positive light, giving him a net favorability rating of +27 points among young people, the highest of any age bracket. What is more, over half of middle-income earners have a positive view of Kennedy, and a full 62% of Black Americans view him favorably according to YouGov surveys. Kennedy’s support in polls sits at about 15%, but his favorability ratings signal that these numbers could climb substantially.

The border, the Russia-Ukraine conflict, and inflation are major pain points for the public, and polling conducted by Redfield & Wilton Strategies shows the economy is the number one issue for both Republicans and Democrats. A full 57% of Biden voters say the economy is the number one issue on which they’ll base their 2024 vote, while smaller shares cite abortion (45%), healthcare (43%), and housing and homelessness (29%) as the most important issues to their 2024 vote.

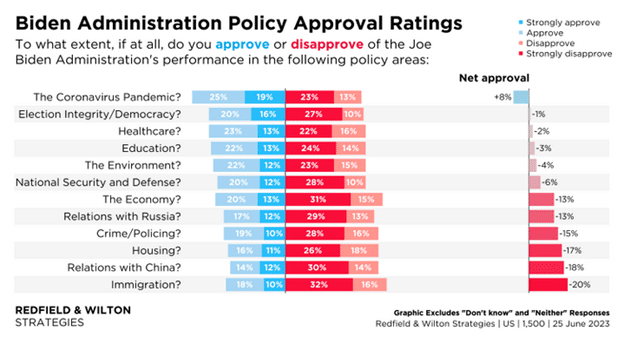

Unfortunately for Biden, the only key issue he has a net positive approval rating on is the coronavirus, which is in the rear-view mirror for most Americans.

Redfield & Wilton’s poll shows Biden’s approval ratings are net negative on eleven out of twelve issues except for one – the coronavirus. Biden has double-digit net negative ratings on the top three issues: immigration, the economy and foreign relations. His approval rating is -20 percent on immigration, -18 percent on relations with China, -15 percent on crime/policing, -13 percent on the economy and -13 percent on relations with Russia.

Biden’s polling numbers are marred in the low 40’s with no indication they’ll rise, but his administration continues to attempt to prop him up. This week Biden is being trotted out on his “Bidenomics” tour, where he’ll be attempting to showcase his economic accomplishments in an attempt to reverse those poling numbers. However, the public does not appear to be buying what Biden is selling. Alt-left candidates like Kennedy as well as third-party challengers like Cornel West are an increasing threat to Biden, and are on track to whittle down his support within his own party and weaken his position in the general election.

Bill Wilson is the former president of Americans for Limited Government.

To view online: https://dailytorch.com/2023/07/bidens-favorability-plummets-as-a-third-of-biden-voters-say-they-support-robert-f-kennedy-jr/

Video: Donald Trump: The People’s President

To view online: https://www.youtube.com/watch?v=Yh9ekCL3PIY

Video: Cocaine In White House: Biden & Carter Have Something Else In Common

To view online: https://www.youtube.com/watch?v=Rgoorey-DdI

Video: Team Biden Finds Convenient Scapegoat for Air Travel Woes

To view online: https://www.youtube.com/watch?v=vBNjunYnoAY

As hiring slows down, so does the economy

By Robert Romano

The U.S. economy added 209,000 jobs in June, according to the latest establishment survey by the Bureau of Labor Statistics, less than expected as 306,000 were added in May, as hiring slowed down nationwide. Meanwhile, the unemployment rate remained about the same at 3.6 percent.

Historically, when hiring slows down by establishments, that usually coincides with economic slowdowns and recessions. In the recent cycle, the 2020 and 2021 recovery from Covid notwithstanding, hiring peaked at about 5.2 percent annualized increase in Feb. 2022. Now, it’s down to 2.5 percent.

That might be worrying to President Joe Biden, who is facing reelection in 2024, but sometimes you just get slowdowns, such as in the mid-1980s and mid-1990s, where afterward you got another bump in hiring before a full-on recession ensued. So, which is it?

Job openings were also down almost 500,000 in May to 9.8 million, a 18.3 percent decrease from its 12 million peak in March 2022, which usually happens during economic slowdowns or recessions.

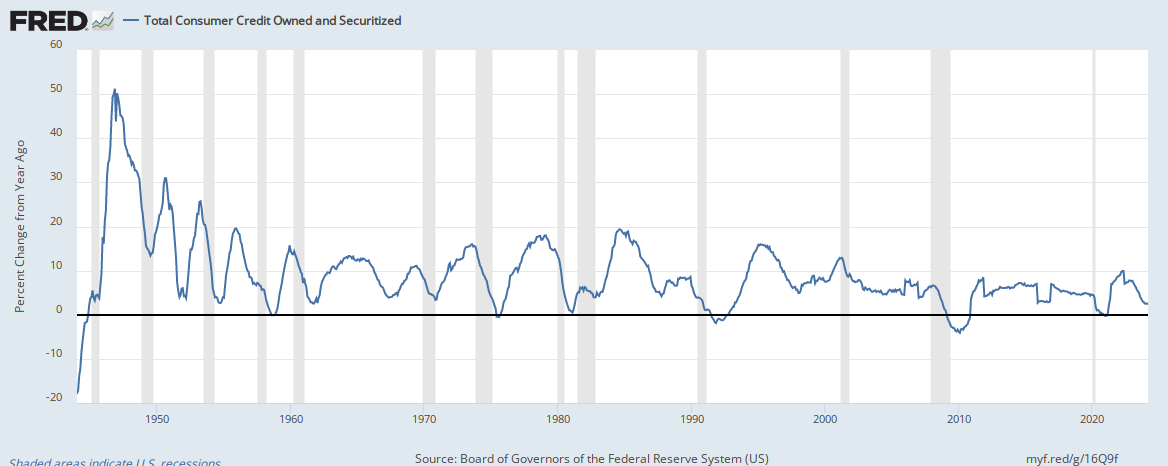

The annual growth of consumer credit appears to have peaked at 8.1 percent in Oct. 2022, flattening slightly to 7.8 percent annualized by Dec. 2022 and now is down to 6.8 percent. This is a sure sign that American households are maxing out their credit after the rampant inflation of 2021 and 2022, and are now slowing down spending to catch up on their bills. The economy overheated and so did household budgets.

The slowdown in credit accumulation has also coincided with the slowdown in inflation, now down to 4 percent in May after peaking at 9.1 percent in June 2022.

But the Federal Reserve is still signaling potential rate hikes on the horizon to deal with any sticky inflation. In June, it held the Federal Funds Rate steady at 5 percent to 5.25 percent, but it also said “additional policy firming” might be necessary: “In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Usually, the Federal Funds Rate will peak towards the end of the business cycle, and then as a recession ensues, the central bank will begin cutting rates to ease lending conditions and foster full employment. But we’re not there yet, right now, the Fed is still fighting inflation as a part of its dual mandate.

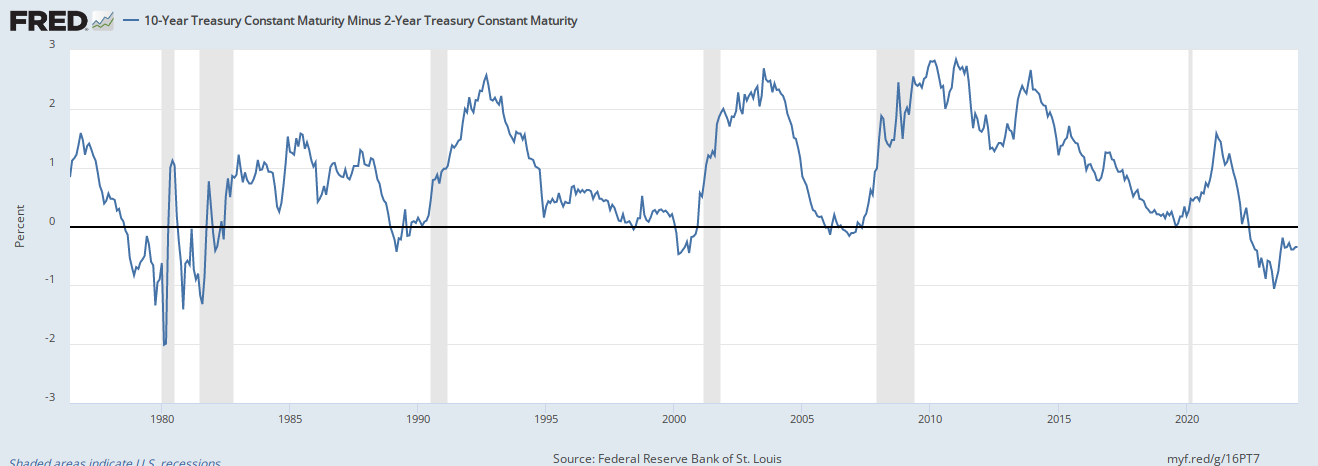

Another key factor to monitor is the spread between 10-year treasuries and 2-year treasuries. Historically, prior to recessions, the curve inverts as the interest rate on short term bonds exceeds that of long term bonds, forecasting slower growth on the horizon.

Right now, the 10-year, 2-year spread is still quite inverted at -0.94 percent. Once it uninverts, that usually comes with Fed easing into the jaws of a recession, and you’ll know that the cycle is ending. When it comes to recessions, the question is not if, but when. Stay tuned. We know President Biden will be.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2023/07/as-hiring-slows-down-so-does-the-economy/