|

John,

Congressional Republicans are getting a little savvier, but no less bold.

In 2017, they passed the Trump-GOP Tax Scam, which will add approximately $1.7 trillion to our national debt―or $3.5 trillion if all the provisions are made permanent, which is their ultimate goal.

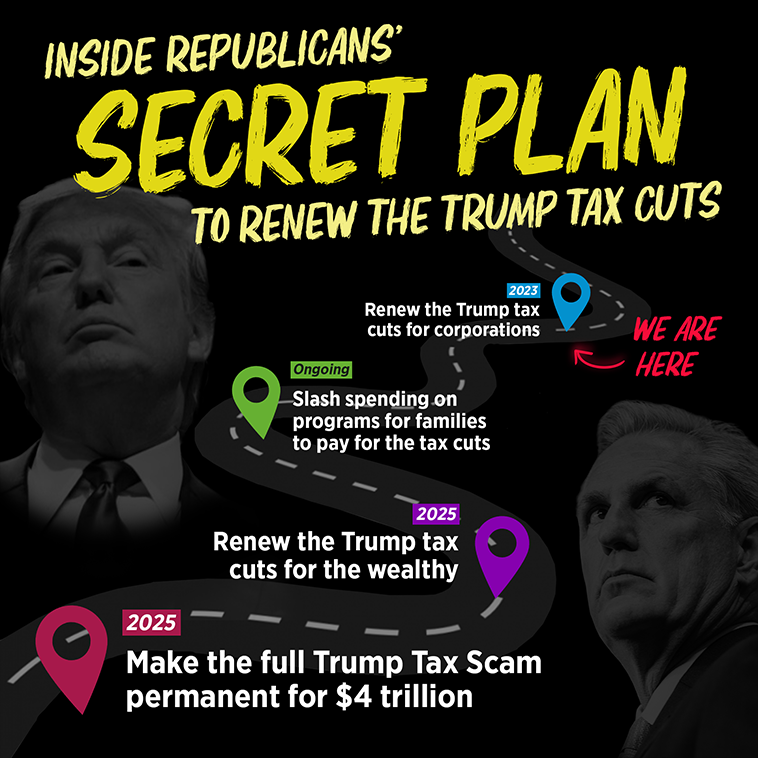

Now, with only a narrow majority in the House, Speaker Kevin McCarthy and his caucus are coming back for more, but they’re being sneaky about it. Instead of trying to expand and make permanent the whole 2017 Tax Scam, they’re going at it piecemeal. Rather than introduce one big bill that opponents can rally against, Republicans are introducing separate tax cuts in a package that they hope to include in a big, end-of-the-year package.

When combined with the cost of extending the Trump-GOP Tax Scam indefinitely, the Republicans’ latest tax cuts would cost over $4 trillion, when made permanent. And they want to pay for them all by cutting critical programs and services such as Social Security, Medicare, education, housing, nutrition, and more.

Help rally the American people against the GOP Tax Scam 2.0. Donate today to bring our latest infographic, below, to voters across the country and fight back against tax handouts to the rich and corporations!

While private equity firms, hugely profitable billion-dollar corporations, the richest 1%, and foreign investors would receive billions of dollars in tax handouts, the poorest fifth of Americans would get on average just $40.

Republicans claim they’ll pay for these tax cuts by revoking green energy tax credits from last year’s Inflation Reduction Act, which are meant to speed the U.S. transition away from fossil fuels and toward renewable energy sources to combat climate change.

But that’s not the whole story. They’re hiding behind accounting gimmicks that make it look like these tax cuts will cost “just” $80 billion when in reality they’ll cost more than $4 trillion when made permanent and combined with the Trump tax cuts.

We’re fighting back, demanding Congress raise, not cut, taxes on the wealthy and corporations, because when they do, we can invest in working families and our future.

The American people need to know exactly what the GOP is up to and how they plan to enrich their millionaire, billionaire, and corporate donors at the expense of programs and services for working families. Donate $5 today to bring our latest infographic to voters across the country and fight back against the GOP Tax Scam 2.0!

If you've saved your payment information with ActBlue Express, your secure donation will go through immediately:

This tax package is part of the larger GOP strategy to hand even more wealth and power to the richest 1%. Thank you for fighting back, demanding an economy and a tax system that works for everyone, not just the wealthy few.

David Kass

Executive Director

Americans for Tax Fairness Action Fund

|