Email

Beginning Farmer Tax Credit Expands to Further Incentivize Land Transfer

| From | Minnesota Department of Agriculture <[email protected]> |

| Subject | Beginning Farmer Tax Credit Expands to Further Incentivize Land Transfer |

| Date | June 22, 2023 2:02 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Program also offers increased support for emerging farmers

department of agriculture

*For Immediate Release*

*Media Contact:?

*Logan Schumacher, MDA Communications

651-201-6193

[email protected] <[email protected]>

June 22, 2023

Previous Announcements [ [link removed] ]

________________________________________________________________________

Beginning Farmer Tax Credit Expands to Further Incentivize Land Transfer

Program also offers increased support for emerging farmers

*St. Paul, MN*: Owners of agricultural assets that lease or sell to beginning farmers in Minnesota may be eligible for the Beginning Farmer Tax Credit [ [link removed] ], which is open for applications through the Minnesota Department of Agriculture?s (MDA) Rural Finance Authority (RFA).

Those who have previously applied should take note of the new application deadlines for rentals (July 17) and sales (November 1). Additionally, recent legislative changes have resulted in several updates to the program to further incentivize farmland sales:

* An increase in the tax credit amount to 8% of the sale price for buyers and 12% if the buyer is an emerging farmer (previously 5% for all).

* A new maximum tax credit of $50,000 (previously $32,000).

* Direct family members such as parents, grandparents, and siblings are now eligible for farmland sales.

Qualifying applicants can include individuals, trusts, or qualified pass-through entities renting or selling land, livestock, facilities, buildings, or machinery used for farming in Minnesota to a beginning farmer.

A beginning farmer is defined as a Minnesota resident with the desire to start farming or who began farming in Minnesota within the past 10 years. They must provide positive projected earnings statements, have a net worth less than $979,000, and enroll in, or have completed, an approved farm business management (FBM) program [ [link removed] ].

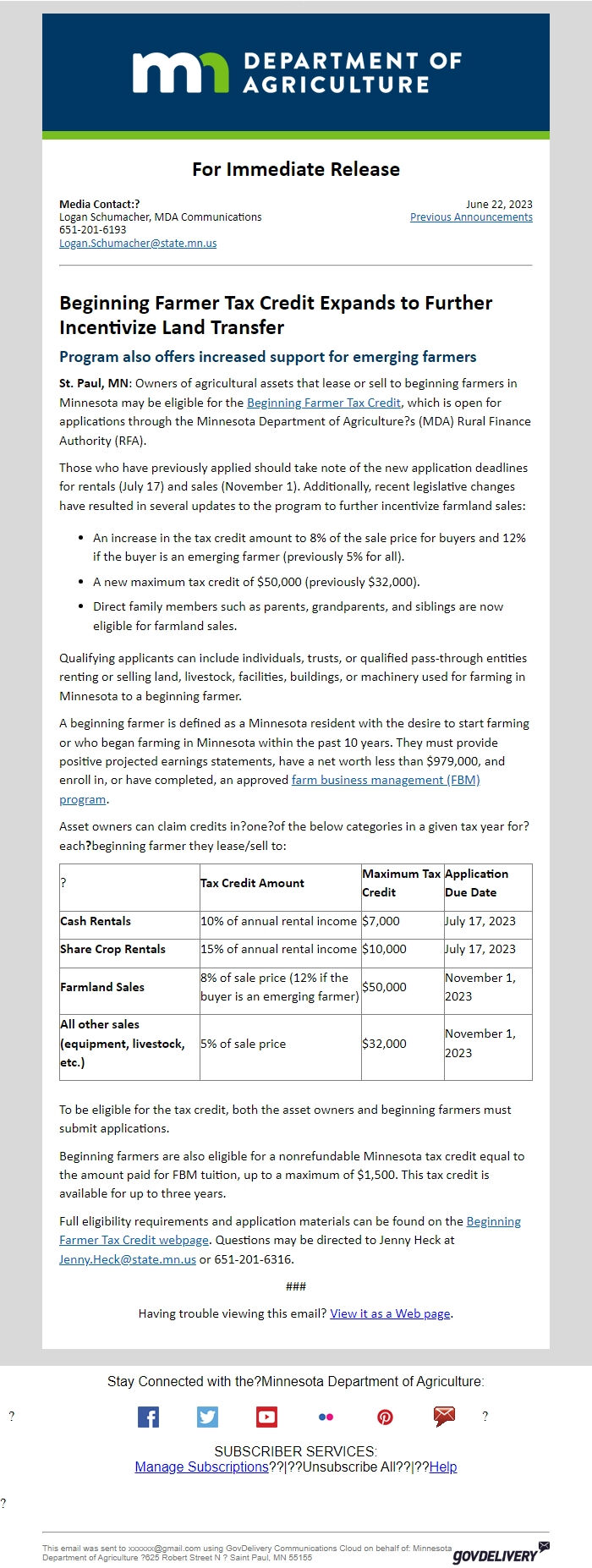

Asset owners can claim credits in?one?of the below categories in a given tax year for?each*?*beginning farmer they lease/sell to:

?

*Tax Credit Amount*

*Maximum Tax Credit*

*Application Due Date*

*Cash Rentals*

10% of annual rental income

$7,000

July 17, 2023

*Share Crop Rentals*

15% of annual rental income

$10,000

July 17, 2023

*Farmland Sales*

8% of sale price (12% if the buyer is an emerging farmer)

$50,000

November 1, 2023

*All other sales (equipment, livestock, etc.)*

5% of sale price

$32,000

November 1, 2023

To be eligible for the tax credit, both the asset owners and beginning farmers must submit applications.

Beginning farmers are also eligible for a nonrefundable Minnesota tax credit equal to the amount paid for FBM tuition, up to a maximum of $1,500. This tax credit is available for up to three years.

Full eligibility requirements and application materials can be found on the Beginning Farmer Tax Credit webpage [ [link removed] ]. Questions may be directed to Jenny Heck at [email protected] or 651-201-6316.

###

Having trouble viewing this email? View it as a Web page [ [link removed] ].

Stay Connected with the?Minnesota Department of Agriculture: ? Facebook [ [link removed] ] Twitter [ [link removed] ] Youtube [ [link removed] ] Flickr [ [link removed] ] Flickr [ [link removed] ] Govdelivery [ [link removed] ] ?

SUBSCRIBER SERVICES:

Manage Subscriptions [ [link removed] ]??|??Unsubscribe All [ [link removed] ]??|??Help [ [link removed] ]

?

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Minnesota Department of Agriculture ?625 Robert Street N ? Saint Paul, MN 55155 GovDelivery logo [ [link removed] ]

body .abe-column-block {min-height: 5px;} table.gd_combo_table img {margin-left:7px; margin-right:7px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

department of agriculture

*For Immediate Release*

*Media Contact:?

*Logan Schumacher, MDA Communications

651-201-6193

[email protected] <[email protected]>

June 22, 2023

Previous Announcements [ [link removed] ]

________________________________________________________________________

Beginning Farmer Tax Credit Expands to Further Incentivize Land Transfer

Program also offers increased support for emerging farmers

*St. Paul, MN*: Owners of agricultural assets that lease or sell to beginning farmers in Minnesota may be eligible for the Beginning Farmer Tax Credit [ [link removed] ], which is open for applications through the Minnesota Department of Agriculture?s (MDA) Rural Finance Authority (RFA).

Those who have previously applied should take note of the new application deadlines for rentals (July 17) and sales (November 1). Additionally, recent legislative changes have resulted in several updates to the program to further incentivize farmland sales:

* An increase in the tax credit amount to 8% of the sale price for buyers and 12% if the buyer is an emerging farmer (previously 5% for all).

* A new maximum tax credit of $50,000 (previously $32,000).

* Direct family members such as parents, grandparents, and siblings are now eligible for farmland sales.

Qualifying applicants can include individuals, trusts, or qualified pass-through entities renting or selling land, livestock, facilities, buildings, or machinery used for farming in Minnesota to a beginning farmer.

A beginning farmer is defined as a Minnesota resident with the desire to start farming or who began farming in Minnesota within the past 10 years. They must provide positive projected earnings statements, have a net worth less than $979,000, and enroll in, or have completed, an approved farm business management (FBM) program [ [link removed] ].

Asset owners can claim credits in?one?of the below categories in a given tax year for?each*?*beginning farmer they lease/sell to:

?

*Tax Credit Amount*

*Maximum Tax Credit*

*Application Due Date*

*Cash Rentals*

10% of annual rental income

$7,000

July 17, 2023

*Share Crop Rentals*

15% of annual rental income

$10,000

July 17, 2023

*Farmland Sales*

8% of sale price (12% if the buyer is an emerging farmer)

$50,000

November 1, 2023

*All other sales (equipment, livestock, etc.)*

5% of sale price

$32,000

November 1, 2023

To be eligible for the tax credit, both the asset owners and beginning farmers must submit applications.

Beginning farmers are also eligible for a nonrefundable Minnesota tax credit equal to the amount paid for FBM tuition, up to a maximum of $1,500. This tax credit is available for up to three years.

Full eligibility requirements and application materials can be found on the Beginning Farmer Tax Credit webpage [ [link removed] ]. Questions may be directed to Jenny Heck at [email protected] or 651-201-6316.

###

Having trouble viewing this email? View it as a Web page [ [link removed] ].

Stay Connected with the?Minnesota Department of Agriculture: ? Facebook [ [link removed] ] Twitter [ [link removed] ] Youtube [ [link removed] ] Flickr [ [link removed] ] Flickr [ [link removed] ] Govdelivery [ [link removed] ] ?

SUBSCRIBER SERVICES:

Manage Subscriptions [ [link removed] ]??|??Unsubscribe All [ [link removed] ]??|??Help [ [link removed] ]

?

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Minnesota Department of Agriculture ?625 Robert Street N ? Saint Paul, MN 55155 GovDelivery logo [ [link removed] ]

body .abe-column-block {min-height: 5px;} table.gd_combo_table img {margin-left:7px; margin-right:7px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Minnesota Department of Agriculture

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery