| From | Center for Jobs and the Economy <[email protected]> |

| Subject | California Energy Price Data for June 2023 |

| Date | July 6, 2023 9:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] [link removed] California Energy Price Data

June 2023

Below are the monthly updates from the most current June 2023 fuel price data (GasBuddy.com) and April 2023 electricity and natural gas price data (US Energy Information Administration). To view additional data and analysis related to the California economy visit our website at [[link removed]].

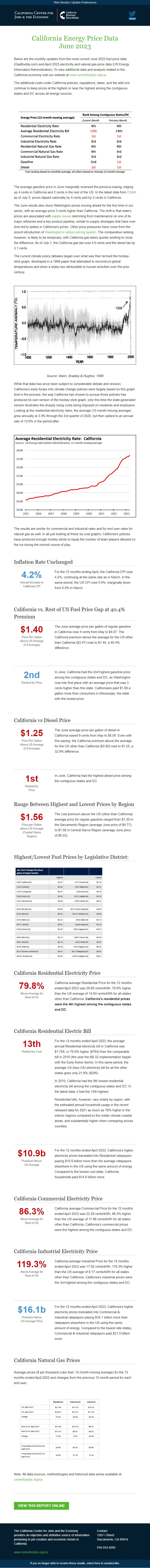

The additional costs under California policies, regulations, taxes, and fee add-ons continue to keep prices at the highest or near the highest among the contiguous states and DC across all energy sources.

The average gasoline price in June marginally reversed the previous easing, edging up 4 cents in California and 2 cents in the rest of the US. In the latest data from CSAA [[link removed]] as of July 5, prices dipped nationally by 4 cents and by 2 cents in California.

The June results also show Washington prices moving ahead for the first time in our series, with an average price 3 cents higher than California. The shift in that state’s prices are associated with supply issues [[link removed]] stemming from maintenance on one of its major refineries and a key product pipeline, similar to supply shortages that have over time led to spikes in California’s prices. Other price pressures have come from the recent introduction of Washington’s carbon pricing system [[link removed]]. The comparative ranking, however, is likely to be temporary, with California gas taxes quickly working to close the difference. As of July 1, the California gas tax rose 4.0 cents and the diesel tax by 3.1 cents.

The current climate policy debates began over what was then termed the hockey-stick graph, developed in a 1998 paper that attempted to reconstruct global temperatures and show a sharp rise attributable to human activities over the prior century.

Source: Mann, Bradely & Hughes, 1998

While that data has since been subject to considerable debate and revision, California’s early forays into climate change policies were largely based on this graph. And in the process, the way California has chosen to pursue those policies has produced its own version of the hockey stick graph, only this time the state-generated version illustrates the sharply rising costs being imposed on residents and employers. Looking at the residential electricity rates, the average (12-month moving average) grew annually at 3.4% through the 3rd quarter of 2020, but then spiked to an annual rate of 12.6% in the period after.

The results are similar for commercial and industrial rates and for end user rates for natural gas as well. In all just looking at these six cost graphs, California’s policies have produced enough hockey sticks to equip the number of team players allowed on the ice during the normal course of play.

Inflation Rate Unchanged 4.2% Annual Increase in

California CPI

For the 12 months ending April, the California CPI rose 4.2%, continuing at the same rate as in March. In the same period, the US CPI rose 4.9%, marginally down from 5.0% in March.

California vs. Rest of US Fuel Price Gap at 40.4% Premium $1.40 Price Per Gallon

Above US Average

(CA Average)

The June average price per gallon of regular gasoline in California rose 4 cents from May to $4.87. The California premium above the average for the US other than California ($3.47) rose to $1.40, a 40.4% difference.

2nd Ranked by Price

In June, California had the 2nd highest gasoline price among the contiguous states and DC, as Washington rose into first place with an average price that was 3 cents higher than this state. Californians paid $1.89 a gallon more than consumers in Mississippi, the state with the lowest price.

California vs Diesel Price $1.25 Price Per Gallon

Above US Average

(CA Average)

The June average price per gallon of diesel in California eased 9 cents from May to $5.05. Even with this easing, the California premium above the average for the US other than California ($3.80) rose to $1.25, a 32.9% difference.

1st Ranked by

Price

In June, California had the highest diesel price among the contiguous states and DC.

Range Between Highest and Lowest Prices by Region $1.56 Price per Gallon

above US Average

(Central Sierra

Region)

The cost premium above the US (other than California) average price for regular gasoline ranged from $1.30 in the Sacramento Region (average June price of $4.77), to $1.56 in Central Sierra Region (average June price of $5.03).

Highest/Lowest Fuel Prices by Legislative District: California Residential Electricity Price 79.8% Above Average for

Rest of US

California average Residential Price for the 12 months ended April 2023 was 26.85 cents/kWh, 79.8% higher than the US average of 14.93 cents/kWh for all states other than California. California’s residential prices were the 4th highest among the contiguous states and DC.

California Residential Electric Bill 13th Ranked by Cost

For the 12 months ended April 2023, the average annual Residential electricity bill in California was $1,758, or 76.9% higher ($764) than the comparable bill in 2010 (the year the AB 32 implementation began with the Early Action items). In this same period, the average US (less CA) electricity bill for all the other states grew only 21.6% ($295).

In 2010, California had the 9th lowest residential electricity bill among the contiguous states and DC. In the latest data, it had the 13th highest.

Residential bills, however, vary widely by region, with the estimated annual household usage in the recent released data for 2021 as much as 78% higher in the interior regions compared to the milder climate coastal areas, and substantially higher when comparing across counties.

$10.9b Premium Above

US Average

For the 12 months ended April 2023, California’s higher electricity prices translated into Residential ratepayers paying $10.9 billion more than the average ratepayers elsewhere in the US using the same amount of energy. Compared to the lowest cost state, California households paid $14.9 billion more.

California Commercial Electricity Price 86.3% Above Average for

Rest of US

California average Commercial Price for the 12 months ended April 2023 was 22.28 cents/kWh, 86.3% higher than the US average of 11.96 cents/kWh for all states other than California. California’s commercial prices were the highest among the contiguous states and DC.

California Industrial Electricity Price 119.3% Above Average for

Rest of US

California average Industrial Price for the 12 months ended April 2023 was 17.92 cents/kWh, 119.3% higher than the US average of 8.17 cents/kWh for all states other than California. California’s industrial prices were the 3rd highest among the contiguous states and DC.

$16.1b Premium Above

US Average Price

For the 12 months ended April 2023, California’s higher electricity prices translated into Commercial & Industrial ratepayers paying $16.1 billion more than ratepayers elsewhere in the US using the same amount of energy. Compared to the lowest rate states, Commercial & Industrial ratepayers paid $21.0 billion more.

California Natural Gas Prices

Average prices ($ per thousand cubic feet; 12-month moving average) for the 12 months ended April 2023 and changes from the previous 12-month period for each end user:

Note: All data sources, methodologies and historical data series available at [[link removed]]

View this Report Online [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

June 2023

Below are the monthly updates from the most current June 2023 fuel price data (GasBuddy.com) and April 2023 electricity and natural gas price data (US Energy Information Administration). To view additional data and analysis related to the California economy visit our website at [[link removed]].

The additional costs under California policies, regulations, taxes, and fee add-ons continue to keep prices at the highest or near the highest among the contiguous states and DC across all energy sources.

The average gasoline price in June marginally reversed the previous easing, edging up 4 cents in California and 2 cents in the rest of the US. In the latest data from CSAA [[link removed]] as of July 5, prices dipped nationally by 4 cents and by 2 cents in California.

The June results also show Washington prices moving ahead for the first time in our series, with an average price 3 cents higher than California. The shift in that state’s prices are associated with supply issues [[link removed]] stemming from maintenance on one of its major refineries and a key product pipeline, similar to supply shortages that have over time led to spikes in California’s prices. Other price pressures have come from the recent introduction of Washington’s carbon pricing system [[link removed]]. The comparative ranking, however, is likely to be temporary, with California gas taxes quickly working to close the difference. As of July 1, the California gas tax rose 4.0 cents and the diesel tax by 3.1 cents.

The current climate policy debates began over what was then termed the hockey-stick graph, developed in a 1998 paper that attempted to reconstruct global temperatures and show a sharp rise attributable to human activities over the prior century.

Source: Mann, Bradely & Hughes, 1998

While that data has since been subject to considerable debate and revision, California’s early forays into climate change policies were largely based on this graph. And in the process, the way California has chosen to pursue those policies has produced its own version of the hockey stick graph, only this time the state-generated version illustrates the sharply rising costs being imposed on residents and employers. Looking at the residential electricity rates, the average (12-month moving average) grew annually at 3.4% through the 3rd quarter of 2020, but then spiked to an annual rate of 12.6% in the period after.

The results are similar for commercial and industrial rates and for end user rates for natural gas as well. In all just looking at these six cost graphs, California’s policies have produced enough hockey sticks to equip the number of team players allowed on the ice during the normal course of play.

Inflation Rate Unchanged 4.2% Annual Increase in

California CPI

For the 12 months ending April, the California CPI rose 4.2%, continuing at the same rate as in March. In the same period, the US CPI rose 4.9%, marginally down from 5.0% in March.

California vs. Rest of US Fuel Price Gap at 40.4% Premium $1.40 Price Per Gallon

Above US Average

(CA Average)

The June average price per gallon of regular gasoline in California rose 4 cents from May to $4.87. The California premium above the average for the US other than California ($3.47) rose to $1.40, a 40.4% difference.

2nd Ranked by Price

In June, California had the 2nd highest gasoline price among the contiguous states and DC, as Washington rose into first place with an average price that was 3 cents higher than this state. Californians paid $1.89 a gallon more than consumers in Mississippi, the state with the lowest price.

California vs Diesel Price $1.25 Price Per Gallon

Above US Average

(CA Average)

The June average price per gallon of diesel in California eased 9 cents from May to $5.05. Even with this easing, the California premium above the average for the US other than California ($3.80) rose to $1.25, a 32.9% difference.

1st Ranked by

Price

In June, California had the highest diesel price among the contiguous states and DC.

Range Between Highest and Lowest Prices by Region $1.56 Price per Gallon

above US Average

(Central Sierra

Region)

The cost premium above the US (other than California) average price for regular gasoline ranged from $1.30 in the Sacramento Region (average June price of $4.77), to $1.56 in Central Sierra Region (average June price of $5.03).

Highest/Lowest Fuel Prices by Legislative District: California Residential Electricity Price 79.8% Above Average for

Rest of US

California average Residential Price for the 12 months ended April 2023 was 26.85 cents/kWh, 79.8% higher than the US average of 14.93 cents/kWh for all states other than California. California’s residential prices were the 4th highest among the contiguous states and DC.

California Residential Electric Bill 13th Ranked by Cost

For the 12 months ended April 2023, the average annual Residential electricity bill in California was $1,758, or 76.9% higher ($764) than the comparable bill in 2010 (the year the AB 32 implementation began with the Early Action items). In this same period, the average US (less CA) electricity bill for all the other states grew only 21.6% ($295).

In 2010, California had the 9th lowest residential electricity bill among the contiguous states and DC. In the latest data, it had the 13th highest.

Residential bills, however, vary widely by region, with the estimated annual household usage in the recent released data for 2021 as much as 78% higher in the interior regions compared to the milder climate coastal areas, and substantially higher when comparing across counties.

$10.9b Premium Above

US Average

For the 12 months ended April 2023, California’s higher electricity prices translated into Residential ratepayers paying $10.9 billion more than the average ratepayers elsewhere in the US using the same amount of energy. Compared to the lowest cost state, California households paid $14.9 billion more.

California Commercial Electricity Price 86.3% Above Average for

Rest of US

California average Commercial Price for the 12 months ended April 2023 was 22.28 cents/kWh, 86.3% higher than the US average of 11.96 cents/kWh for all states other than California. California’s commercial prices were the highest among the contiguous states and DC.

California Industrial Electricity Price 119.3% Above Average for

Rest of US

California average Industrial Price for the 12 months ended April 2023 was 17.92 cents/kWh, 119.3% higher than the US average of 8.17 cents/kWh for all states other than California. California’s industrial prices were the 3rd highest among the contiguous states and DC.

$16.1b Premium Above

US Average Price

For the 12 months ended April 2023, California’s higher electricity prices translated into Commercial & Industrial ratepayers paying $16.1 billion more than ratepayers elsewhere in the US using the same amount of energy. Compared to the lowest rate states, Commercial & Industrial ratepayers paid $21.0 billion more.

California Natural Gas Prices

Average prices ($ per thousand cubic feet; 12-month moving average) for the 12 months ended April 2023 and changes from the previous 12-month period for each end user:

Note: All data sources, methodologies and historical data series available at [[link removed]]

View this Report Online [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor