| From | Governor Lamont's Office <[email protected]> |

| Subject | List of Tax Cuts Approved by Governor Lamont Since Taking Office |

| Date | June 12, 2023 7:23 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed]

List of Tax Cuts Approved by Governor Lamont Since Taking Office [[link removed]]

Posted on June 12, 2023

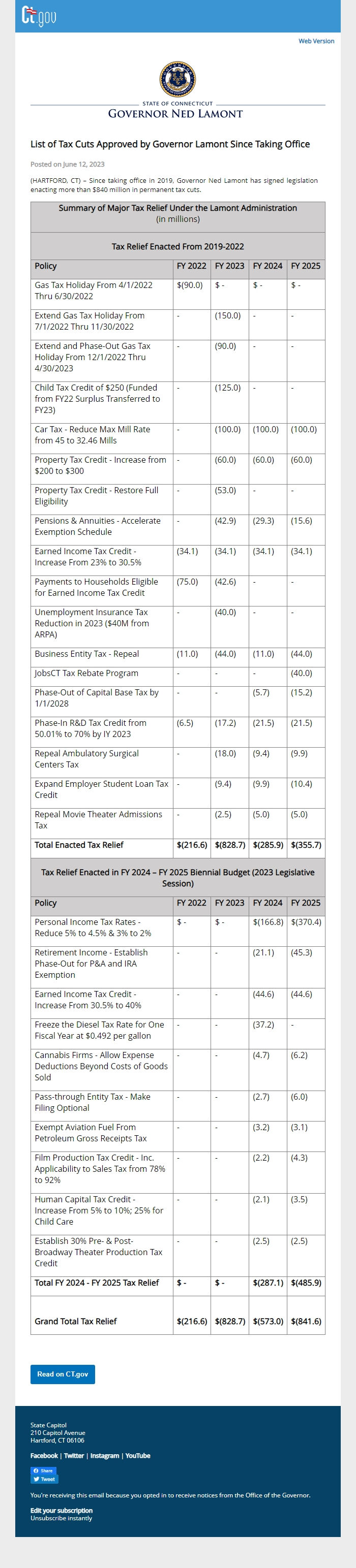

(HARTFORD, CT) – Since taking office in 2019, Governor Ned Lamont has signed legislation enacting more than $840 million in permanent tax cuts.

Summary of Major Tax Relief Under the Lamont Administration

(in millions)

Tax Relief Enacted From 2019-2022

Policy

FY 2022

FY 2023

FY 2024

FY 2025

Gas Tax Holiday From 4/1/2022 Thru 6/30/2022

$(90.0)

$ -

$ -

$ -

Extend Gas Tax Holiday From 7/1/2022 Thru 11/30/2022

-

(150.0)

-

-

Extend and Phase-Out Gas Tax Holiday From 12/1/2022 Thru 4/30/2023

-

(90.0)

-

-

Child Tax Credit of $250 (Funded from FY22 Surplus Transferred to FY23)

-

(125.0)

-

-

Car Tax - Reduce Max Mill Rate from 45 to 32.46 Mills

-

(100.0)

(100.0)

(100.0)

Property Tax Credit - Increase from $200 to $300

-

(60.0)

(60.0)

(60.0)

Property Tax Credit - Restore Full Eligibility

-

(53.0)

-

-

Pensions & Annuities - Accelerate Exemption Schedule

-

(42.9)

(29.3)

(15.6)

Earned Income Tax Credit - Increase From 23% to 30.5%

(34.1)

(34.1)

(34.1)

(34.1)

Payments to Households Eligible for Earned Income Tax Credit

(75.0)

(42.6)

-

-

Unemployment Insurance Tax Reduction in 2023 ($40M from ARPA)

-

(40.0)

-

-

Business Entity Tax - Repeal

(11.0)

(44.0)

(11.0)

(44.0)

JobsCT Tax Rebate Program

-

-

-

(40.0)

Phase-Out of Capital Base Tax by 1/1/2028

-

-

(5.7)

(15.2)

Phase-In R&D Tax Credit from 50.01% to 70% by IY 2023

(6.5)

(17.2)

(21.5)

(21.5)

Repeal Ambulatory Surgical Centers Tax

-

(18.0)

(9.4)

(9.9)

Expand Employer Student Loan Tax Credit

-

(9.4)

(9.9)

(10.4)

Repeal Movie Theater Admissions Tax

-

(2.5)

(5.0)

(5.0)

Total Enacted Tax Relief

$(216.6)

$(828.7)

$(285.9)

$(355.7)

Tax Relief Enacted in FY 2024 – FY 2025 Biennial Budget (2023 Legislative Session)

Policy

FY 2022

FY 2023

FY 2024

FY 2025

Personal Income Tax Rates - Reduce 5% to 4.5% & 3% to 2%

$ -

$ -

$(166.8)

$(370.4)

Retirement Income - Establish Phase-Out for P&A and IRA Exemption

-

-

(21.1)

(45.3)

Earned Income Tax Credit - Increase From 30.5% to 40%

-

-

(44.6)

(44.6)

Freeze the Diesel Tax Rate for One Fiscal Year at $0.492 per gallon

-

-

(37.2)

-

Cannabis Firms - Allow Expense Deductions Beyond Costs of Goods Sold

-

-

(4.7)

(6.2)

Pass-through Entity Tax - Make Filing Optional

-

-

(2.7)

(6.0)

Exempt Aviation Fuel From Petroleum Gross Receipts Tax

-

-

(3.2)

(3.1)

Film Production Tax Credit - Inc. Applicability to Sales Tax from 78% to 92%

-

-

(2.2)

(4.3)

Human Capital Tax Credit - Increase From 5% to 10%; 25% for Child Care

-

-

(2.1)

(3.5)

Establish 30% Pre- & Post-Broadway Theater Production Tax Credit

-

-

(2.5)

(2.5)

Total FY 2024 - FY 2025 Tax Relief

$ -

$ -

$(287.1)

$(485.9)

Grand Total Tax Relief

$(216.6)

$(828.7)

$(573.0)

$(841.6)

Read on CT.gov [[link removed]]

State Capitol

210 Capitol Avenue

Hartford, CT 06106

Facebook [[link removed]] | Twitter [[link removed]] | Instagram [[link removed]] | YouTube [[link removed]]

[link removed] [link removed]

You're receiving this email because you opted in to receive notices from the Office of the Governor.

Edit your subscription [link removed]

Unsubscribe instantly [link removed]

List of Tax Cuts Approved by Governor Lamont Since Taking Office [[link removed]]

Posted on June 12, 2023

(HARTFORD, CT) – Since taking office in 2019, Governor Ned Lamont has signed legislation enacting more than $840 million in permanent tax cuts.

Summary of Major Tax Relief Under the Lamont Administration

(in millions)

Tax Relief Enacted From 2019-2022

Policy

FY 2022

FY 2023

FY 2024

FY 2025

Gas Tax Holiday From 4/1/2022 Thru 6/30/2022

$(90.0)

$ -

$ -

$ -

Extend Gas Tax Holiday From 7/1/2022 Thru 11/30/2022

-

(150.0)

-

-

Extend and Phase-Out Gas Tax Holiday From 12/1/2022 Thru 4/30/2023

-

(90.0)

-

-

Child Tax Credit of $250 (Funded from FY22 Surplus Transferred to FY23)

-

(125.0)

-

-

Car Tax - Reduce Max Mill Rate from 45 to 32.46 Mills

-

(100.0)

(100.0)

(100.0)

Property Tax Credit - Increase from $200 to $300

-

(60.0)

(60.0)

(60.0)

Property Tax Credit - Restore Full Eligibility

-

(53.0)

-

-

Pensions & Annuities - Accelerate Exemption Schedule

-

(42.9)

(29.3)

(15.6)

Earned Income Tax Credit - Increase From 23% to 30.5%

(34.1)

(34.1)

(34.1)

(34.1)

Payments to Households Eligible for Earned Income Tax Credit

(75.0)

(42.6)

-

-

Unemployment Insurance Tax Reduction in 2023 ($40M from ARPA)

-

(40.0)

-

-

Business Entity Tax - Repeal

(11.0)

(44.0)

(11.0)

(44.0)

JobsCT Tax Rebate Program

-

-

-

(40.0)

Phase-Out of Capital Base Tax by 1/1/2028

-

-

(5.7)

(15.2)

Phase-In R&D Tax Credit from 50.01% to 70% by IY 2023

(6.5)

(17.2)

(21.5)

(21.5)

Repeal Ambulatory Surgical Centers Tax

-

(18.0)

(9.4)

(9.9)

Expand Employer Student Loan Tax Credit

-

(9.4)

(9.9)

(10.4)

Repeal Movie Theater Admissions Tax

-

(2.5)

(5.0)

(5.0)

Total Enacted Tax Relief

$(216.6)

$(828.7)

$(285.9)

$(355.7)

Tax Relief Enacted in FY 2024 – FY 2025 Biennial Budget (2023 Legislative Session)

Policy

FY 2022

FY 2023

FY 2024

FY 2025

Personal Income Tax Rates - Reduce 5% to 4.5% & 3% to 2%

$ -

$ -

$(166.8)

$(370.4)

Retirement Income - Establish Phase-Out for P&A and IRA Exemption

-

-

(21.1)

(45.3)

Earned Income Tax Credit - Increase From 30.5% to 40%

-

-

(44.6)

(44.6)

Freeze the Diesel Tax Rate for One Fiscal Year at $0.492 per gallon

-

-

(37.2)

-

Cannabis Firms - Allow Expense Deductions Beyond Costs of Goods Sold

-

-

(4.7)

(6.2)

Pass-through Entity Tax - Make Filing Optional

-

-

(2.7)

(6.0)

Exempt Aviation Fuel From Petroleum Gross Receipts Tax

-

-

(3.2)

(3.1)

Film Production Tax Credit - Inc. Applicability to Sales Tax from 78% to 92%

-

-

(2.2)

(4.3)

Human Capital Tax Credit - Increase From 5% to 10%; 25% for Child Care

-

-

(2.1)

(3.5)

Establish 30% Pre- & Post-Broadway Theater Production Tax Credit

-

-

(2.5)

(2.5)

Total FY 2024 - FY 2025 Tax Relief

$ -

$ -

$(287.1)

$(485.9)

Grand Total Tax Relief

$(216.6)

$(828.7)

$(573.0)

$(841.6)

Read on CT.gov [[link removed]]

State Capitol

210 Capitol Avenue

Hartford, CT 06106

Facebook [[link removed]] | Twitter [[link removed]] | Instagram [[link removed]] | YouTube [[link removed]]

[link removed] [link removed]

You're receiving this email because you opted in to receive notices from the Office of the Governor.

Edit your subscription [link removed]

Unsubscribe instantly [link removed]

Message Analysis

- Sender: Ned Lamont

- Political Party: Democratic

- Country: United States

- State/Locality: Connecticut

- Office: State Governor

-

Email Providers:

- Campaign Monitor