| From | Internal Revenue Service (IRS) <[email protected]> |

| Subject | e-News for Tax Professionals 2023-24 |

| Date | June 16, 2023 8:03 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Tax Forums: IRS Commissioner keynotes Atlanta, four special events added; home credits e-poster; and more

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

?

IRS.gov Banner

e-News for Tax Professionals June 16, 2023

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate?Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

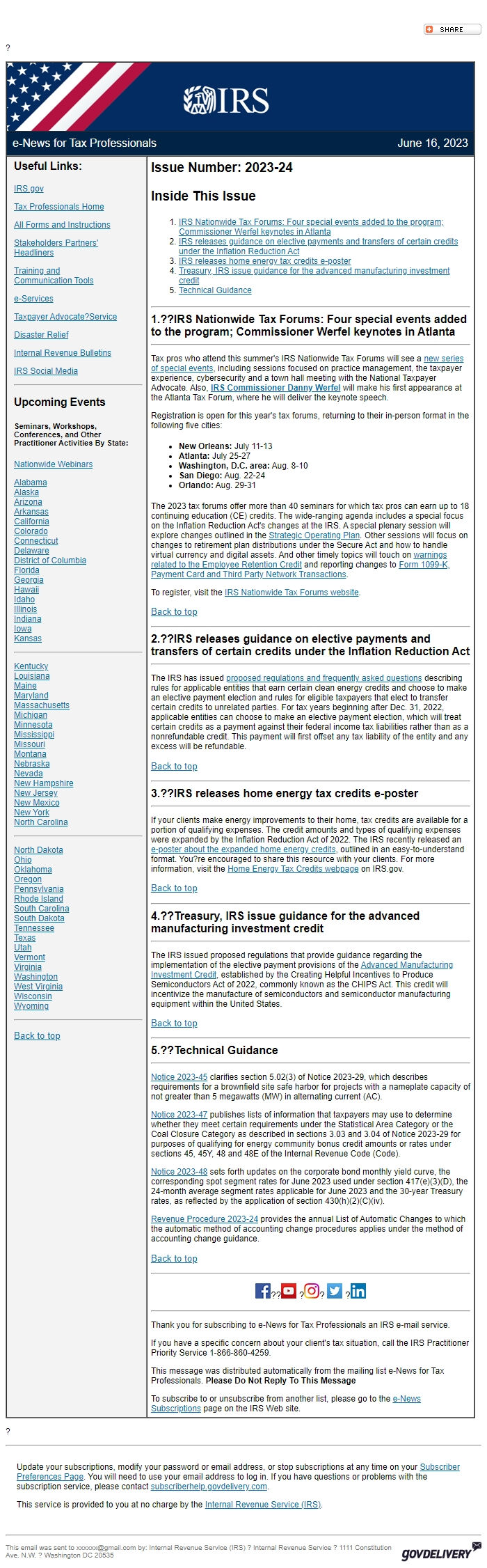

Issue Number: 2023-24

Inside This Issue

* IRS Nationwide Tax Forums: Four special events added to the program; Commissioner Werfel keynotes in Atlanta [ #First ]

* IRS releases guidance on elective payments and transfers of certain credits under the Inflation Reduction Act [ #Second ]

* IRS releases home energy tax credits e-poster [ #Third ]

* Treasury, IRS issue guidance for the advanced manufacturing investment credit [ #Fourth ]

* Technical Guidance [ #Fifth ]

________________________________________________________________________

*1.??IRS Nationwide Tax Forums: Four special events added to the program; Commissioner Werfel keynotes in Atlanta*________________________________________________________________________

Tax pros who attend this summer's IRS Nationwide Tax Forums will see a new series of special events [ [link removed] ], including sessions focused on practice management, the taxpayer experience, cybersecurity and a town hall meeting with the National Taxpayer Advocate. Also, *IRS Commissioner Danny Werfel [ [link removed] ]* will make his first appearance at the Atlanta Tax Forum, where he will deliver the keynote speech.

Registration is open for this year's tax forums, returning to their in-person format in the following five cities:

* *New Orleans:* July 11-13

* *Atlanta:* July 25-27

* *Washington, D.C. area:* Aug. 8-10

* *San Diego:* Aug. 22-24

* *Orlando:* Aug. 29-31

The 2023 tax forums offer more than 40 seminars for which tax pros can earn up to 18 continuing education (CE) credits. The wide-ranging agenda includes a special focus on the Inflation Reduction Act's changes at the IRS. A special plenary session will explore changes outlined in the Strategic Operating Plan [ [link removed] ]. Other sessions will focus on changes to retirement plan distributions under the Secure Act and how to handle virtual currency and digital assets. And other timely topics will touch on warnings related to the Employee Retention Credit [ [link removed] ] and reporting changes to Form 1099-K, Payment Card and Third Party Network Transactions [ [link removed] ].

To register, visit the IRS Nationwide Tax Forums website [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*2.??IRS releases guidance on elective payments and transfers of certain credits under the Inflation Reduction Act*________________________________________________________________________

The IRS has issued proposed regulations and frequently asked questions [ [link removed] ] describing rules for applicable entities that earn certain clean energy credits and choose to make an elective payment election and rules for eligible taxpayers that elect to transfer certain credits to unrelated parties. For tax years beginning after Dec. 31, 2022, applicable entities can choose to make an elective payment election, which will treat certain credits as a payment against their federal income tax liabilities rather than as a nonrefundable credit. This payment will first offset any tax liability of the entity and any excess will be refundable.

Back to top [ #top ]

________________________________________________________________________

*3.??IRS releases home energy tax credits e-poster*________________________________________________________________________

If your clients make energy improvements to their home, tax credits are available for a portion of qualifying expenses. The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022. The IRS recently released an e-poster about the expanded home energy credits [ [link removed] ], outlined in an easy-to-understand format. You?re encouraged to share this resource with your clients. For more information, visit the Home Energy Tax Credits webpage [ [link removed] ] on IRS.gov.

Back to top [ #top ]

________________________________________________________________________

*4.??Treasury, IRS issue guidance for the advanced manufacturing investment credit*________________________________________________________________________

The IRS issued proposed regulations that provide guidance regarding the implementation of the elective payment provisions of the Advanced Manufacturing Investment Credit [ [link removed] ], established by the Creating Helpful Incentives to Produce Semiconductors Act of 2022, commonly known as the CHIPS Act. This credit will incentivize the manufacture of semiconductors and semiconductor manufacturing equipment within the United States.

Back to top [ #top ]

________________________________________________________________________

*5.??Technical Guidance*________________________________________________________________________

Notice 2023-45 [ [link removed] ] clarifies section 5.02(3) of Notice 2023-29, which describes requirements for a brownfield site safe harbor for projects with a nameplate capacity of not greater than 5 megawatts (MW) in alternating current (AC).

Notice 2023-47 [ [link removed] ] publishes lists of information that taxpayers may use to determine whether they meet certain requirements under the Statistical Area Category or the Coal Closure Category as described in sections 3.03 and 3.04 of Notice 2023-29 for purposes of qualifying for energy community bonus credit amounts or rates under sections 45, 45Y, 48 and 48E of the Internal Revenue Code (Code).

Notice 2023-48 [ [link removed] ] sets forth updates on the corporate bond monthly yield curve, the corresponding spot segment rates for June 2023 used under section 417(e)(3)(D), the 24-month average segment rates applicable for June 2023 and the 30-year Treasury rates, as reflected by the application of section 430(h)(2)(C)(iv).

Revenue Procedure 2023-24 [ [link removed] ] provides the annual List of Automatic Changes to which the automatic method of accounting change procedures applies under the method of accounting change guidance.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

?

IRS.gov Banner

e-News for Tax Professionals June 16, 2023

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate?Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

Issue Number: 2023-24

Inside This Issue

* IRS Nationwide Tax Forums: Four special events added to the program; Commissioner Werfel keynotes in Atlanta [ #First ]

* IRS releases guidance on elective payments and transfers of certain credits under the Inflation Reduction Act [ #Second ]

* IRS releases home energy tax credits e-poster [ #Third ]

* Treasury, IRS issue guidance for the advanced manufacturing investment credit [ #Fourth ]

* Technical Guidance [ #Fifth ]

________________________________________________________________________

*1.??IRS Nationwide Tax Forums: Four special events added to the program; Commissioner Werfel keynotes in Atlanta*________________________________________________________________________

Tax pros who attend this summer's IRS Nationwide Tax Forums will see a new series of special events [ [link removed] ], including sessions focused on practice management, the taxpayer experience, cybersecurity and a town hall meeting with the National Taxpayer Advocate. Also, *IRS Commissioner Danny Werfel [ [link removed] ]* will make his first appearance at the Atlanta Tax Forum, where he will deliver the keynote speech.

Registration is open for this year's tax forums, returning to their in-person format in the following five cities:

* *New Orleans:* July 11-13

* *Atlanta:* July 25-27

* *Washington, D.C. area:* Aug. 8-10

* *San Diego:* Aug. 22-24

* *Orlando:* Aug. 29-31

The 2023 tax forums offer more than 40 seminars for which tax pros can earn up to 18 continuing education (CE) credits. The wide-ranging agenda includes a special focus on the Inflation Reduction Act's changes at the IRS. A special plenary session will explore changes outlined in the Strategic Operating Plan [ [link removed] ]. Other sessions will focus on changes to retirement plan distributions under the Secure Act and how to handle virtual currency and digital assets. And other timely topics will touch on warnings related to the Employee Retention Credit [ [link removed] ] and reporting changes to Form 1099-K, Payment Card and Third Party Network Transactions [ [link removed] ].

To register, visit the IRS Nationwide Tax Forums website [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*2.??IRS releases guidance on elective payments and transfers of certain credits under the Inflation Reduction Act*________________________________________________________________________

The IRS has issued proposed regulations and frequently asked questions [ [link removed] ] describing rules for applicable entities that earn certain clean energy credits and choose to make an elective payment election and rules for eligible taxpayers that elect to transfer certain credits to unrelated parties. For tax years beginning after Dec. 31, 2022, applicable entities can choose to make an elective payment election, which will treat certain credits as a payment against their federal income tax liabilities rather than as a nonrefundable credit. This payment will first offset any tax liability of the entity and any excess will be refundable.

Back to top [ #top ]

________________________________________________________________________

*3.??IRS releases home energy tax credits e-poster*________________________________________________________________________

If your clients make energy improvements to their home, tax credits are available for a portion of qualifying expenses. The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022. The IRS recently released an e-poster about the expanded home energy credits [ [link removed] ], outlined in an easy-to-understand format. You?re encouraged to share this resource with your clients. For more information, visit the Home Energy Tax Credits webpage [ [link removed] ] on IRS.gov.

Back to top [ #top ]

________________________________________________________________________

*4.??Treasury, IRS issue guidance for the advanced manufacturing investment credit*________________________________________________________________________

The IRS issued proposed regulations that provide guidance regarding the implementation of the elective payment provisions of the Advanced Manufacturing Investment Credit [ [link removed] ], established by the Creating Helpful Incentives to Produce Semiconductors Act of 2022, commonly known as the CHIPS Act. This credit will incentivize the manufacture of semiconductors and semiconductor manufacturing equipment within the United States.

Back to top [ #top ]

________________________________________________________________________

*5.??Technical Guidance*________________________________________________________________________

Notice 2023-45 [ [link removed] ] clarifies section 5.02(3) of Notice 2023-29, which describes requirements for a brownfield site safe harbor for projects with a nameplate capacity of not greater than 5 megawatts (MW) in alternating current (AC).

Notice 2023-47 [ [link removed] ] publishes lists of information that taxpayers may use to determine whether they meet certain requirements under the Statistical Area Category or the Coal Closure Category as described in sections 3.03 and 3.04 of Notice 2023-29 for purposes of qualifying for energy community bonus credit amounts or rates under sections 45, 45Y, 48 and 48E of the Internal Revenue Code (Code).

Notice 2023-48 [ [link removed] ] sets forth updates on the corporate bond monthly yield curve, the corresponding spot segment rates for June 2023 used under section 417(e)(3)(D), the 24-month average segment rates applicable for June 2023 and the 30-year Treasury rates, as reflected by the application of section 430(h)(2)(C)(iv).

Revenue Procedure 2023-24 [ [link removed] ] provides the annual List of Automatic Changes to which the automatic method of accounting change procedures applies under the method of accounting change guidance.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery